BYD ranks second with 25.06 GWh of installed power battery capacity and 16.2 percent market share in 2021.

Contemporary Amperex Technology Co Ltd (CATL) has been dominating the Chinese power battery market and did so for the full year 2021.

The Tesla, Nio supplier has 80.51 GWh of power batteries installed in China for the full year 2021, capturing a 52.1 percent market share, according to data released yesterday by the China Automotive Battery Innovation Alliance (CABIA).

In 2021, the cumulative installed base of power batteries in China was 154.5 GWh, up 142.8 percent year-on-year.

BYD ranks second with 25.06 GWh of power batteries installed in 2021, with a 16.2 percent market share.

CALB ranks third with a 5.9 percent market share with 9.05 GWh installed in 2021.

Gotion High-tech and LG Energy Solution ranked fourth and fifth with 5.2 percent and 4.0 percent shares, respectively.

(Graphic by CnEVPost)

Among the top five, CALB and LG Energy Solution are the ones to watch for the most.

Late last month, local media outlet 36kr reported that Xpeng Motors planned to bring in CALB as its new primary battery supplier in addition to CATL (SHE: 300750).

Cailian later quoted Xpeng sources as suggesting that the report was true, saying that the supply chain of components needed for vehicle production needs to be constantly improved to better ensure supply and yield, and to more accurately predict delivery lead times.

Xpeng's main battery supplier is currently CATL, and 36kr reports that Xpeng's chairman and CEO He Xiaopeng and CATL founder and chairman Robin Zeng had a mid-year meeting in which they argued, with Zeng even walking out of the meeting at the height of the heat in order to calm down for more than 10 minutes.

The argument was over He's plan to bring in CALB as the new main battery supplier, which would cut into CATL's share of supply. CALB, on the other hand, is seen by CATL as a serious threat to its nemesis.

Local news portal Sina quoted a CATL source as saying that the quarrel was completely false, without providing any further details.

It is worth noting that CATL has previously begun to take action against potential threats from CALB.

On July 21, 2021, CATL announced that it had formally sued CALB for patent infringement, claiming that CALB's allegedly infringing batteries are on tens of thousands of vehicles.

LG Energy Solution recently launched the process for its initial public offering in South Korea, with plans to raise up to $10.8 billion.

CATL maintained its dominant position in the global electric vehicle battery market with a 31.8 percent share from January to November, according to data released late last month by South Korean market research firm SNE Research.

CATL's share was 11.3 percentage points higher than second-place LG Energy Solution's 20.5 percent.

Given the apparently high order backlog and other factors, LG Energy Solution's share of the global electric vehicle battery market could surpass CATL's, the company's CEO Kwon Young-soo, said on January 10.

Kwon made the remarks in an online press release about the company's upcoming IPO, emphasizing LG Energy Solution's dominance in terms of intellectual property and diversity of its foreign customer base.

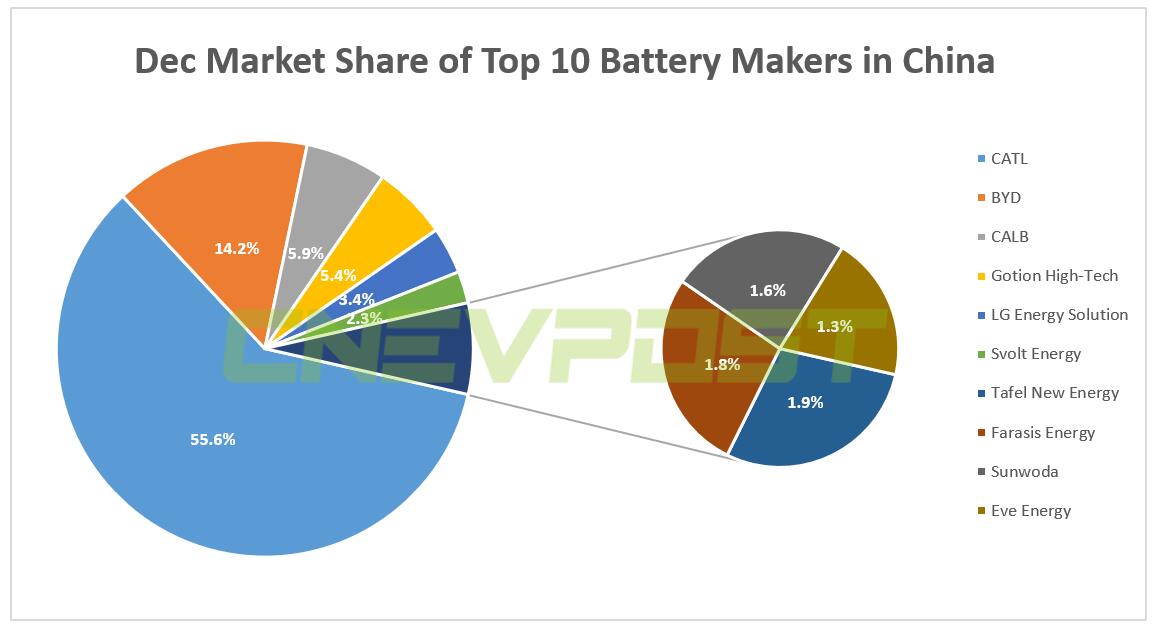

In December, CATL held 55.6 percent of the Chinese power battery market, followed by BYD at 14.2 percent, CALB at 5.9 percent, Gotion at 5.4 percent and LG Energy Solution at 3.4 percent, according to CABIA.

(Graphic by CnEVPost)

Become A CnEVPost Member

Become a member of CnEVPost for an ad-free reading experience and support us in producing more quality content.

Already a member? Sign in here.