- "Potential cost pressures this year are quite significant. The biggest cost pressure isn't raw materials, but memory chips," said William Li.

- For the entire automotive sector, rising memory chip prices could exert immense pressure throughout the year, Li added.

Nio Inc (NYSE: NIO, HKG: 9866) management has cautioned about potential cost pressures stemming from memory chips, as prices for these components -- widely used in digital products -- have surged globally.

"Potential cost pressures this year are quite significant. The biggest cost pressure isn't raw materials, but memory chips," said William Li, founder, chairman, and CEO of Nio, today.

"The price increase for memory chips is crazy," Li said during a media session with outlets including CnEVPost, following Nio Inc's celebration of its 1-millionth vehicle production milestone today.

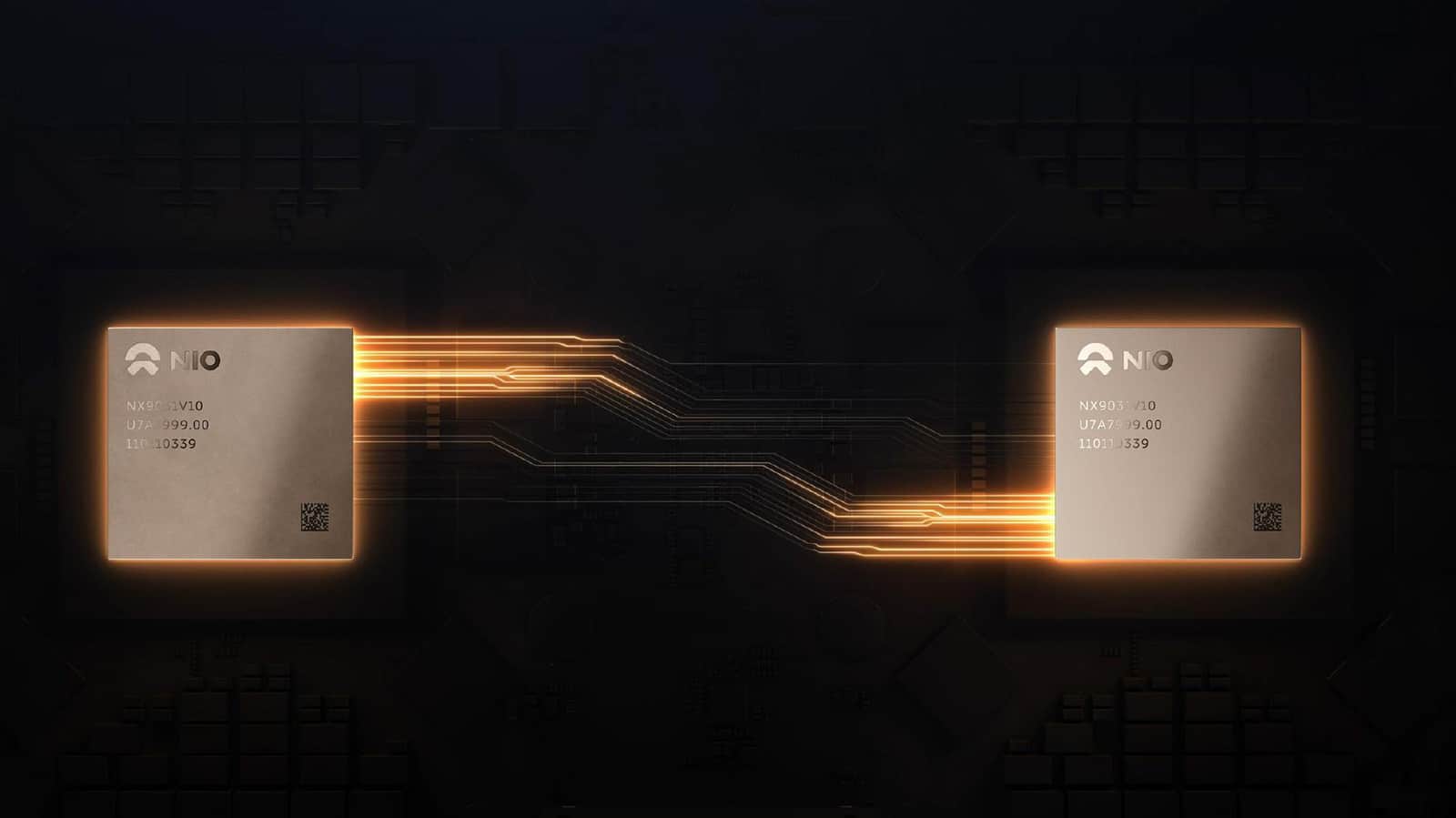

The Nio CEO explained that the company's Shenji chips, as well as Nvidia chips and cockpit chips used in its vehicles, all use memory chips.

For the entire automotive industry, memory chip price hikes this year could pose immense pressure, Li said.

"For memory chips, we need to compete for resources with AI players and computing centers," he said.

Demand for data center servers remains robust, and DDR5 memory chip contract prices are expected to rise throughout 2026, with particularly significant increases in the first half of the year, market research firm TrendForce said in a report released on October 29.

The memory shortage has already triggered a scramble for resources among consumer electronics giants. The Korea Economic Daily reported yesterday that Apple executives have arrived in South Korea to negotiate supply agreements with Samsung and SK Hynix.

Rising raw material and memory chip prices represent significant potential cost pressures this year, a challenge facing the entire industry, Li said.

However, Li noted that Nio currently has no plans to pass on these cost increases to vehicle prices.

"This remains within our manageable range for now, though we'll also monitor the broader industry landscape," he said.

Nio currently has sufficient gross margin to manage this situation, with future decisions depending on market conditions, Li said.