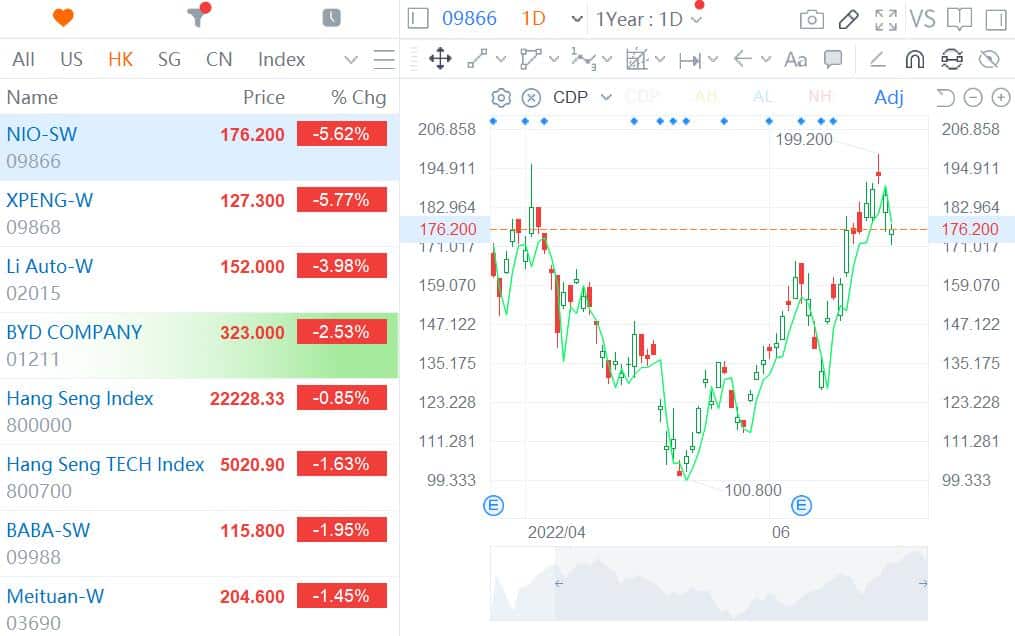

At press time, Nio was down 5.62 percent in Hong Kong, Xpeng was down 5.77 percent and Li Auto was down 3.98 percent.

Shares of major Chinese electric vehicle (EV) makers trading in Hong Kong were down in early trading today, along with overall market weakness.

Nio (NYSE: NIO, HKG: 9866, SGX: Nio) was down 5.62 percent to HK$176.2 in Hong Kong at press time. The stock was down 3.51 percent at the close yesterday.

Xpeng Motors (NYSE: XPEV, HKG: 9868) fell 5.77 percent to HK$127.3, its second straight day of losses, after falling 2.1 percent yesterday.

Li Auto (NASDAQ: LI, HKG: 2015) fell 3.98 percent to HK$152, its third straight day of losses.

Hong Kong markets were lower overall today, with the Hang Seng Index down 0.85 percent and the Hang Seng Tech Index down 1.63 percent at press time. Alibaba was down 1.95 percent, Meituan was down 1.45 percent and BYD was down 2.53 percent.

At the macroeconomic level, there were no obvious events that would impact investor sentiment from yesterday to today.

Notably, China announced yesterday that it will shorten the Covid quarantine period, at a time when the economy is facing continued downward pressure.

The quarantine period for close contacts of Covid cases and inbound arrivals was adjusted from "14 days of centralized isolation + 7 days of home monitoring" to "7 days of centralized isolation + 3 days of home monitoring," Chinese health authorities said yesterday.

China adjusted quarantine period for close contacts of Covid cases and inbound people from "14 days centralized isolation + 7 days home monitoring" to " 7 days centralized isolation + 3 days home monitoring".https://t.co/AzfiX7IVFj https://t.co/JWsX1PJrts

— CnEVPost (@CnEVPost) June 28, 2022

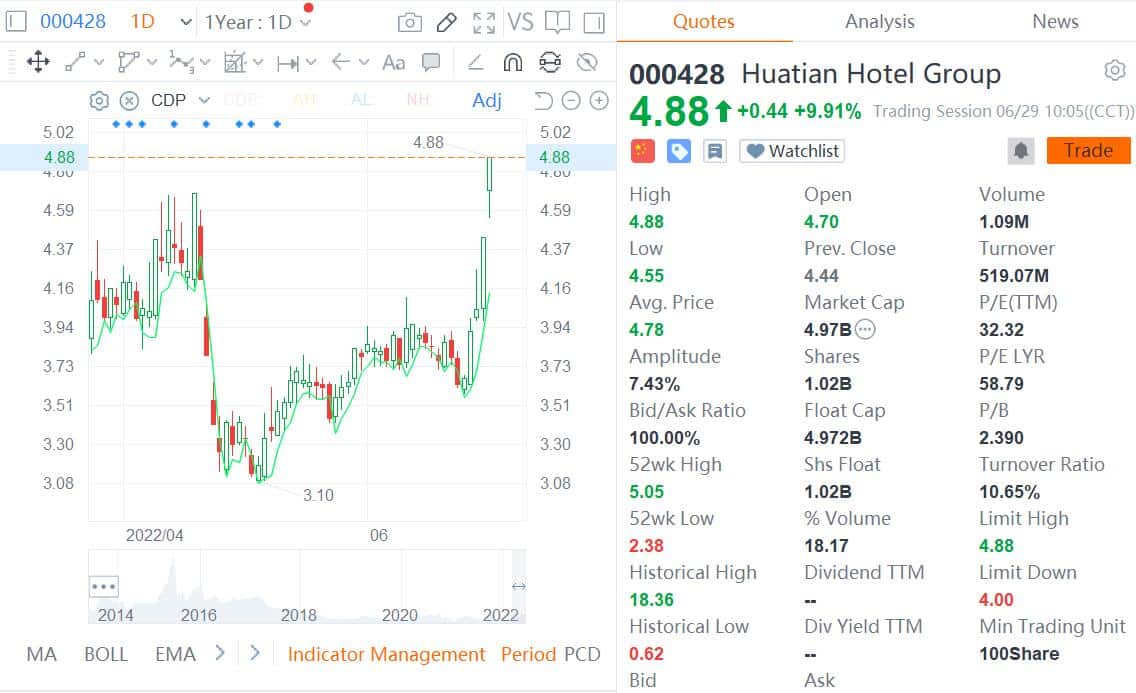

The policy adjustment has investors optimistic about the travel industry, with several hotel management and tourism companies in the A-share market rising by the 10 percent one-day limit as of press time.

In specific company news, a firm called Grizzly Research launched a short-selling attack against Nio on Tuesday, saying the company is playing a Valeant-like accounting game to inflate revenue and boost net income margins to achieve its goals.

In a response to CnEVPost's request for comment today, Nio said it has taken note of the report, which is full of inaccuracies and misinterpretations of the company's disclosures.

Nio has been strictly adhering to the guidelines for public companies and has initiated procedures in response to the report, the company told CnEVPost.

Li Auto has chosen to raise capital by issuing additional shares after its share price has accumulated significant gains over the past few months.

The company has filed a prospectus supplement to sell up to a total of $2 billion in American Depositary Shares (ADSs) in an at-the-market stock offering program on the Nasdaq, according to a press release it issued yesterday.

There has been no noteworthy news about Xpeng in the last two days.