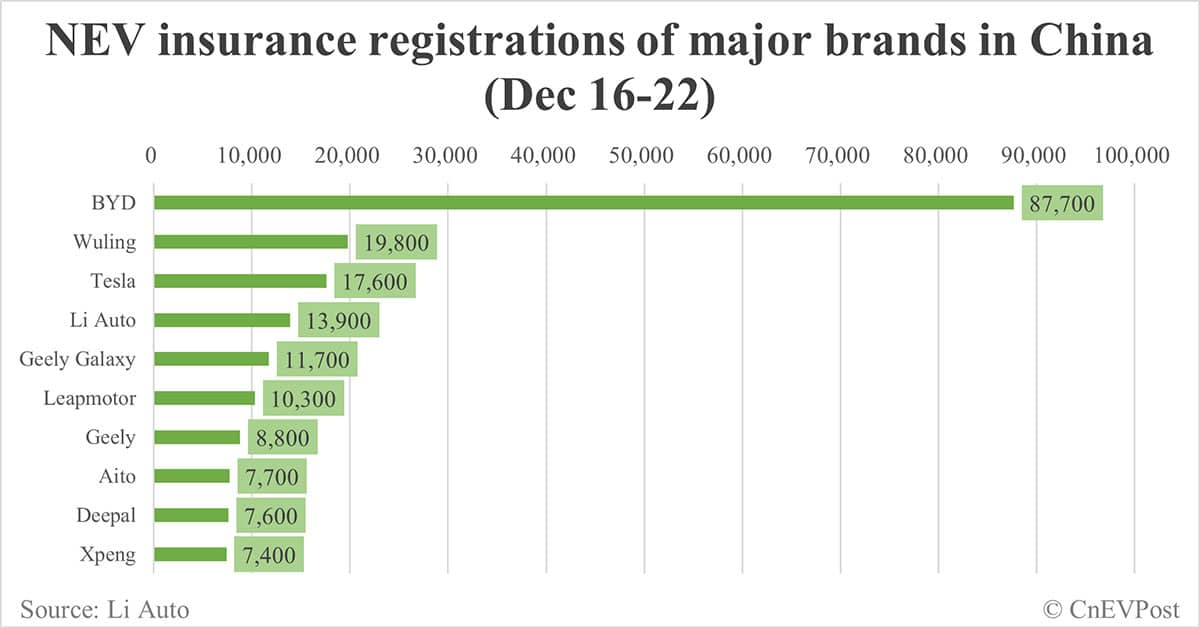

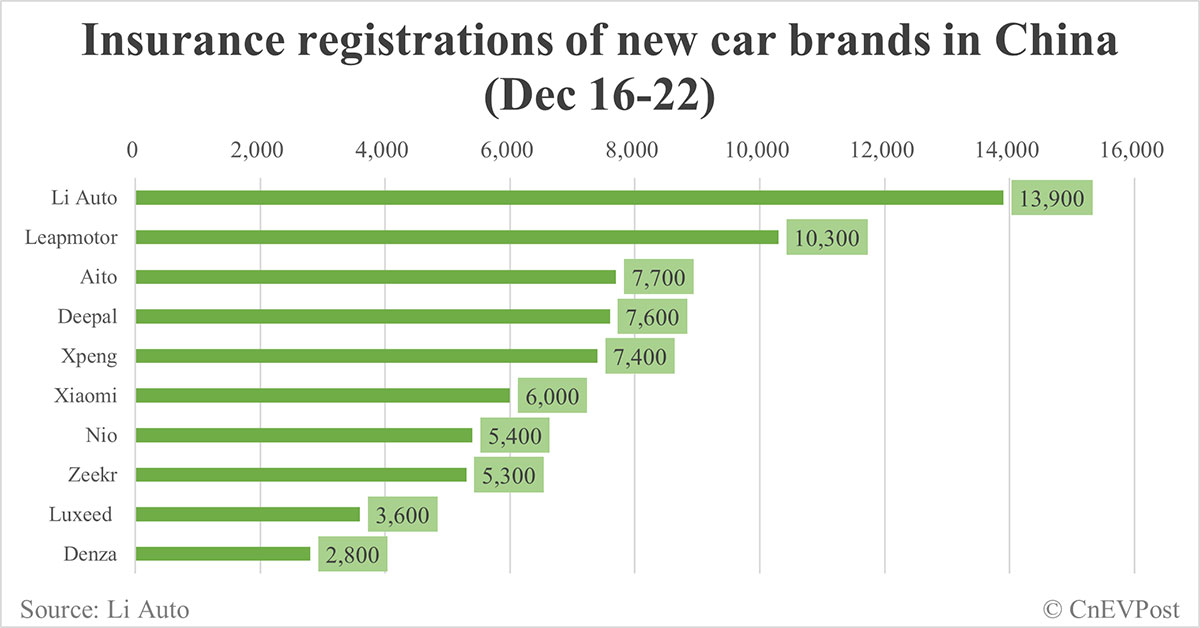

Onvo had 2,100 insurance registrations last week, Li Auto 13,900, Xpeng 7,400, Zeekr 5,300, Leapmotor 10,300 and Aito 7,700.

Major electric vehicle (EV) makers saw insurance registrations in China continue to rise last week as the end of the month approached with typically higher deliveries.

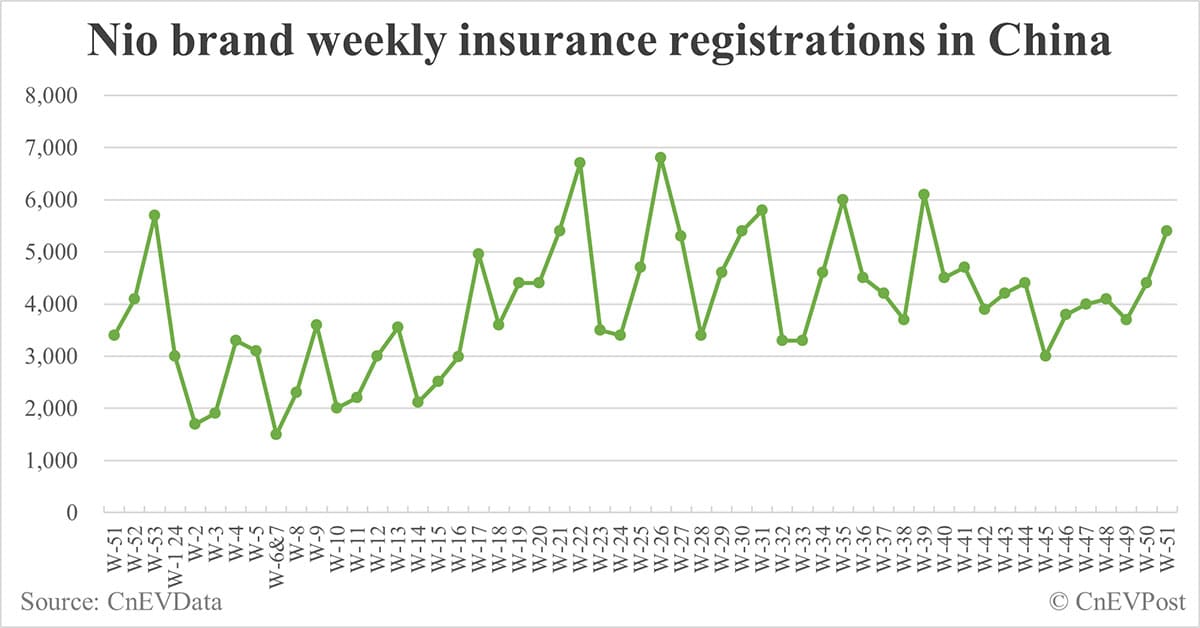

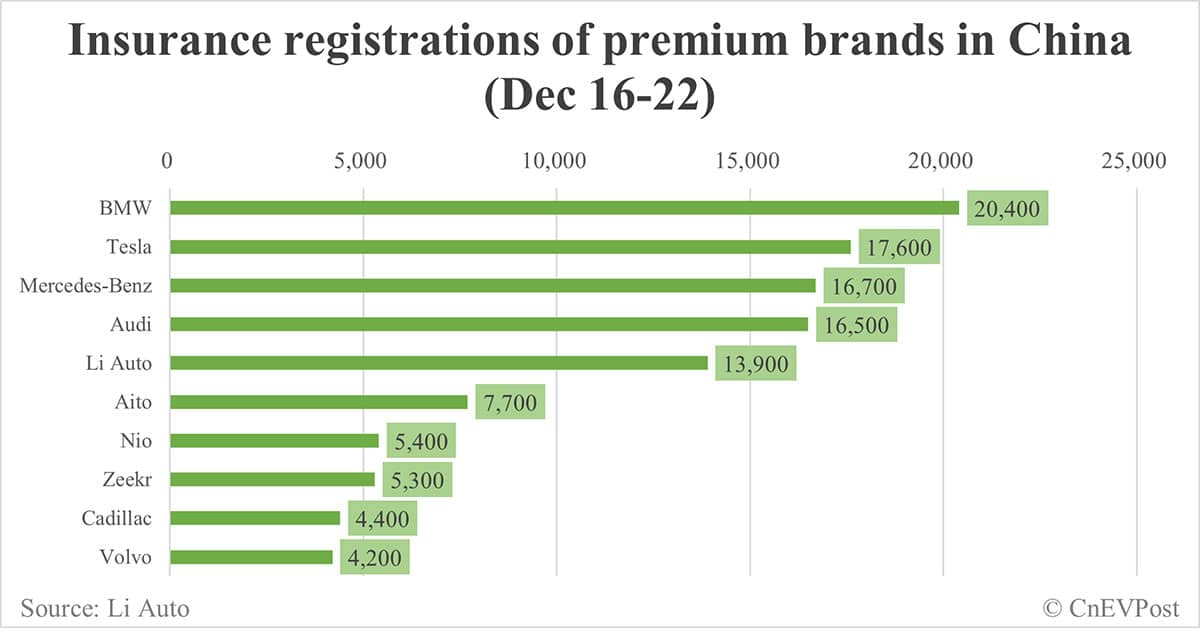

For the week of December 16 to December 22, Nio (NYSE: NIO) branded vehicles saw 5,400 insurance registrations in China, up 22.73 percent from 4,400 in the previous week, according to data shared today by Li Auto (NASDAQ: LI).

Li Auto stopped sharing weekly insurance registrations earlier this year, and after about a year of doing so. It resumed sharing those numbers in the form of weekly rankings in early May.

The figures Li Auto shares are by brand, excluding sales of sub-brand Onvo in Nio's case.

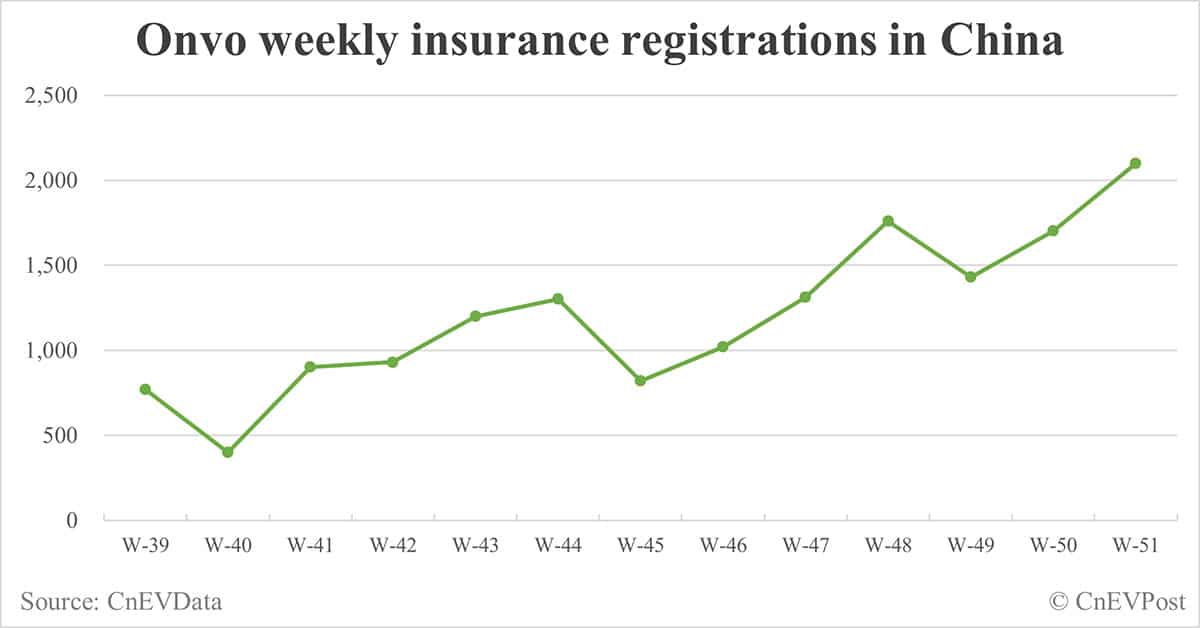

Onvo failed to make the list shared by Li Auto as before, though the Nio sub-brand saw 2,100 insurance registrations last week, up 23.53 percent from 1,700 the week before, according to figures shared by several car bloggers on Weibo.

Onvo launched its first model, the L60, on September 19, with deliveries beginning on September 28.

Nio Inc delivered 20,575 vehicles in November, including 15,493 under the Nio main brand and 5,082 under Onvo.

The company guided last month that fourth-quarter vehicle deliveries would be in the range of 72,000 to 75,000, meaning that it could deliver at least 30,449 vehicles in December.

On December 12, Nio founder, chairman, and CEO William Li said in a media meetup in response to a question from CnEVPost that the company was confident it would meet its fourth-quarter deliveries guidance, with more than 30,000 units to be delivered in December.

On December 18, Onvo president Alan Ai said the brand's deliveries would pick up speed this month, with more than 10,000 vehicles sure to be delivered in December.

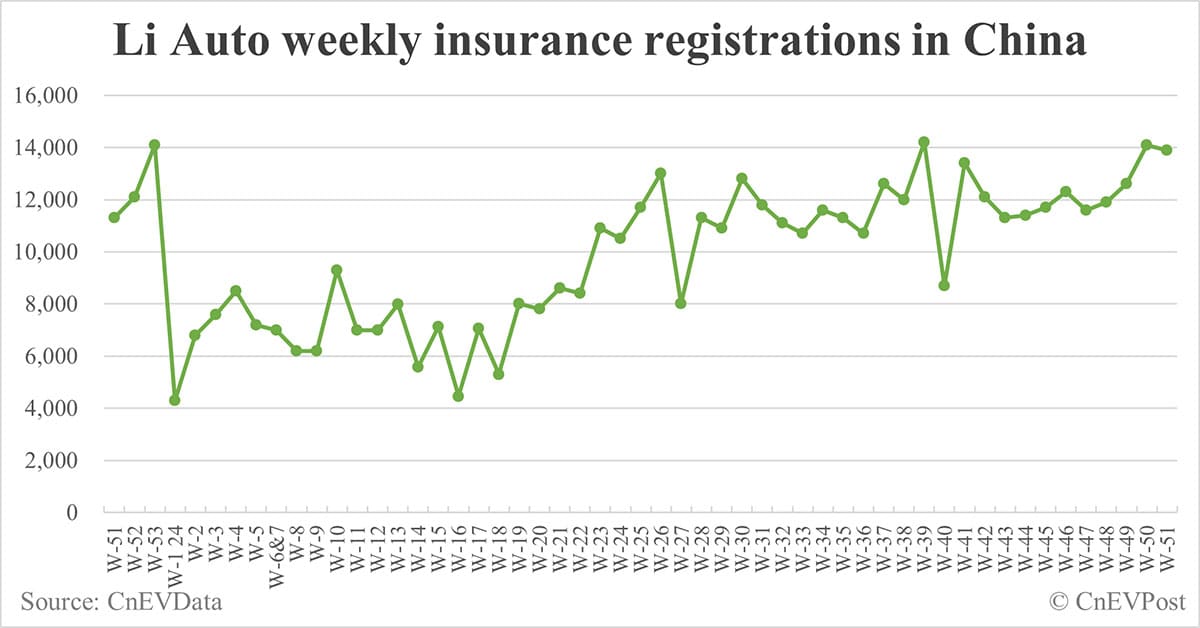

Li Auto had 13,900 insurance registrations last week, down 1.42 percent from 14,100 the week before, according to figures it shared.

The company delivered 48,740 vehicles in November, up 18.79 percent from 41,030 in the same month last year, but down 5.25 percent from 51,443 in October, its second consecutive sequential decline.

Li Auto on October 31 guided for fourth-quarter vehicle deliveries between 160,000 and 170,000 units, implying year-on-year growth of 21.4 percent to 29.0 percent, slightly higher than the 152,831 vehicles delivered in the third quarter.

If Li Auto is to meet that guidance, it will need to deliver at least 59,817 vehicles in December.

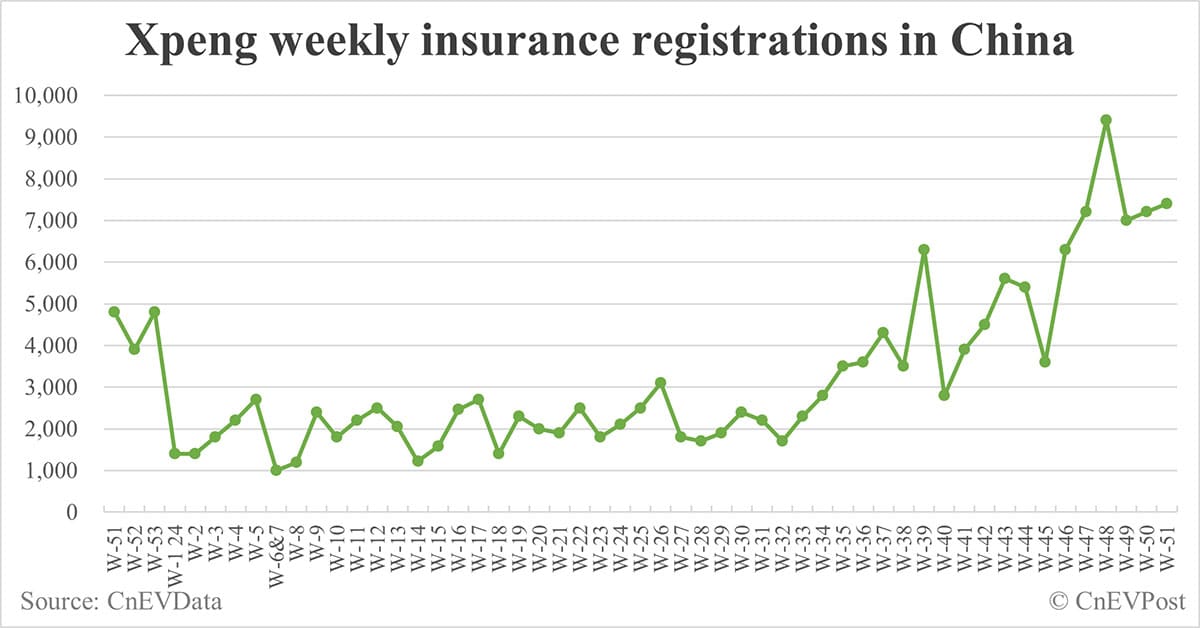

Xpeng (NYSE: XPEV) saw 7,400 insurance registrations last week, up 2.78 percent from 7,200 the week before.

The company delivered 30,895 vehicles in November, marking the first time it has surpassed the 30,000 mark and the third consecutive month of record highs.

Xpeng had previously guided for fourth-quarter vehicle deliveries in the range of 87,000 to 91,000, meaning it could deliver at least 32,188 vehicles in December.

An Xpeng executive said last week that deliveries of the new P7+ model had accelerated after battery maker Eve Energy increased the battery capacity it supplies to the company.

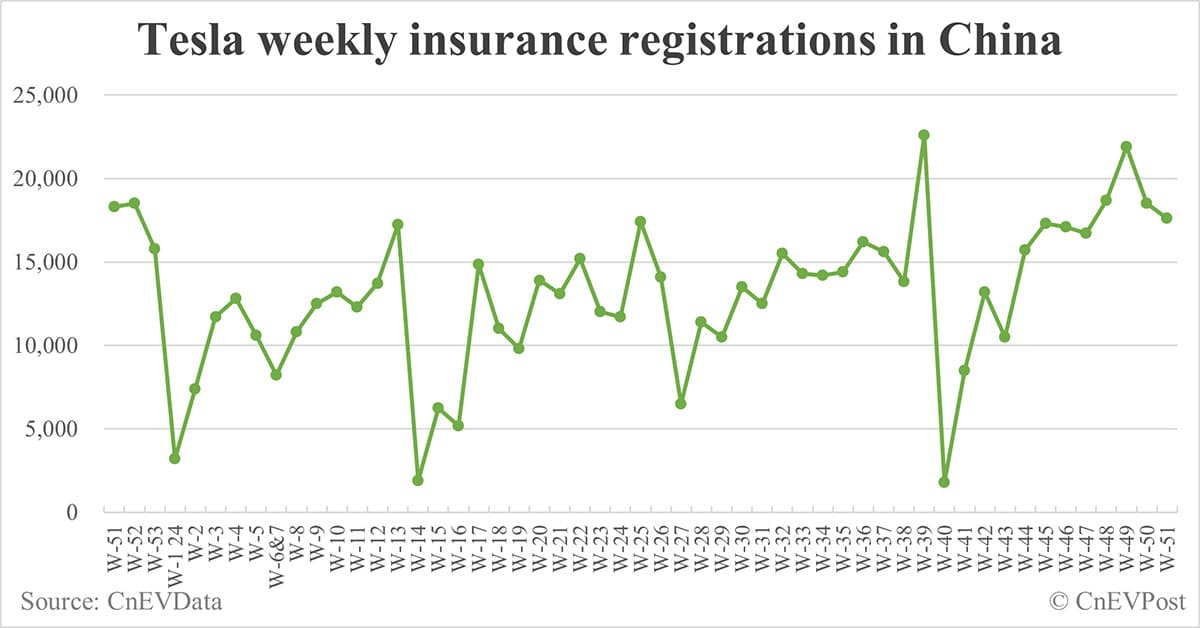

Tesla had 17,600 insurance registrations in China last week, down 4.86 percent from 18,500 the week before.

Tesla has a factory in Shanghai that produces the Model 3 sedan and Model Y crossover, delivering both to local customers and serving as an export hub for it.

Tesla China sold 78,856 vehicles in November, including 5,366 for export, data from the China Passenger Car Association (CPCA) showed.

The US EV maker sold 73,490 vehicles in China in November, its highest month of the year, CnEVPost's calculations show. That's up 12.19 percent from 65,504 vehicles in the same month last year and up 81.52 percent from 40,485 in October.

Earlier today, Tesla announced that it is offering final payment reductions on existing Model Y vehicles in China, and extended its 5-year 0 percent interest financing through January 31, as the previous promotion was set to expire at the end of this month.

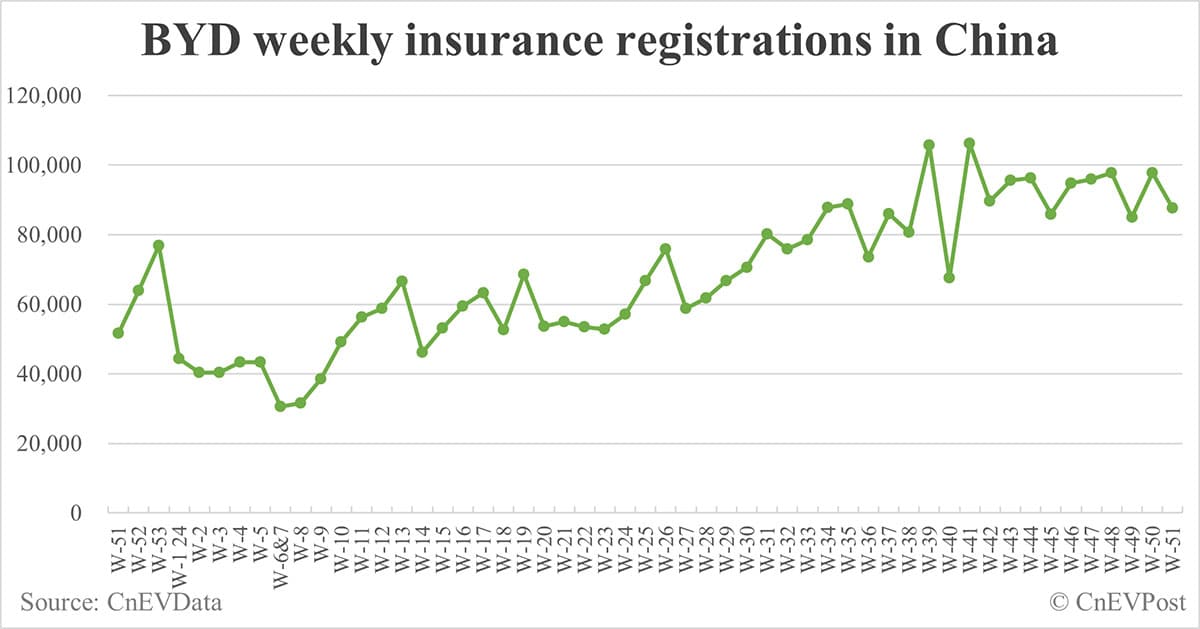

BYD (HKG: 1211, OTCMKTS: BYDDY) had 87,700 insurance registrations last week, down 10.33 percent from 97,800 the week before.

The company sold 506,804 new energy vehicles (NEVs) in November, marking the second time it has surpassed the 500,000 mark and the sixth consecutive month of record sales.

In the January-November period, BYD sold 3,757,336 NEVs, up 40.02 percent year-on-year.

On December 13, BYD chief scientist Lian Yubo said the company's annual sales in 2024 were expected to reach 4.25 million units.

Also on December 13, BYD's plant in Xi'an, Shaanxi province in northwestern China reached its goal of producing 1 million vehicles for this year, the first time its largest vehicle assembly plant has seen annual sales exceed that mark.

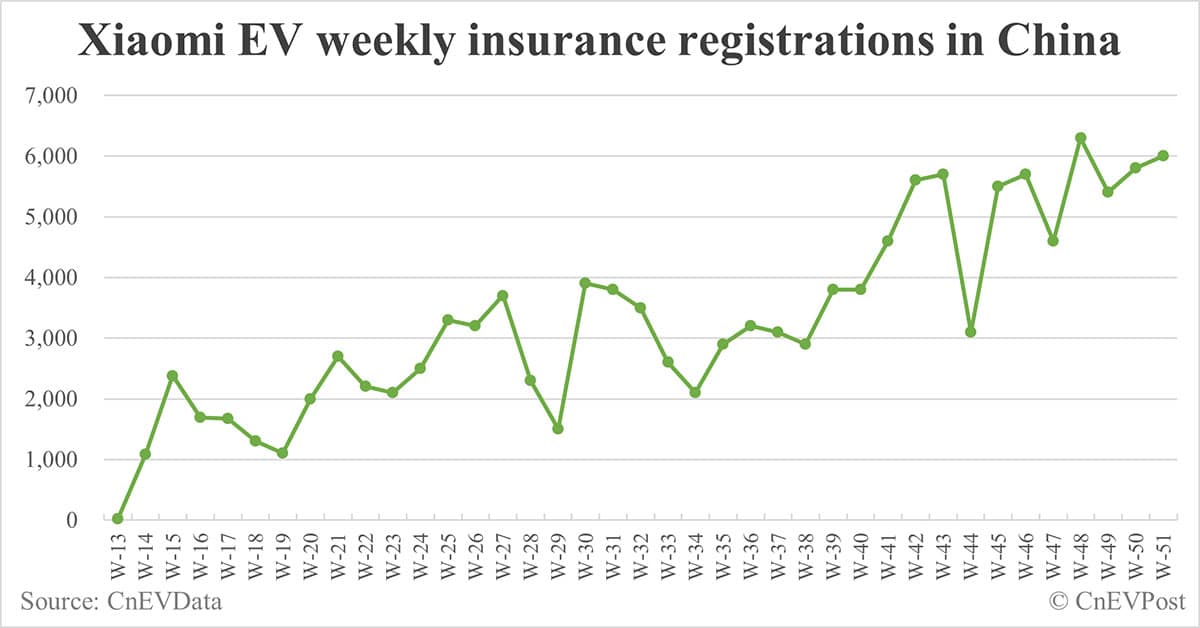

Xiaomi (HKG: 1810, OTCMKTS: XIACY) saw 6,000 insurance registrations last week, up 3.45 percent from 5,800 the week before.

It said on December 1 that Xiaomi SU7 deliveries continued to exceed 20,000 units in November, marking the second consecutive month above the 20,000 mark.

Xiaomi EV is confident of reaching its new delivery target of over 130,000 units for the year, it said.

Xiaomi announced on December 9 that its second EV model had been named Xiaomi YU7 and the SUV (sport utility vehicle) was expected to go on sale in June or July next year.

Yesterday, Xiaomi EV said it entered into a charging network partnership with Nio, Xpeng, and Li Auto.

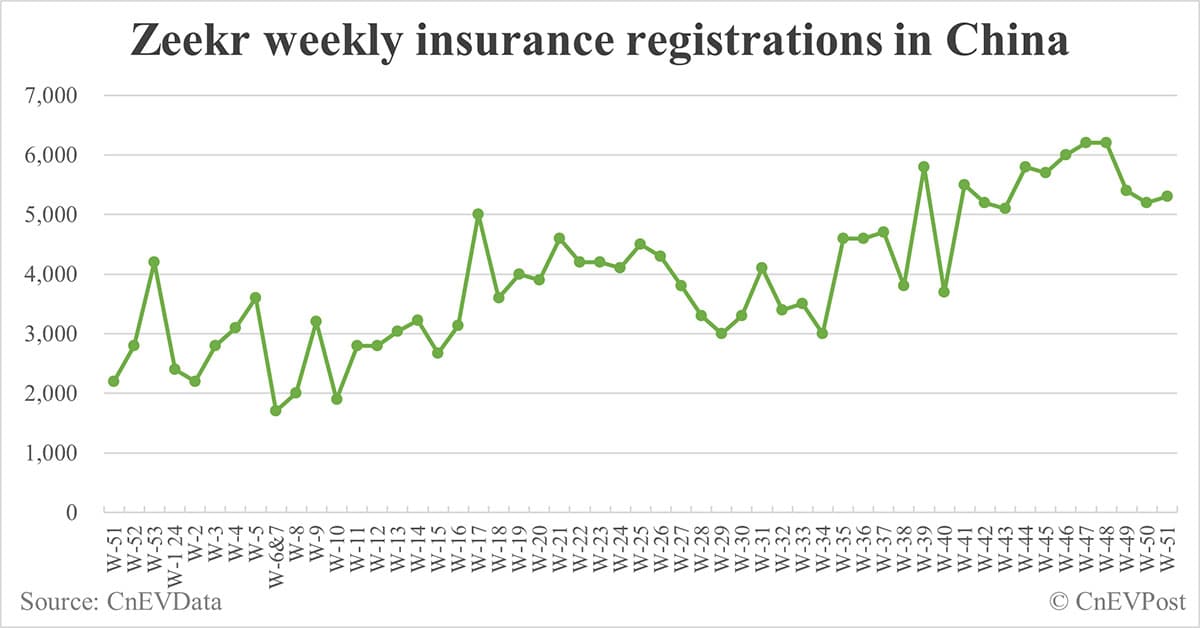

Zeekr (NYSE: ZK) had 5,300 insurance registrations last week, up 1.92 percent from 5,200 the week before.

The company delivered 27,011 vehicles in November, its third consecutive month of record highs. This is up 106.13 percent from 13,104 vehicles in the same period last year and 7.83 percent from 25,049 in October.

In the January-November period, Zeekr delivered 194,933 vehicles, an increase of 85.28 percent year-on-year.

The company is targeting full-year deliveries of 230,000 vehicles in 2024, meaning that December deliveries would need to reach 35,067 vehicles to meet that target.

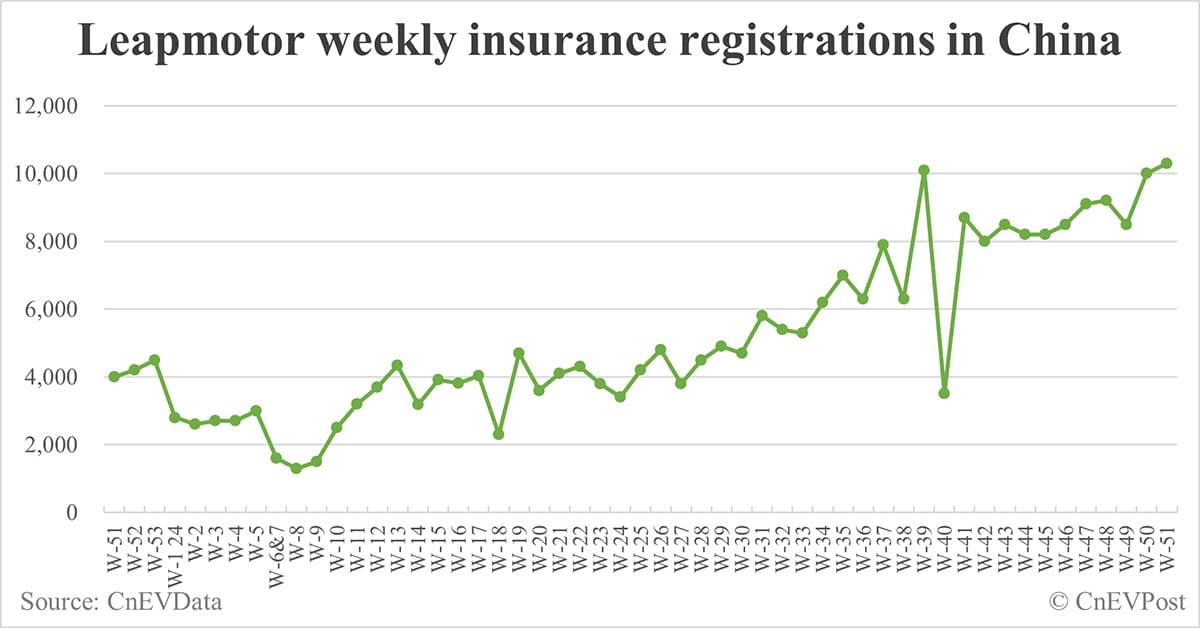

Leapmotor (HKG: 9863) registered 10,300 insurance registrations last week, up 3.00 percent from 10,000 the week before.

It delivered 40,169 vehicles in November, marking the first time monthly deliveries have topped the 40,000 mark and the 6th consecutive month of record highs.

This is an increase of 117.04 percent from 18,508 units in the same period last year and 5.22 percent from 38,177 in October.

From January to November, Leapmotor delivered 251,207 vehicles, up 100.11 percent year-on-year and ahead of its full-year sales target.

In 2025, Leapmotor would challenge its 500,000 annual sales target, the company said on December 1, repeating a previously mentioned goal.

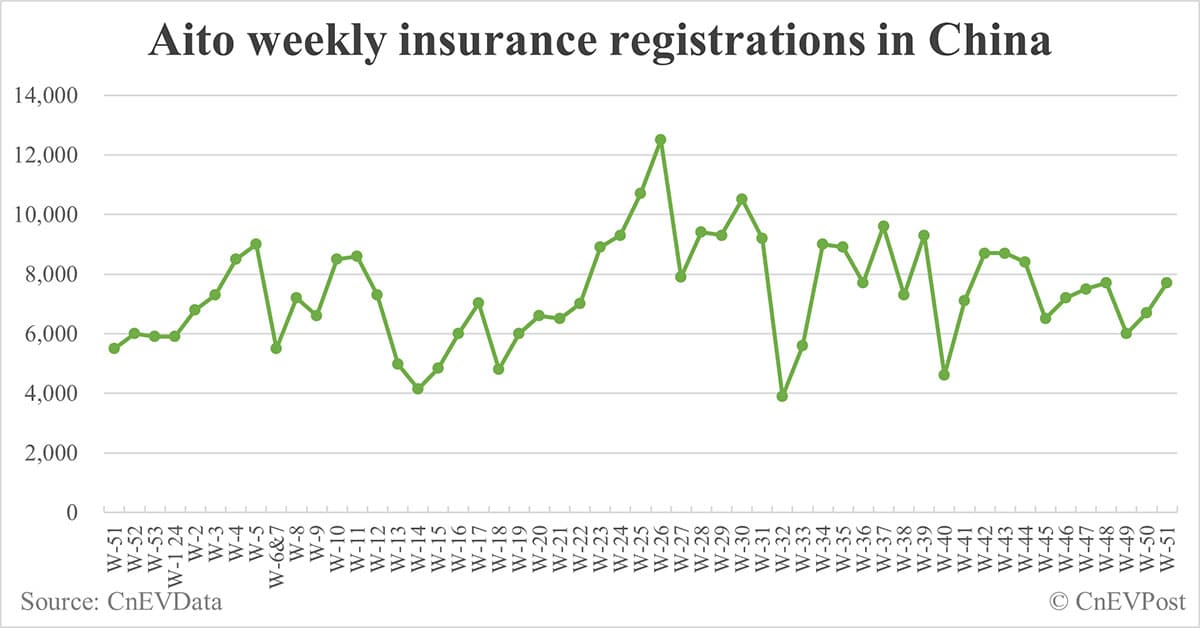

Aito -- a brand jointly created by Huawei and Seres Group -- had 7,700 insurance registrations last week, up 14.93 percent from 6,700 the week before.

($1 = RMB 7.2888)