BYD has set a budget of more than $20 billion for its commercial vehicle division through 2025, with major spending planned for research, product development and capacity expansion, according to the Wall Street Journal.

BYD has become the world's largest maker of new energy passenger vehicles, and now the company is reportedly planning a major push in the battery electric commercial vehicle business.

BYD plans to launch new commercial vehicle models in markets including China, Europe and Japan over the next three years, the Wall Street Journal reported today, citing people familiar with the company's plans.

The company has mapped out a budget of more than $20 billion for its commercial vehicle division through 2025, with major spending planned for research, product development and capacity expansion, the people said.

The move to expand in commercial vehicles could help BYD offset a possible slowdown in passenger electric vehicle sales growth, the report noted.

BYD expects commercial vehicle sales to recover in China after the country ended strict Covid-19 curbs that had squeezed public transportation and commercial activity, the report said, citing people familiar with the company's plans.

BYD researchers are now working on modifying batteries and platforms so they can better integrate with each other and be optimized for commercial vehicles, people familiar with the company's plans said.

BYD sold 1,863,494 new energy vehicles (NEVs) in 2022, making it the world's largest player in the field. The company stopped production and sales of vehicles powered entirely by internal combustion engines in March 2022.

These NEVs include 1,857,379 passenger cars as well as 6,115 commercial vehicles, data monitored by CnEVPost show.

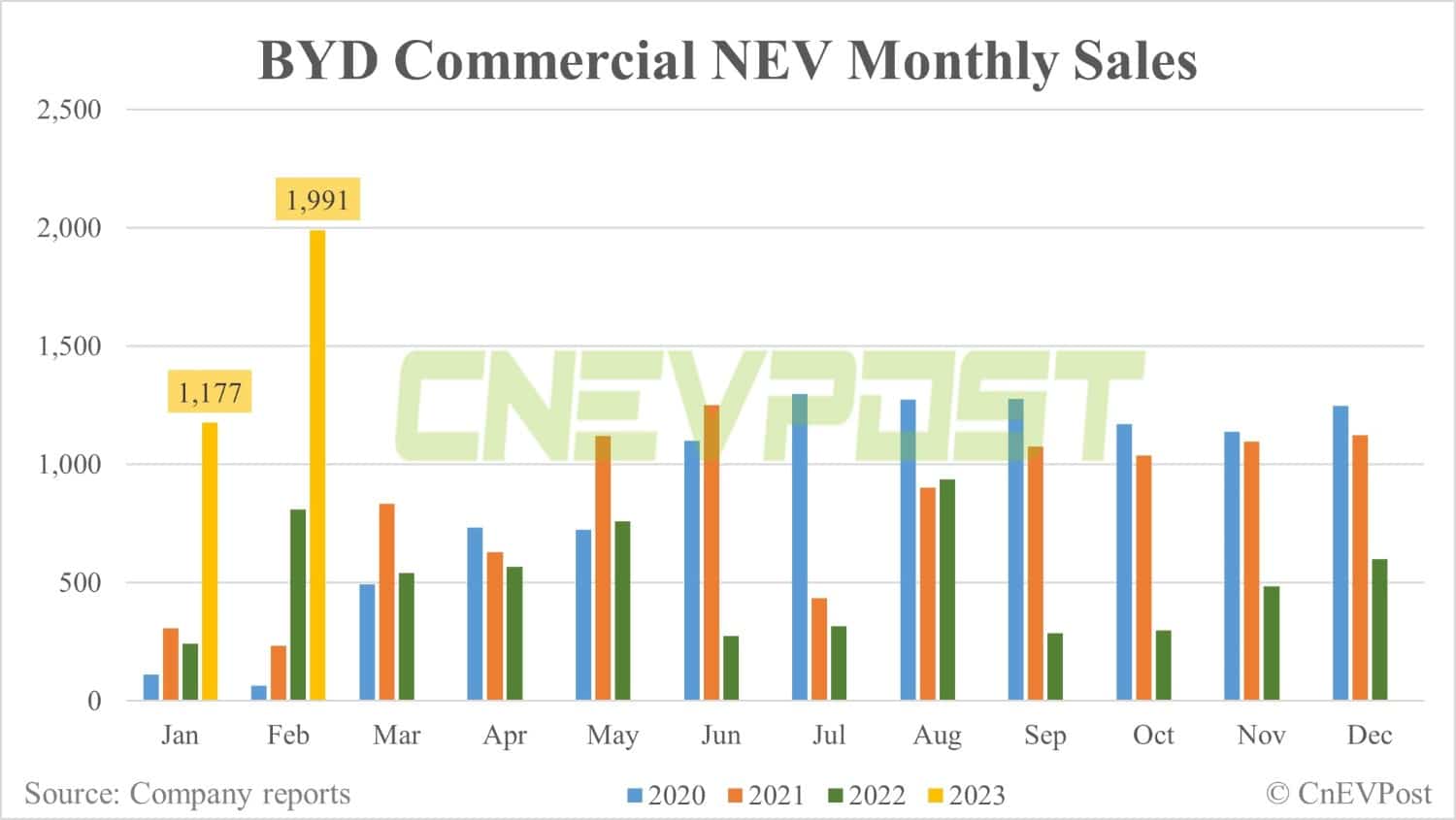

Notably, BYD's new energy commercial vehicle sales have continued to decrease over the past three years, with 10,635 and 10,038 units in 2020 and 2021, respectively.

Going into this year, BYD's new energy commercial vehicle sales grew significantly as Chinese society began a new norm after zero-Covid.

The company sold 1,177 and 1,991 new energy commercial vehicles in January and February, up 386.36 percent and 145.8 percent year-on-year, respectively. It sold 151,341 and 193,655 units of all NEVs in January and February, respectively.

Sales of electric commercial vehicles are likely to continue to grow in China, but the market is highly competitive, with more than 100 manufacturers offering electric bus or truck options, said Yvonne Zhang, a Shanghai-based research associate at market intelligence firm Interact Analysis, as quoted by the Wall Street Journal.

That competition has led Chinese automakers to look abroad, Ms. Zhang added.

China's large and fairly well-developed market gives local companies a cost advantage, and the advent of battery-powered trucks and buses provides them with access to overseas markets, she said.