An increase in vehicle prices and an upward pivot in its product sales mix are seen as the main reasons why BYD beat earnings estimates in the second quarter.

BYD reported bright first-half results on Monday, following rapid sales growth and an upward revision of vehicle prices.

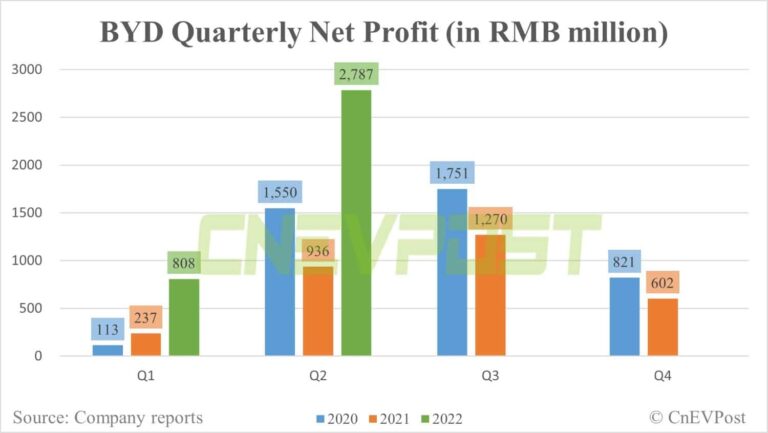

The company posted a net profit of RMB 2.79 billion ($400 million) in the second quarter, up 197.76 percent from RMB 936 million in the same period last year and 244.93 percent from RMB 808 million in the first quarter.

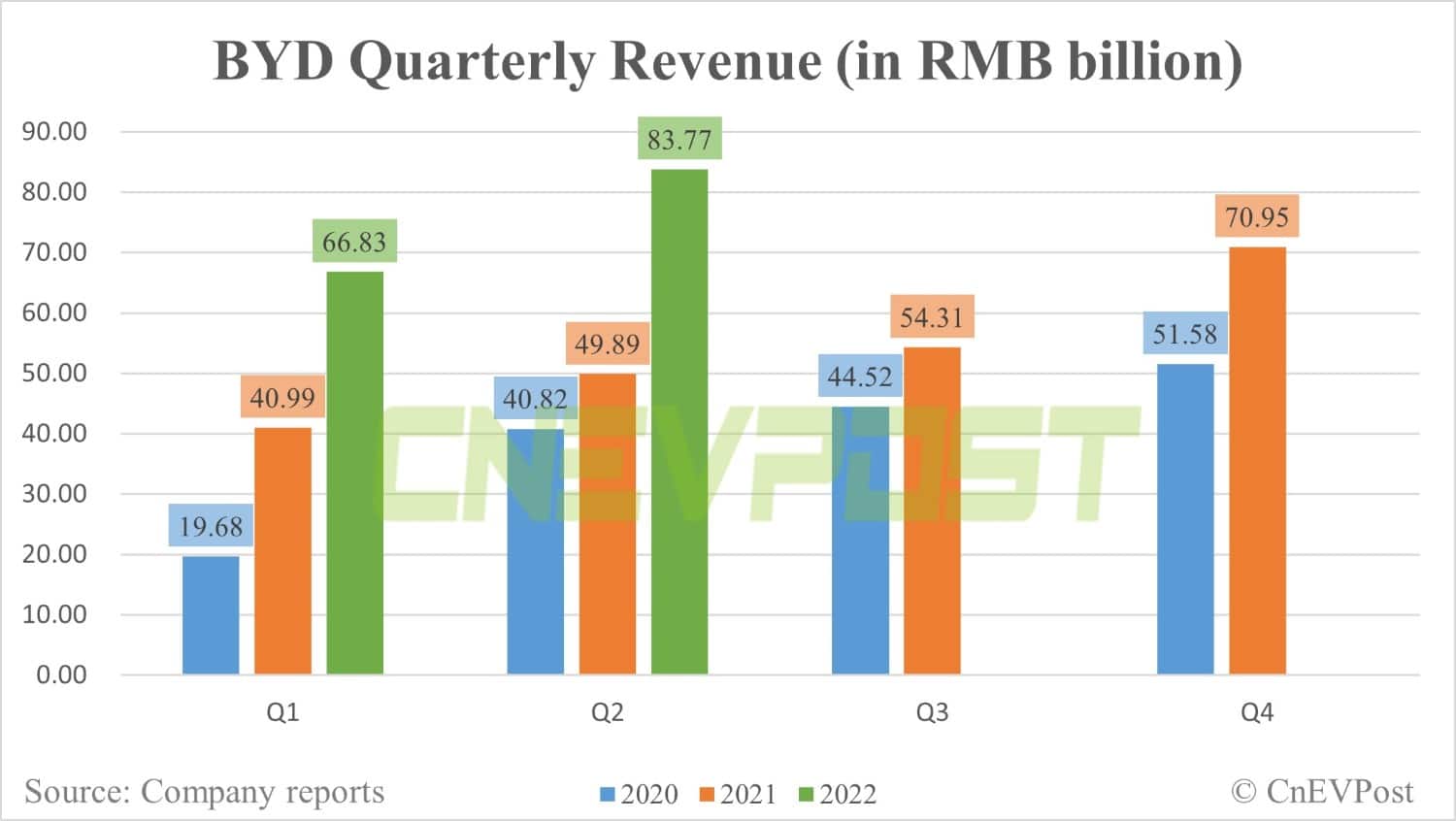

BYD's revenue in the second quarter was RMB83.77 billion, up 67.91 percent from RMB49.89 billion in the same period last year and up 25.35 percent from RMB66.83 billion in the first quarter.

In the first half of the year, BYD's revenue was RMB 150.6 billion, up 65.71 percent year-on-year. Its net profit for the period was RMB 3.6 billion, up 206.35 percent year-on-year.

Several analyst teams today released their views on the performance of this BYD.

Essence Securities: BYD may exceed expectations again in H2

Analysts at Essence Securities believe that BYD's performance in the first half of the year exceeded expectations due to the contribution of three main factors:

BYD's product mix was significantly optimized. In the second quarter, sales of high value-added models, including Han DM-i, Song Pro DM-i and Destroyer 05, grew significantly from the first quarter.

The scale advantage from the rapid growth in vehicle sales brought down operating costs.

The company's two price increases in the first quarter were reflected in the second quarter, allowing average earnings per vehicle to improve from the first quarter.

The team believes that BYD's earnings are expected to continue to grow at a high rate in the second half of the year.

The company currently has ample orders on hand, and monthly sales are expected to continue at record highs as new models are launched and production capacity expands, according to the team.

The sales ratio of high value-added models, such as Han DM-i, Seal, Frigate 07 and Denza D9, are expected to keep increasing in the second half of the year, further improving the product structure and profitability structure.

With the further expansion of revenue, BYD's expense ratio is expected to continue downward. And the effect of the price increase in the first quarter will be fully reflected in the second half of the year, driving earnings to the upside, the team said.

Huaxi Securities: BYD's full-year sales are expected to exceed 1.7 million

Backed by strong demand and a vertically integrated supply chain advantage, BYD's vehicle production and sales are rising rapidly, analysts at Huaxi Securities said.

As sales of BYD's high-end models, including the Han and Tang, accounted for a higher share of sales, the company's vehicles were priced at an average of RMB 173,000 ($25,000) in the second quarter, up from RMB 158,000 in the first quarter, according to the team.

This also allowed BYD to earn an average profit of RMB 7,000 per vehicle in the second quarter, an increase of RMB 5,000 from the first quarter.

The introduction of new models will drive BYD's rapid sales growth, supported by the performance of the Dynasty as well as the Ocean series models, which are expected to exceed 1.7 million units this year, according to the team.

In addition, BYD has announced its entry into the passenger car market in a number of countries, including Japan, Germany and Sweden. Supported by domestic and overseas sales, the company's medium- to long-term growth path is clear, the team said.

Changjiang Securities: BYD's gross margin hit one-year high

BYD's gross margin improved to 14.4 percent in the second quarter, the highest level since the first quarter of 2021, as the scale effect and the effect of price increases began to materialize, analysts at Changjiang Securities said.

BYD is currently in an intensive new product launch period, the sales expense ratio and research and development expense ratio slightly increased, but is expected to be reduced in the future, the team said.

Credit Suisse: Price increases help improve profit

Analysts at Credit Suisse attributed BYD's gross margin improvement in the second quarter to its car price hikes in March, coupled with an improved product mix.

The team mentioned that based on BYD's order backlog of more than 800,000 vehicles, the company is expected to sell a record high of about 170,000 vehicles in August, up about 150 percent year-on-year.

The bank expects BYD to sell up to 480,000 units in the third quarter, driving quarterly earnings to a record high of RMB 5 billion, given that more than 40,000 units of BYD Denza D9 were pre-sold, of which more than 10,000 were non-refundable orders.