China will strictly investigate and punish hoarding, price gouging and unfair competition in the upstream and downstream lithium battery industry to maintain market order, a government document said today.

China's industry and market regulators say they will crack down on behaviors including price gouging in the lithium battery industry chain, as rising raw material prices, including lithium carbonate, put electric vehicle companies under enormous pressure.

Market regulators across China have to step up supervision and strictly investigate hoarding, price gouging and unfair competition in the upstream and downstream lithium battery industry to maintain market order, according to a government document today.

China's Ministry of Industry and Information Technology and the State Administration for Market Regulation mentioned the wording in a joint notice issued today that aims to make the lithium battery industry chain stable.

Local industry regulators need to guide companies upstream and downstream in the industry to strengthen communication and promote a stable and efficient synergistic development mechanism, the document reads.

China encourages industry players including lithium cell and battery pack producers, producers of raw materials including lithium, nickel and cobalt, and lithium battery recycling companies to strengthen cooperation and guide industry chain participants to stabilize expectations and secure supply by signing long-term orders, the document says.

These measures are not good news for raw material producers, but they are long-awaited for battery manufacturers and electric vehicle companies.

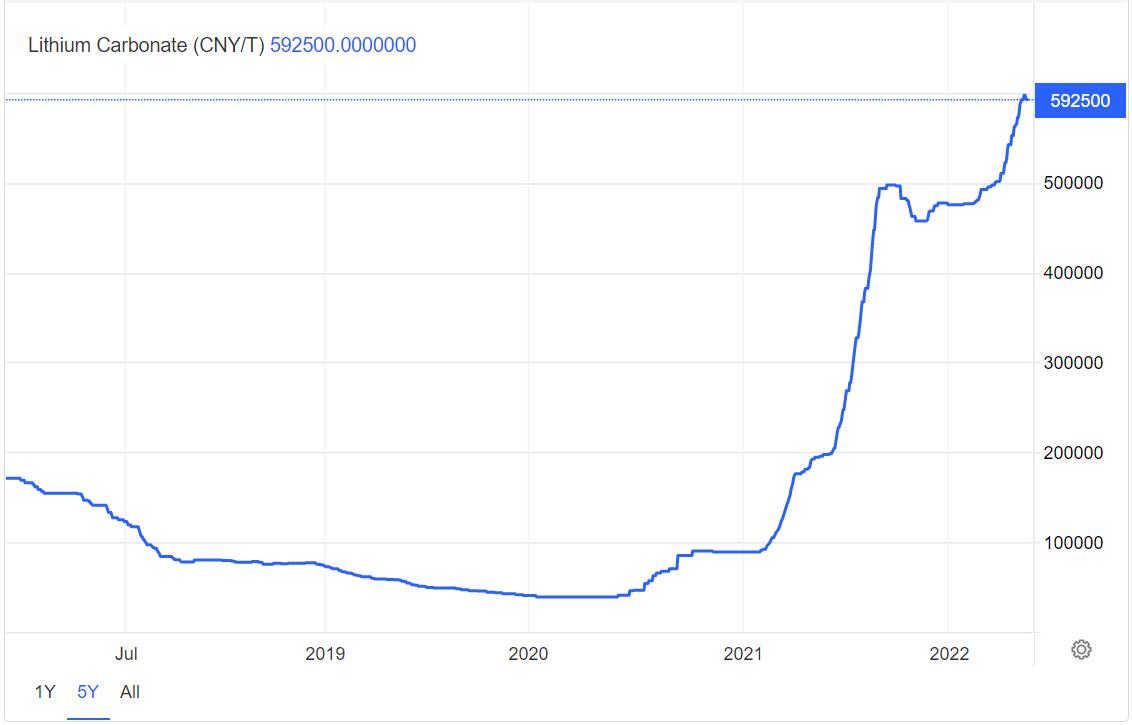

The price of battery-grade lithium carbonate in China at one point last week exceeded 600,000 yuan ($85,380) per ton, continuing a record high. The current price is about RMB 590,000 per ton.

That's about 14 times the June 2020 average of RMB 41,000 per ton and up about 55 percent from RMB 364,000 per ton in early February this year.

Recently there have been rumors that battery makers are planning to cut production as lithium carbonate prices have risen to RMB 600,000 per ton. This has been denied by some mainstream producers but highlights the dilemma facing the industry.

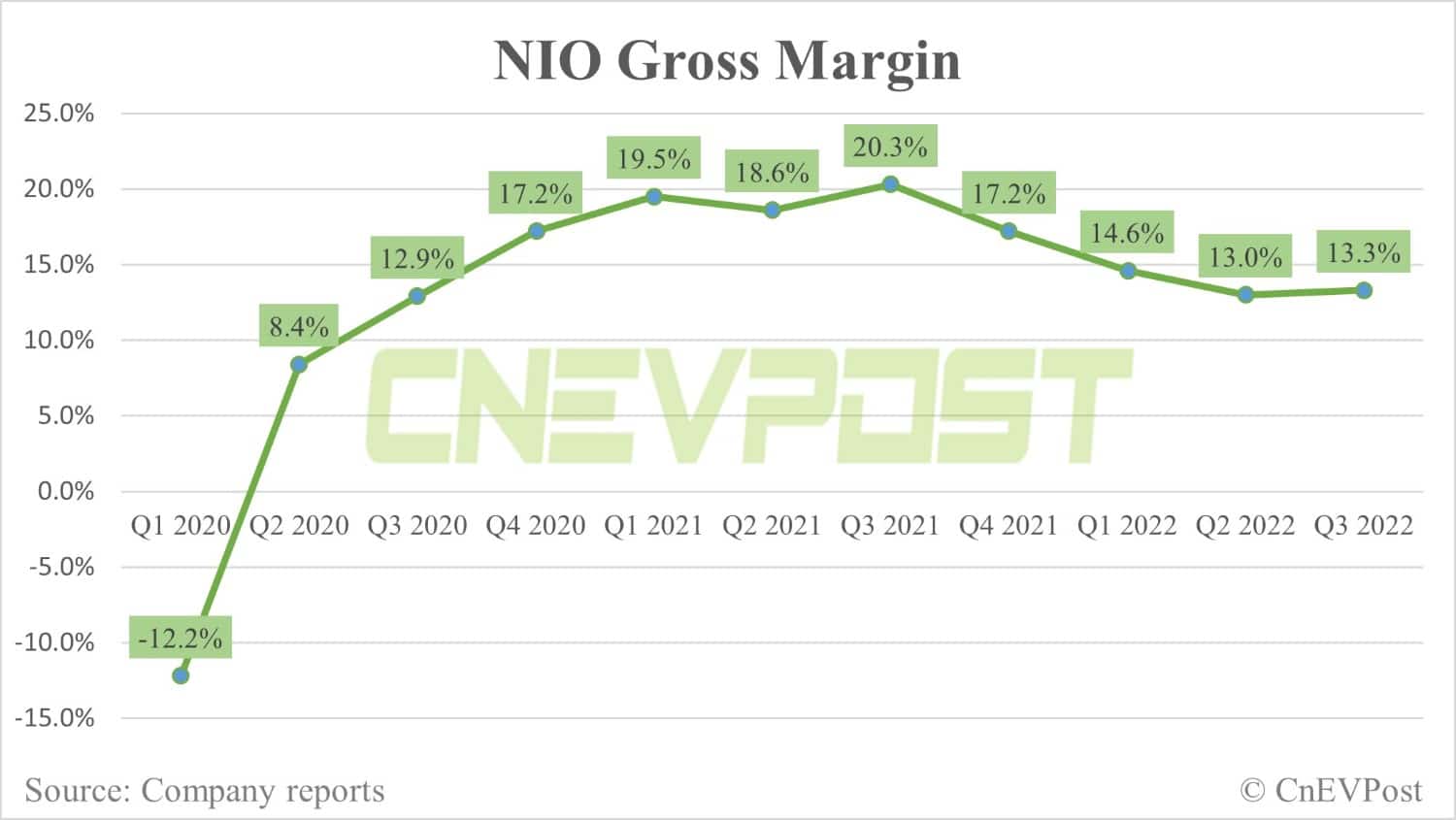

If lithium carbonate prices stay this high, it will have a relatively big impact on Nio's gross margins, William Li, the electric vehicle maker's founder, chairman and CEO, said in a conference call with analysts after the company announced its third-quarter earnings on November 10.

Every RMB 100,000 increase in lithium carbonate prices will have a 2 percentage point impact on Nio's gross margin, Li said.

However, Li does not believe the continued rise in lithium carbonate prices is due to a supply-demand imbalance, but rather to speculation.

In a speech at the 2022 China Auto Forum on November 9, Zhu Huarong, chairman of Chinese auto giant Changan Automobile, said high battery prices are caused by factors including raw material price hikes, speculation by capital, sellers' hesitation to sell and hoarding by middlemen.

Zhu suggested that China should carry out a crackdown on some players' profiteering and stop some companies from hoarding and speculating on raw materials.

In addition to mentioning that price gouging will be cracked down on, the latest document also says that lithium battery producers should set reasonable development goals to avoid low-level homogeneous development and vicious competition.