The key to Xpeng regaining relevance is winning back demand, and that could take several quarters, creating significant uncertainty heading into 2023.

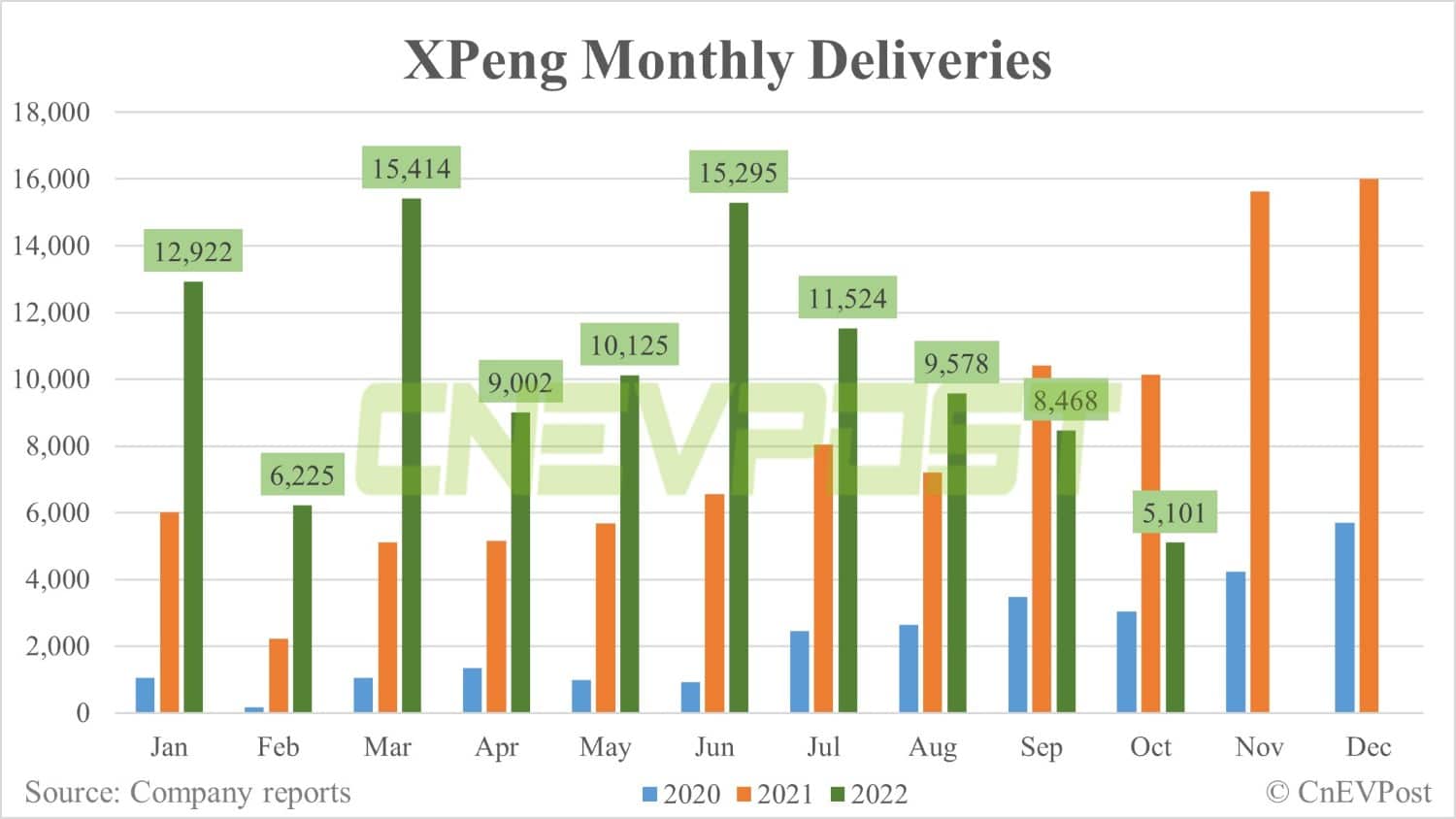

Xpeng Motors' deliveries have plummeted since the second half of this year, as demand issues begin to continue to plague the company.

In the view of Deutsche Bank analyst Edison Yu's team, the key to Xpeng's success will be winning back demand, which could take several quarters, creating significant uncertainty heading into 2023.

Third-quarter earnings preview

Xpeng will report unaudited third-quarter earnings on Wednesday, November 30, before the US stock market opens.

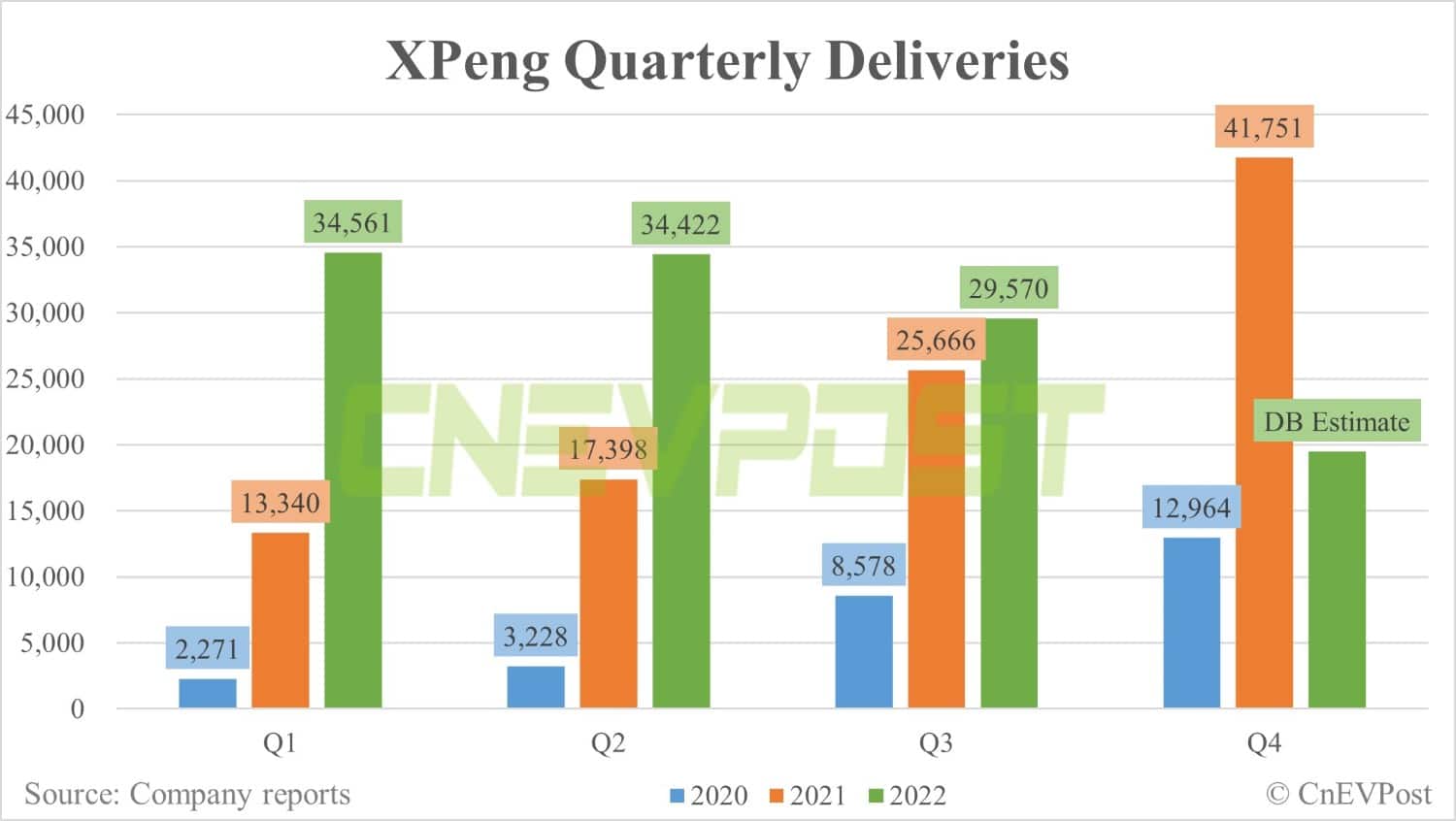

The company has previously reported data showing it delivered 29,570 vehicles in the third quarter, near the low end of its guidance range of 29,000-31,000.

In a research note sent to investors today, Yu's team said they expect the quarter to be essentially flat.

Specifically, the team expects Xpeng to report revenue of RMB 6.8 billion, a gross margin of 12.0 percent and adjusted earnings per share of RMB -2.13 for the third quarter.

The team expects Xpeng's vehicle margin to be 9.9 percent or up 80 bps sequentially.

This compares to the current analyst consensus of RMB 6.9 billion, 12.1 percent, and RMB -2.42 in a Bloomberg survey.

Weak finish to the year

Yu's team believes that Xpeng's management may provide a rather grim fourth quarter outlook with delivery guidance likely around 20,000 units as demand remains very weak.

The team now forecasts Xpeng deliveries in the fourth quarter to be 19,500 units, the lowest quarterly sales since the second quarter of 2021, or about half of the peak in the fourth quarter of 2021.

"This can be partly attributed to the P7 sedan order book rapidly declining as competition heats up and customers anticipate the revamp coming in early 2023 (gets Lidar option, enabling ADAS upgrade and new motors)," the team said.

In addition, the G9 does not appear to be ramping up as quickly as expected, and the G3i and the P5 appear to be being quasi-phased out as Xpeng management has been de-emphasizing these models for months, the team said.

The team believes Xpeng's gross margins will remain flat in the fourth quarter as the G9 mix is accretive, offsetting higher raw material prices and promotions.

Overall, Yu's team now forecasts Xpeng will deliver only about 118,000 units for the full year, up 20 percent year-on-year. The company's gross margin is expected to be just under 12.0 percent, with a vehicle margin of less than 10 percent.

The team believes that Xpeng's over-focus on technology and lack of thoughtfulness in brand building and segmentation has created mixed signals for customers.

In addition, Xpeng has too many SKUs per model, the team said, adding that the company has reduced those SKUs by about half in recent weeks, which is encouraging.

Uncertainty heading into 2023

"As we have written previously, Xpeng is embarking on multiple painful pivots (price, segment, tech roadmap) but clearly these transitions are shaping up to be much more difficult than we could have anticipated," the team said.

The team believes the key to Xpeng regaining relevance is to win back demand, and that could take several quarters, creating significant uncertainty heading into 2023.

On the demand side, the G9 will need to consistently sell at least 5,000 units per month to be relevant, and the upcoming smaller midsize SUV, the G5, will need to hit 7,500-10,000 units per month by the late next year to be considered a success, Yu's team said.

Xpeng will then have another new large C-segment vehicle coming out in the second half of next year that will garner lower sales, which is likely to be an MPV, the team noted.

Overall, Yu's team reduced their forecast for Xpeng deliveries in 2023 from 245,000 units to about 160,000, and gross margin forecasts from 16 percent to 15 percent.

"The main risks for Xpeng are demand weakness/volatility stemming from intensifying competition, product cycle changeovers and supply-chain constraints across chips, raw materials, and traditional auto components," the team wrote.