Xpeng delivered better-than-expected third-quarter operating results, accompanied by a slightly better-than-feared outlook.

Xpeng Motors today reported a third-quarter performance that exceeded expectations, and guidance for the fourth quarter implies it will deliver significantly better volumes in December.

As always, Deutsche Bank analyst Edison Yu provided his first impressions of Xpeng's earnings report in a research note sent to investors today.

Here is the content from the note.

Xpeng delivered better than expected 3Q operating results, accompanied by a slightly better than feared 4Q outlook that at least shows Dec sales will improve sequentially by a meaningful degree.

Deliveries for 3Q were already reported at 29,570 units, leading to revenue of 6.8bn RMB, in line with our forecast.

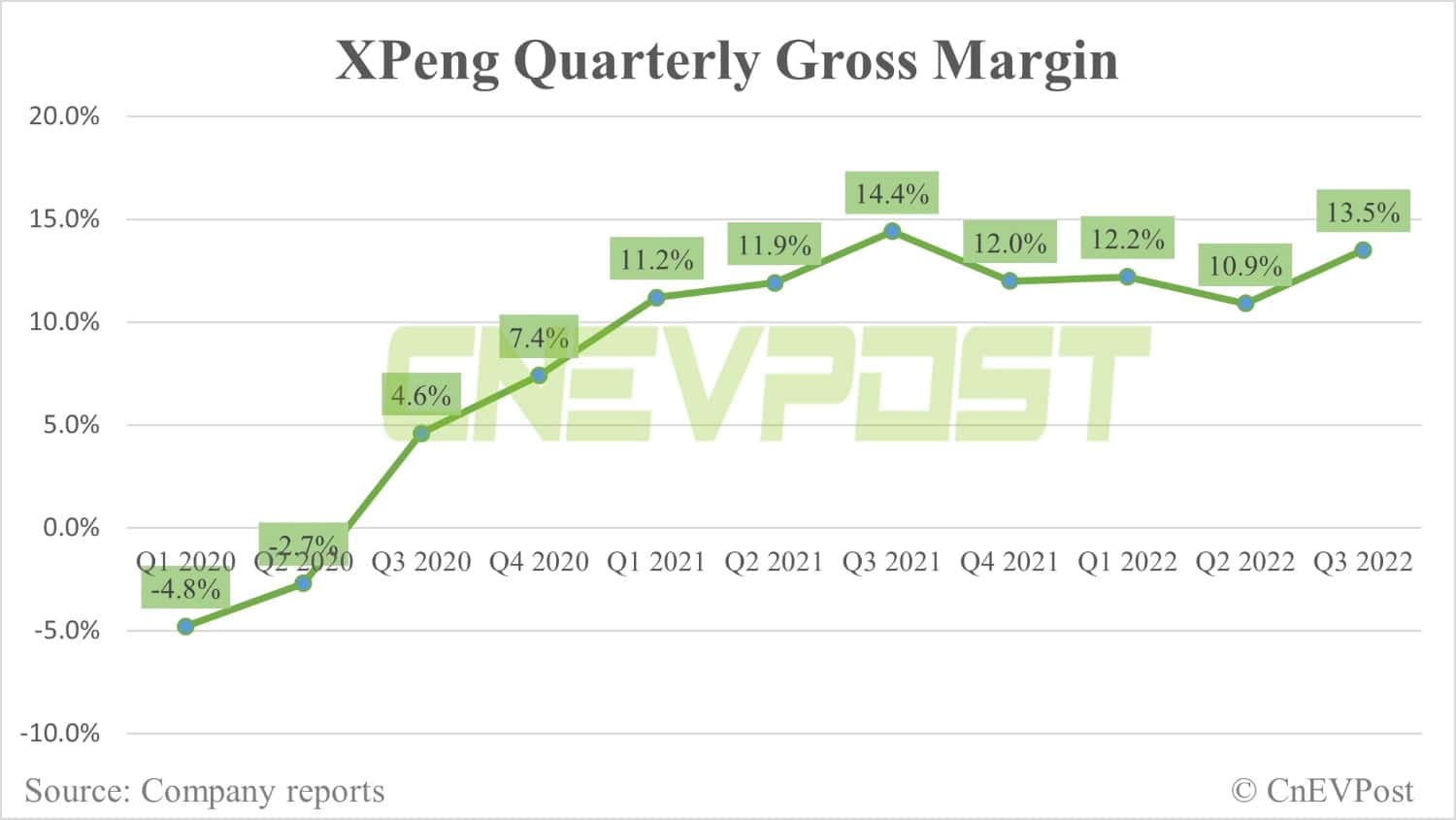

Total gross margin increased 260bps QoQ to 13.5%, easily beating our 12.0% estimate, driven by higher vehicle margin (11.6% vs. our 9.9% due to better mix and likely more favorable battery pricing than anticipated).

Opex of 3,125m RMB essentially matched our model.

All together, EPS of (2.59) came in worse than our (2.13) forecast due to a large FX revaluation loss caused by depreciation impact of RMB-denominated assets held in USD functional currency subsidiaries.

Management provided a slightly better than feared 4Q volume guidance, calling for 20,000-21,000 deliveries, vs. our 19,500 forecast (translating into 4.8-5.1bn RMB in revenue).

This would imply a big step-up in December, close to 10,000 units potentially or double the amount sold in Oct.

On the earnings call, we will look for further color on the demand for G9, gross margin dynamics, and initial thoughts for 2023.