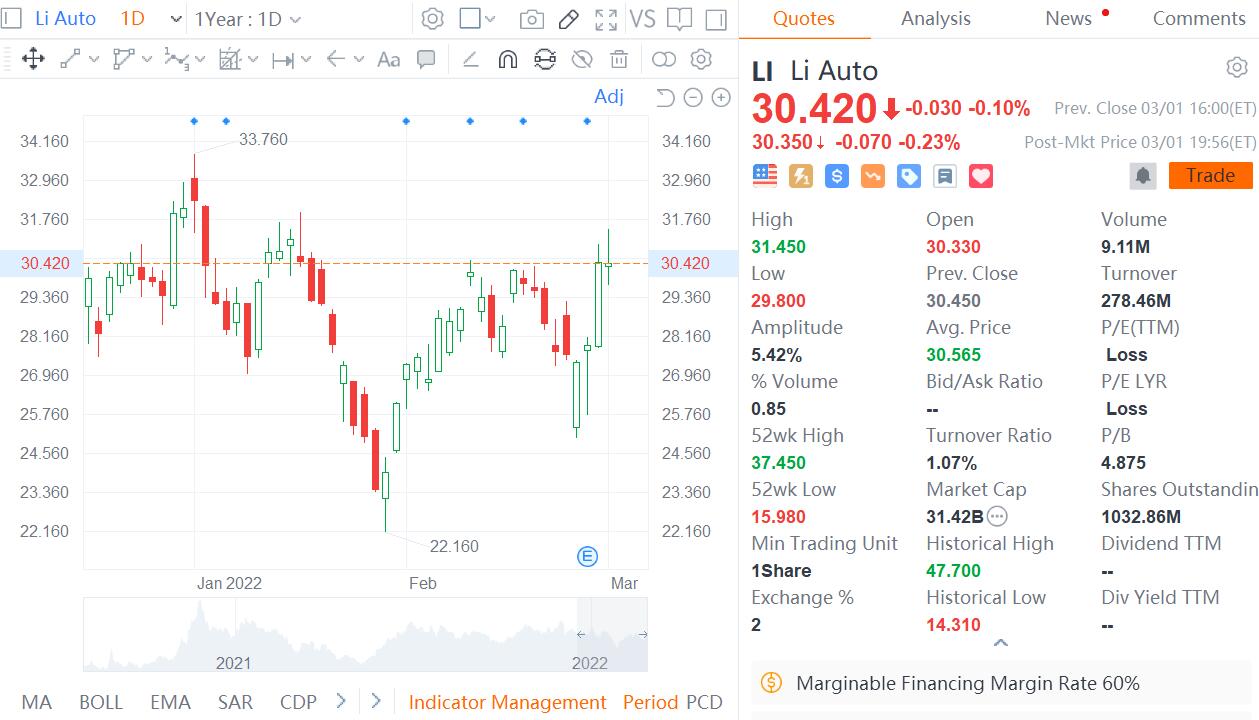

The price target implies a 44 percent upside.

(Image credit: Li Auto)

Chinese local brokerage firm Guosheng Securities initiated coverage on Li Auto in a research note on Tuesday, bullish on the company's ability to build hot products with a unique rhythm.

Analysts Xia Jun and Liu Lan gave Li Auto a Buy rating in the note, giving the company a HK$171 price target for shares traded in Hong Kong and a $43.9 price target for shares traded in the US.

Li Auto closed down 0.1 percent to $30.42 in the US on Tuesday, and the target price implies a 44 percent upside.

The team believes Li Auto has a distinct positioning compared to other new carmakers in China:

1. Targeting "family SUV" demand; 2. taking the extended-range and all-electric technology routes; and 3. building hot-selling models.

Li Auto's Li ONE sold 14,087 units in December 2021 and delivered 90,491 units for the year, topping China's mid-size SUV sales, the only new carmaker to sell more than 10,000 units per month, the team noted.

The team believes Li Auto's founder, chairman and CEO, Li Xiang, is an outstanding product manager with a top-notch ability to control the pace of the product.

Li ONE's success reflects Li Auto's ability to capture user needs and the company's very strong team execution, according to Guosheng Securities.

"According to our calculations, the company's directly managed stores saw monthly sales of 65 units under conservative estimates, nearly twice as many as the rest of the other leading new carmakers," the team said.

The team is bullish on the new models Li Auto will launch after the Li ONE, noting that the company's full-size SUV, the X01, which is expected to go into production in the third quarter of this year, is expected to be the next hot seller with its enhanced performance and smart driving experience.

Li Auto's X02 and X03 models could also be delivered in 2022-2023, the team said.

Guosheng Securities expects Li Auto to deliver 150,000 units, 230,000 units, 370,000 units and 520,000 units from 2022-2025, with revenues of RMB 47.6 billion, RMB 77.1 billion, RMB 120.5 billion and RMB 165 billion, respectively, and non-GAAP net margins of about 4 percent, 4 percent, 5 percent and 6 percent.

The team gave Li Auto a target market capitalization of about RMB 285.4 billion, corresponding to about 6x 2022e P/S. It gave the company a price target of HK$171 for Hong Kong shares and about $43.9 for shares traded in the US.

Li Auto has achieved positive free cash flow since the second quarter of 2020, and based on its solid operating style and strong profitability, Guosheng Securities expects the company to be profitable in 2022.

Li Auto's annual non-GAAP net income is expected to reach RMB10.6 billion in 2025, with the target market cap of about 27x P/E, providing a strong margin of safety, the team said.

Li Auto posts Q4 revenue of $1.67 billion, beating expectations

Become A CnEVPost Member

Become a member of CnEVPost for an ad-free reading experience and support us in producing more quality content.

Already a member? Sign in here.