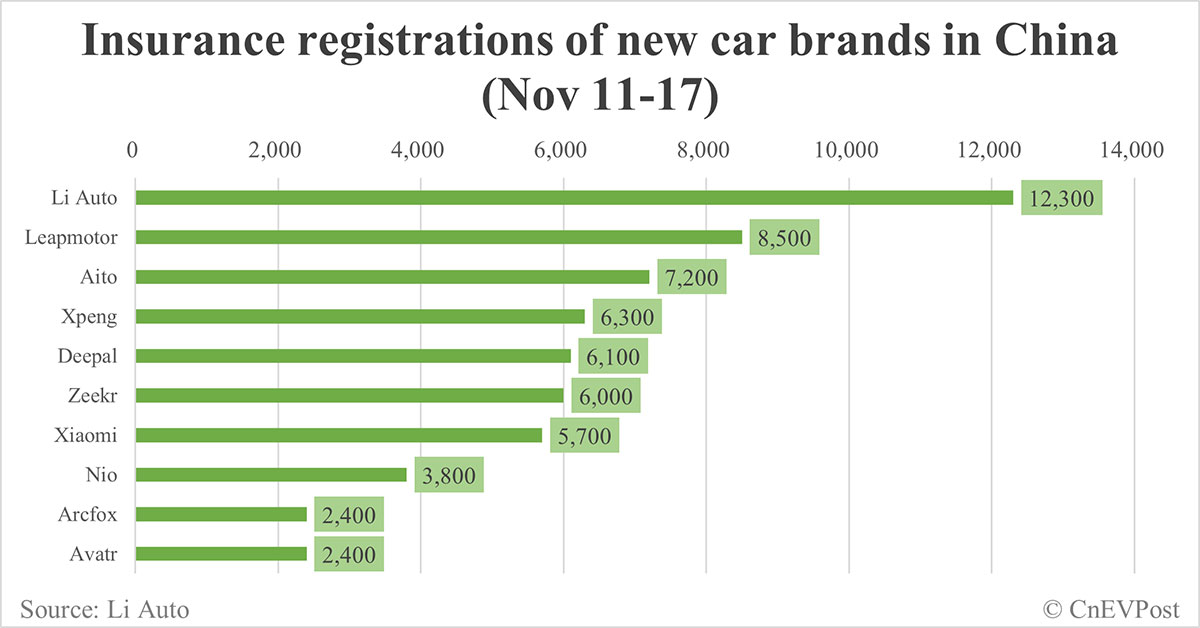

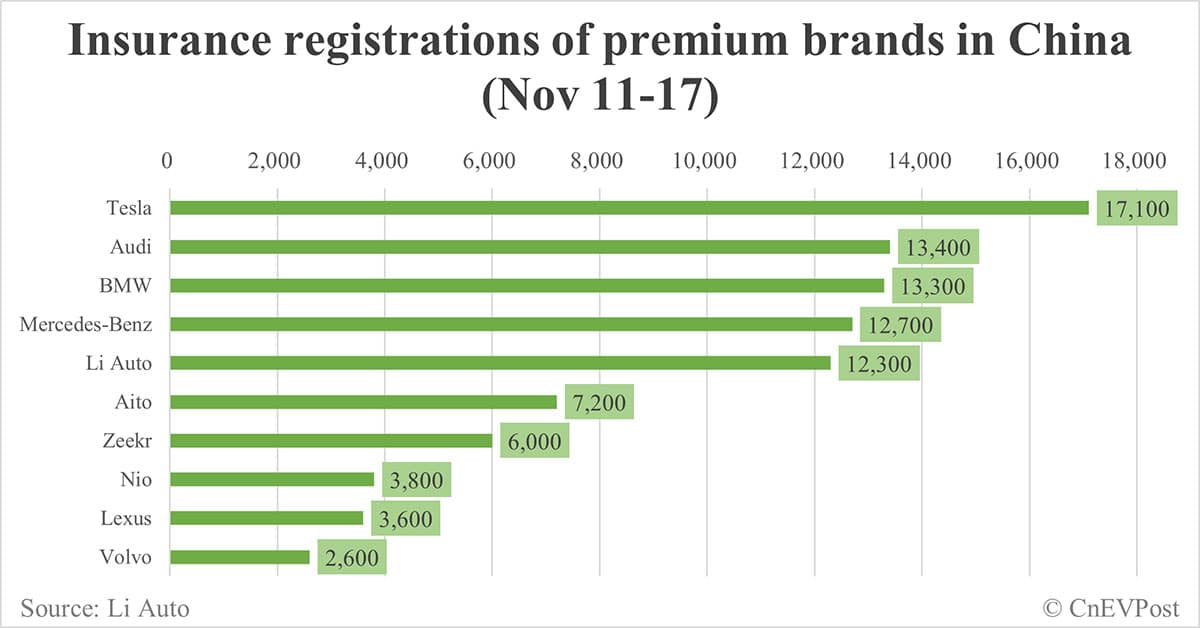

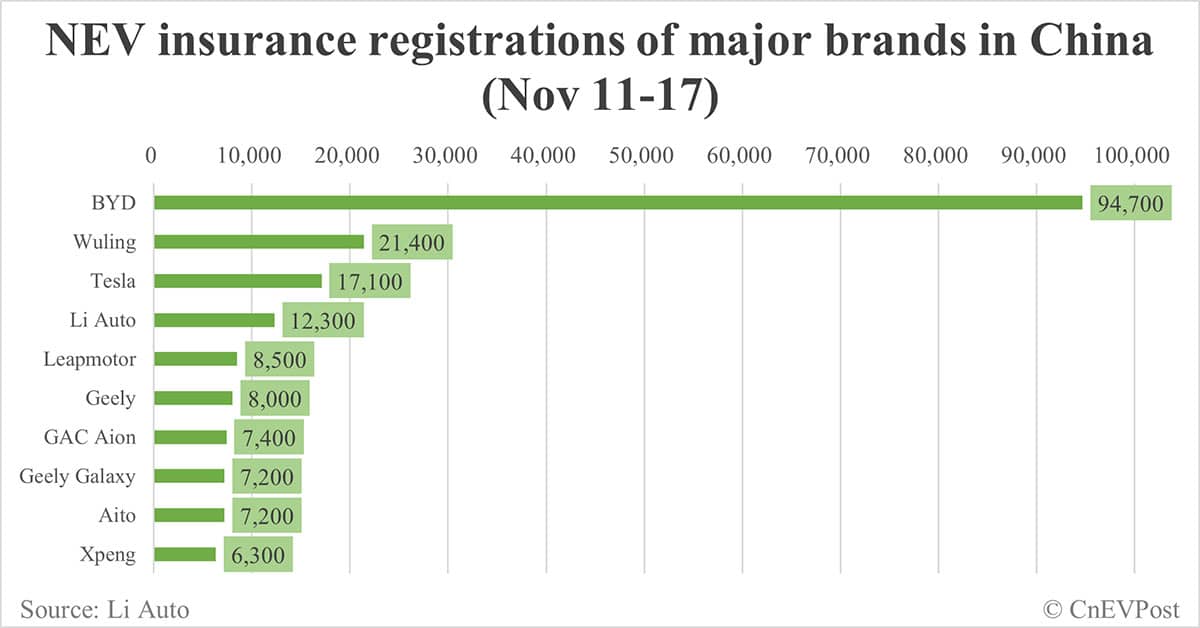

Li Auto had 12,300 insurance registrations last week, Xpeng 6,300, Zeekr 6,000, Leapmotor 8,500 and Aito 7,200.

Major electric vehicle (EV) makers mostly saw insurance registrations in China rise last week, as opposed to weakness earlier in the month.

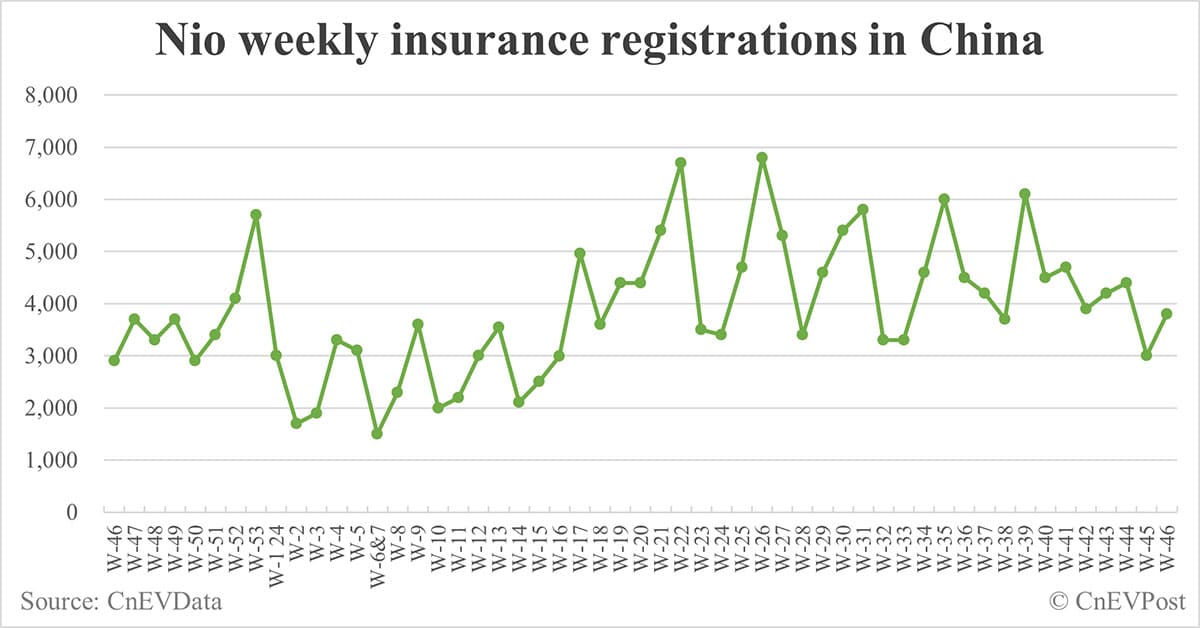

For the week of November 11-17, Nio (NYSE: NIO) branded vehicles saw insurance registrations of 3,800 units in China, up 26.67 percent from 3,000 in the previous week, according to data shared today by Li Auto (NASDAQ: LI).

Li Auto stopped sharing weekly insurance registration numbers earlier this year, after doing so for about 1 year. In early May, it resumed sharing those numbers in the form of weekly rankings.

The figures Li Auto shares are by brand, and in Nio's case do not include sales of sub-brand Onvo.

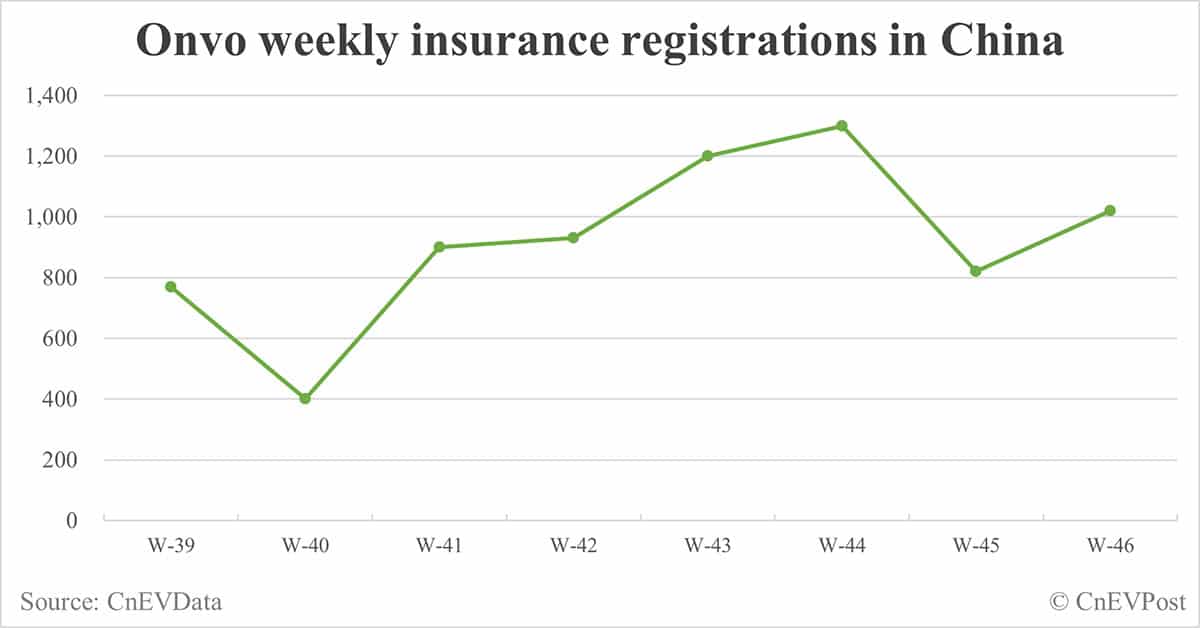

Onvo failed to make the list shared by Li Auto as before, though according to figures shared by several car bloggers on Weibo, the Nio sub-brand had around 1,020 insurance registrations last week, up 24.39 percent from 820 the week before.

Onvo launched its first model, the L60, on September 19 and deliveries began on September 28.

Nio Inc delivered 20,976 vehicles in October, up 30.50 percent from 16,074 a year ago while down 0.97 percent from 21,181 in September.

Nio's main brand delivered 16,657 vehicles in October, up 3.63 percent from 16,074 a year ago but down 18.14 percent from 20,349 in September. Onvo delivered 4,319 vehicles in October, up 419.11 percent from 832 in September.

Nio will report its unaudited financial results for the third quarter of 2024 on Wednesday, November 20, before the US markets open.

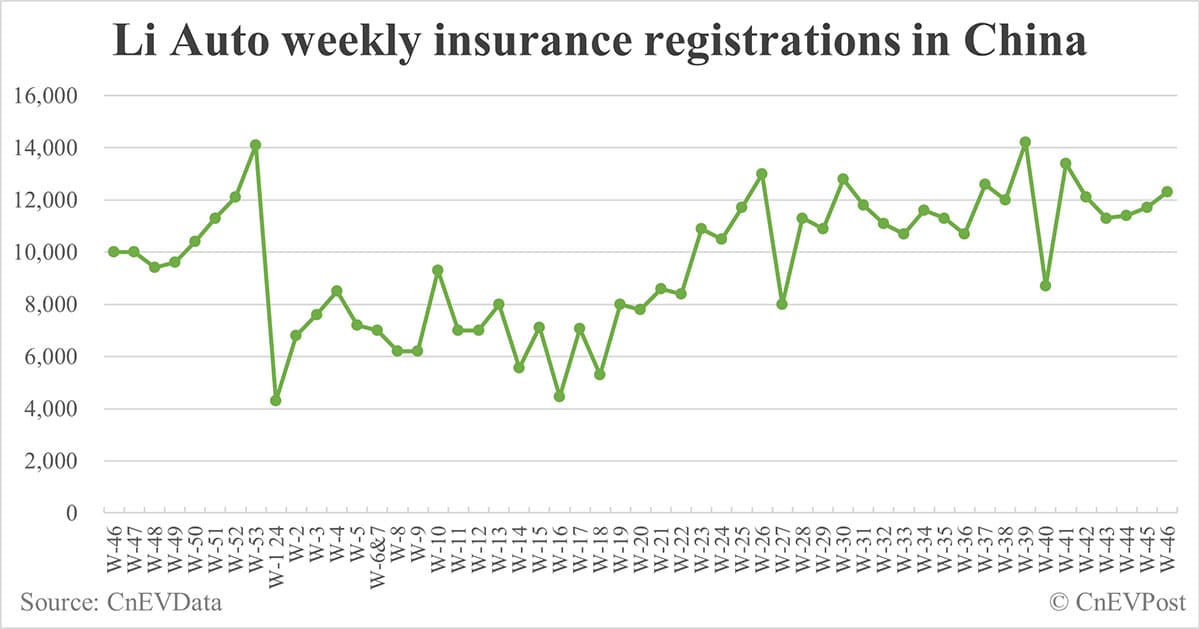

Li Auto had 12,300 insurance registrations last week, up 5.13 percent from 11,700 the previous week, according to figures shared by the company.

The automaker delivered 51,443 vehicles in October, up 27.26 percent year-on-year but down 4.22 percent from September.

Li Auto on October 31 guided fourth-quarter vehicle deliveries to be between 160,000 and 170,000 vehicles, implying a year-on-year increase of 21.4 percent to 29.0 percent, just slightly higher than the 152,831 vehicles delivered in the third quarter.

The guidance implies that Li Auto's monthly deliveries for the last two months of the year will likely be at just over 50,000 units.

Li Auto's deliveries for the full year 2024 will be in the range of 501,812 to 511,812 units, as per the guidance.

In the January-October period, Li Auto delivered 393,255 vehicles, up 38.16 percent year-on-year.

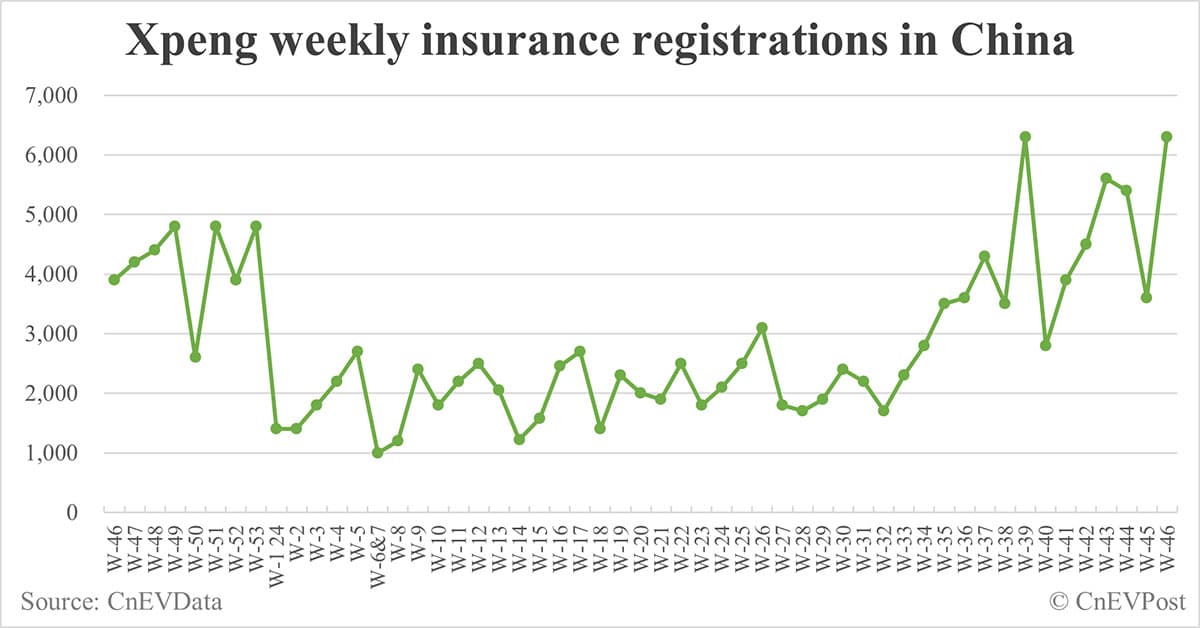

Xpeng (NYSE: XPEV) had 6,300 insurance registrations last week, up 75.00 percent from 3,600 the week before and on par with its record high for the week ending September 29.

It delivered 23,917 vehicles in October, up 19.57 percent from 20,002 a year ago and up 12.01 percent from 21,352 in September.

In the January-October period, Xpeng delivered 122,478 vehicles, up 20.73 percent year-on-year.

The company launched the P7+ on November 7, and the new electric sedan received 31,528 orders three hours after its launch.

On November 11, Xpeng said it began volume deliveries of the P7+ in China.

Xpeng will report its unaudited financial results for the third quarter of 2024 later today -- Tuesday, November 19 -- before the US markets open.

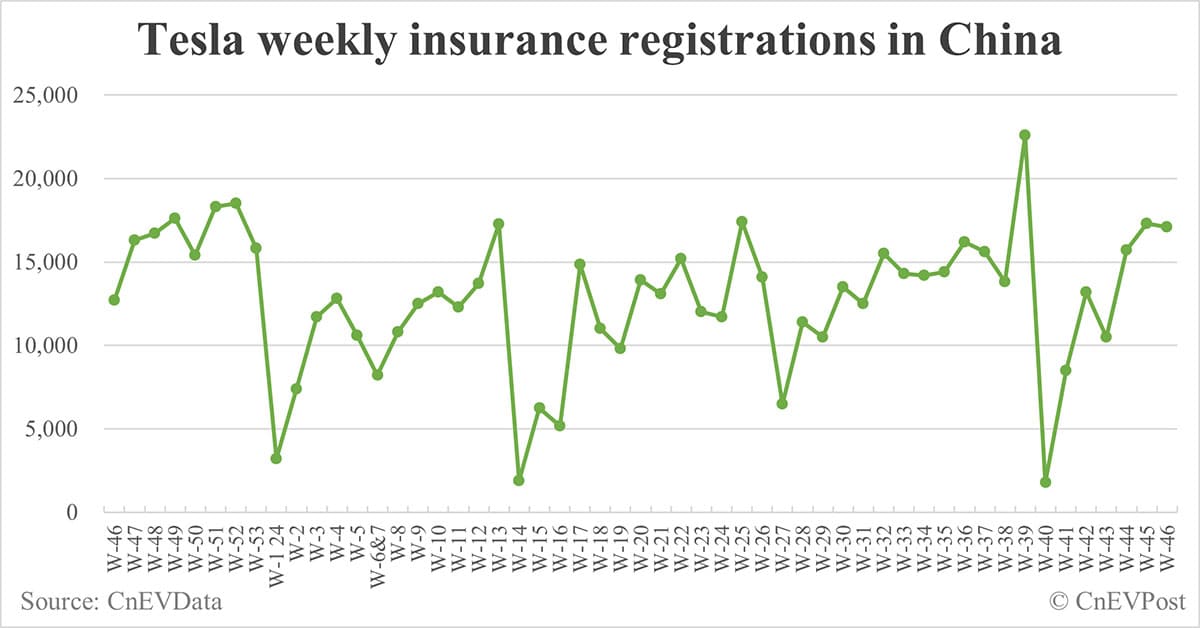

Tesla (NASDAQ: TSLA) had 17,100 insurance registrations in China last week, down 1.16 percent from 17,300 the week before.

Tesla has a factory in Shanghai that produces the Model 3 sedan and Model Y crossover, both for deliveries to local customers and as an export hub for it.

Earlier today, the Model 3 wait time in China was shortened to 1-3 weeks from the previous 2-4 weeks, and the Model Y remained unchanged at 1-3 weeks.

Tesla China sold 68,280 vehicles in October, including 27,795 for export, according to the China Passenger Car Association (CPCA).

The US electric vehicle (EV) maker sold 40,485 vehicles in China in October, its lowest since April.

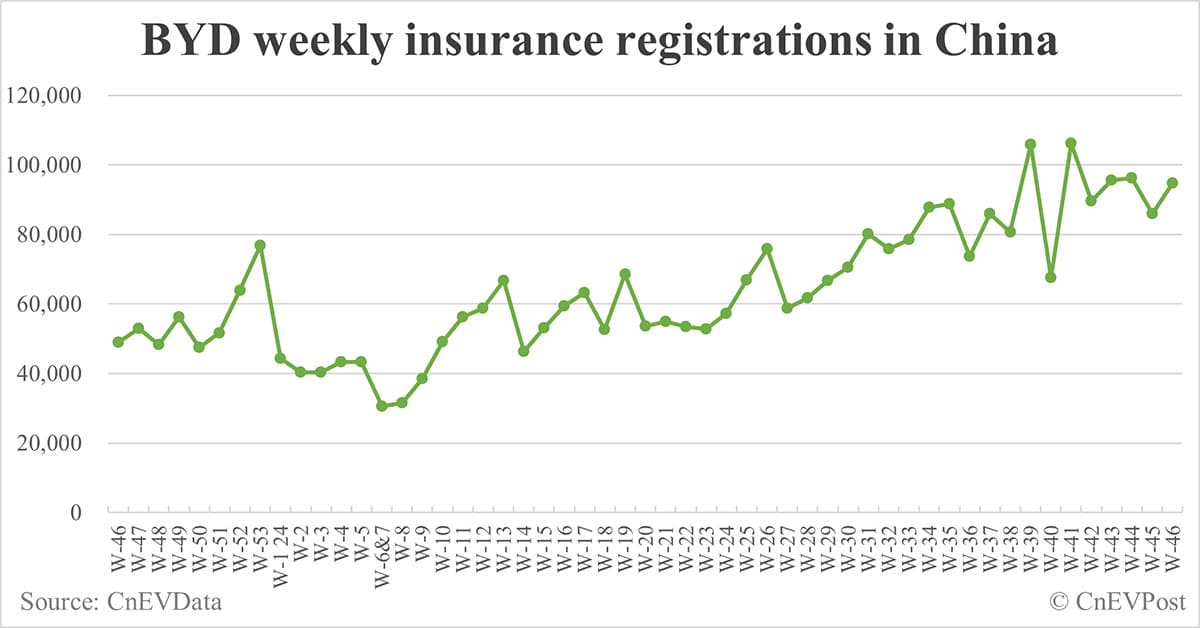

BYD (HKG: 1211, OTCMKTS: BYDDY) had 94,700 insurance registrations last week, up 10.24 percent from 85,900 the week before.

It sold 502,657 new energy vehicles (NEVs) in October, surpassing the 500,000 mark for the first time and marking the fifth consecutive month of record highs.

This is up 66.53 percent from 301,833 in the same period last year and up 19.84 percent from 419,426 in September.

In the January-October period, BYD sold 3,250,532 NEVs, up 36.49 percent year-on-year.

BYD announced yesterday that its 10 millionth NEV rolled off the assembly line, a Z9 sedan officially launched by sub-brand Denza on November 15, the first day of the Guangzhou auto show.

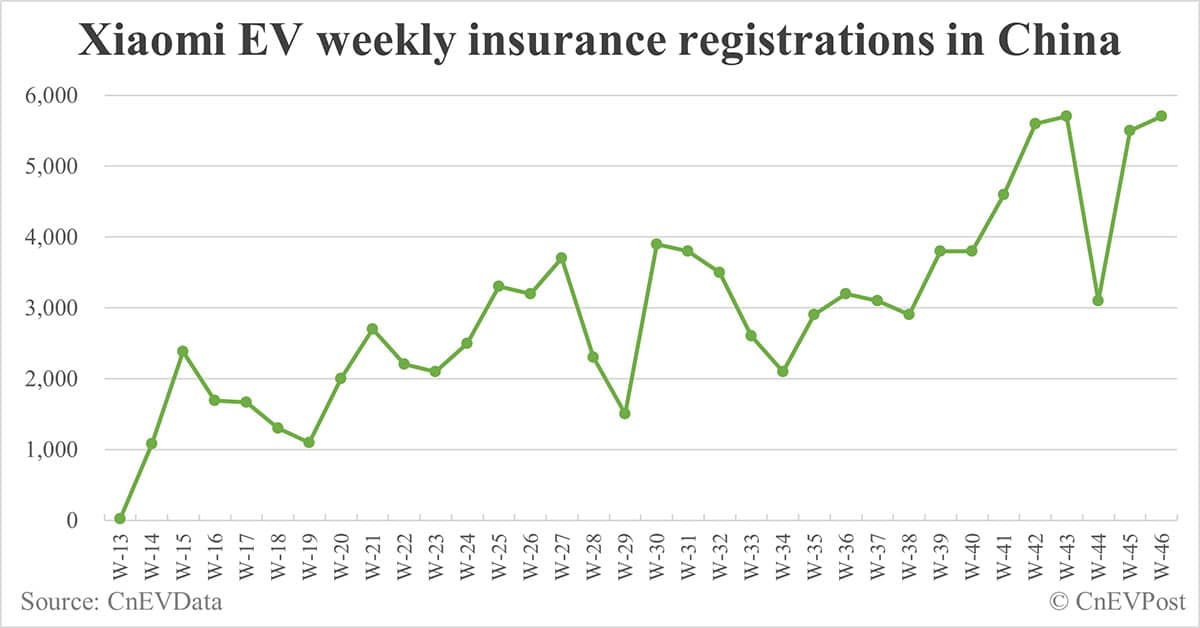

Xiaomi (HKG: 1810, OTCMKTS: XIACY) had insurance registrations of 5,700 units last week, up 3.64 percent from 5,500 the week before and matching its all-time high for the week ended October 27.

Xiaomi said yesterday it had delivered more than 100,000 units of its sole model, the SU7, and announced a new 2024 target of 130,000 units.

In the third quarter, Xiaomi generated revenue of RMB 9.5 billion ($1.3 billion) from its EV business, up 52.1 percent from RMB 6.2 billion in the second quarter.

It delivered 39,790 SU7 series EVs in the third quarter.

Xiaomi announced on October 29 that the SU7 Ultra with powerful performance began pre-sales in China at a price of RMB 814,900 yuan.

The official launch of the SU7 Ultra -- priced at nearly four times the regular SU7's RMB 215,900 starting price -- will take place in March 2025, the company said.

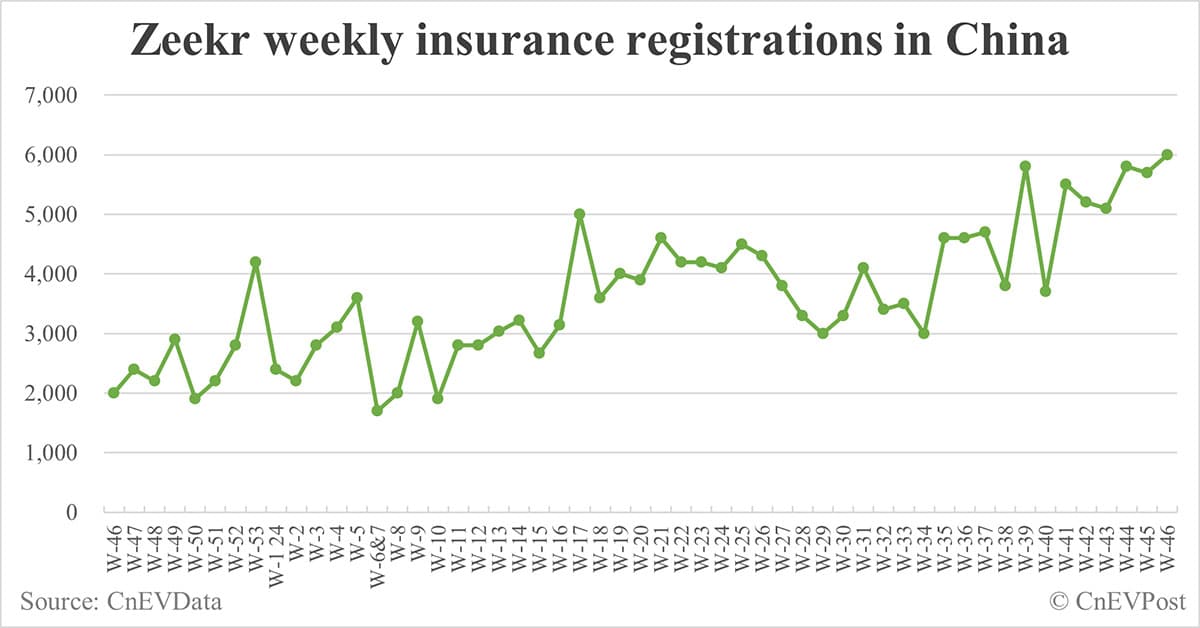

Zeekr (NYSE: ZK) had 6,000 insurance registrations last week, up 5.26 percent from 5,700 the previous week.

It delivered a record high of 25,049 vehicles in October, surpassing September's previous record of 21,333 vehicles. This is a 91.55 percent increase year-on-year and a 17.42 percent increase from September.

In the January-October period, Zeekr delivered 167,922 vehicles, up 82.32 percent year-on-year.

The company is targeting to deliver around 230,000 vehicles for the whole of this year. This means that to accomplish its goal, it needs to deliver an average of about 31,000 vehicles per month in the remaining two months.

Zeekr announced a series of deals on November 14 that will give it a 51 percent stake in Lynk & Co.

Zeekr saw its net loss narrow significantly in the third quarter, with revenue declining slightly, according to its unaudited financial report released on November 14.

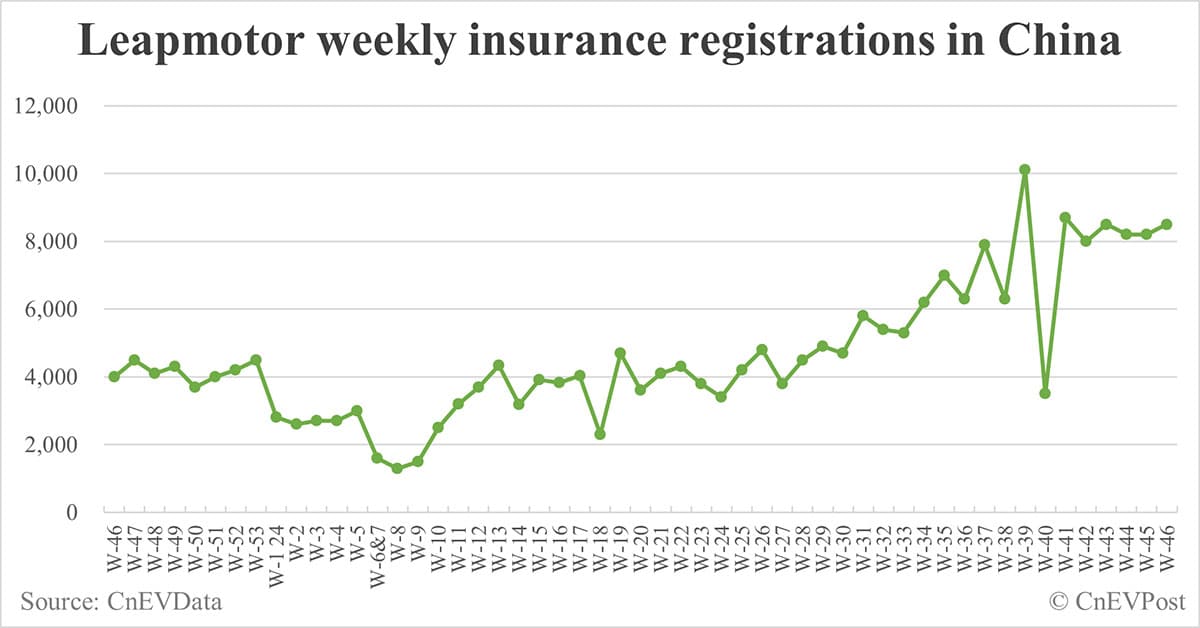

Leapmotor (HKG: 9863) had 8,500 insurance registrations last week, up 3.66 percent from 8,200 the week before.

It delivered 38,177 vehicles in October, up 109.74 percent year-on-year and 13.06 percent from September.

This is the fifth consecutive month of record monthly deliveries for the NEV maker and the third consecutive month of over 30,000 units.

In the January-October period, Leapmotor delivered 211,038 vehicles, an increase of 97.18 percent year-on-year. It is targeting 250,000 deliveries for the full year.

The Stellantis NV (NYSE: STLA) backed Chinese NEV maker showcased the B10 SUV (sport utility vehicle) in China on November 15 on the first day of the 2024 Guangzhou auto show, saying the official launch will be in the first quarter of 2025.

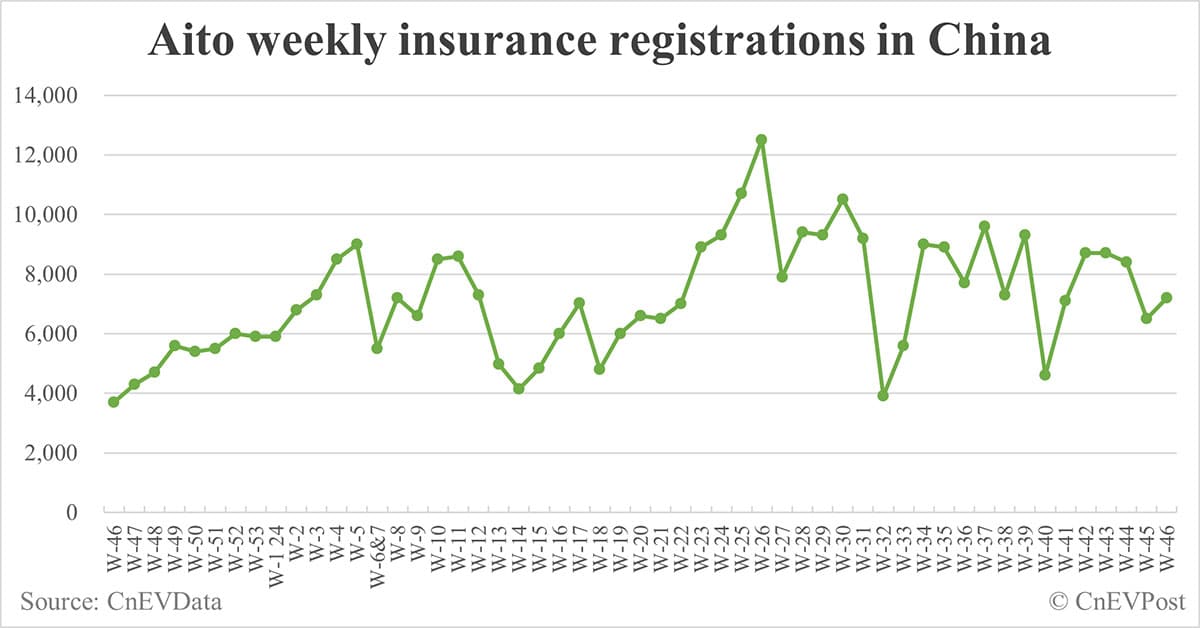

Aito -- a brand jointly created by Huawei and Seres Group -- saw insurance registrations of 7,200 vehicles last week, up 10.77 percent from 6,500 the week before.

($1 = RMB 7.2340)