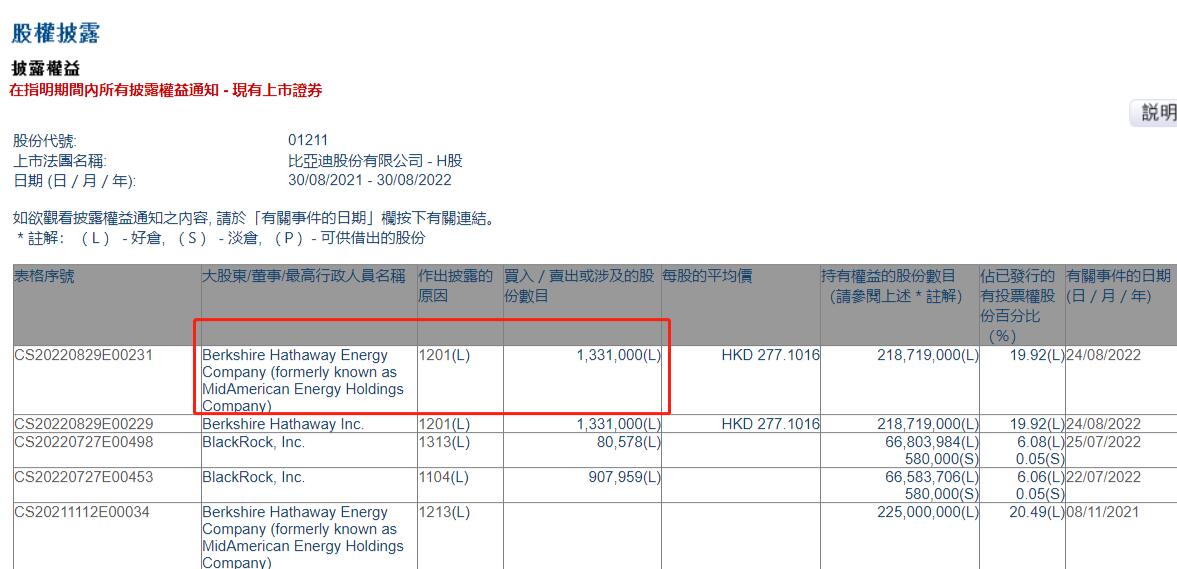

Following the move, Berkshire Hathaway's stake in BYD fell from 20.04 percent to 19.92 percent.

Berkshire Hathaway, owned by legendary US investor Warren Buffett, began reducing its position in BYD after some rumors last month sparked volatility in the Chinese new energy car giant's stock price.

Berkshire Hathaway sold 1.33 million shares of BYD traded in Hong Kong on August 24 at an average trading price of HK$277.1 per share, according to an exchange filing.

Following the move, Berkshire Hathaway's stake in BYD fell from 20.04 percent to 19.92 percent.

On September 29, 2008, Berkshire Hathaway Energy, which is 91.1 percent owned by Berkshire, spent $230 million to buy 225 million shares of BYD at HK$8 per share.

After that, there was no change in Berkshire's holdings of BYD.

On July 11, the number of BYD H shares in Citi's seat reached 388.6 million shares, an increase of about 225 million shares from the previous week, which was seen at the time as a prelude to Buffett's reduction of BYD's holdings.

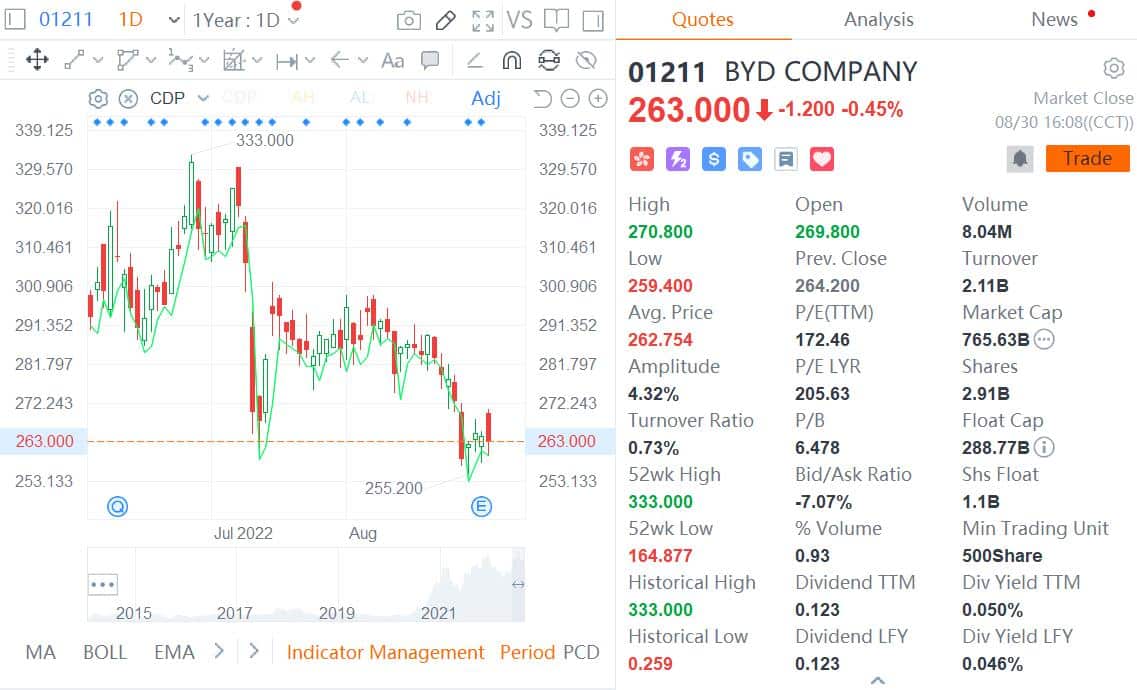

This caused BYD to plunge 11.83 percent in Hong Kong on July 12, and the stock traded in Shenzhen fell 4.72 percent the same day.

BYD then said that the major shareholders need to declare their interests to reduce their holdings, and HKEX's equity disclosure platform did not show the reduction information at that time.

Some analysts previously said that BYD's share price fluctuations at the time may have been a misinterpretation by investors of the HKSE's trading rules.

There had been a change in the HKSE rules where the entity's shares needed to be replaced with electronic shares, and this needed to be done through brokerage channels including Citi and Morgan Stanley, which all have a CCASS account, some local analysts said.

Notably, this appears to be a key factor holding down BYD's share price since then.

BYD has been down 14 percent in Hong Kong and 4 percent in Shenzhen since July 12, even though it had record sales in July.

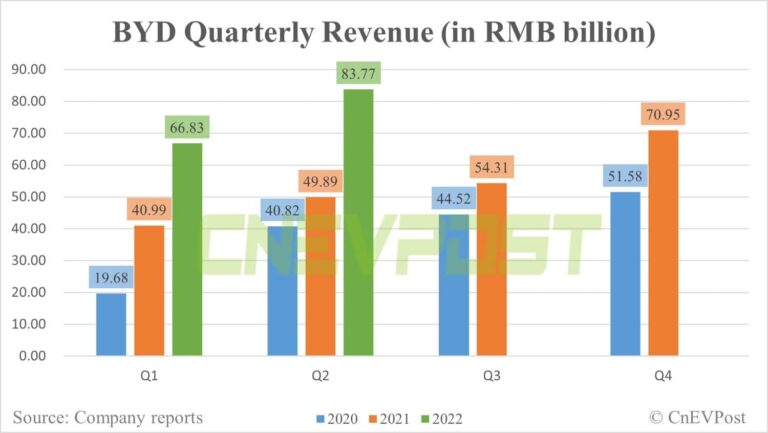

It's also worth noting that BYD reported first-half results yesterday that beat expectations, but despite that, the company is down slightly in both Hong Kong and Shenzhen today.