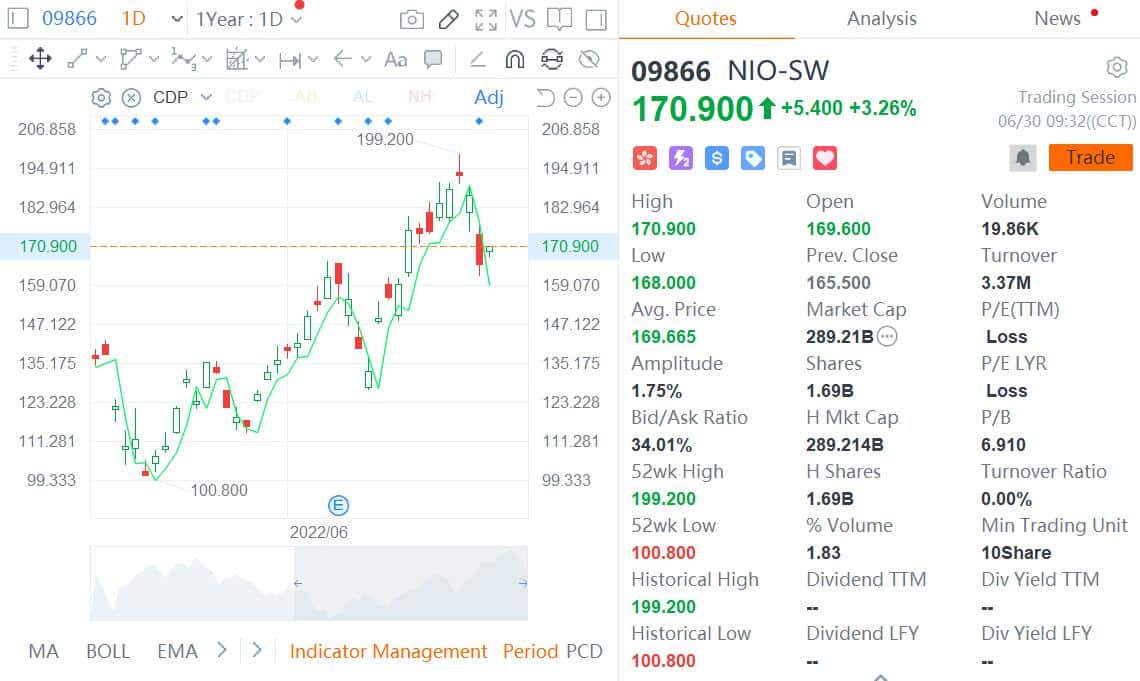

Nio is up 3.26 percent in Hong Kong as of this writing. It closed down 11.26 percent in Hong Kong yesterday, the biggest one-day drop since May 6.

Nio (NYSE: NIO, HKG: 9866, SGX: Nio) has recovered some of its lost ground in Hong Kong is early trading today after yesterday's big drop.

At press time, Nio was up 3.26 percent to HK$170.9 in Hong Kong. It closed down 11.26 percent in Hong Kong yesterday, its biggest one-day loss since April 11.

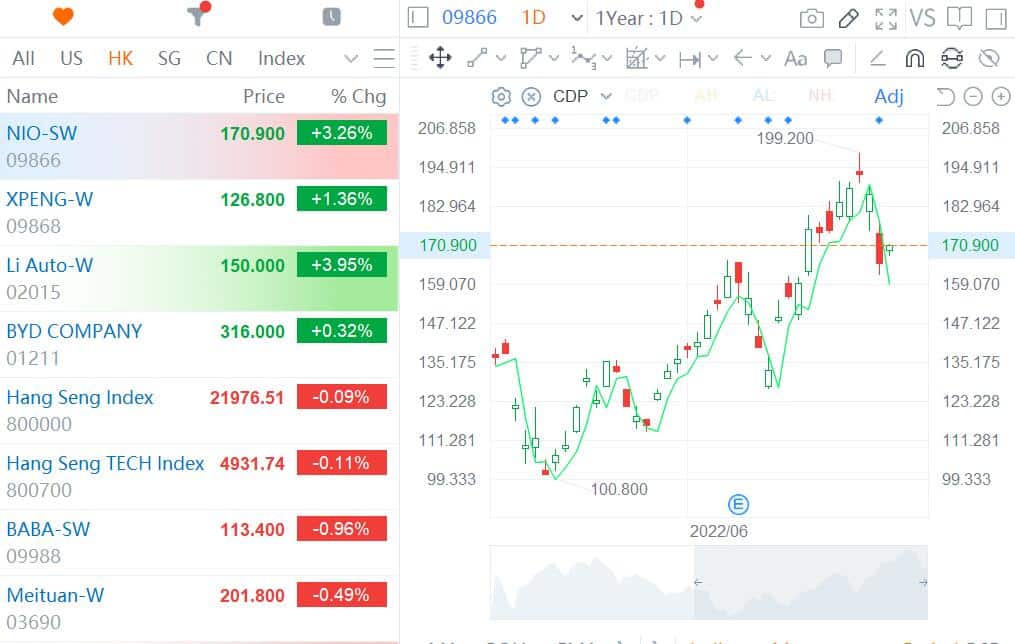

Xpeng Motors (NYSE: XPEV, HKG: 9868) rose 1.36 percent to HK$126.8 and Li Auto (NASDAQ: LI, HKG: 2015) rose 3.95 percent to HK$150, after they fell 7.4 percent and 8.84 percent, respectively, yesterday.

Hong Kong stocks were weak overall, with the Hang Seng Index and the Hang Seng Tech Index largely flat at press time.

A short seller called Grizzly Research launched an attack against Nio on Tuesday, claiming that Nio is playing a Valeant-like accounting game to inflate revenue and boost net income margins to meet its targets.

Nio issued a statement yesterday saying the report is without merit and contains numerous errors, unsupported speculations and misleading conclusions and interpretations regarding information relating to the company.

Nio's board of directors, including the audit committee, is reviewing the allegations and considering the appropriate course of action to protect the interests of all shareholders, it said.

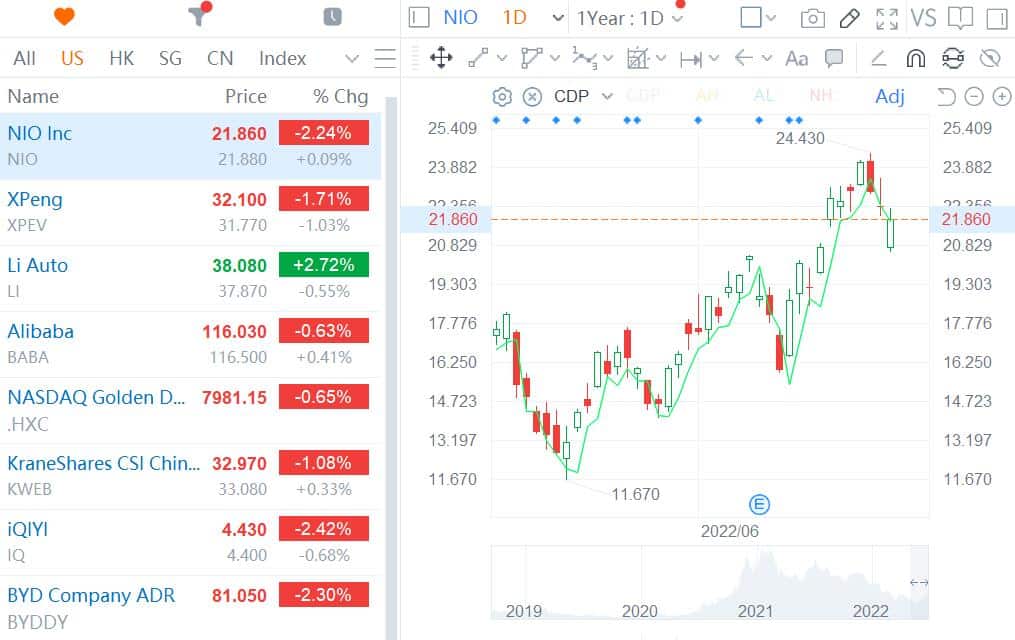

Notably, while Nio plunged in Hong Kong on Wednesday, its US-traded shares fared much better.

Nio closed down 2.24 percent in the US stock market overnight, after closing down 2.57 percent on Tuesday.

China's A-share auto chain as a whole is higher today, with an ETF tracking the new energy vehicle (NEV) sector up 1.57 percent at press time.

BYD is up 1.3 percent in the A-share market, while JAC is up 9.14 percent.

Sales of NEVs by China's major automakers grew at a high rate in June, with retail sales expected to approach 500,000 units, likely to reach a record high, the China Passenger Car Association said Wednesday.

On the macroeconomic front, data released earlier today showed that Purchasing Manager Index (PMI) of China's manufacturing industry was 50.2 in June, back to expansion. The figure was 49.6 last month, in contraction territory.