Li Auto reported record revenue of RMB 42.9 billion in the third quarter, beating analysts' expectations as it delivered a record number of vehicles.

Li Auto (NASDAQ: LI) reported strong third-quarter results, with record vehicle deliveries, but guidance for the fourth quarter appeared to disappoint investors.

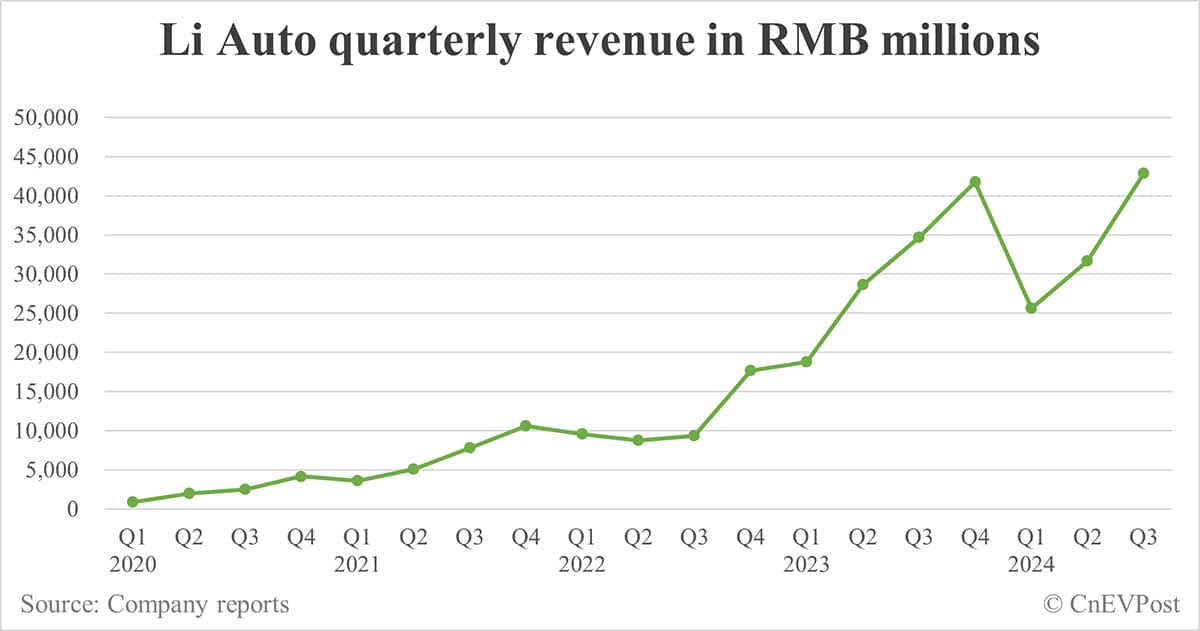

The Chinese automaker posted record revenue of 42.9 billion yuan ($6.1 billion) in the third quarter, beating analysts' estimates of RMB 41.27 billion yuan in a Bloomberg survey and exceeding the upper end of its guidance range of 39.4 billion yuan to 42.2 billion yuan, according to unaudited financial results released today.

This represents a 23.6 percent increase from RMB 34.7 billion in the third quarter of 2023 and a 35.3 percent increase from RMB 31.7 billion in the second quarter of 2024.

Li Auto reported vehicle sales of RMB 41.3 billion in the third quarter, an increase of 22.9 percent from RMB 33.6 billion in the third quarter of 2023 and an increase of 36.3 percent from RMB 30.3 billion in the second quarter of 2024.

The increase in revenue from vehicle sales was primarily attributable to higher vehicle deliveries, partially offset by the lower average selling price mainly due to different product mix, the company said.

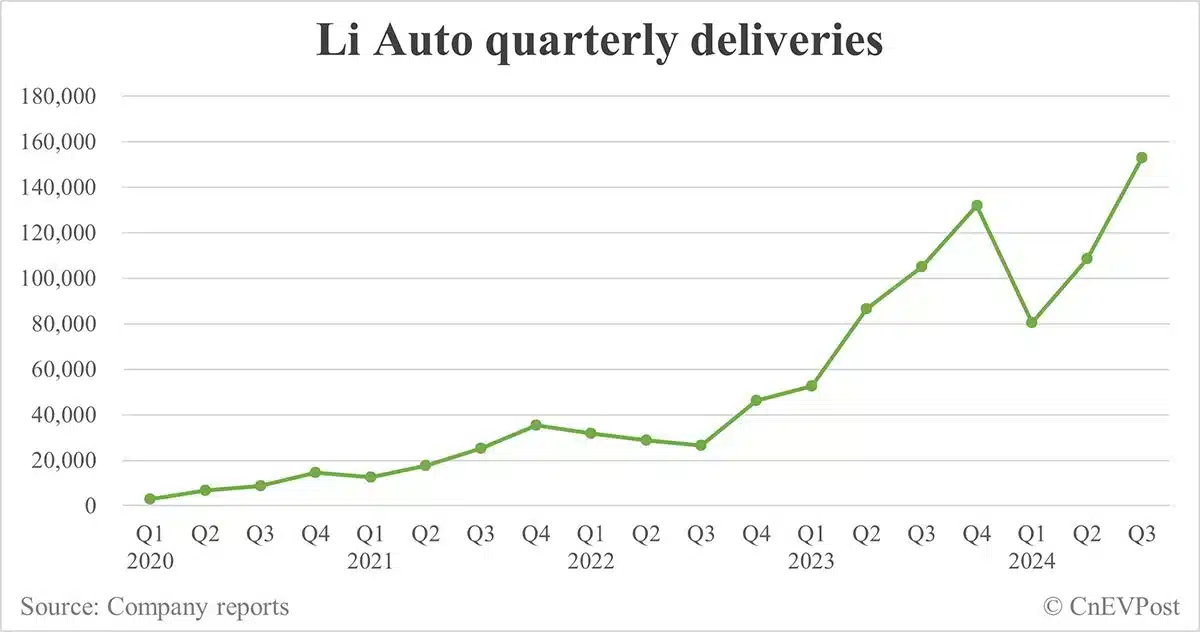

It achieved a record 152,831 deliveries in the third quarter, which was within the guidance range of 145,000 to 155,000 units. Deliveries for the quarter were up 45.4 percent year-on-year and up 40.75 percent from the second quarter.

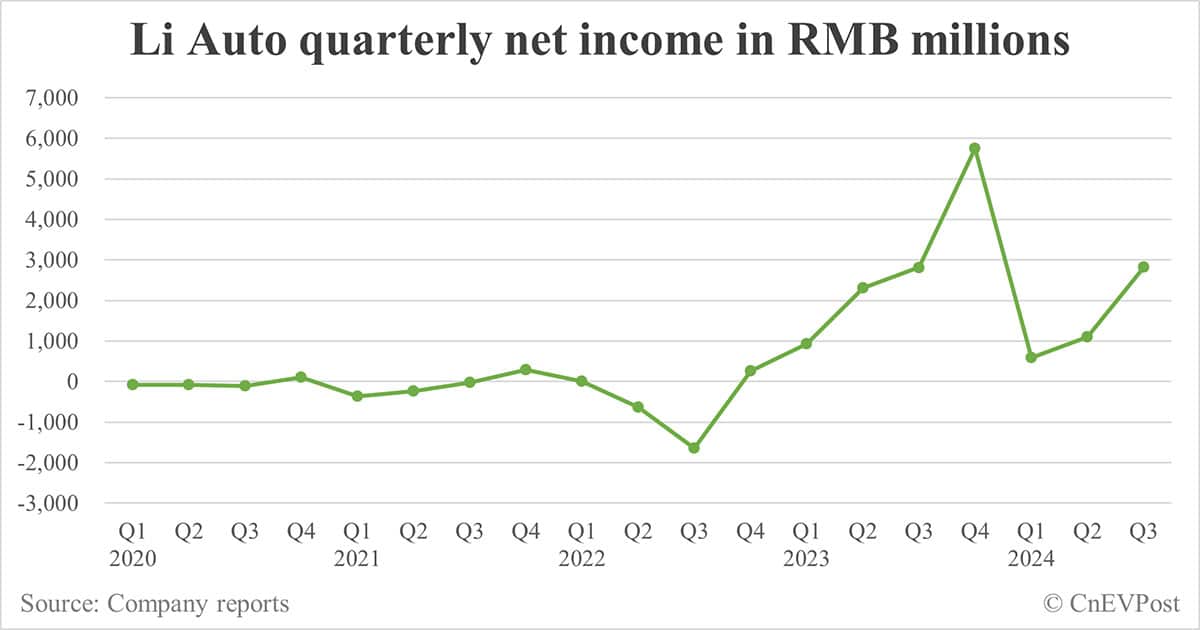

Li Auto's net income for the third quarter was RMB 2.82 billion, higher than analysts' expectations of RMB 2.38 billion. This represents an increase of 0.3 percent from RMB 2.8 billion in the third quarter of 2023 and an increase of 156.2 percent from RMB 1.1 billion in the second quarter of 2024.

Non-GAAP net income for the third quarter was RMB 3.9 billion, an increase of 11.1 percent from RMB 3.5 billion in the third quarter of 2023 and an increase of 156.2 percent from RMB 1.5 billion in the second quarter of 2024.

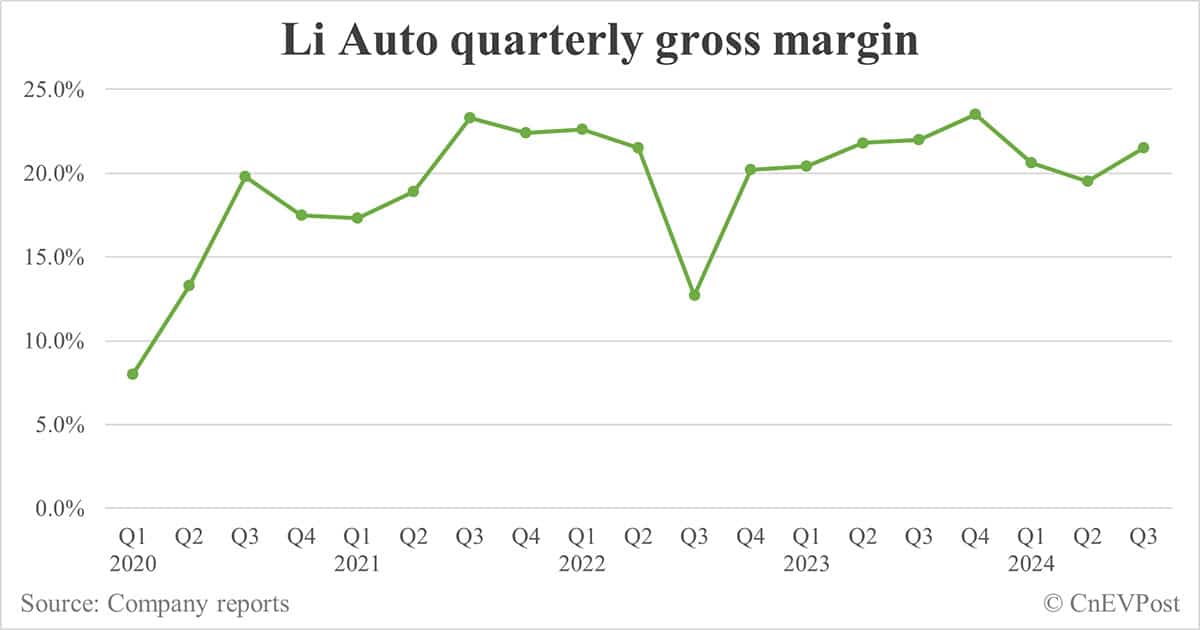

The company's gross margin was 21.5 percent in the third quarter, compared to 22.0 percent in the third quarter of 2023 and 19.5 percent in the second quarter of 2024.

The increase in gross margin from the second quarter was primarily due to an increase in vehicle margin, it said.

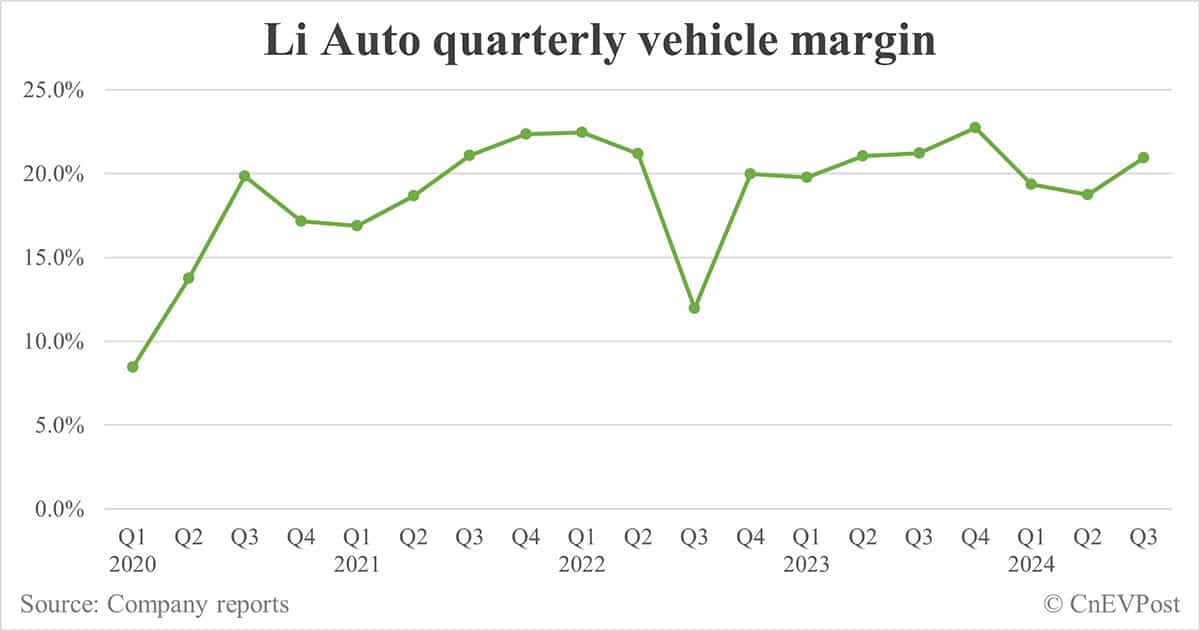

Vehicle margin was 20.9 percent in the third quarter, compared to 21.2 percent in the third quarter of 2023 and 18.7 percent in the second quarter of 2024.

The increase in vehicle margin from the second quarter was primarily due to lower costs, partially offset by lower average selling prices primarily due to a different product mix.

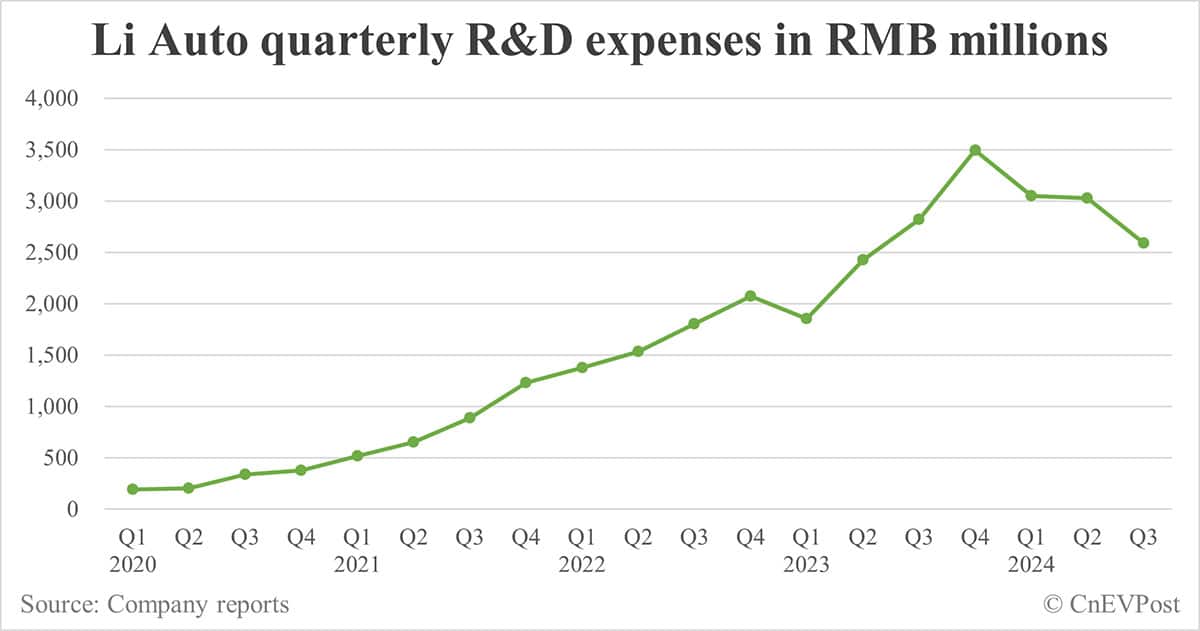

R&D expenses were RMB 2.6 billion in the third quarter, a decrease of 8.2 percent from RMB 2.8 billion in the third quarter of 2023 and a decrease of 14.6 percent from RMB 3.0 billion in the second quarter of 2024.

The decrease in R&D expenses was mainly attributable to lower design and development costs for new products and technologies, as well as lower employee compensation, Li Auto said.

Li Auto's cash position was RMB 106.5 billion as of September 30, up from RMB 97.3 billion at the end of the second quarter.

Li Auto guided fourth-quarter vehicle deliveries to be in the range of 160,000 to 170,000 units, implying year-on-year growth of 21.4 percent to 29.0 percent, just slightly higher than the 152,831 vehicles delivered in the third quarter.

It guided fourth-quarter revenue to be in the range of 43.2 billion yuan to 45.9 billion yuan, up 3.5 percent to 10.0 percent year-on-year.

The guidance implies that Li Auto is expected to deliver between 501,812 and 511,812 vehicles for the full year 2024.

In February, Li Xiang, founder, chairman and CEO of Li Auto, announced a full-year sales target of 800,000 units on the eve of the launch of the company's first battery electric vehicle (BEV) model, the Li Mega, but the target was lowered shortly thereafter.

On March 21, Li Auto adjusted its full-year sales target to “50-70 percent growth on the basis of 2023 sales,” meaning 560,000-640,000 units, due to weaker-than-expected orders for both the Li Mega and the 2024 L series model, a report in local media outlet LatePost said.

In June, Li Auto further lowered its full-year sales target for 2024 to around 480,000 units, implying a year-on-year growth of 27.6 percent, LatePost said in a June 4 report.

Li Auto fell 5.32 percent to $27.4 in US pre-market trading at press time.