Nio reported better-than-expected revenue in the second quarter, with net loss reduced further and gross margins rebounding to a new high since the end of 2022.

Nio (NYSE: NIO) today reported second-quarter earnings that beat expectations, as vehicle deliveries unexpectedly exceeded the upper end of its guidance range.

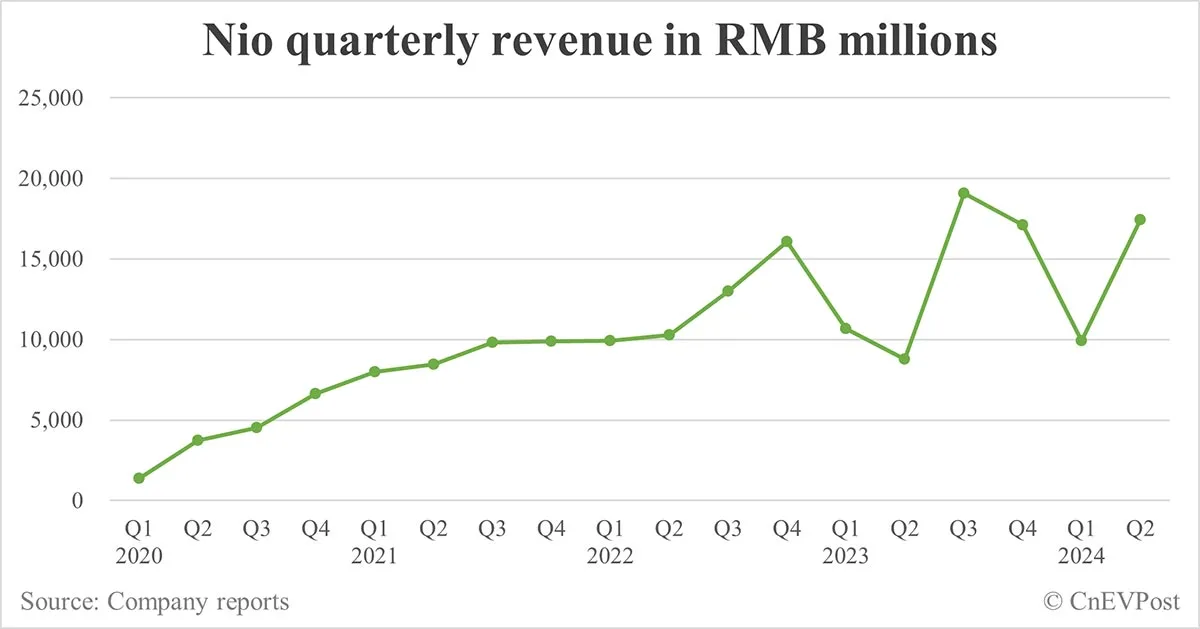

The Chinese electric vehicle (EV) maker posted revenue of RMB 17.446 billion ($2.4 billion) in the second quarter, better than the RMB 17.385 billion that analysts expected in a Bloomberg survey.

That's up 98.89 percent year-on-year and up 76.07 percent from the first quarter, and also exceeded the upper end of the guidance range of RMB 16.59 billion to RMB 17.14 billion.

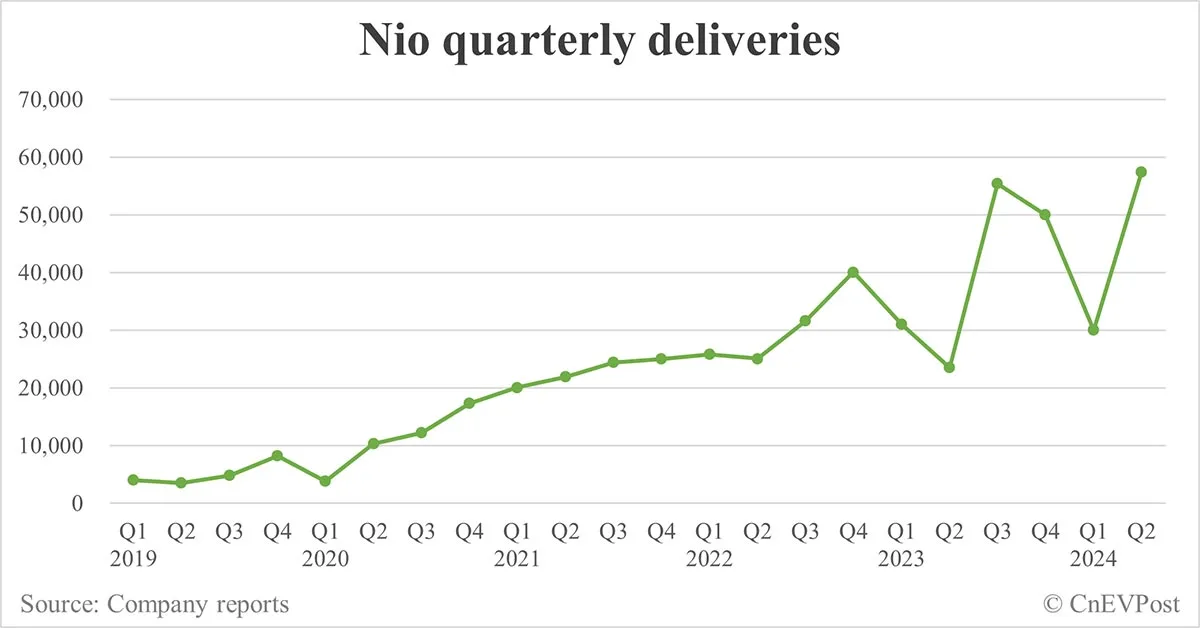

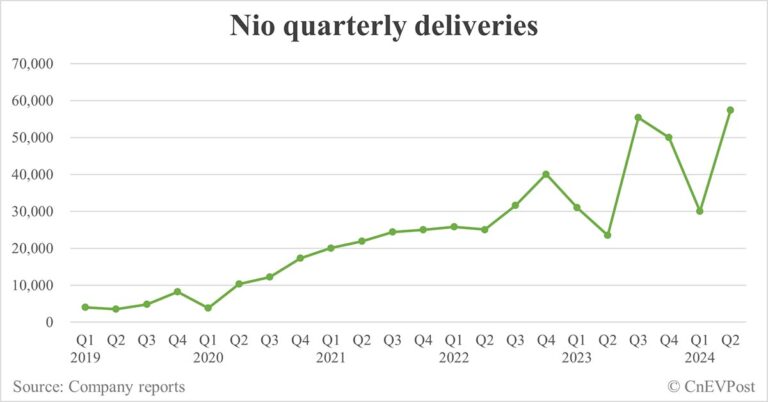

The strong rebound in revenue was largely due to a sharp increase in vehicle deliveries.

Nio delivered a record 57,373 vehicles in the second quarter, exceeding the upper end of its guidance range of between 54,000 and 56,000 vehicles. That's a 143.93 percent increase year-on-year and a 90.91 percent increase from the first quarter.

The company reported revenue of RMB 9.91 billion in the first quarter, missing analysts' expectations of RMB 10.75 billion at the time, mainly due to a decline in deliveries amid a traditionally slow season and price wars.

Nio guided third-quarter vehicle deliveries to be between a record 61,000 and 63,000 units, representing year-on-year growth of about 10 percent to 13.7 percent.

The guidance means it expects September deliveries to be between 20,326 and 22,326 vehicles, considering it delivered 20,498 and 20,176 vehicles in the last two months, respectively.

The company guided third-quarter revenue to be between RMB 19.11 billion ($2.63 billion) and RMB 19.67 billion, representing growth of about 0.2 percent to 3.2 percent.

Nio's vehicle sales revenue in the second quarter were RMB 15.68 billion, an increase of 118.2 percent year-on-year and up 87.1 percent from the first quarter.

The year-on-year increase was mainly due to higher deliveries, partially offset by lower average selling prices due to changes in product mix and user rights adjustments since June 2023, Nio said.

Its cost of sales increased 81.4 percent year-on-year to RMB 15.76 billion in the second quarter, up 67.3 percent from the first quarter.

The year-on-year increase in cost of sales was mainly attributable to an increase in deliveries, partially offset by a decrease in material costs per vehicle, according to the company.

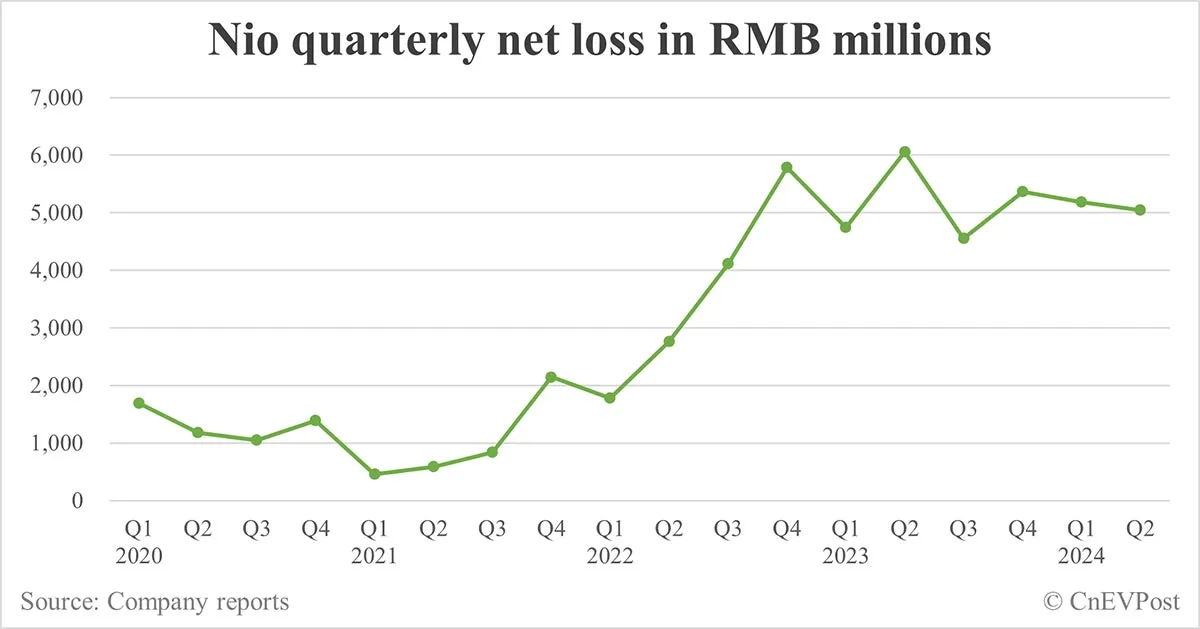

Nio reported a net loss of RMB 5.05 billion in the second quarter, a decrease of 16.7 percent year-on-year and a decrease of 2.7 percent from the first quarter.

Excluding share-based compensation expenses, adjusted net loss for the second quarter was RMB 4.54 billion, below analysts' expectations of RMB 4.9 billion. That was down 16.7 percent year-on-year and 7.5 percent from the first quarter.

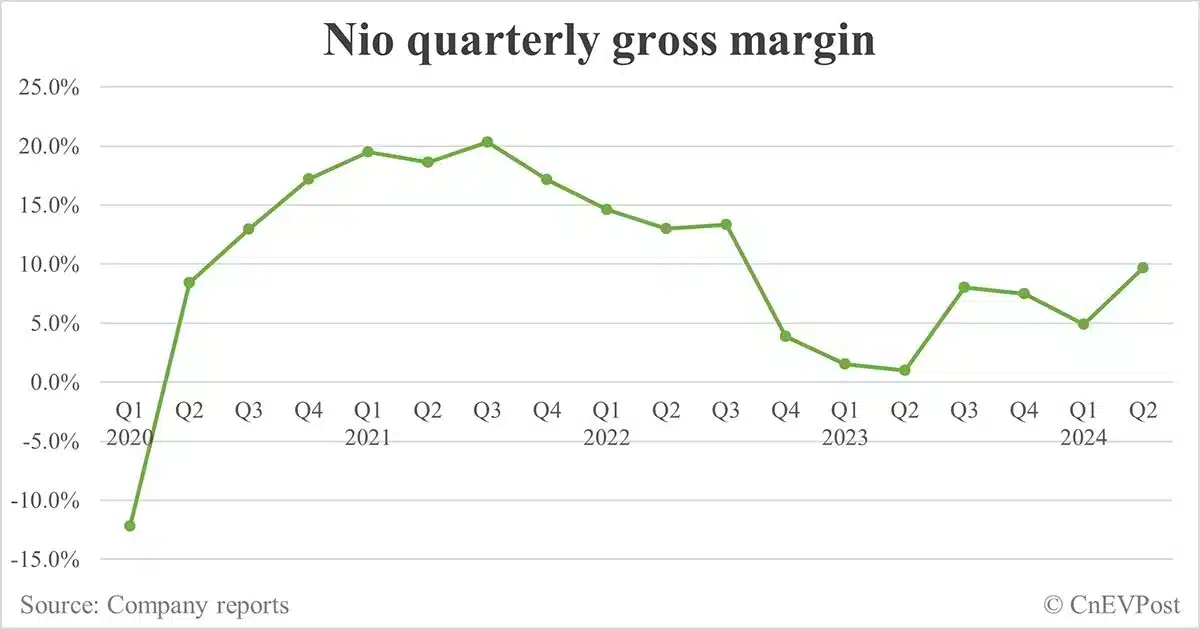

It posted a gross margin of 9.7 percent in the second quarter, above analysts' expectations of 8.736 percent and a new high since the third quarter of 2022. The figure was 1.0 percent in the second quarter of 2023 and 4.9 percent in the first quarter of 2024.

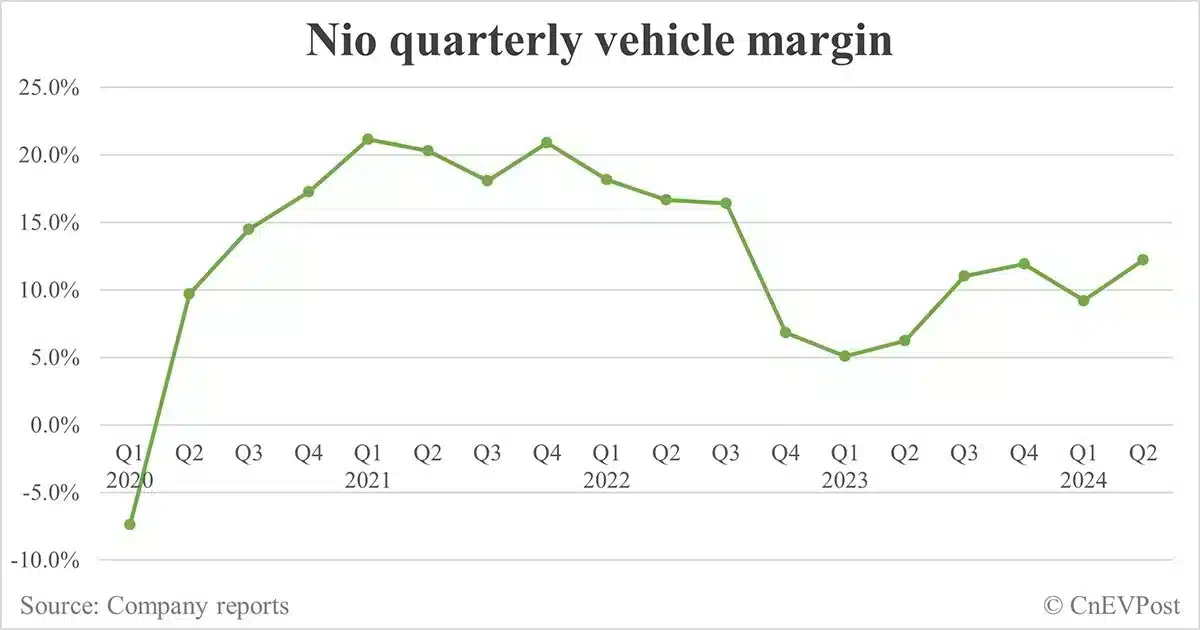

Vehicle margin was 12.2 percent in the second quarter, compared to 6.2 percent in the second quarter of 2023 and 9.2 percent in the first quarter of 2024.

The increase in vehicle margin was primarily attributable to lower unit material costs, partially offset by lower average selling prices due to user rights adjustments since June 2023, the company said in its earnings report.

Due to ongoing cost optimizations, Nio's vehicle margin rose to 12.2 percent in the second quarter, its CFO Stanley Qu said, adding that the company will continue to adopt flexible market strategies and optimize product portfolio.

“We are confident that these efforts will result in steady improvements in gross profit and cost efficiency in the future,” he said.

Qu started as Nio's new CFO on July 5, replacing former CFO Steven Feng.

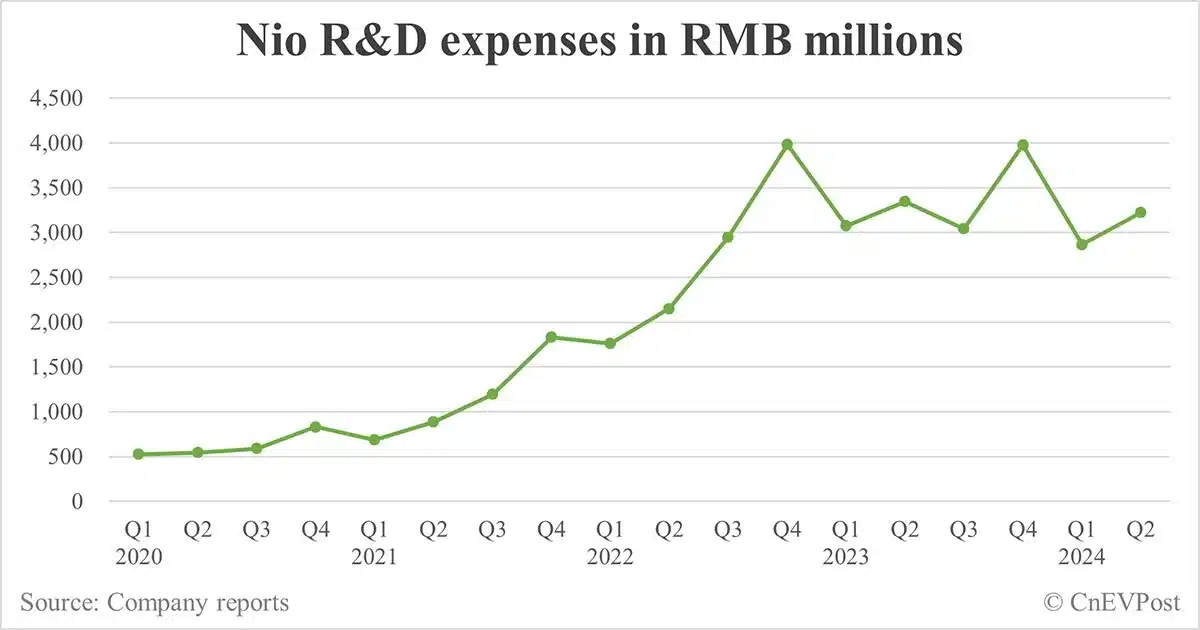

Nio reported R&D expenses of RMB 3.22 billion in the second quarter, a decrease of 3.8 percent year-on-year, but an increase of 12.4 percent from the first quarter.

Excluding equity incentive expenses, non-GAAP R&D expenses were RMB 2.89 billion, a decrease of 1.9 percent year-on-year, but an increase of 8.7 percent from the first quarter.

The sequential increase in R&D expenses was primarily due to higher design and development costs for new products and technologies and higher personnel costs for R&D functions, according to the company.

As of June 30, Nio's balance of cash and cash equivalents, restricted cash, short-term investments and long-term time deposits was RMB 41.6 billion.