Nio's new order flow is estimated to be around 22,000 units as it extends its "demo car" discount in June, analysts at Deutsche Bank said, citing dealer feedback.

Deutsche Bank expects Nio's (NYSE: NIO) vehicle deliveries to decline this month from May's record, in line with a trend hinted at in the electric vehicle (EV) maker's previous guidance.

In a June 21 research note, analyst Wang Bin's team projected Nio to deliver 18,200 vehicles in June, up 68 percent year-on-year but down 12 percent from May.

In the first two weeks of June, Nio's domestic retail sales totaled 7,000 units, the team noted.

As a result, Nio's deliveries in the second quarter of 2024 would total 54,200 units, in line with its guidance range of 54,000 to 56,000 units, the team said.

Nio delivered 20,544 vehicles in May, surpassing its previous record high of 20,462 vehicles in July 2023, according to data it announced on June 1.

That's up 233.78 percent from 6,155 vehicles in the same period last year and up 31.52 percent from 15,620 in April.

The company guided for second-quarter deliveries of between 54,000 and 56,000 units when it reported first-quarter earnings on June 6, implying that June deliveries are expected to be between 17,836 and 19,836 units.

For the week of May 27 to June 2, insurance registrations of Nio vehicles in China were 6,700, according to figures shared by Li Auto (NASDAQ: LI). The week included June 1 and June 2, a Saturday and Sunday, respectively.

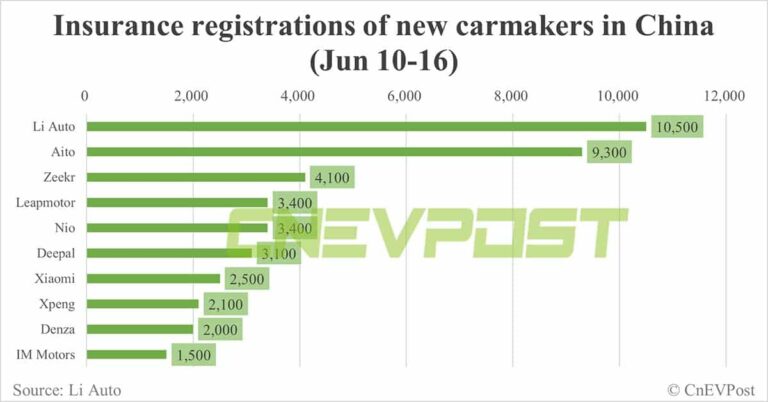

Insurance registrations for Nio vehicles were 3,500 for the week of June 3-9, and 3,400 for the week of June 10-16.

According to dealer feedback, Nio's new order flow is estimated to be around 22,000 units as it extended the "demo car" discount in June, according to Wang's team.

Nio also adjusted its product feature purchase fund in June to boost its product portfolio, with the ET5 dropping from RMB 11,000 ($1,510) to RMB 8,000, the ES6 and EC6 dropping from RMB 11,000 to RMB 10,000, and the ES7, EC7, and ES8 rising from RMB 13,000 to RMB 18,000, according to the team.

Meanwhile, Nio canceled its official price discounts in June due to a supply shortage in the month, Wang's team noted. The previous discounts were RMB 6,000 for the ET5, ES6 and EC6, and RMB 8,000 for the ES7, EC7 and ES8.

Previously, Nio's management had said that the company had encountered some very short-term supply chain constraints and expected to resolve them quickly, according to Wang's team.

The team expects BYD (HKG: 1211, OTCMKTS: BYDDY) to post retail sales of 260,000 units in June, up 11 percent year-on-year and flat from May.

BYD's wholesale sales of new energy vehicles (NEVs) in May were 331,817, including 37,499 vehicles sold overseas, according to data it released on June 2.

BYD's retail sales of passenger NEVs in China totaled 268,226 vehicles in May, continuing to rank No. 1 with a 33.4 percent share, according to the China Passenger Car Association (CPCA).

Tesla (NASDAQ: TSLA)'s retail sales in China are expected to be 55,000 units in June, down 27 percent year-on-year and essentially flat from May, according to Wang's team.

Tesla China sold 72,573 vehicles in May, including 17,358 exported and 55,215 sold in China, according to the CPCA.

Wang's team expects Xpeng (NYSE: XPEV) to deliver 10,000 vehicles in June, up 16 percent year-on-year and essentially flat from May.

Li Auto's deliveries in June are expected to be 46,000 units, up 40 percent year-on-year and up 30 percent from May, according to the team.

Zeekr (NYSE: ZK) is expected to deliver 20,000 units in June, up 88 percent year-on-year and up 7 percent from May, according to Deutsche Bank.

They expect Leapmotor to deliver 21,000 units in June, up 59 percent year-on-year and up 16 percent from May.

The team expects Huawei-backed Aito to sell 40,000 units at retail in June, up 600 percent year-on-year and up 47 percent from May.

($1 = RMB 7.2610)