Deutsche Bank expects the latest round of price cuts to spur a big rebound in EV orders, with at least eight automakers already offering some type of price discount or promotion so far.

China's new energy vehicle (NEV) market saw weak overall sales performance in January, with major automakers reporting falling numbers. In Deutsche Bank's view, NEV sales in January were weaker than expected, but price cuts should boost future sales.

"Moving forward, we expect the recent round of price cuts to stimulate a big rebound in EV orders. Thus far, we have seen some type of price discount or promotion from at least 8 OEMs including Tesla, Xpeng, and Nio," Deutsche Bank analyst Edison Yu's team said in a research note sent to investors on Wednesday.

Retail sales of new energy passenger vehicles in China stood at 332,000 units in January, down 6.3 percent from a year earlier and down 48.3 percent from December, according to data released yesterday by the China Passenger Car Association (CPCA).

This was below the CPCA's estimate of 360,000 units released on January 28, indicating that the market performance was weaker than expected in the final days of January.

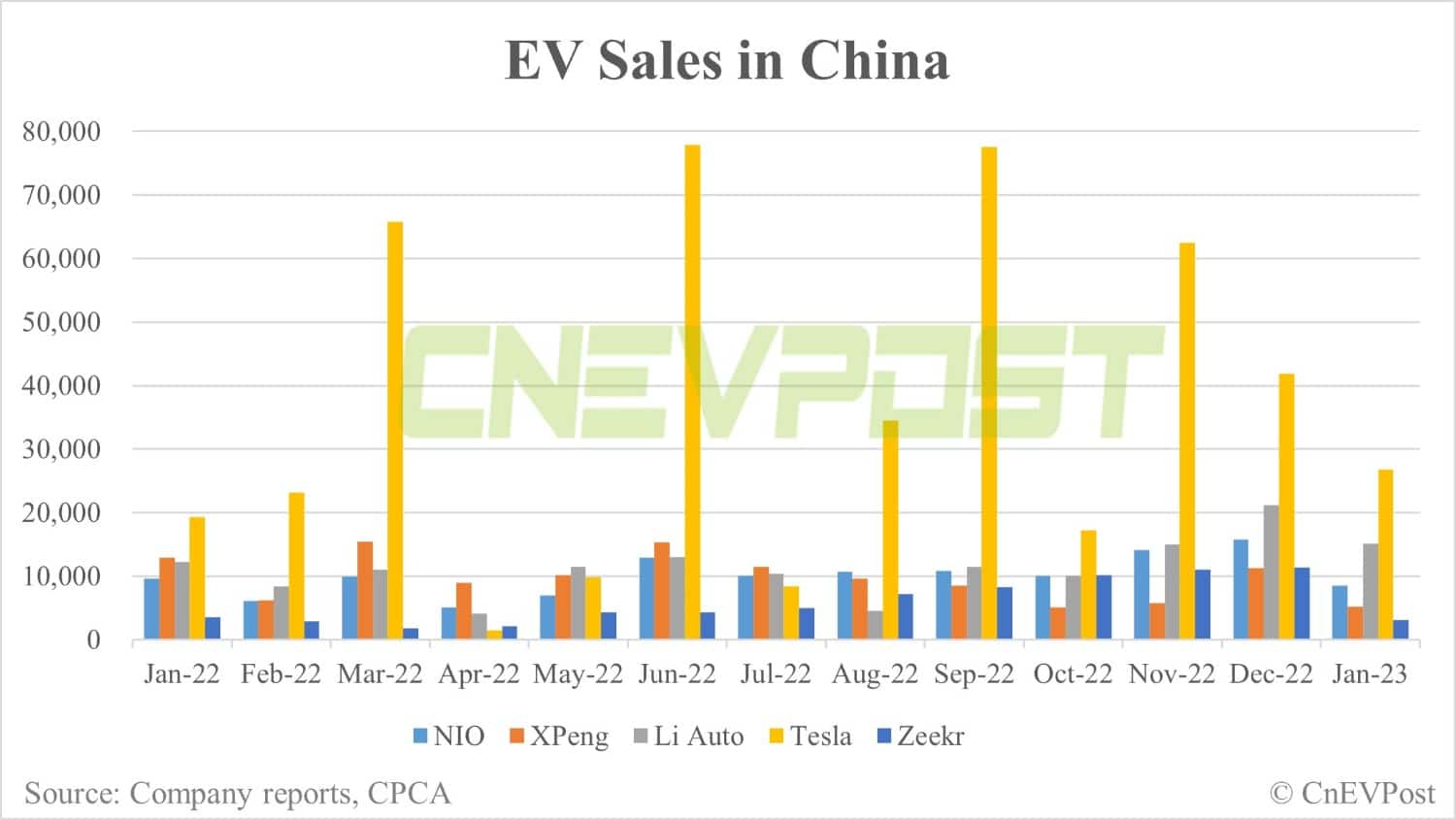

For major NEV manufacturers, Nio (NYSE: NIO) delivered 8,506 vehicles in January, down 46.22 percent from 15,815 in December and down 11.87 percent from 9,652 in the same month last year.

Xpeng (NYSE: XPEV) delivered 5,218 vehicles in January, down 59.62 percent from 12,922 vehicles in the same month last year and down 53.79 percent from 11,292 vehicles in December.

Li Auto (NASDAQ: LI) delivered 15,141 vehicles in January, down 28.69 percent from 21,233 vehicles in December and up 23.42 percent from 12,268 vehicles in the same month last year.

Zeekr delivered 3,116 units in January, down 11.73 percent from 3,530 units in the same month last year and down 72.51 percent from 11,337 units in December.

BYD (OTCMKTS: BYDDY) reported sales of 151,341 NEVs in January, up 62.44 percent from 93,168 units in the same month last year but down 35.65 percent from 235,197 units in December.

Tesla (NASDAQ: TSLA) delivered 26,843 vehicles in China in January, with 39,208 units exported from its Shanghai plant.

Here's Yu's team's take on EV sales in China in January.

January NEV sales came in weaker than previewed. Retail volume was 332k units, down 48% relative to December (-6% YoY); CPCA previewed ~360k in late Jan anticipating a stronger close to the month that did not materialize.

Total passenger vehicle retail sales were 1.29m (-40% MoM, -38% YoY), implying NEV penetration of 26% (-4% points MoM).

Moving forward, we expect the recent round of price cuts to stimulate a big rebound in EV orders. Thus far, we have seen some type of price discount or promotion from at least 8 OEMs including Tesla, Xpeng, and Nio.

In addition, Li Auto introduced lower price trims of the L7 and L8 called the "Air" version. Therefore, we maintain our 1Q forecasts, calling for NEV sales/production down about 25% QoQ.

By OEM, Li Auto delivered another strong month in January, selling >15k vehicles or more than Nio+Xpeng combined.

Tesla also outperformed the market at the retail level.

January OEM recap

Tesla sold 26,843 vehicles at the retail level (-36% MoM, +39% YoY) and exported 39,208 units, adding up to wholesales of 66,051.

Li Auto delivered 15,141 vehicles (-29% MoM, +23% YoY), mostly in-line with our forecast, demonstrating another solid month of execution.

Li Auto also officially launched the L7 five-seat SUV earlier today at a starting price of 320k RMB; deliveries will begin on March 1st for higher end versions.

Entry-level trims (of both L7 and L8 Air) will use batteries from Sunwoda EVB and SVOLT and hit the roads in early April. The company exited the month with 296 retail stores and 320 servicing centers.

Nio delivered 8,506 units (-46% MoM, -12% YoY), missing our forecast for the second straight month. We attribute this to lackluster demand for its older products and consumers taking a more patient approach toward premium BEVs more broadly. Nio has about 4-5k units of inventory in China, mainly of gen-1 vehicles.

Moreover, it's become clear that the various operational woes the company encountered in 2H22 caused a meaningful amount of order delays/cancellations where customers initially wanted the newest trendy electric car (e.g., ET7) but eventually cancelled due to a prolonged wait time.

As a result, management is optimizing the corporate structure, and resource efficiency has become the main priority for 2023.

Xpeng delivered 5,218 units (-54% MoM; -60% YoY), meeting our expectations. Following big price cuts before CNY, we expect February volume to pick up materially as management is now clearly prioritizing market share over margin which we believe is the right tactical move to remain relevant.

Zeekr delivered soft sales of 3,116 vehicles (-73% MoM; -12% YoY), in part due to a 21 day factory shut down to upgrade production lines. Average order valued held steady at +336k RMB for the 001. The recently launched Zeekr 009 high-end MPV saw an average order value of 527k RMB.

Separately, Zeekr unveiled its third model called the Zeekr X, a hatchback "urban" SUV; this is expected to launch in 2Q.