New order flow for Nio's main brand is estimated at around 20,000 units in September, flat from August, but new brand Onvo has received more than 30,000 non-cancelable orders, according to Deutsche Bank.

With the data bazooka of car sales on the first day of the month just around the corner, Deutsche Bank shared their forecasts as usual.

In a research note sent to investors yesterday, analyst Wang Bin's team expects major electric vehicle (EV) players to sell about the same number of units in September as they did in August, with some of them seeing upside.

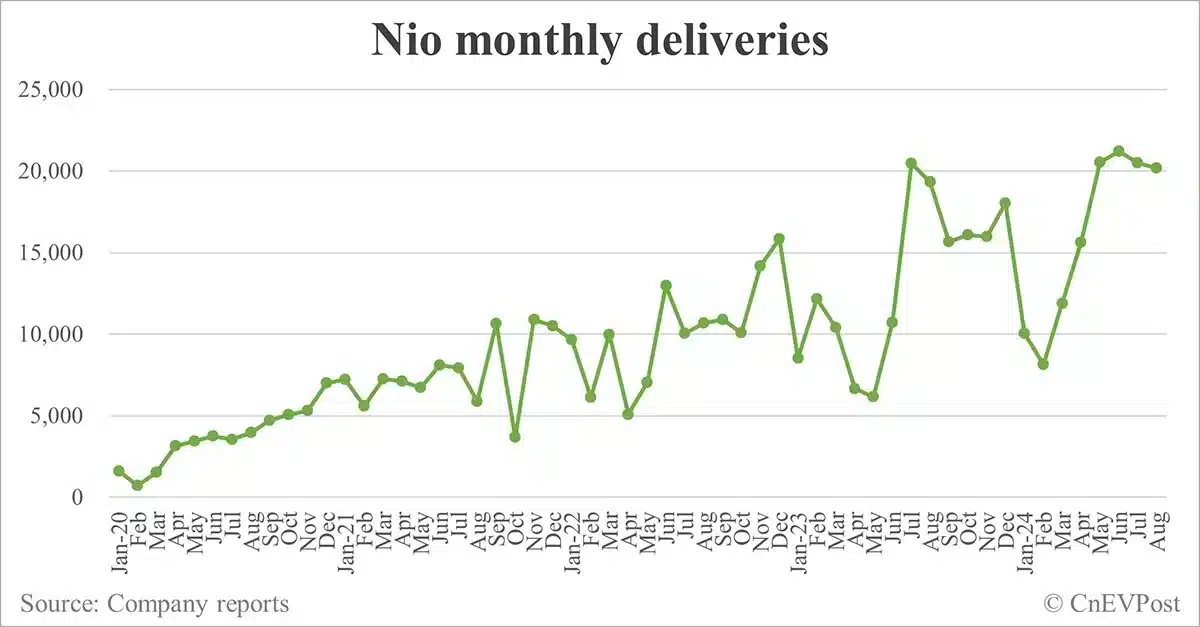

Nio (NYSE: NIO) is expected to deliver about 21,000 units for the full month of September, up 34 percent year-on-year and 4 percent from August, in line with the company's 20,300-22,300 unit estimate, the team wrote.

In the first three weeks of September, Nio's domestic retail sales totaled 13,000 units, according to the team.

New order flow for Nio's main brand is expected to be around 20,000 units in September, flat month-on-month, but new brand Onvo has received more than 30,000 non-cancelable orders, Wang's team said, citing dealer feedback.

Onvo officially launched its first model, the L60, on September 19, and deliveries of the SUV (sport utility vehicle) are set to begin on September 28.

The Onvo L60 will contribute to Nio sales in September, Wang's team noted.

Nio management said on September 20 that the Onvo L60's production capacity is expected to reach 5,000 units in October and 10,000 units in December.

By January 2025, the model's capacity will reach at least 16,000 units and 20,000 units by March, according to the EV maker.

For Nio's main brand, the company upped its promotional efforts in September in order to keep up the flow of new orders, according to Deutsche Bank.

On the one hand, Nio introduced a show car subsidy for all its products, and on the other hand, it also increased the accessary purchase incentive for volume products -- ET5 sedan, ET5T sedan, ES6 SUV, EC6 SUV -- from RMB 8,000 ($1,140) per vehicle in August to RMB 18,000 in September, while eliminating the RMB 5,000 value gift, according to the team.

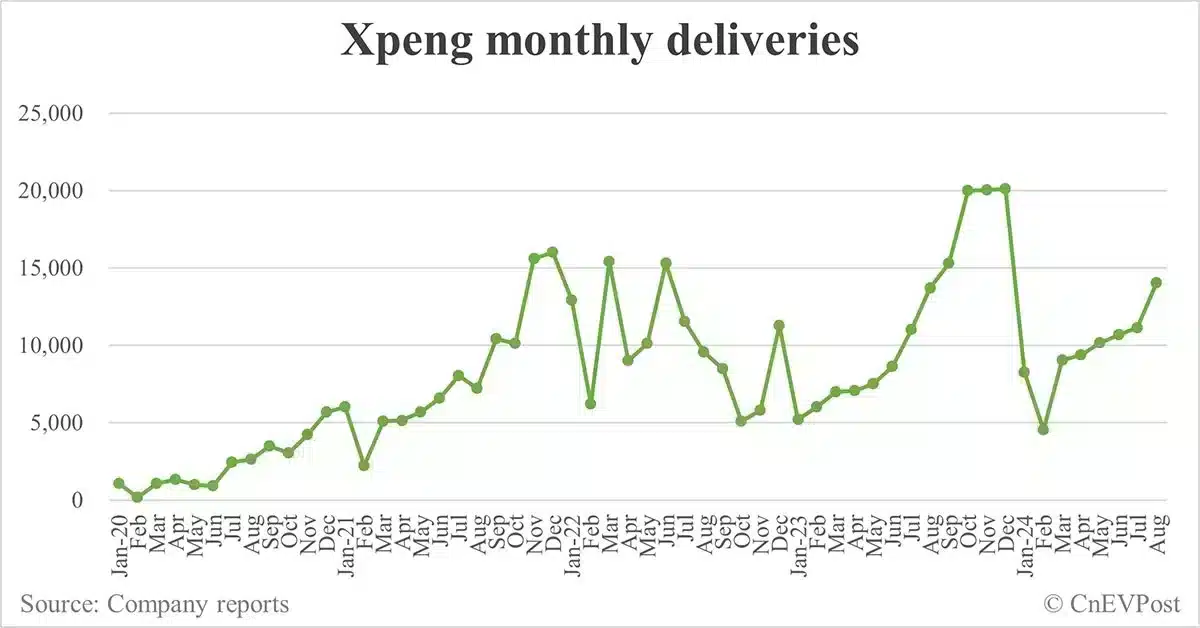

Deutsche Bank expects Xpeng (NYSE: XPEV) to deliver about 20,000 units in September, up 30 percent year-on-year and up 42 percent sequentially. That includes about 17,000 domestic retail deliveries and about 3,000 overseas deliveries.

“Our estimated 20k units of delivery are higher than the company's guidance of 15.8-19.8k units,” the team wrote.

In the first three weeks of September, Xpeng's domestic retail sales totaled 11,400 units, according to the team.

Xpeng officially launched the Mona M03 on August 27 and said the electric sedan received more than 30,000 orders in its first 48 hours.

The Mona M03 sedan has been a great success and September deliveries are expected to be around 10,000 units, Wang's team said.

Xpeng's other products' September incentives remain largely unchanged, such as subsidies of RMB 20,000 to RMB 25,000 per unit for the P7i sedan and RMB 15,000 per unit for the G9 SUV, G6 SUV, and P5 sedan, according to Deutsche Bank.

The company also offers a car insurance subsidy of RMB 5,000 per vehicle for other products, the team noted.

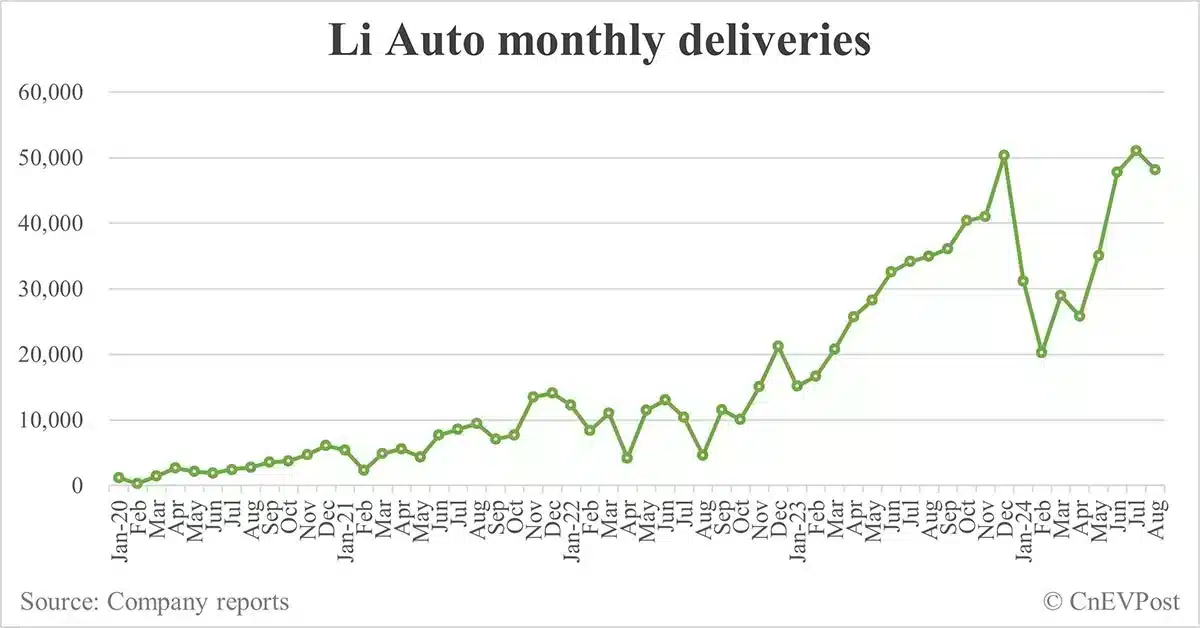

Deutsche Bank estimates Li Auto (NASDAQ: LI) will deliver about 50,000 units for the full month of September, up 27 percent year-on-year and up 4 percent sequentially, in line with the company's guidance of 46,000 to 56,000 units.

Li Auto's domestic retail sales totaled 35,000 units in the first three weeks of September, the team noted.

The company's new order flow was estimated at around 14,000 units last week as it upped promotional efforts in September, Deutsche Bank said, citing dealer feedback.

Li Auto raised the Li L6 accessory purchase incentive to RMB 8,000 in September from RMB 5,000 in August, and introduced new discounts of RMB 5,000 per unit for the Li L7 and Li L8, and RMB 7,000 per unit for the Li L9 and Li Mega MPV, the team said.

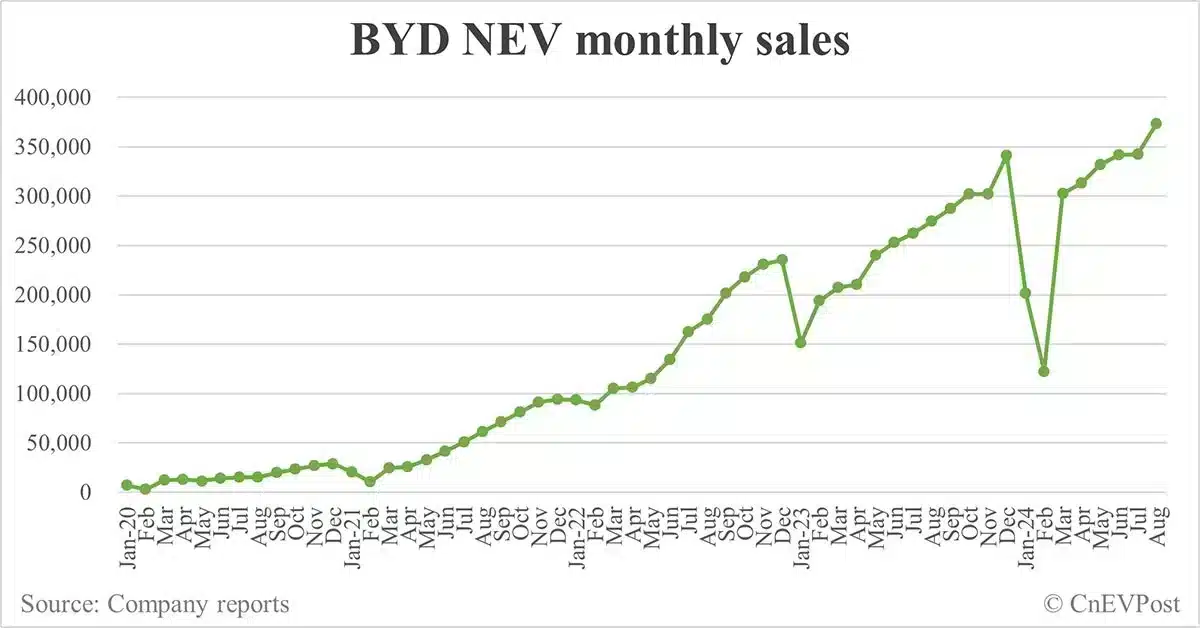

Deutsche Bank expects BYD (HKG: 1211, OTCMKTS: BYDDY) to deliver around 370,000 units domestically in September, up 50 percent year-on-year and flat sequentially.

In the first three weeks of September, BYD's domestic retail sales totaled 250,000 units, according to the team.

The company expects its monthly new orders to exceed 400,000 units, driven primarily by its DM 5.0 technology offerings, Deutsche Bank said.

BYD has a waiting list of more than a month at the dealership level, and recent delivery numbers have been limited by supply rather than demand, the team said.

Additionally, BYD launched the Denza Z9GT in September and received more than 5,000 non-cancelable orders within 36 hours of launch, the team noted.

Deutsche Bank estimates BYD's wholesale volume -- from automakers to dealers -- will reach a record high of about 440,000 units in September, up 55 percent year-on-year and 19 percent sequentially.

The team expects Tesla to deliver about 64,000 units in China in September, up 48 percent year-on-year and flat sequentially.

Domestic retail sales for Tesla's China operations totaled 46,000 units in the first three weeks of September, the team said.

Tesla extended its maximum 5-year zero-percent auto financing program through September, while wait times for Model 3 sedans were extended to 4-6 weeks in September from 3-5 weeks in August, the team noted.

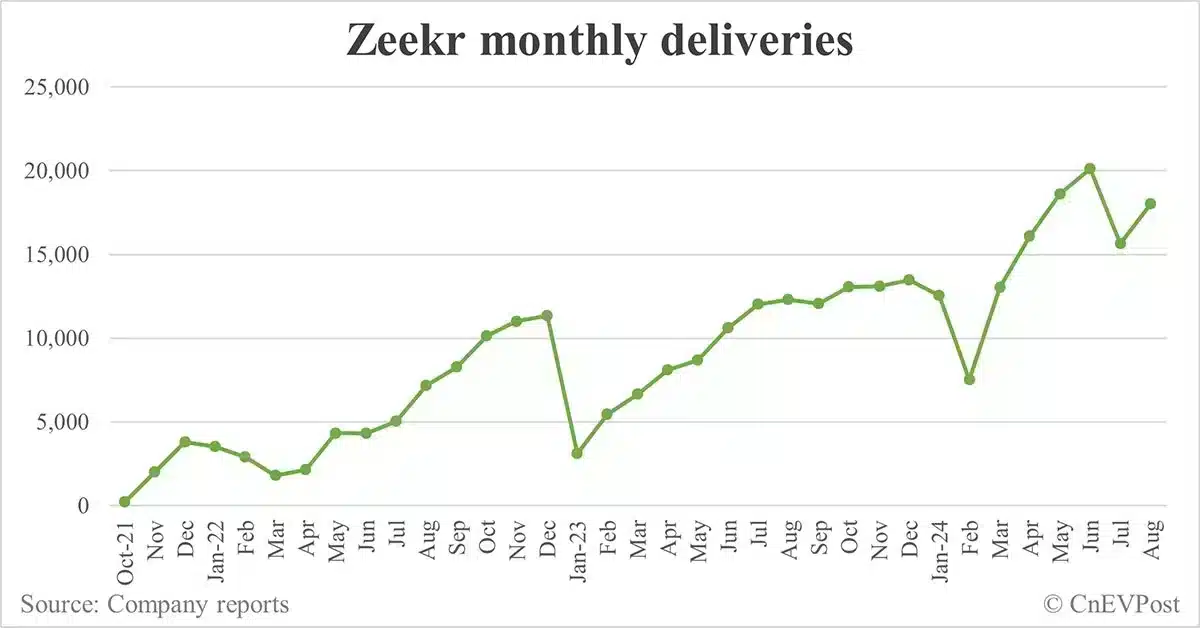

Deutsche Bank forecasts Zeekr (NYSE: ZK) to deliver about 24,000 units in September, doubling year-on-year and up 33 percent sequentially. This includes domestic retail sales of about 22,000 units, including about 3,000 units of the new Zeekr 7X SUV, and exports of about 2,000 units.

Zeekr's domestic retail sales in the first three weeks of September totaled 13,000 units, according to the team.

The company launched the Zeekr 7X family SUV on September 20 with more than 60,000 cancelable orders, Wang's team noted.

Within 24 hours of the Zeekr 7X's launch, it had converted cancelable orders into at least 6,000 non-cancelable orders, according to dealer feedback, Deutsche Bank said, adding that the number should increase further as more salespeople interact with potential car buyers with cancelable orders.

Zeekr's promotional efforts in September remain largely unchanged, as the company has officially lowered the selling prices of all its products in July and August, the team said.

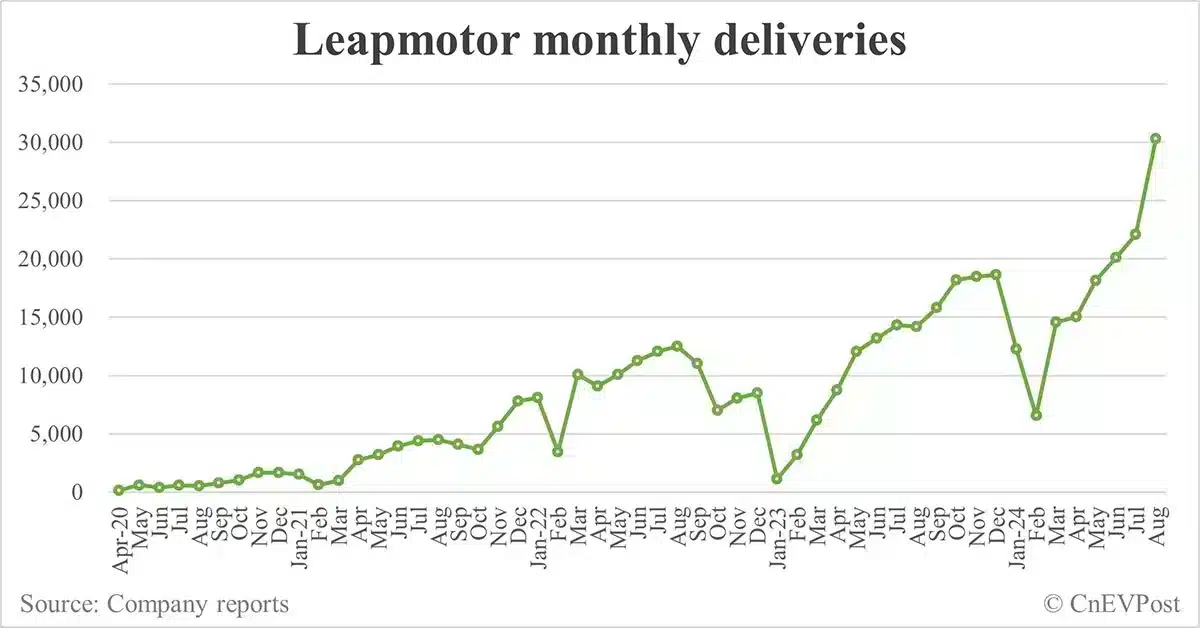

Deutsche Bank expects Leapmotor to deliver around 32,000 units in September, doubling year-on-year and up 6 percent sequentially. This includes domestic retail sales of around 30,000 units and exports of around 2,000 units.

The company's domestic retail sales in the first three weeks of September totaled 20,500 units, the team noted.

According to dealer feedback, new orders were estimated at around 10,000 units last week due to Leapmotor's increased promotions in September.

Deliveries of Aito -- a brand jointly created by Huawei and Seres Group -- are expected to be around 36,000 units in September, up 15 percent from August, according to Deutsche Bank.

The brand's domestic retail sales in the first three weeks of September totaled 25,000 units, the team said.

Deutsche Bank estimates Aito's order backlog at the end of August to be around 50,000 units, including around 30,000 units of the Aito M9, 10,000 units of the Aito M7 and 10,000 units of the Aito M5.

($1 = RMB 7.0251)