Lotus Technology has a market capitalization of $9.3 billion, higher than Xpeng's $8.1 billion and slightly lower than Nio's $11.2 billion.

(Image credit: Lotus Technology)

Lotus Technology, the luxury electric vehicle (EV) company majority-owned by Geely Holding, was up slightly in its Nasdaq debut Friday, after completing a merger with a special purpose acquisition company (SPAC).

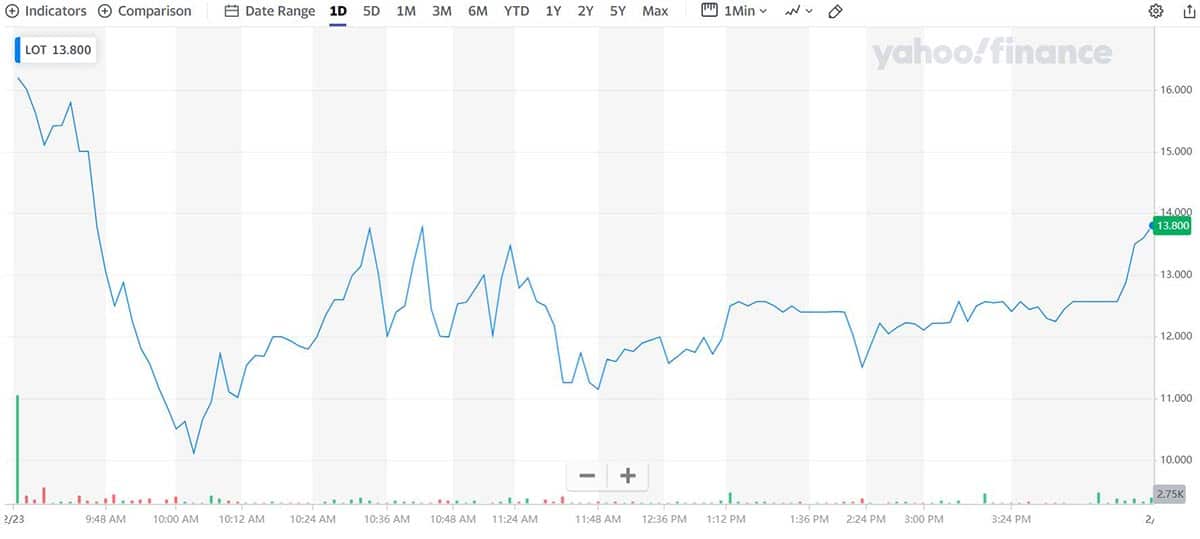

Lotus Technology, which trades under the ticker symbol "LOT," was up 2.15 percent to $13.80 by the end of Friday's trading on the US stock market, giving it a market capitalization of $9.3 billion.

That's higher than Xpeng's (NYSE: XPEV) $8.1 billion, and slightly lower than Nio's (NYSE: NIO) $11.2 billion. Li Auto (NASDAQ: LI) has the highest market capitalization among US-listed Chinese EV makers, currently at $36.9 billion.

Nio fell 7.69 percent to $5.40 at yesterday's US stock market close, after JPMorgan downgraded its rating on the EV maker to Underweight from Neutral and cut its price target to $5 from $8.50 on Friday.

Lotus Technology's listing on the Nasdaq was achieved through a merger with L Catterton Asia Acquisition Corp (LCAA), which closed on February 22.

(Lotus Technology stock price intraday performance on February 23, 2024 on the Nasdaq.)

The listing of Lotus Technology, headquartered in Wuhan, Hubei province, is the largest listing of a China-concept stock so far this year.

"We are proud to carry Lotus’s heritage into the future, and to open a new chapter in the Lotus story with our public listing today," Lotus Technology CEO Feng Qingfeng said, according to an overnight statement.

Founded in 1948, Lotus Group is a longtime luxury sports car company. In the 1980s, Lotus was in deep financial trouble and in 1983 Toyota bought a 16.5 percent stake in the company.

In 1986, General Motors acquired 58 percent of Lotus and increased its stake to 97 percent in 1987.

In 1993, GM sold Lotus to an Italian businessman for €300 million. In 1996, Lotus was sold to Proton Holdings of Malaysia.

In May 2017, Geely acquired 49.9 percent of Proton and 51 percent of Lotus. Etika Automotive of Malaysia currently holds the remaining stake in Lotus.

At the end of August 2021, Lotus established a new company in China, Wuhan Lotus Technology, with an investment from Nio Capital.

The Nasdaq listing will support the development of Lotus Technology's next-generation n automobility technologies and the expected expansion of its global distribution network from around 200 to over 300 stores globally by 2025, the company said in the overnight statement.

Lotus Technology is set to be the first traditional luxury car brand to achieve a 100 percent electric portfolio by 2027, it said.

The company has already launched two EVs, including the Eletre hyper-SUV and Emeya hyper-GT, and plans to launch two additional luxury EVs over the next two years.