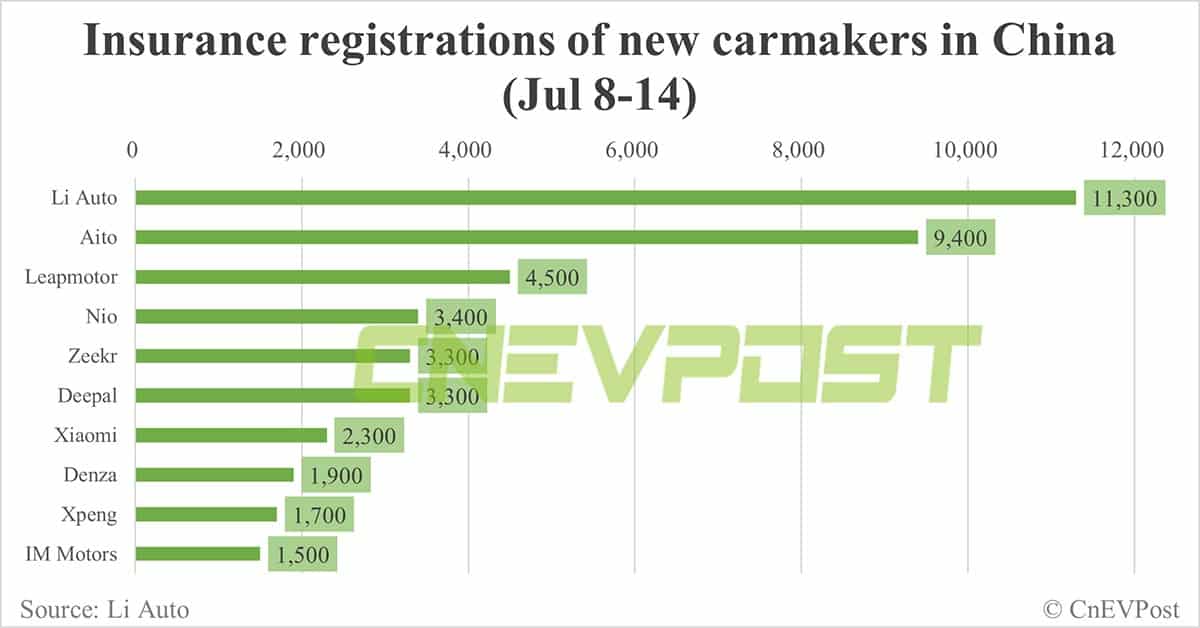

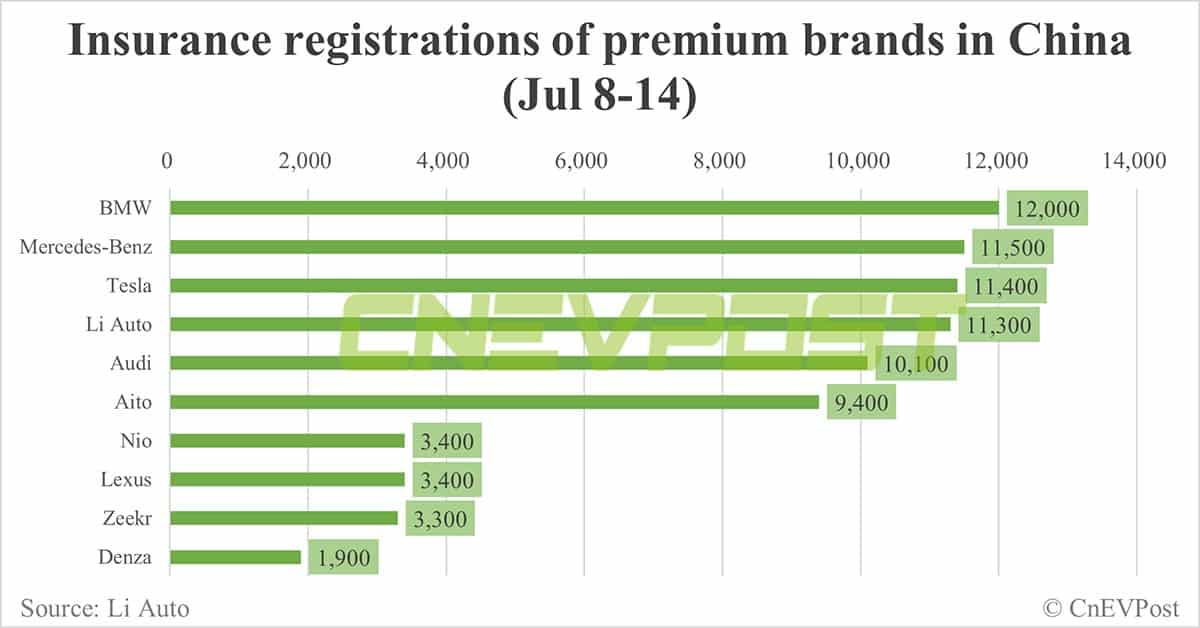

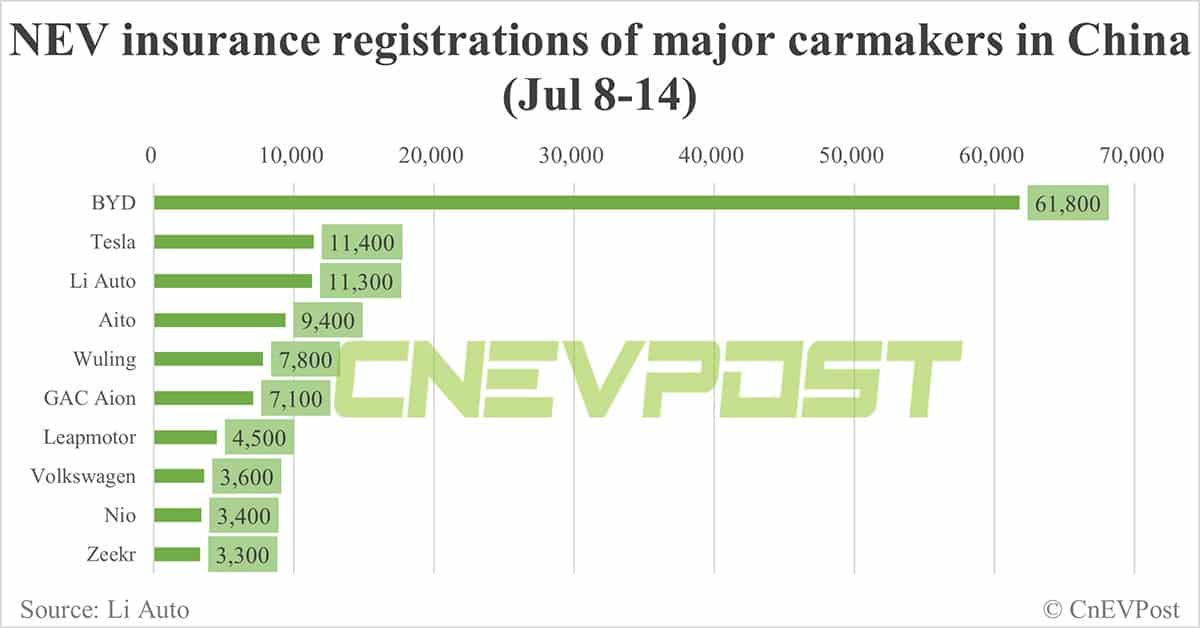

Xpeng had 1,700 insurance registrations last week, Li Auto 11,300, Zeekr 3,300 and Aito 9,400.

Major electric vehicle (EV) makers saw mixed sales performance last week.

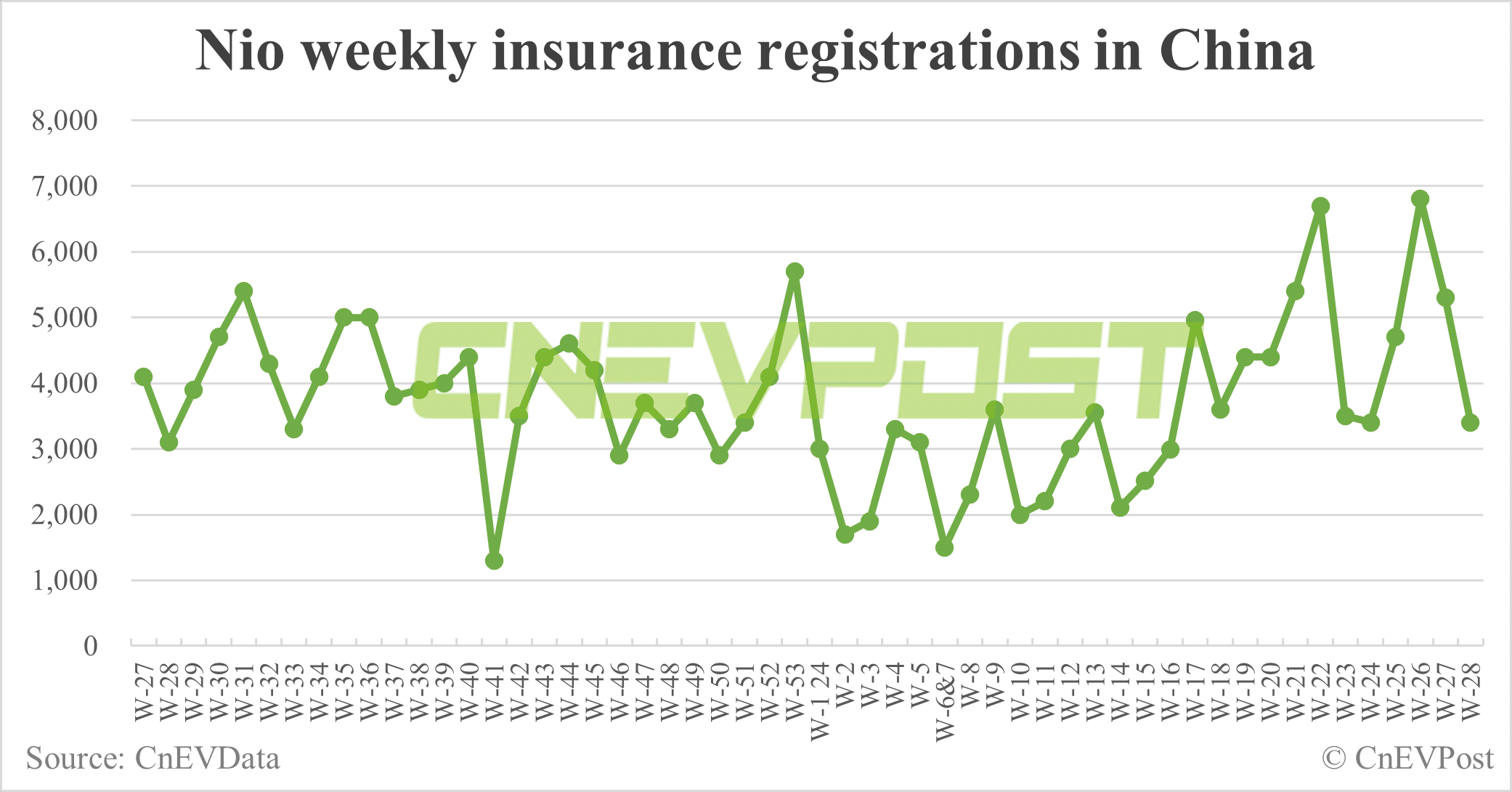

For the week of July 8-14, insurance registrations of Nio (NYSE: NIO) vehicles in China stood at 3,400, a decrease of 35.85 percent from 5,300 in the previous week, according to data shared today by Li Auto (NASDAQ: LI).

Li Auto stopped sharing weekly insurance registrations figures earlier this year, and after about a year of doing so. It resumed sharing those numbers in early May.

Nio delivered 21,209 vehicles in June, surpassing May's previous record of 20,544 vehicles for a second consecutive record month.

The EV maker delivered a record 57,373 vehicles in the second quarter, unexpectedly exceeding the upper end of its guidance range of between 54,000 and 56,000 vehicles.

On July 5, Nio announced that CFO (chief financial officer) Steven Feng had resigned, effective immediately, and that he had been replaced by senior vice president of finance Stanley Qu.

A C-level change is rarely good news, but Nio's recent solid operation should help ease market concerns, thus preventing any panic knee-jerk reaction, Morgan Stanley analyst Tim Hsiao's team said in a July 5 research note.

On July 14, Nio showed off the chassis capabilities of its executive flagship sedan, the ET9, in a new video and teased the imminent arrival of the next-generation Nio Phone.

CnEVPost had learned that Nio is expected to hold its Nio IN 2024 event in Shanghai in two weeks, where it could launch the second-generation Nio Phone.

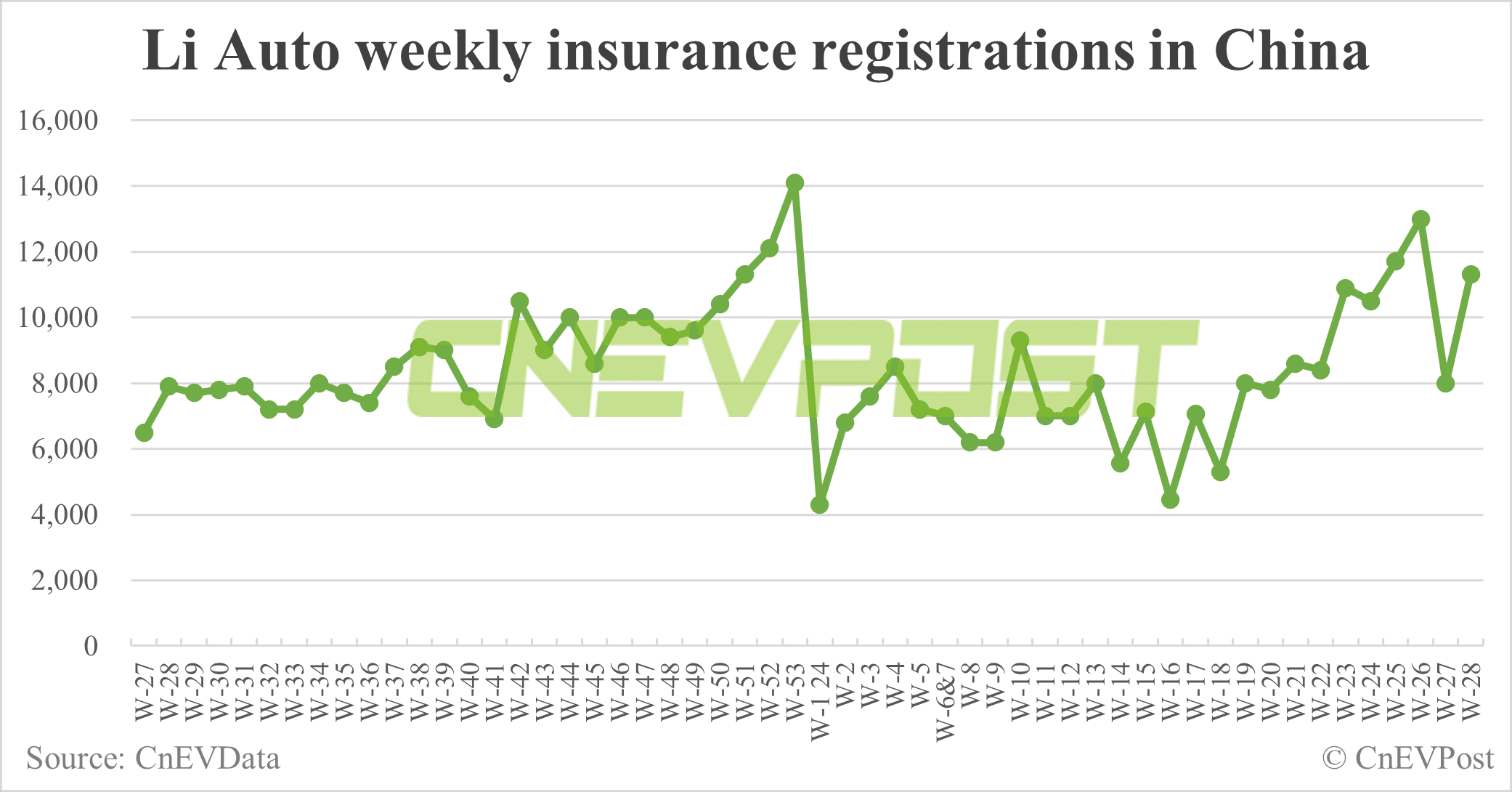

Li Auto had 11,300 insurance registrations last week, up 41.25 percent from 8,000 the week before.

The company delivered 47,774 vehicles in June, second only to its record high of 50,353 vehicles in December last year.

During the second quarter, Li Auto delivered 108,581 vehicles, falling within the guidance range of between 105,000 and 110,000 vehicles.

Li Auto's current vehicle offering includes the L-series extended-range electric vehicle (EREV) models -- Li L6, Li L7, Li L8, Li L9 -- and the battery electric vehicle (BEV) model Li Mega MPV (multi-purpose vehicle).

The company said on July 8 that cumulative deliveries of the Li L7 exceeded 200,000 units and on July 10 that cumulative deliveries of the Li L9 exceeded 200,000 units.

On July 15, Li Auto began rolling out the latest OTA 6.0 software update to its vehicles, bringing NOA (Navigate on Autopilot) functionality that is not dependent on HD maps to eligible vehicles.

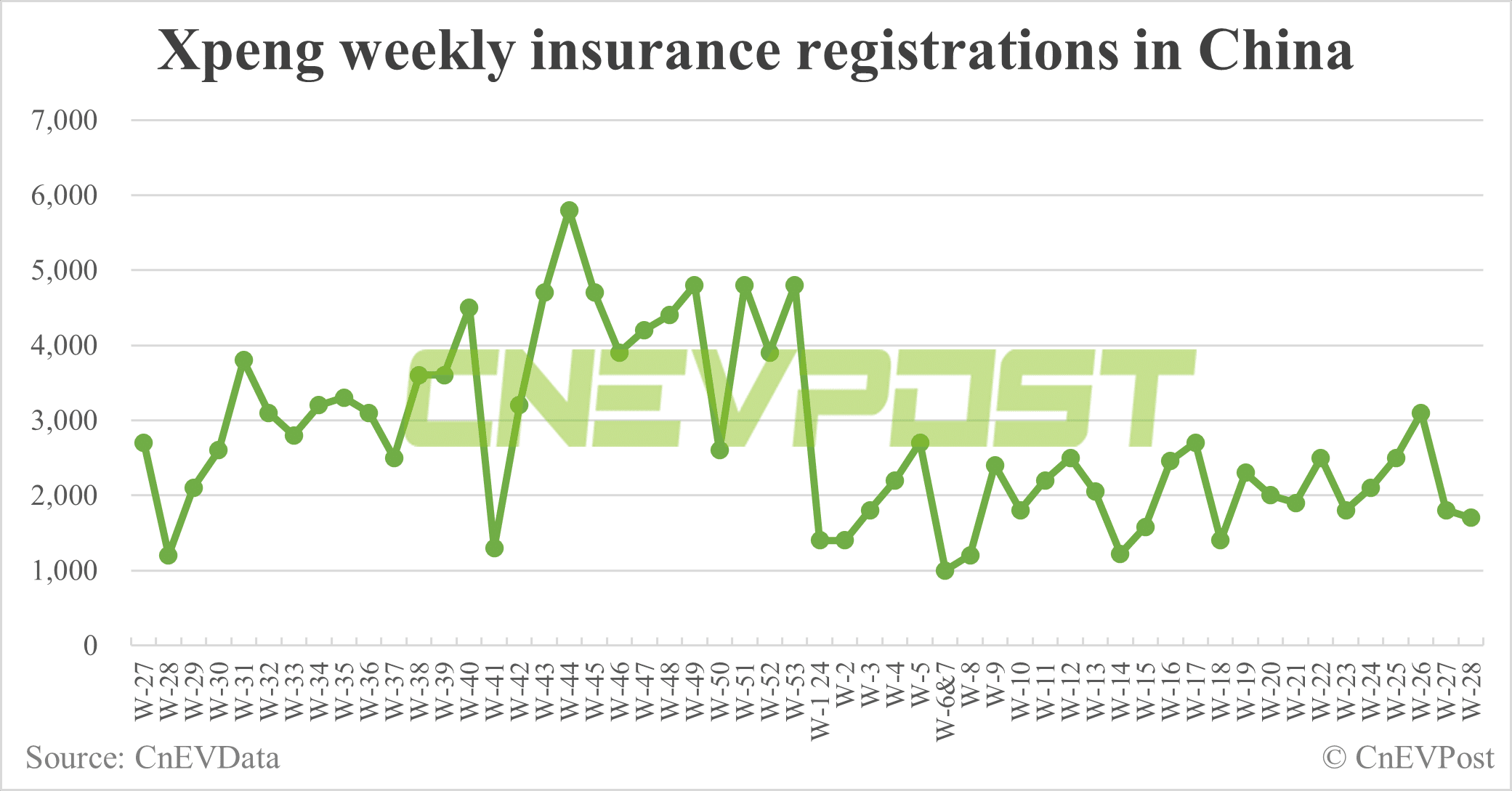

Xpeng (NYSE: XPEV) had 1,700 insurance registrations last week, down 5.56 percent from 1,800 the week before.

The company delivered 10,668 vehicles in June, up 23.76 percent year-on-year and up 5.14 percent from May.

During the second quarter, Xpeng delivered 30,207 vehicles, falling within the guidance range of between 29,000 and 32,000 vehicles.

Xpeng gave the first model in its Mona array, the M03, its debut on July 3, saying it would be priced under RMB 200,000 ($27,530), with an official launch in August.

The company announced on July 10 that its new model, internally codenamed F57, was named the Xpeng P7+ and released the first official images.

A day before that, CnEVPost exclusively obtained a rendering of the F57 on July 9 and learned that the model will not be using any LiDAR, with the intelligent driving system moving to a pure vision solution similar to Tesla's (NASDAQ: TSLA).

On July 12, the Xpeng P7+ entered a model catalog released by China's Ministry of Industry and Information Technology (MIIT), bringing to light information about its core specifications. The model is expected to go on sale in the fourth quarter of this year.

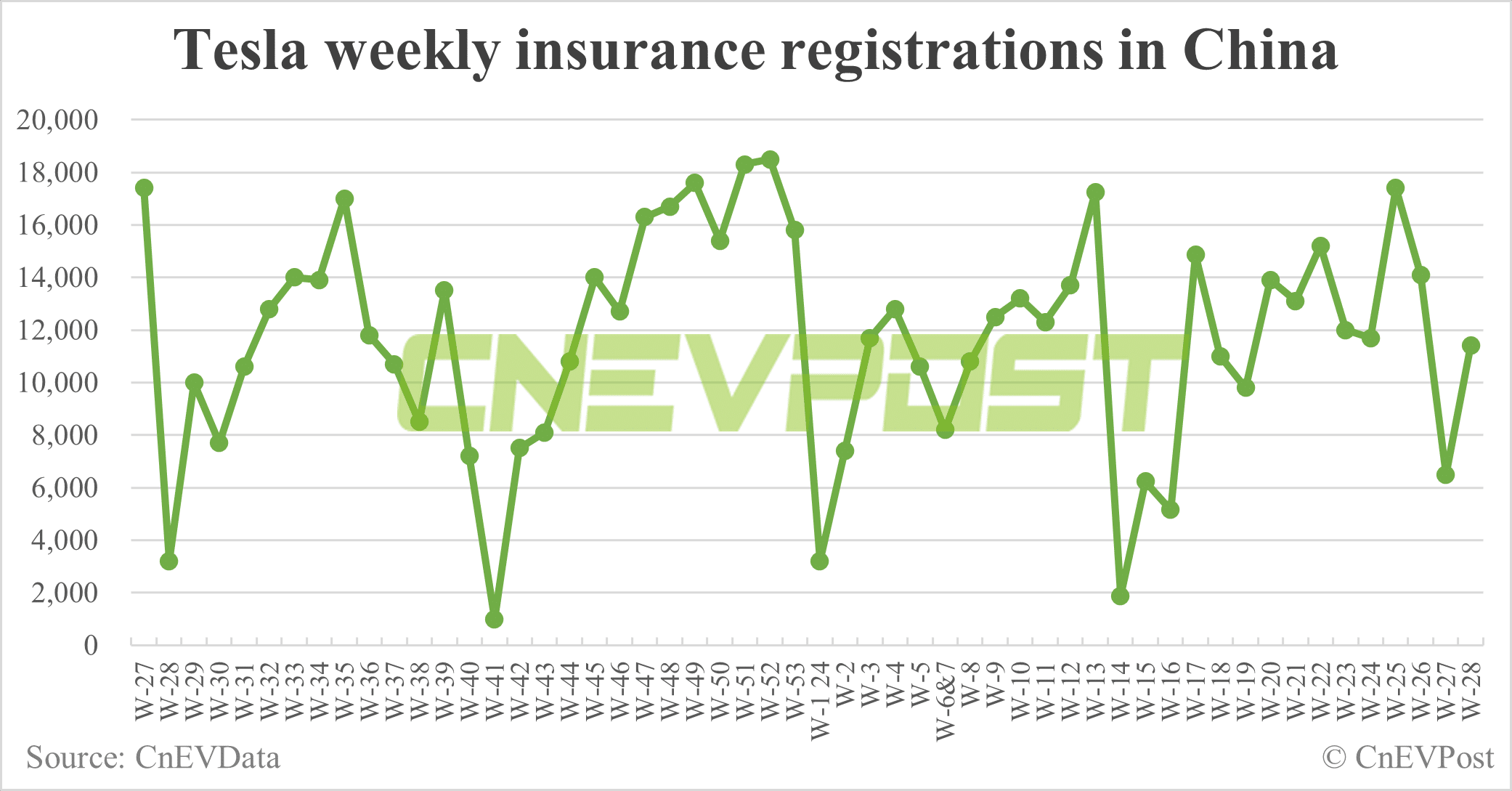

Tesla (NASDAQ: TSLA) had 11,400 insurance registrations in China last week, up 75.38 percent from 6,500 in the previous week.

Tesla has a factory in Shanghai that produces the Model 3 sedan and Model Y crossover, both for deliveries to local customers and as an export hub for it.

Tesla's pattern is to produce cars for export in the first half of the quarter and for the local market in the second half, it previously said.

The US EV maker sold 59,261 vehicles in China in June, down 20.15 percent from 74,212 a year earlier while up 7.33 percent from 55,215 in May.

Tesla China exported 11,746 vehicles in June, a 39.67 percent decrease from 19,468 in the same month last year and a 32.33 percent decrease from 17,358 in May.

On July 11, the wait time in China for the Model 3 went from 1-4 weeks to 2-4 weeks, and the Model Y remained unchanged at 1-3 weeks, according to CnEVPost's daily monitoring.

In the first half of the year, Tesla sold 278,317 vehicles in China, down 5.37 percent year-on-year.

The Model 3 sold 70,500 units in China in the first half of the year and the Model Y at 207,817 units, contributing 25.33 percent and 74.67 percent of Tesla's sales in China, respectively, data compiled by CnEVPost showed.

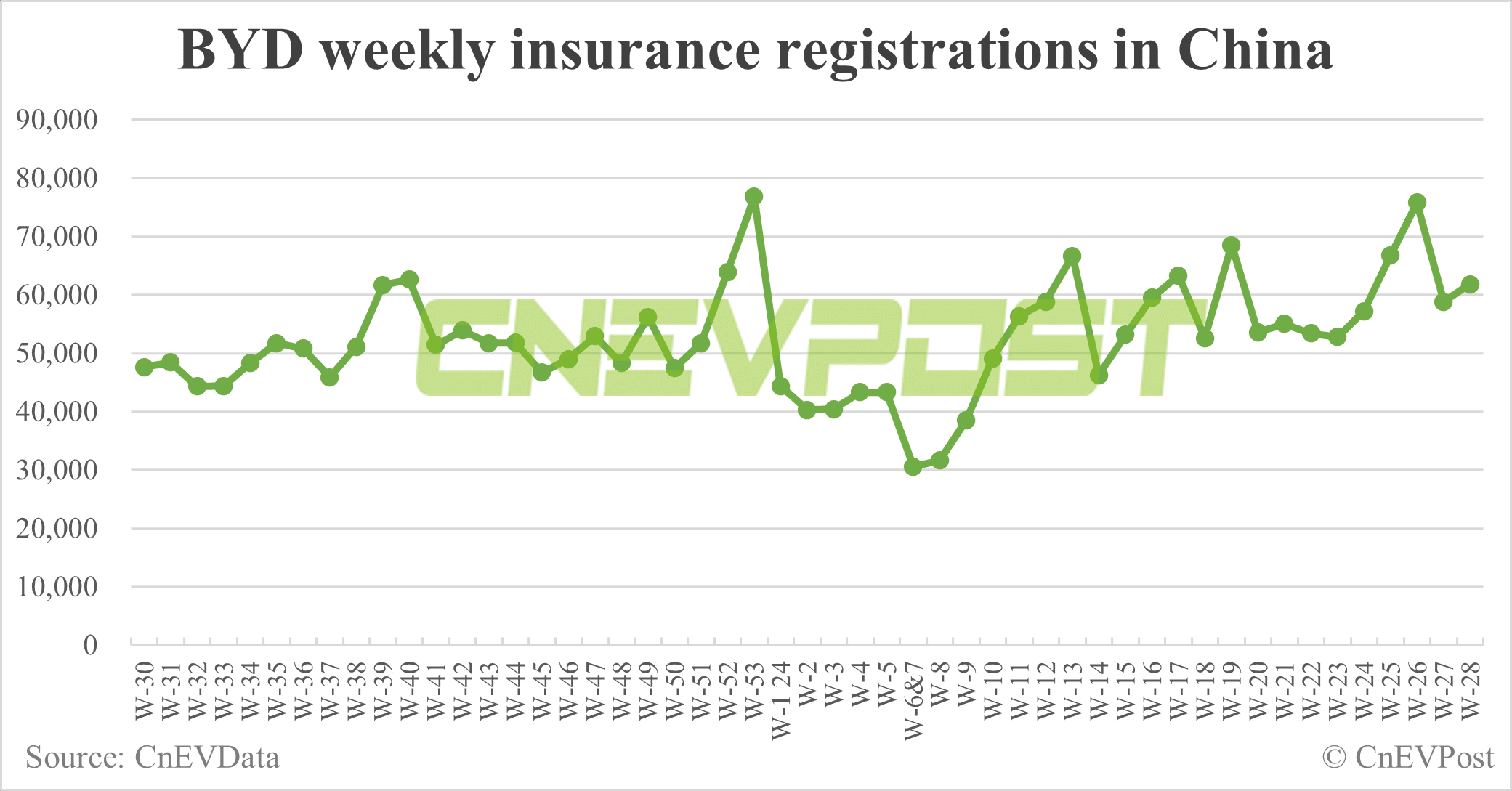

BYD (HKG: 1211, OTCMKTS: BYDDY) vehicles had 61,800 insurance registrations in China last week, up 5.10 percent from 58,800 the week before.

BYD sold 341,658 new energy vehicles (NEVs) in June, surpassing its previous record of 341,043 vehicles in December 2023.

In the second quarter, BYD sold a record 986,720 NEVs, an increase of 40.25 percent year-on-year and up 57.56 percent from the first quarter.

In the first half of 2024, BYD's NEV sales amounted to 1,612,983 units, an increase of 28.46 percent year-on-year.

BYD's passenger battery electric vehicles (BEVs) sold 726,153 units in the first half of the year, up 17.73 percent. Its passenger plug-in hybrid electric vehicles (PHEVs) sold 880,992 units in the first half of the year, a year-on-year increase of 39.54 percent.

BYD sold 203,404 units overseas in the first half of the year, up 173.80 percent.

By 2026, BYD's global deliveries will reach 6 million units, with about 1.5 million in overseas markets and the rest at home, JPMorgan said in a July 9 research note.

BYD's new hybrid SUV, the Sea Lion 05, made it into the MIIT catalog published on July 12, and will be the second model in the Sea Lion lineup after the Sea Lion 07 EV.

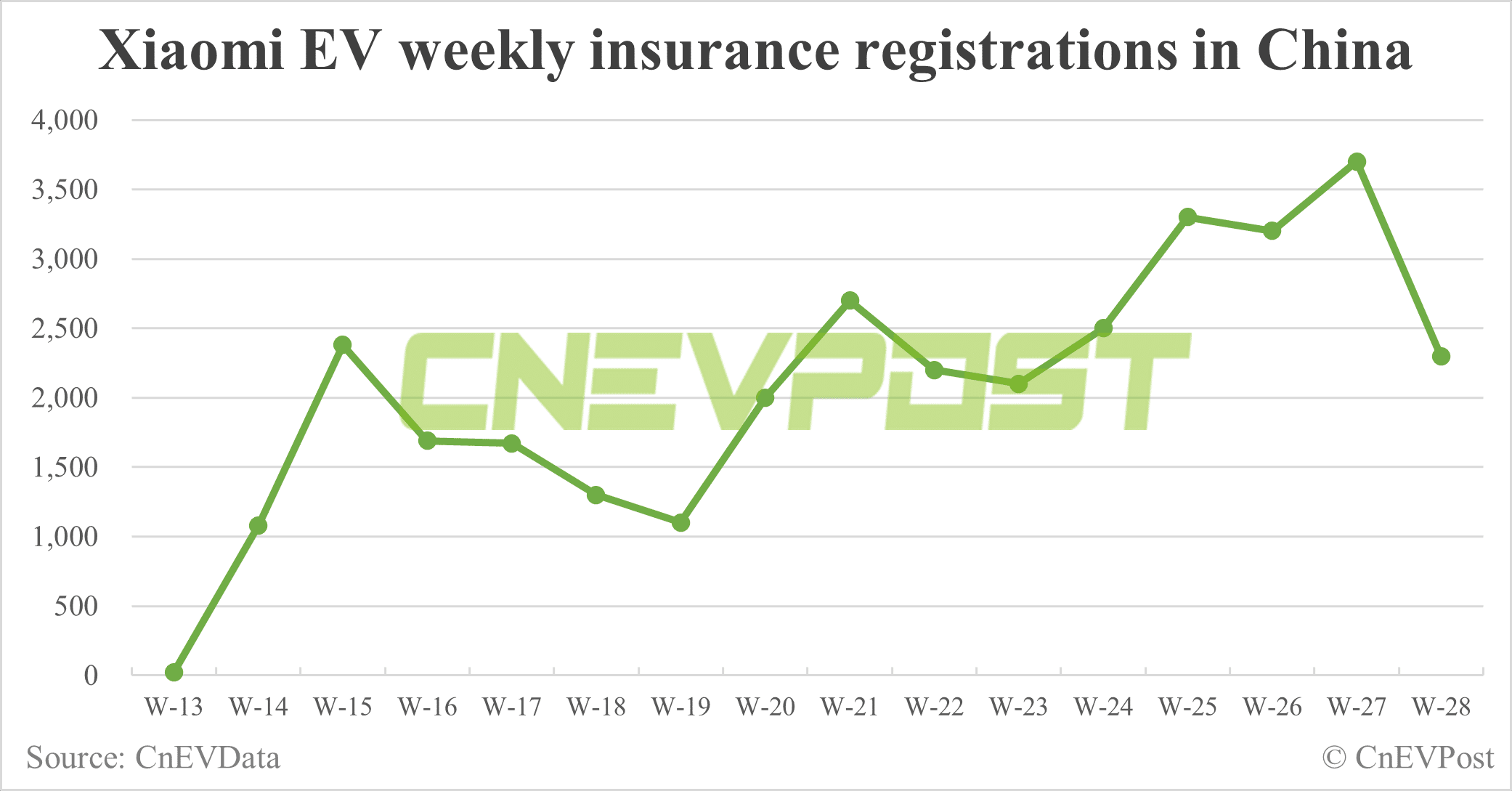

Xiaomi EV's insurance registrations in China last week were 2,300 units, down 37.84 percent from 3,700 in the previous week.

In June 2024, Xiaomi's only current model, the SU7, delivered more than 10,000 units, Xiaomi EV announced on Weibo earlier this month without revealing specific numbers.

In July, Xiaomi SU7 deliveries will still exceed 10,000 units, Xiaomi EV previously said.

On July 2, Xiaomi EV said it would conduct a new round of production line optimization to boost capacity.

The Xiaomi SU7 delivery ramp-up was going well, with the factory having started double-shift production in June, Xiaomi EV said at the time.

The MIIT catalog published on July 12 showed that Xiaomi had refiled for the SU7, with the manufacturer changing from BAIC to Xiaomi itself, and the branding on the vehicle's rear end changing from Beijing Xiaomi to Xiaomi. This means that Xiaomi has gained independent qualifications to build cars.

On July 9, local media outlet 21jingji reported that the second model of the Xiaomi EV will be an all-electric SUV, which is expected to be launched in the first half of 2025, and the third model will be an EREV and SUV, which will go on sale in 2026.

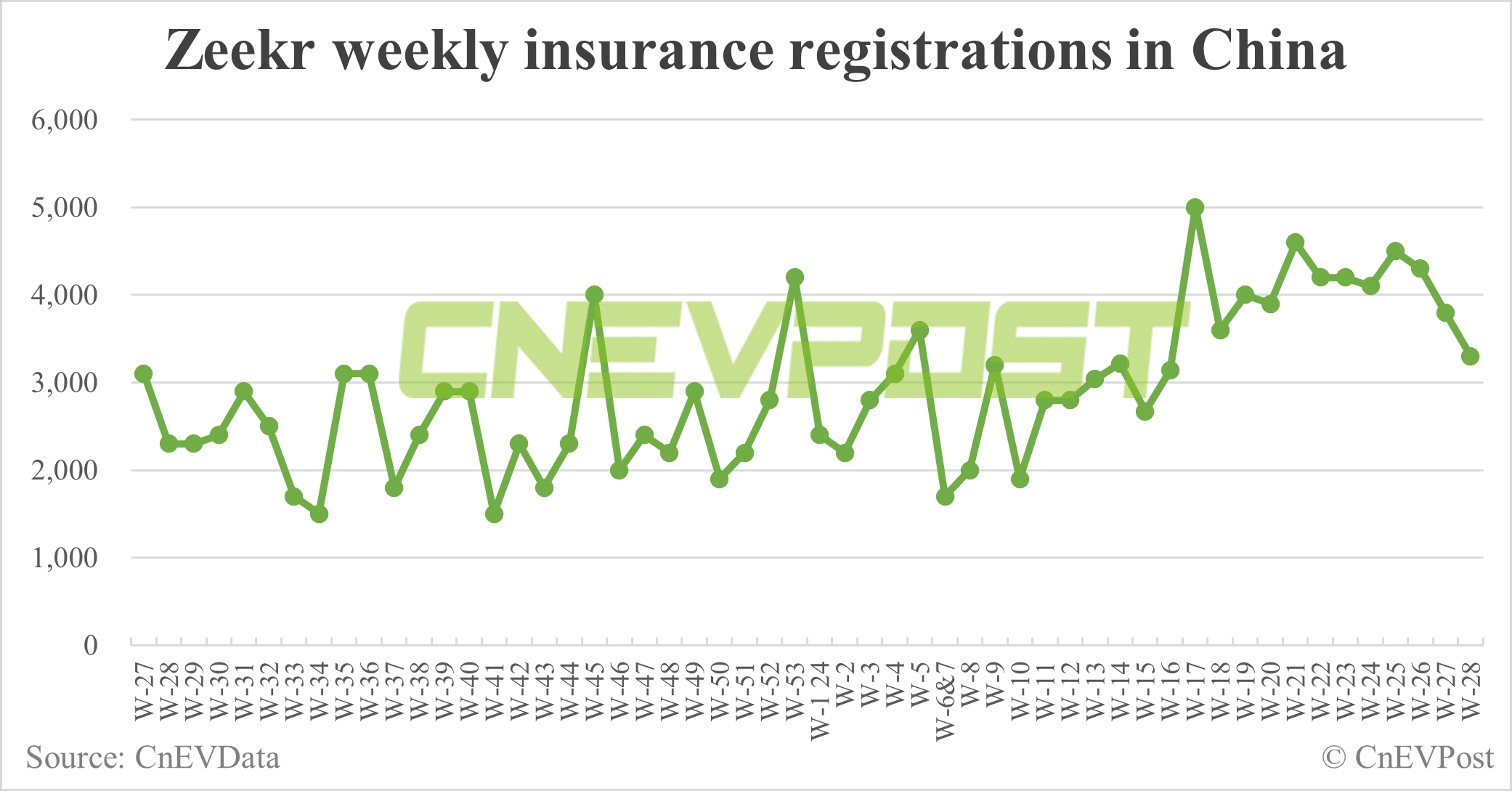

Zeekr (NYSE: ZK) had 3,300 insurance registrations last week, down 13.16 percent from 3,800 the previous week.

The company delivered a record 20,106 vehicles in June, marking the first time monthly deliveries exceeded the 20,000 mark.

Zeekr delivered a record 54,811 vehicles in the second quarter, up 100.05 percent year-on-year and up 65.80 percent from the first quarter.

The company announced on July 10 that its new SUV, internally codenamed CX1e, is officially named the Zeekr 7X and will be its first family SUV.

Zeekr's current models on sale include the Zeekr 001, Zeekr 007, Zeekr 009, and Zeekr X. The Zeekr 7X is expected to go on sale within the year.

The company announced on July 13 that the all-new Zeekr 009 will have its global launch in Hong Kong on July 19, and will come in 6-seat and 7-seat options.

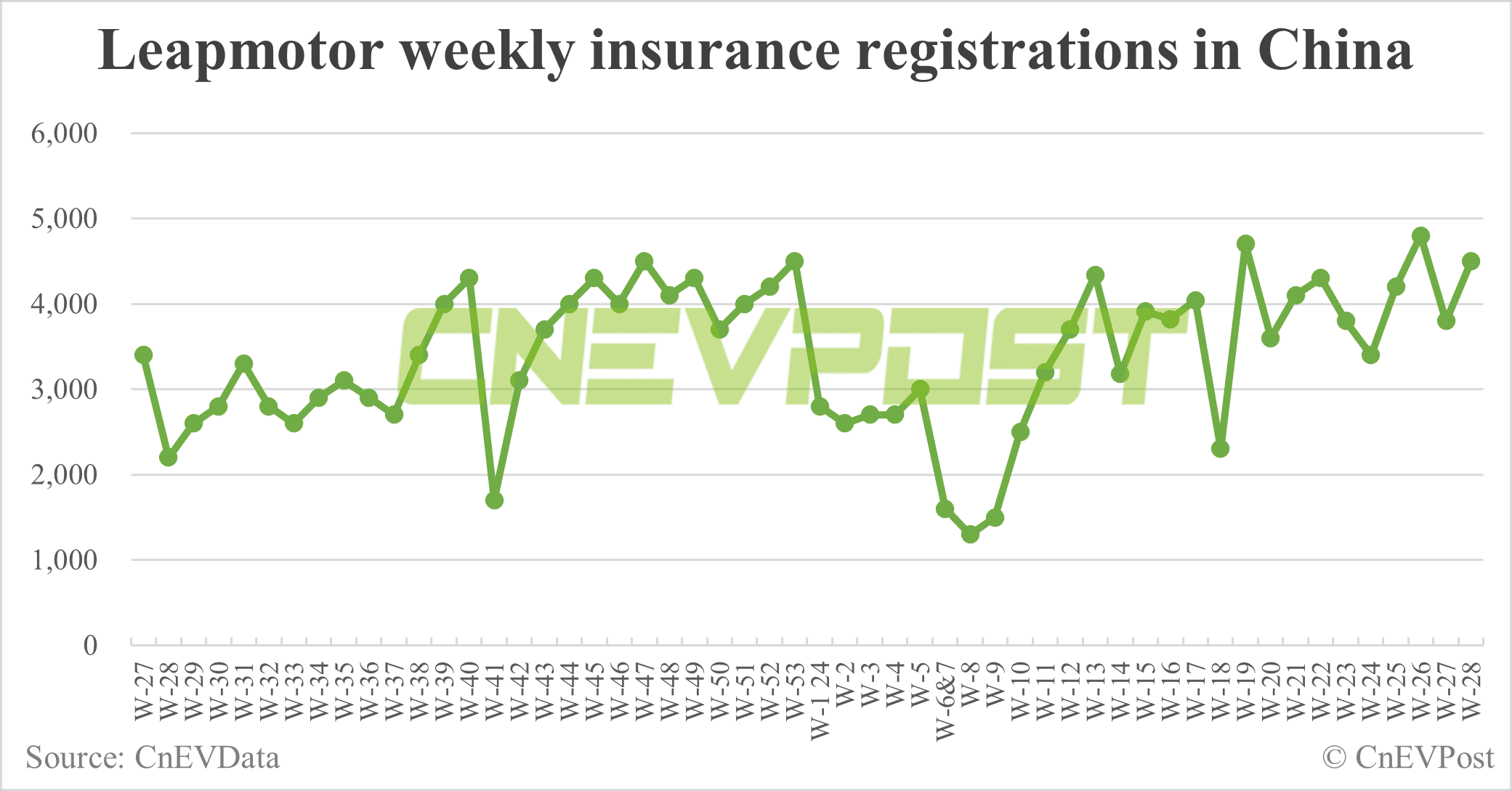

Leapmotor (HKG: 9863) had insurance registrations of 4,500 vehicles last week, up 18.42 percent from 3,800 the week before.

Leapmotor delivered a record 20,116 vehicles in June, bringing second-quarter deliveries to 53,286.

Earlier today, Leapmotor said it had accumulated more than 400,000 deliveries since its inception.

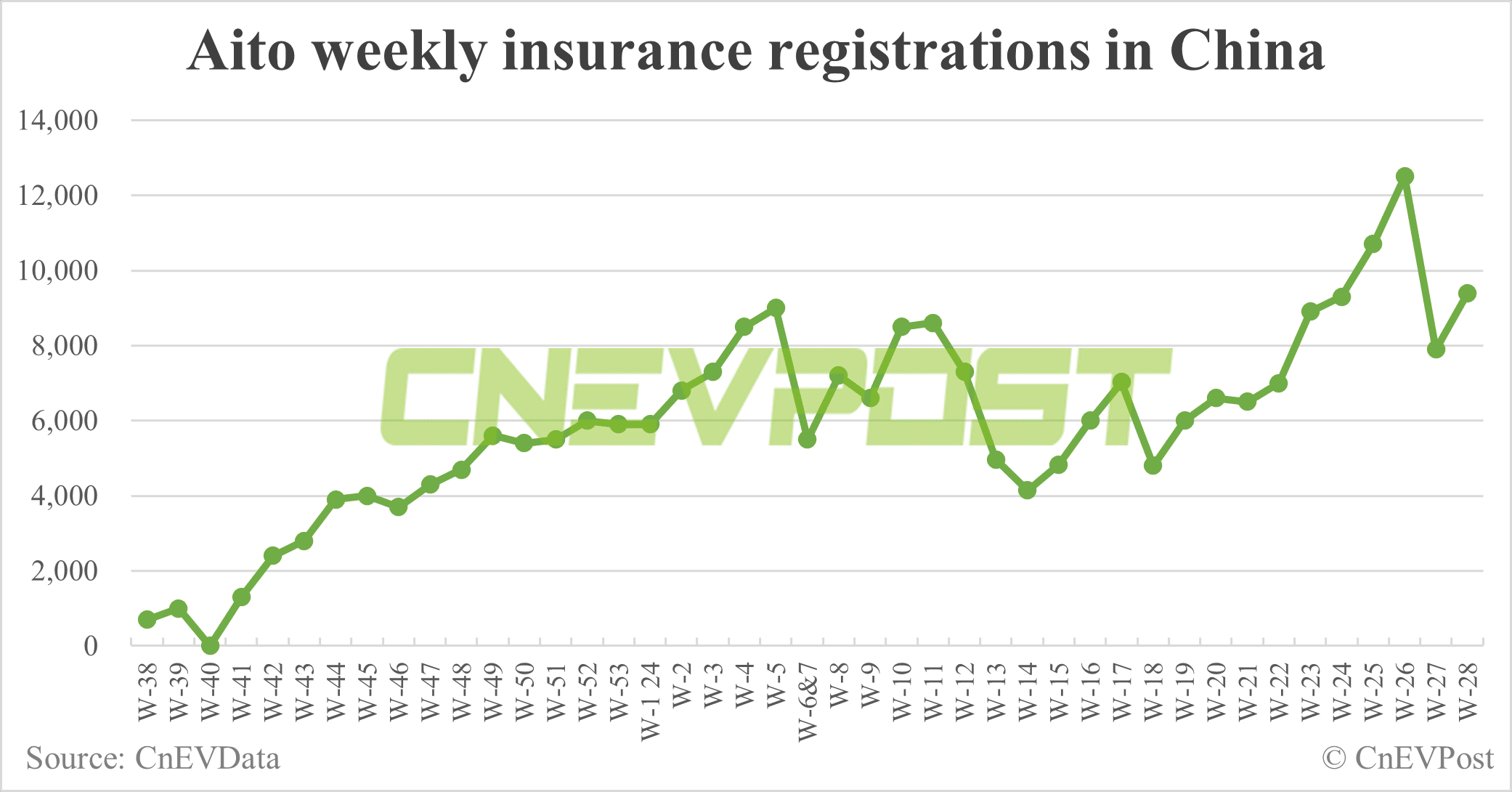

Aito, the brand jointly created by Huawei and Seres Group, saw insurance registrations of 9,400 vehicles last week, up 18.99 percent from 7,900 the week before.

($1 = RMB 7.2653)