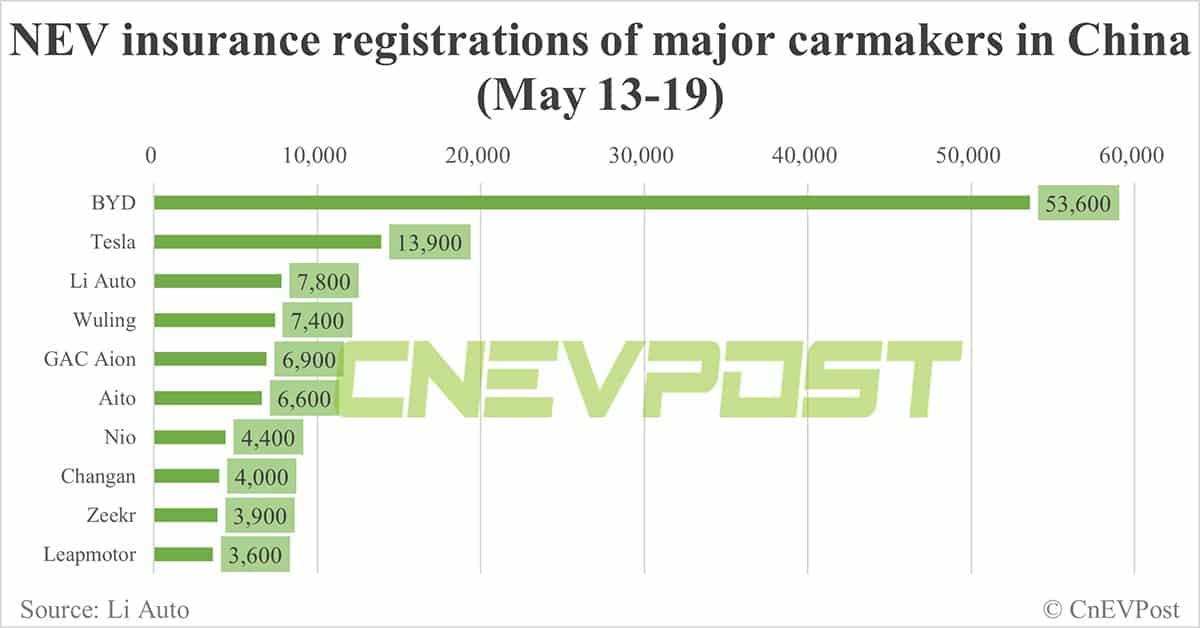

Between May 1-19, Nio had 10,000 insurance registrations, Tesla 30,800, BYD 154,900, Xiaomi 4,000, Li Auto 18,600, and Xpeng 4,800 units.

Major electric vehicle (EV) makers saw mixed insurance registrations in China last week.

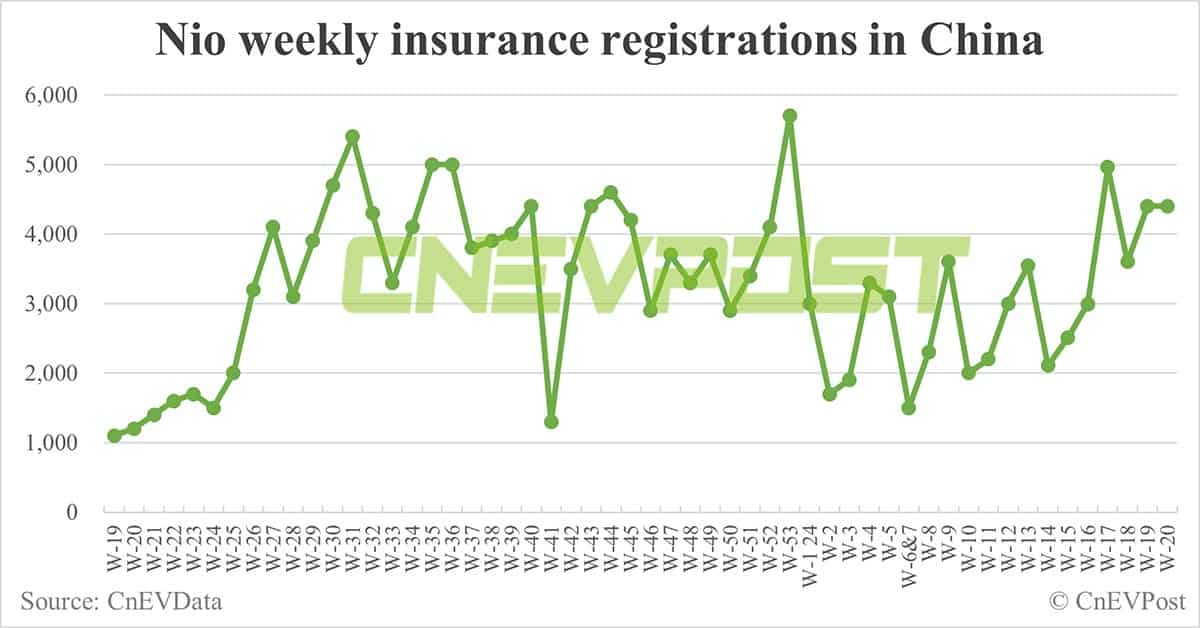

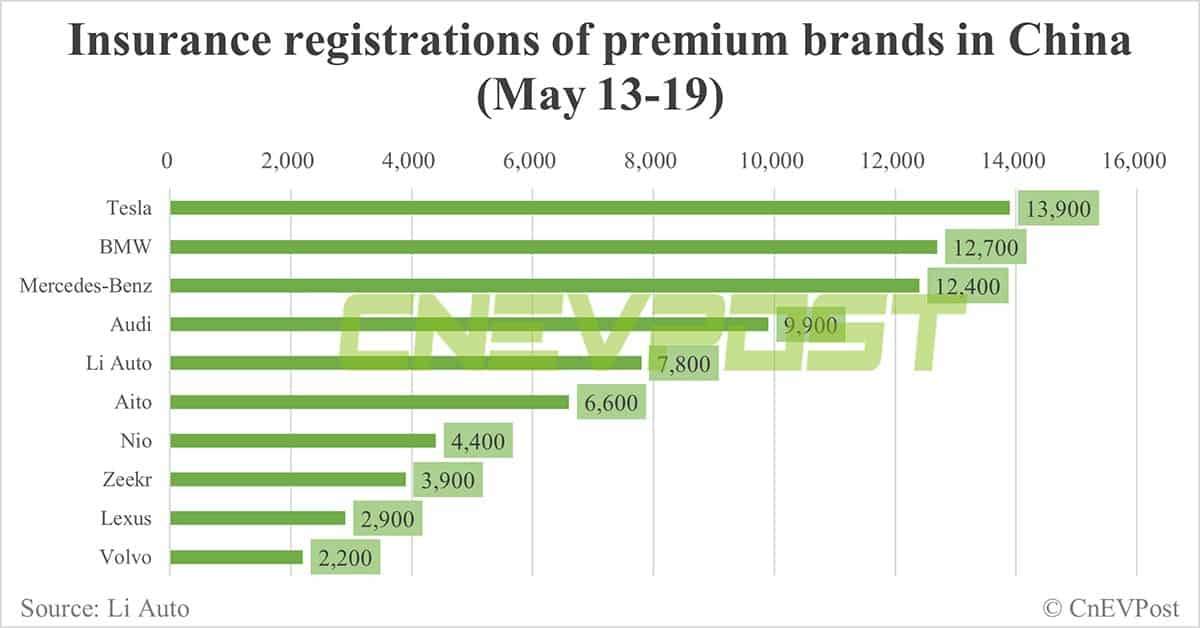

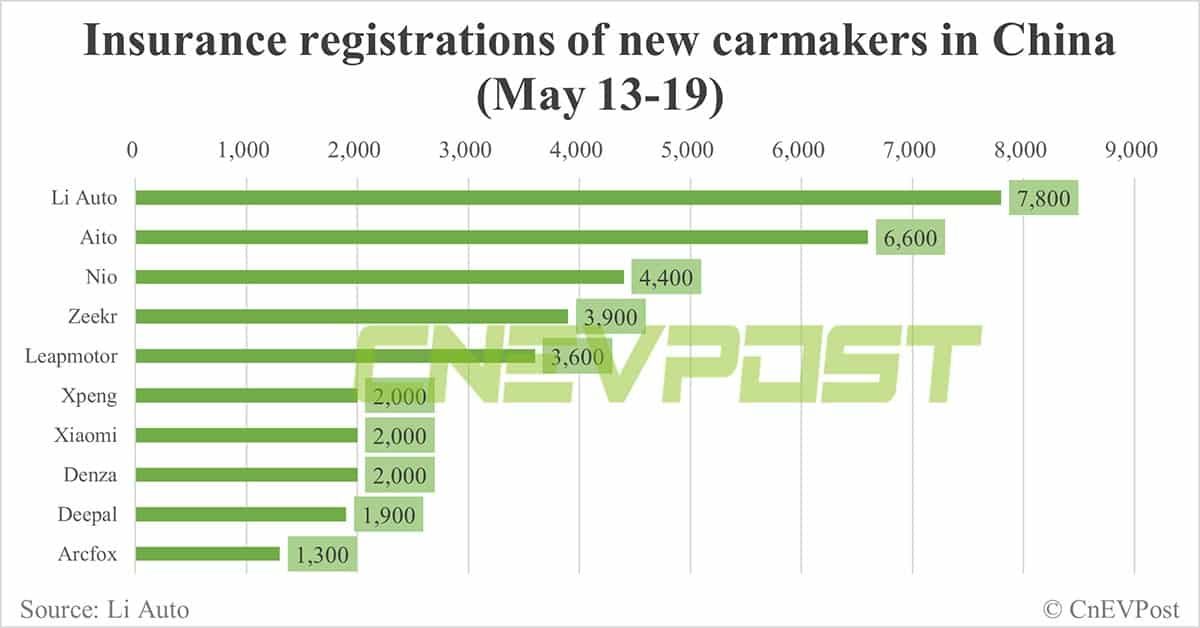

For the week of May 13-19, insurance registrations of Nio (NYSE: NIO) vehicles in China were 4,400, unchanged from the previous week, according to data shared today by Li Auto (NASDAQ: LI).

Li Auto stopped sharing weekly insurance registrations figures earlier this year, after doing so for about a year. In early May, it resumed sharing those numbers. The company did not share month-to-date numbers as it had done previously.

During May 1-12, Nio vehicles had 5,600 insurance registrations in China, according to figures shared by Li Auto last week. This means that in the May 1-19 period, Nio vehicles had 10,000 insurance registrations in China.

Nio delivered 15,620 vehicles in April, up 31.64 percent from March and up 134.60 percent year-on-year, according to figures it released on May 1.

Nio officially launched the Onvo (Ledao in China) sub-brand on May 15 and began pre-sales of the new brand's first model, the L60, for RMB 219,900 ($30,440) including the battery.

Additionally, local media outlet Cailian reported on May 17 that China FAW will join the Nio-led battery swap alliance, becoming the seventh automaker to do so.

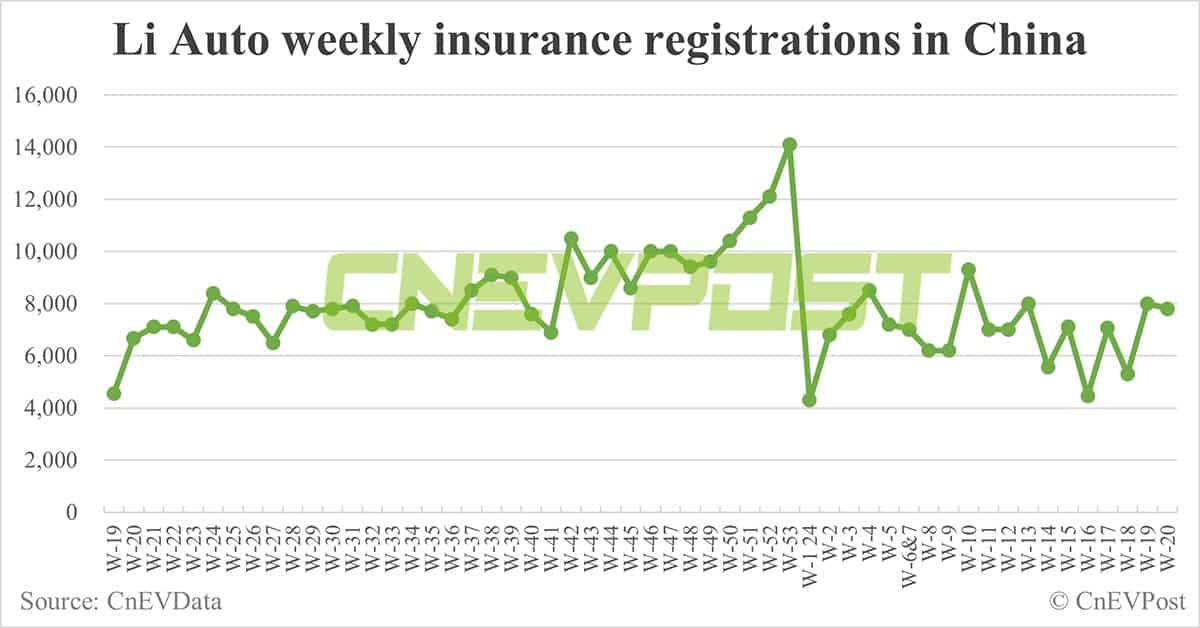

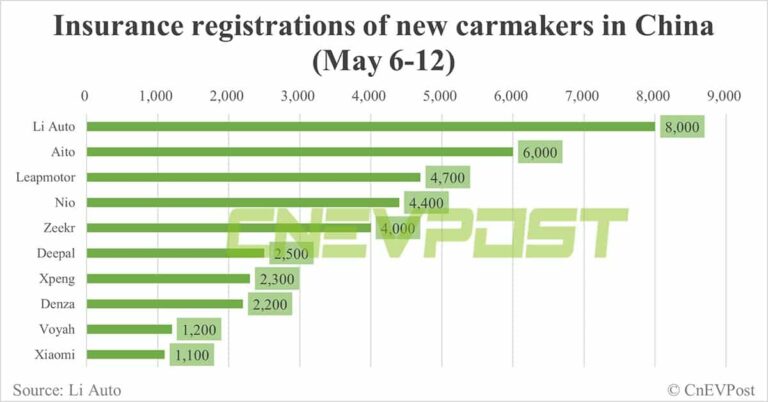

Li Auto had 7,800 insurance registrations last week, down 2.5 percent from 8,000 the week before.

Li Auto's insurance registrations for May 1-19 stood at 18,600 units, considering it was at 10,800 units for May 1-12.

The company delivered 25,787 vehicles in April, up 0.41 percent year-on-year but down 11.03 percent from March.

Li Auto yesterday guided for vehicle deliveries in the second quarter to be in the range of 105,000 to 110,000 vehicles, implying a year-on-year increase of 21.3 percent to 27.1 percent.

Considering Li Auto delivered 25,787 vehicles in April, the guidance means it expected to deliver a total of 79,213 to 84,213 vehicles in May and June.

The company said in an earnings call yesterday that it won't release pure electric SUVs this year, and that they will be released in the first half of next year.

Li Auto said in its last earnings call that it would release three purely electric SUV models in the second half of 2024.

Li Auto is one of China's major players in extended-range electric vehicles (EREVs), with the main models on sale being the L-series EREVs, including the Li L6, Li L7, Li L8 and Li L9.

On March 1 this year, Li Auto's first BEV model, Li Mega MPV (multi-purpose vehicle), was launched with a starting price of RMB 559,800 yuan.

The less-than-expected performance of the Li Mega, as well as the challenges facing the sales of the L series, may be part of the reasons why Li Auto adjusted its product launch strategy.

On May 19, local media outlet LatePost reported that some employees at Li Auto's Beijing factory had been on vacation for most of the last week, as sales of the Li Mega fell short of expectations.

At press time, Li Auto's Hong Kong-traded stock was down about 19 percent, mainly due to yesterday's weaker-than-expected earnings and guidance announcement, as well as a delay in the release of more BEV models.

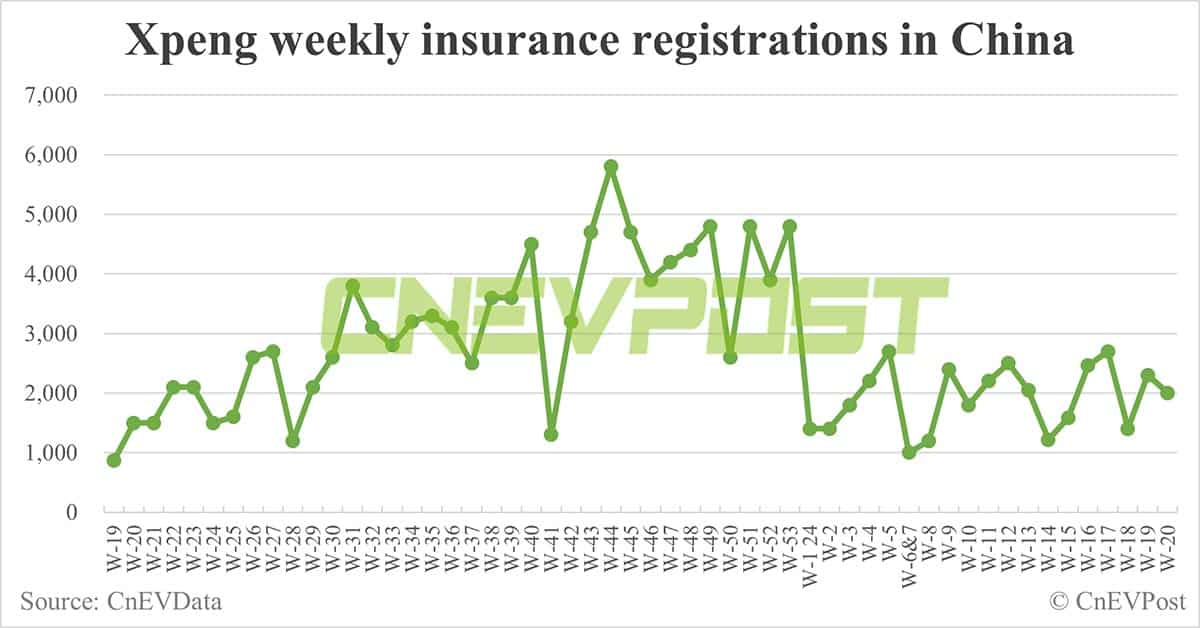

Xpeng (NYSE: XPEV) had 2,000 insurance registrations last week, down 13.04 percent from 2,300 the week before.

Xpeng's insurance registrations for May 1-19 were 4,800 units, considering it was at 2,800 units for May 1-12.

The company delivered 9,393 vehicles in April, up 4.07 percent from March and up 32.69 percent year-on-year.

The first model of Xpeng's sub-brand codenamed Mona will be unveiled in June, the company said at an AI Day event yesterday.

Xpeng will invest RMB 3.5 billion in research and development of AI technology around smart driving in 2024 and recruit 4,000 new professionals, He Xiaopeng, chairman and CEO of Xpeng, said yesterday.

Next, Xpeng will also invest more than RMB 700 million a year in computing power and AI training, Mr. He said.

Xpeng will announce its first-quarter 2024 earnings later today and hold an analyst call at 8 pm Beijing Time.

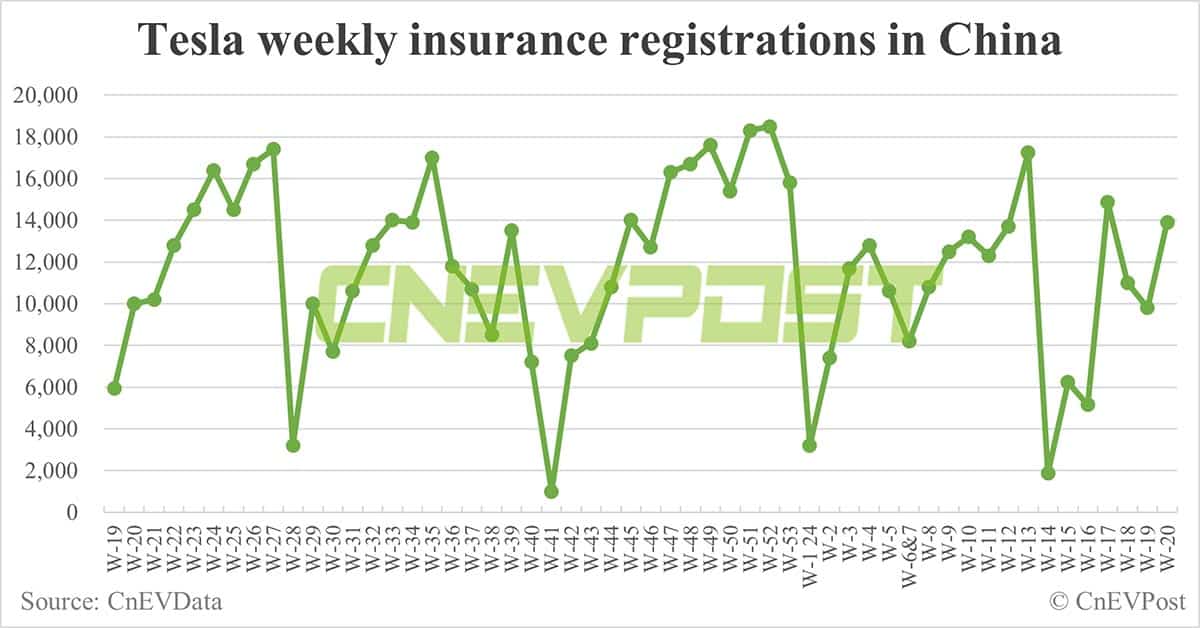

Tesla (NASDAQ: TSLA) had 13,900 insurance registrations in China last week, up 41.84 percent from 9,800 in the previous week.

The US EV maker had 30,800 insurance registrations in China from May 1-19, considering it had a May 1-12 figure of 16,900 units.

Tesla sold 31,421 units in China in April, down 49.64 percent from 62,398 in March and down 21.36 percent from 39,956 a year earlier, according to data released earlier this month by the China Passenger Car Association (CPCA).

It sold 62,167 China-made vehicles in April, including 30,746 exported.

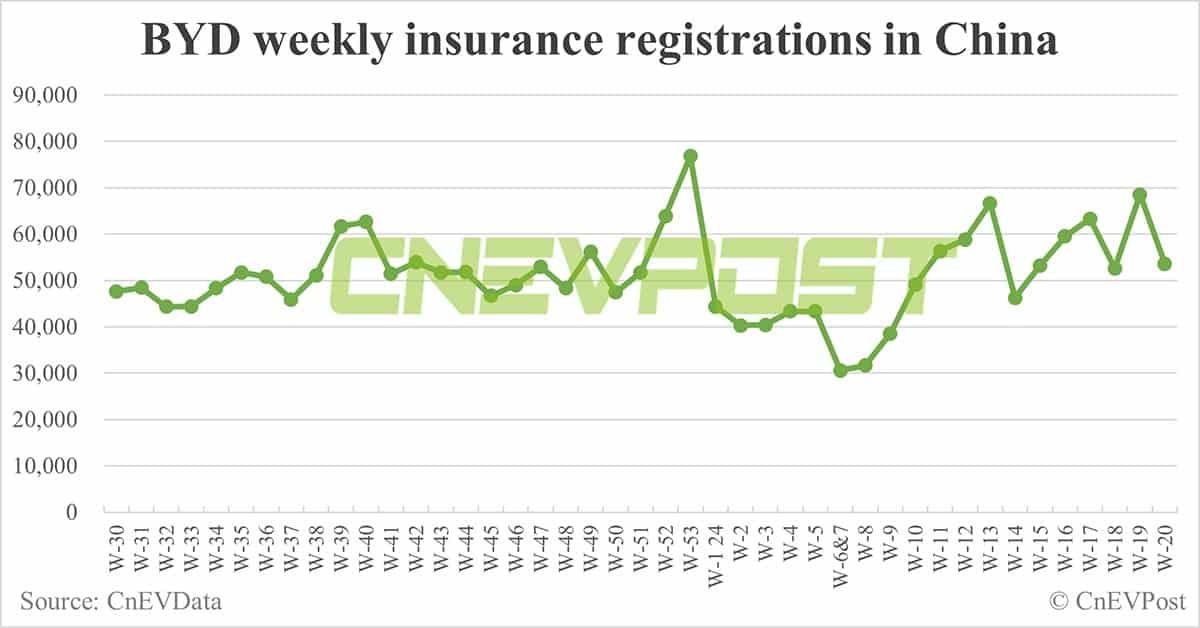

BYD (HKG: 1211, OTCMKTS: BYDDY) vehicles had 53,600 insurance registrations in China last week, down 21.75 percent from 68,500 the week before.

From May 1-19, BYD's insurance registrations in China stood at 154,900 vehicles, CnEVPost's calculations show. The company had that figure at 101,300 vehicles in the May 1-12 period.

BYD sold 313,245 new energy vehicles (NEVs) in April, up 48.96 percent from 210,295 in the same month last year and up 3.57 percent from 302,459 in March.

In April, BYD sold a record 41,011 vehicles in overseas markets, surpassing March's previous record of 38,434. That's up 176.6 percent year-on-year and 6.71 percent from March.

BYD launched the BYD Shark, its first pickup truck model, in Mexico on May 14, local time, with a starting price of 899,980 Mexican pesos ($53,400).

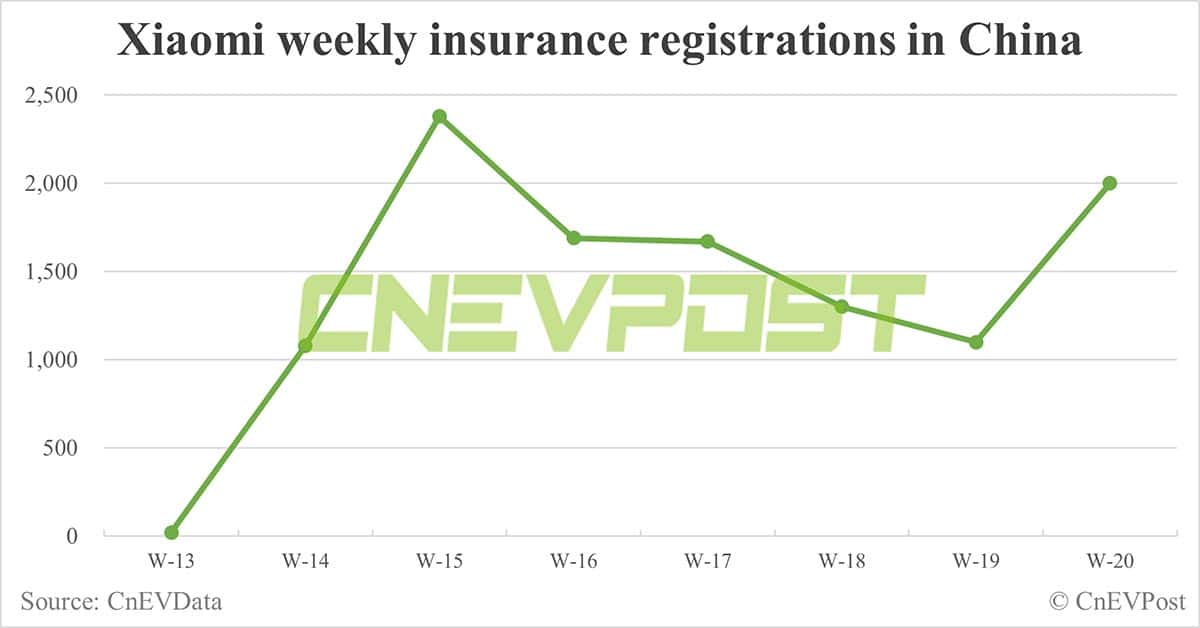

Xiaomi had 2,000 insurance registrations last week, up 81.82 percent from 1,100 the previous week.

The company's insurance registrations for May 1-19 stood at 4,000 units, considering it had a figure of 2,000 vehicles for May 1-12.

Xiaomi EV's factory had shut down during the Labor Day holiday earlier this month in order to maintain equipment and ramp up production capacity, it said on Weibo last week.

That's intended to prepare for a continued rapid ramp-up of delivery capacity next, Xiaomi EV said.

On May 14, local media outlet Wallstreetcn cited unnamed supply chain sources as saying that Xiaomi EV was asking upstream suppliers to boost the supply of parts and increased orders by about 80 percent.

On May 15, Cailian cited multiple sources as saying that Xiaomi EV's Beijing factory planned to start double-shift production in June, increasing daily production time from 8 hours to 16 hours.

Also on May 15, Xiaomi EV said it completed the delivery of its 10,000th vehicle of the SU7 and was working to boost production capacity to ensure it meets its 100,000-unit delivery target this year.

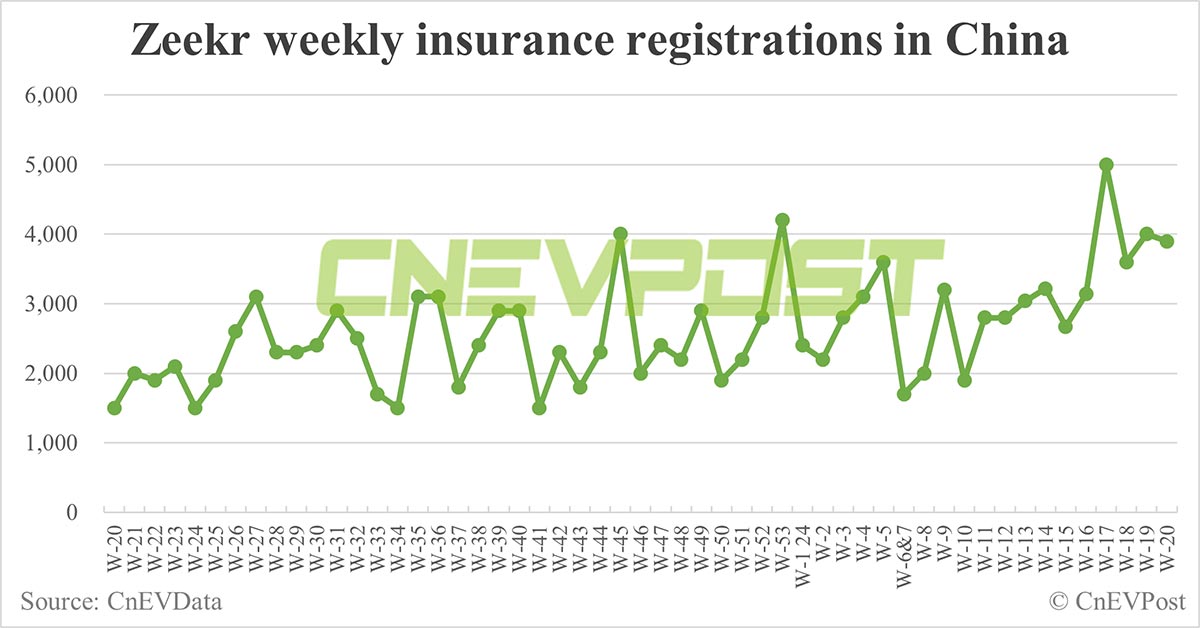

Zeekr (NYSE: ZK) had 3,900 insurance registrations last week, down 2.5 percent from 4,000 vehicles the week before.

Zeekr's insurance registrations for May 1-19 were 9,500 vehicles, considering it had a May 1-12 figure of 5,600 vehicles.

Zeekr went public on the New York Stock Exchange on May 10, becoming the latest Chinese EV maker to list in the US.

Yesterday, the company said it had accumulated more than 250,000 deliveries since its inception.