A rumor -- later confirmed -- that CATL is suspending lithium production in Jiangxi sent shares of major lithium producers soaring.

A rumor -- later confirmed -- that CATL is suspending lithium production in Jiangxi sent shares of major lithium producers soaring, after the sector experienced a prolonged drop in prices due to overcapacity.

In a widely circulated research note today, UBS analyst Sky Han's team said CATL has finally decided to suspend its Jiangxi lithium operations.

“It's not the first time for us to hear CATL to cut/suspend lithium production in Jiangxi. Although the previous news turned out to be speculation, we get higher conviction this time,” the team wrote.

“According to our channel checks with several contacts, CATL finally decides to suspend its lithium lepidolite operation in Jiangxi after a meeting on 10 September,” these analysts said.

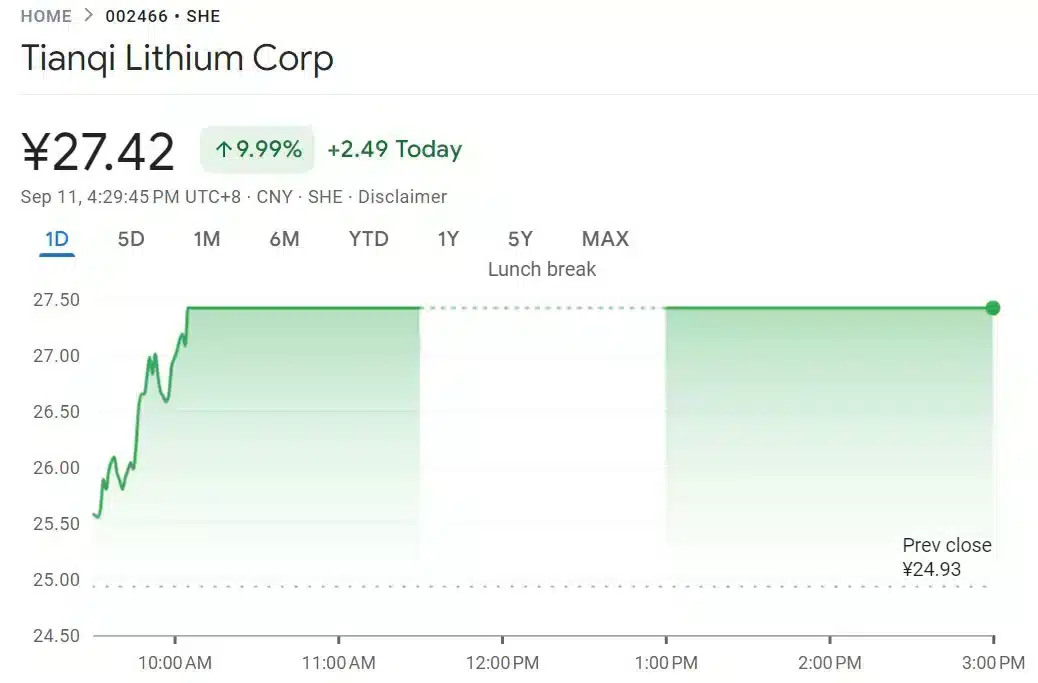

Buoyed by the news, shares of China's major lithium producers surged, with Ganfeng Lithium and Tianqi Lithium, both traded in Shenzhen, up by a 10 percent daily limit by today's close.

Hours later, local media outlet Cailian cited a response from CATL confirming the rumor was true.

The company plans to adjust its lithium carbonate production arrangements in Yichun based on recent lithium carbonate market conditions, a CATL source said.

CATL acquired exploration rights for a lithium mine in Yichun, Jiangxi province -- known as the lithium capital of Asia -- in April 2022 for an offer of RMB 865 million.

Earlier this year, amid the continuing declines in lithium prices, there were rumors that CATL had suspended production at the lithium mine, which were later denied.

UBS analysts believe CATL's cash cost of mining lithium carbonate in Yichun is $10,968 per ton, excluding VAT. After VAT is taken into account, the cost is RMB 89,000 ($12,520) per ton.

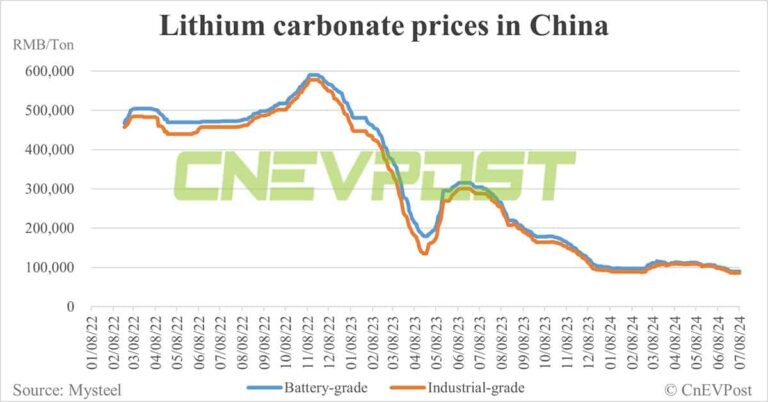

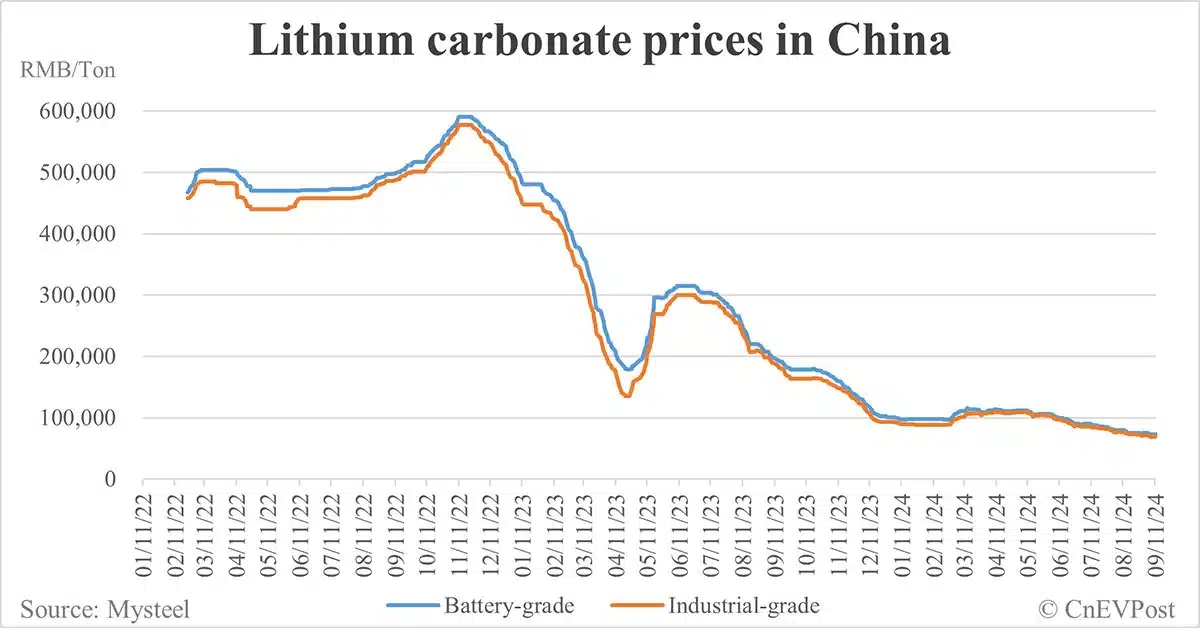

Since mid-July 2024, the spot price of lithium carbonate has been below CATL's cash cost level, the team said, citing data from market researcher SMM.

Battery-grade lithium carbonate was quoted at RMB 73,500 per ton today, down 27 percent year to date, according to data from Mysteel monitored by CnEVPost.

For all of last year, the price of battery-grade lithium carbonate fell 80 percent from about RMB 520,000 per ton to just over RMB 100,000 per ton.

Han's team said they had thought CATL would be more tolerant on losses in its lithium business, as its focus was likely to be on its overall battery margins.

“But after making a loss for two months in lithium business and continuous downside risk on lithium price, we finally see normal supply response from marginal-cost producer,” the team said.

CATL's suspension of lithium production in Jiangxi will result in an 8 percent reduction in China's monthly lithium carbonate production, or 5,000 to 6,000 tons of lithium carbonate equivalent, and help to achieve a supply-demand balance, according to the team.

UBS expects this to have a positive impact on lithium prices, which are projected to rise 11 percent to 23 percent over the remainder of 2024.

“Based on our analysis on 2024E global cash cost curve, we believe the price will see support at US$9,909/t(excl. VAT),” the team wrote.

Lithium prices could be capped at $10,968/ton, excluding VAT, as CATL could resume lithium production if lithium prices rise to $10,968/ton, the team said.

($1 = RMB 7.1113)