Deutsche Bank analyst Edison Yu's team expects several new product cycles to drive sales up in November and December, and sales should also broadly benefit from NEV subsidies that expire at the end of the year.

China's major new car makers announced their October deliveries yesterday, and as usual, Deutsche Bank analyst Edison Yu's team provided their take.

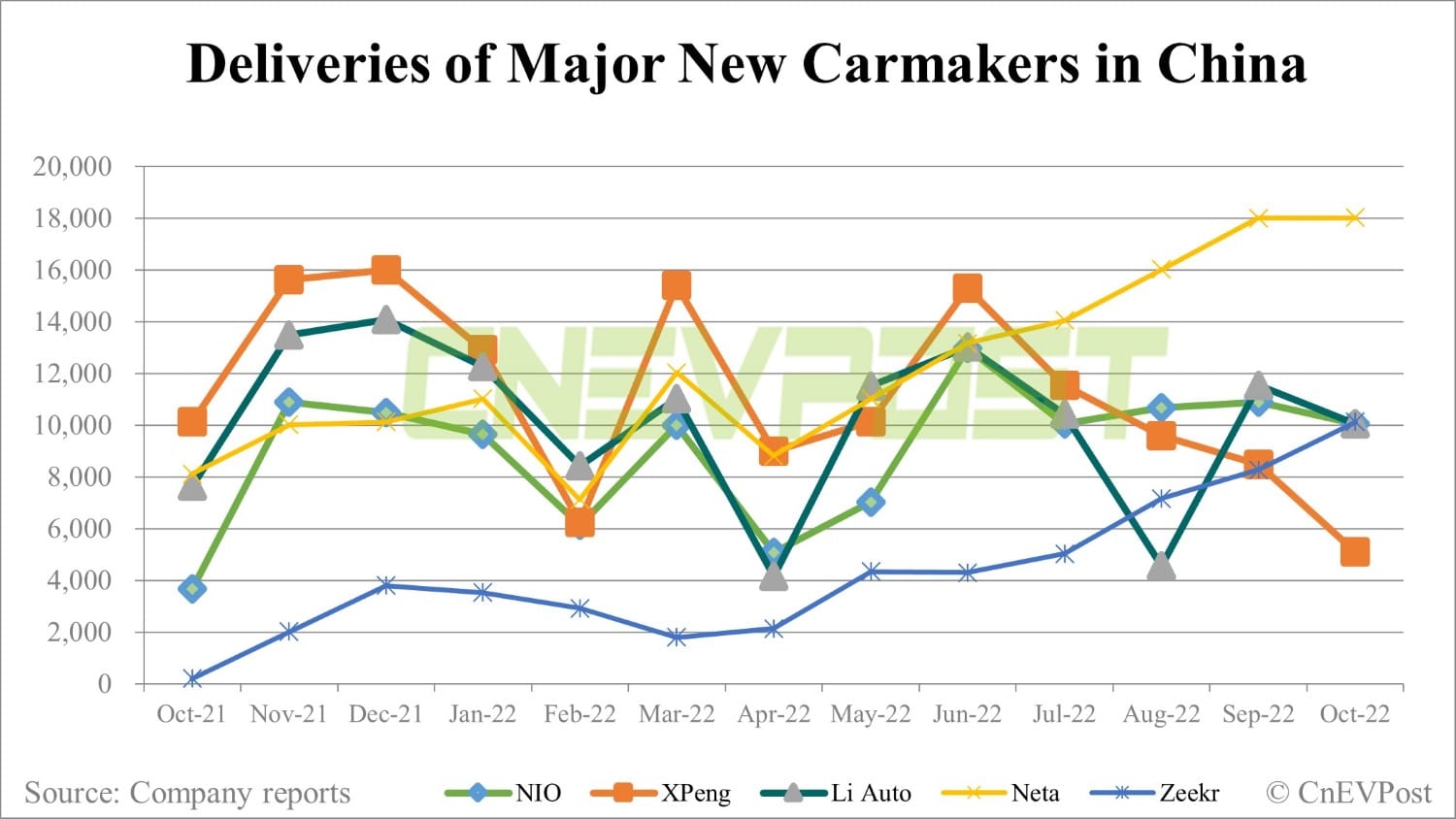

As background, Yu's team focuses on what they call the Fab 5 of Chinese EV companies -- Nio, Xpeng, Li Auto, Zeekr, and Hozon Auto -- all five of which saw deliveries flat or down in October, except for Zeekr.

China's electric vehicle (EV) sales were generally weak in October as continued Covid measures hurt production and consumer sentiment and model transitions continue to be messy, Yu's team said in a research note sent to investors Tuesday.

Looking ahead, the team expects several new product cycles to drive sales higher in November and December, and that sales should also broadly benefit from new energy vehicle (NEV) subsidies that expire at the end of the year.

Following is the full text of the team's note.

Messy October, but still expect Nov/Dec rebound

Fab 5 China EV sales came in generally weaker during October as ongoing COVID measures hurt production (and consumer sentiment) and model transitions continue to be messy.

Nio saw a meaningful impact from Hefei's lock-downs, hurting the ET5 ramp while Li Auto reported better than feared sales driven by its big late month push. Xpeng's struggles continue as it quickly tries to roll out new G9 SUV.

Conversely, Zeekr once again saw robust demand achieving record deliveries (surpassing Nio/LI/XPEV) and Hozon Neta maintained volume at flat MoM.

Looking ahead, we expect several new product cycles to drive sales up in Nov/Dec where volume should also broadly benefit from NEV subsidies expiring at year-end.

October EV sales

Nio delivered 10,059 units (-8% MoM and +174%YoY), below our forecast mainly due to COVID disruptions. The Hefei govt locked down areas of the city and Nio has experienced high volatility getting certain parts and workers to come in (e.g., paying extra for workers to be closed-loop when possible).

This has held back ET5 volumes in particular (only ~1,000 units delivered during Oct). ET7 sedan sales were 3,050 units, still dragged down by casting supply but going forward should improve after qualifying more suppliers. ES7 saw healthy MoM increase in volume to 2,814 units.

Looking ahead, 4Q volume will be heavily influenced by the local COVID situation.

Li Auto delivered 10,052 units (-13% MoM, +31% YoY), in-line with our expectations and likely better than feared. The volume in the month was heavily back-end loaded. We continue to expect L9 to sell well through the rest of the year and L8 to launch in November.

Xpeng delivered 5,101 units (-40% MoM; -50% YoY), meaningfully below our forecast. Sales continue to struggle across all models as focus turns to G9 ramp which sold 623 units in the month (mass production began on 10/27); this should increase materially in Nov/Dec, taking 4Q to at least 10,000 units. The company also went through a organizational restructuring as a result of the poor sales performance in recent months.

Zeekr delivered record monthly sales again at 10,119, up from September's 8,276 as demand for the uniquely styled 001 remains robust (ASP >336k RMB).

Hozon sold 18,016 units of its Neta-branded EVs (+0% MoM; +122% YoY).