Major EV makers saw sales in China fall last week, partly due to the Tomb Sweeping Day holiday.

Major electric vehicle (EV) companies saw sales in China fall last week, partly due to the Qingming Festival, or Tomb Sweeping Day, holiday.

For the week of April 1-7, Nio (NYSE: NIO) vehicles sold 2,110 units in China, according to Deutsche Bank's China passenger car weekly sales monitor.

Weekly sales are measured in terms of insurance registrations, and for the past year Li Auto (NASDAQ: LI) would publish those numbers every Tuesday, but it has stopped doing that.

For Nio, it sold 40.56 percent fewer units last week than the 3,550 it sold the week before, CnEVPost's calculations show.

April 4-6 was China's Qingming Festival this year, which may have created a disruption in insurance registrations for cars. April 7 was a workday, albeit a Sunday.

Nio delivered 11,866 vehicles in March, up 45.92 percent from 8,132 in February and up 14.34 percent from 10,378 a year earlier, according to data it released on April 1.

It delivered 30,053 vehicles in the first quarter, hitting recently lowered guidance of about 30,000.

Tesla (NASDAQ: TSLA) sold 1,880 vehicles in China last week, down 89.1 percent from 17,250 the week before.

Tesla has a factory in Shanghai that produces the Model 3 and Model Y, and not only delivers to local consumers, but is also an export hub for it.

The EV maker sold 89,064 China-made vehicles in March, including 62,398 sold in China and 26,666 exported from the Shanghai plant, according to figures released earlier today by the China Passenger Car Association (CPCA).

Tesla's March sales in China were up 107.02 percent from February's 30,141 units, although they were down 18.61 percent from the 76,663 units sold in the same month last year.

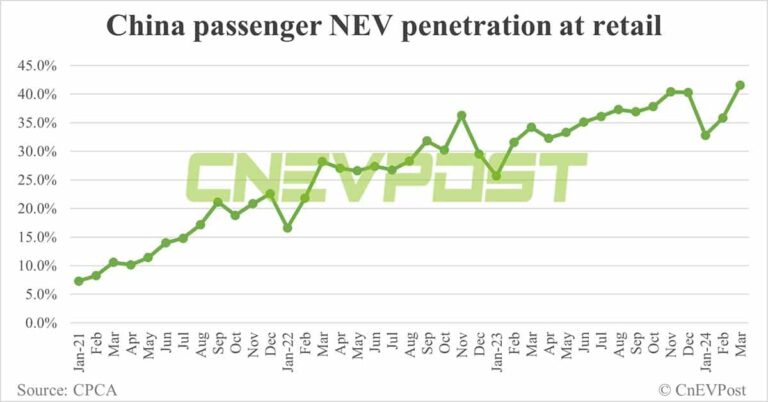

On March 22, Bloomberg reported that Tesla had reduced production of EVs at its China plant due to sluggish growth in new energy vehicle (NEV) sales and fierce competition in the market.

On April 1, Tesla raised the prices of all three variants of the Model Y by RMB 5,000 yuan ($690) in China, in contrast to price cuts by other EV makers in the price war.

The price hike appears to be part of its strategy to boost orders from customers on the sidelines, with the company teasing the move 10 days in advance.

On April 3, Tesla began offering a limited-time finance policy in China, with down payments as low as RMB 79,900 and 0 percent interest loans for consumers.

BYD (HKG: 1211, OTCMKTS: BYDDY) sold 46,250 units in China last week, down 30.61 percent from 66,650 the week before.

BYD sold 302,459 NEVs in March, the second highest ever behind last December's 341,043, according to figures it announced on April 1. That's up 147.29 percent from 122,311 in February and up 46.06 percent from 207,080 in the same month last year.

The internal sales target for BYD-branded vehicles in 2024 is 3.3 million units, excluding overseas markets, according to an April 1 story in local media outlet LatePost.

BYD Group currently owns brands including BYD, Denza, Yangwang and Fang Cheng Bao (Formula Bao), with BYD-branded passenger cars including the Dynasty and Ocean series.

Xpeng (NYSE: XPEV) saw sales of 1,220 units last week, down 40.49 percent from 2,050 the week before.

The company delivered 9,026 vehicles in March, up 98.6 percent from 4,545 in February and up 28.91 percent from 7,002 a year ago.

During the first quarter, Xpeng delivered 21,821 vehicles, which was within the previously provided guidance range of 21,000-22,500 vehicles.

Li Auto (NASDAQ: LI) sold 5,570 units last week, down 30.29 percent from 7,990 units in the previous week.

Until the end of March, Li Auto had been sharing weekly sales numbers every Tuesday for several months to demonstrate its leadership among new EV makers.

But the company stopped sharing those numbers after its first battery electric vehicle (BEV), the Li Mega MPV (Multi-Purpose Vehicle), saw poor initial acceptance.

Li Auto delivered 28,984 vehicles in March, up 43.12 percent from 20,251 in February and up 39.19 percent from 20,823 a year ago.

Li Auto on March 21 lowered its guidance for first-quarter deliveries to 76,000 to 78,000 units from 100,000 to 103,000 units previously, citing lower-than-expected order intake.

In the first quarter, Li Auto delivered 80,400 vehicles, exceeding the upper end of the lowered guidance range.

Zeekr was the only one of the major EV makers to see an uptick in sales last week at 3,220 units, up 5.92 percent from the previous week's 3,040 units.

Zeekr launched the updated Zeekr 001 on February 27 and was offering customers who order the model by March 31 free upgrades including premium exterior colors and wheels.

On March 30, the company said the updated Zeekr 001 received more than 30,000 firm orders in its first month of availability.

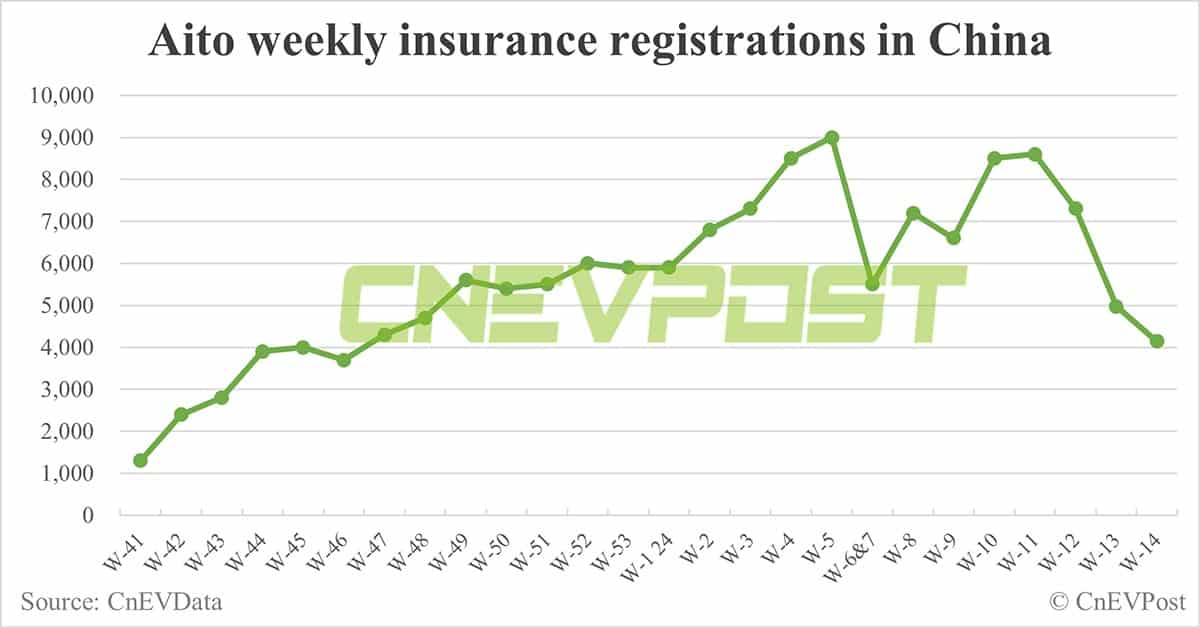

Aito, an automotive brand built by Huawei with Seres Group, sold 4,140 units last week, down 16.7 percent from 4,970 the previous week.

Aito announced on April 1 that customers who purchase the new M7 before April 30 would receive a RMB 20,000 cash discount.

The Aito M7 was initially released on July 4, 2022. On September 12, 2023, Huawei rolled out the updated M7 at one of its launch events, allowing the price to be reduced significantly.

On January 20, Richard Yu, chairman of Huawei's intelligent car solutions, said in a Weibo post that the new Aito M7 has accumulated more than 130,000 firm orders in the four months since its launch.

Smartphone giant Xiaomi sold 1,080 EVs last week.

Xiaomi launched the SU7 on March 28, offering three variants -- standard, Pro and Max.

Deliveries of the customized cars in the Standard and Max versions will begin by the end of April, and the Pro version by the end of May, the company said at the model's launch event.

Meanwhile, Xiaomi offered a Founders Edition for the SU7, limited to 5,000 units at the same prices as the Standard and Max editions, and deliveries started on April 3.

($1 = RMB 7.2312)