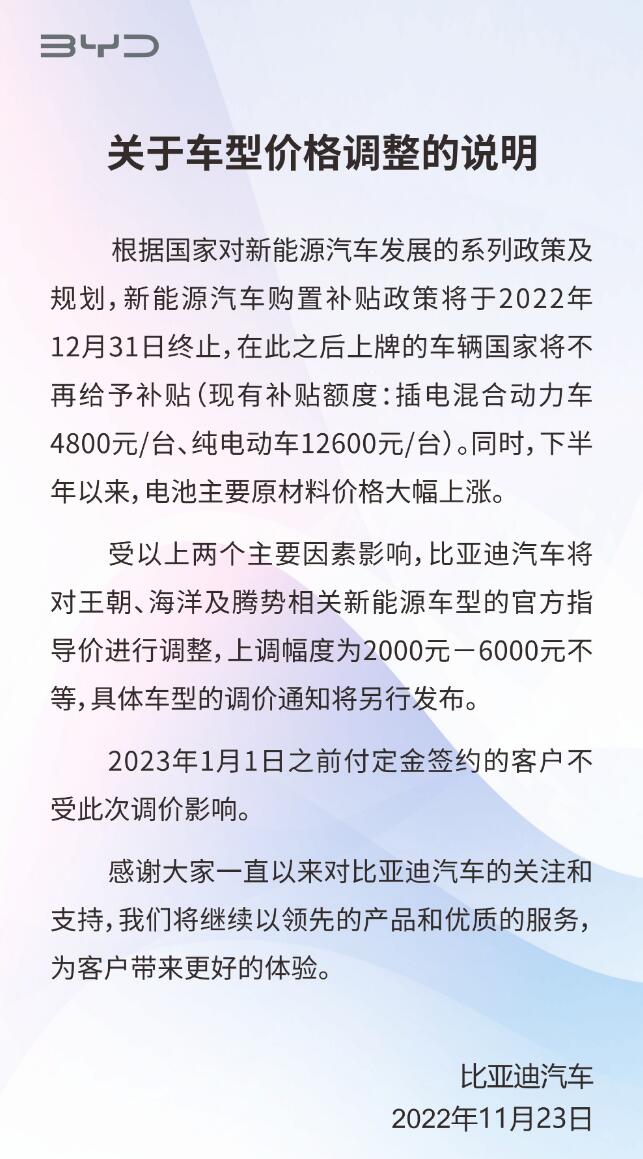

BYD said this is due to the imminent expiration of China's NEV purchase subsidies, as well as a significant increase in the prices of key raw materials.

(Image credit: BYD)

With the imminent expiration of China's purchase subsidies for new energy vehicles (NEVs) and rising raw material prices, BYD will raise vehicle prices next year.

BYD will increase the official guide prices for models in the Dynasty and Ocean series, as well as those in the Denza brand, by 2,000 yuan - 6,000 yuan ($840), the company announced today on Weibo.

Consumers who pay a deposit and sign up before January 1, 2023, will not be affected by the price adjustment, BYD said.

This is because China's subsidies for NEV purchases will expire on December 31, and vehicles that receive license plates after that date will not be eligible for the subsidies, BYD said.

Meanwhile, the prices of major raw materials, including batteries, have risen sharply since the second half of this year, BYD said.

Consumers can currently get a subsidy of RMB 4,800 for BYD's plug-in hybrid models, or RMB 12,600 for pure electric models.

This means that for consumers who buy a BYD model next year, they will face an additional cost of up to RMB 18,600.

In stark contrast to BYD's price hike, local media reported yesterday that Tesla may continue to cut prices in China.

After two promotions in China, Tesla's order intake still fell short of expectations and it will introduce new "price cuts" before the end of the year to boost sales, local tech media Huxiu said in a November 22 report, citing unnamed channel sources.

On October 24, Tesla cut the prices of its entire Model 3 and Model Y lineup in China, and on November 8, the electric vehicle maker announced a discount of up to 8,000 yuan on final payments for Model 3 and Model Y models already produced by December 31.

BYD sold 217,816 NEVs in October, a new all-time high and the second consecutive month of over 200,000 units.

BYD's NEVs include passenger cars as well as commercial vehicles, and they sold 217,518 and 298 units in October, respectively.

Among these passenger vehicles, pure electric vehicle sales were 103,157 units, the first time they exceeded 100,000 units, up 150.19 percent from 41,232 units in the same month last year. The number of plug-in hybrid vehicles was 114,361, up 194.97 percent from 38,771 units in the same period last year.

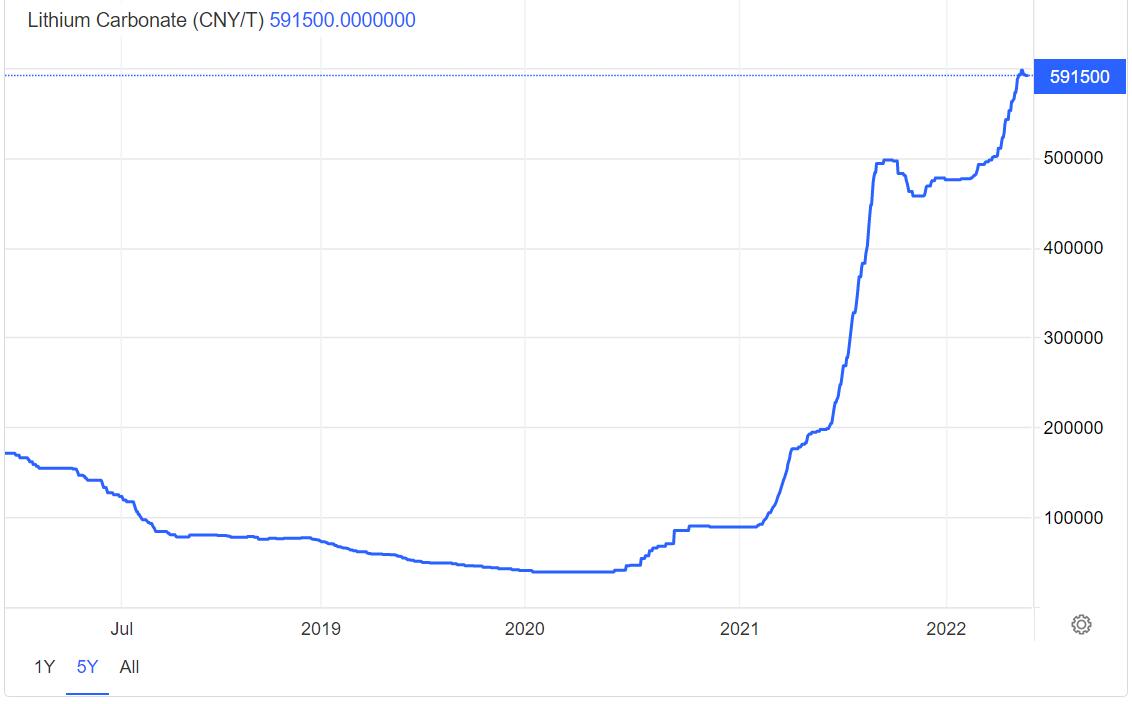

In addition to the expiration of state subsidies, the rising prices of raw materials mentioned by BYD are a problem that plagues the entire industry.

As one of the key raw materials for power batteries, the continued rise in lithium prices seems to show no sign of stopping.

The current price of battery-grade lithium carbonate in China is near RMB 600,000 per ton, about 14 times the average price of RMB 41,000 per ton in June 2020.

Those at the helm of car companies, including Changan Automobile's chairman Zhu Huarong and William Li, founder, chairman, and CEO of Nio, have called for regulatory efforts to bring down the cost of raw materials, including lithium.

On November 18, China's Ministry of Industry and Information Technology and the State Administration for Market Regulation said in a joint announcement that measures would be taken to stabilize the lithium battery industry chain.

Market regulators across China will step up supervision and investigate and deal with hoarding, price gouging and unfair competition in the upstream and downstream of the lithium battery industry to maintain market order, the announcement said.