Li Auto reported second quarter results that were generally in line with expectations, with net income up 86.24 percent from the first quarter while gross margin slipping to 19.5 percent.

Li Auto (NASDAQ: LI) reported second-quarter earnings performance that was generally in line with expectations after a weak first quarter.

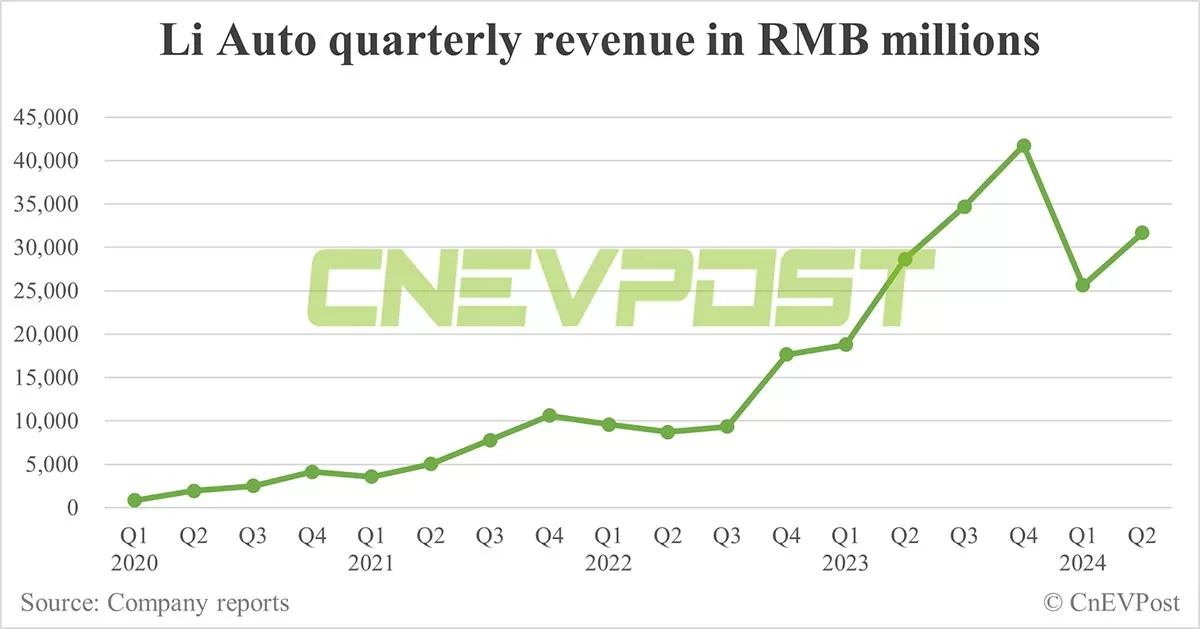

The company had total revenues of RMB 31.7 billion ($4.4 billion) in the second quarter, topping analysts' estimates of RMB 31.4 billion in a Bloomberg survey and exceeding the upper end of the guidance range of RMB 29.9 billion to RMB 31.4 billion, according to unaudited financial results released today.

That's up 10.6 percent from RMB 28.7 billion in the second quarter of 2023 and up 23.6 percent from RMB 25.6 billion in the first quarter of 2024.

Li Auto's vehicle sales were RMB 30.3 billion in the second quarter, an increase of 8.4 percent from RMB 28.0 billion in the second quarter of 2023 and an increase of 25.0 percent from RMB 24.3 billion in the first quarter of 2024.

The increase in revenue from vehicle sales was primarily attributable to higher vehicle deliveries, partially offset by lower average selling prices primarily due to a different product mix, Li Auto said.

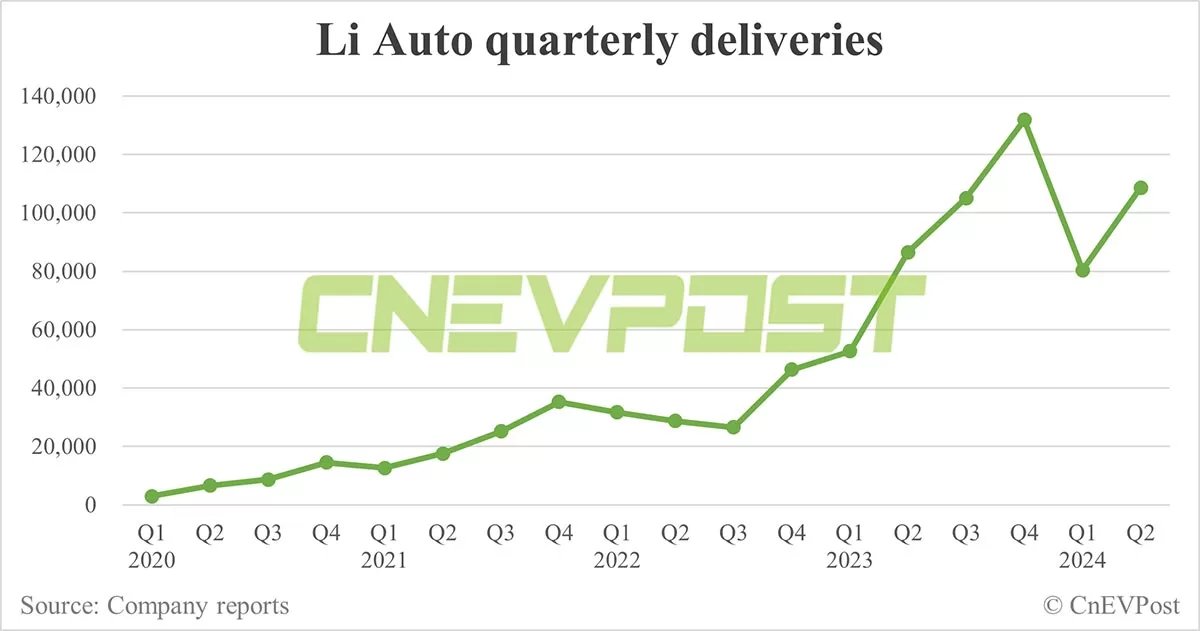

Li Auto delivered 108,581 vehicles in the second quarter, within the guidance range of between 105,000 and 110,000 vehicles, according to previously announced data. Deliveries for the quarter were up 25.48 percent year-on-year and up 35.05 percent from the first quarter.

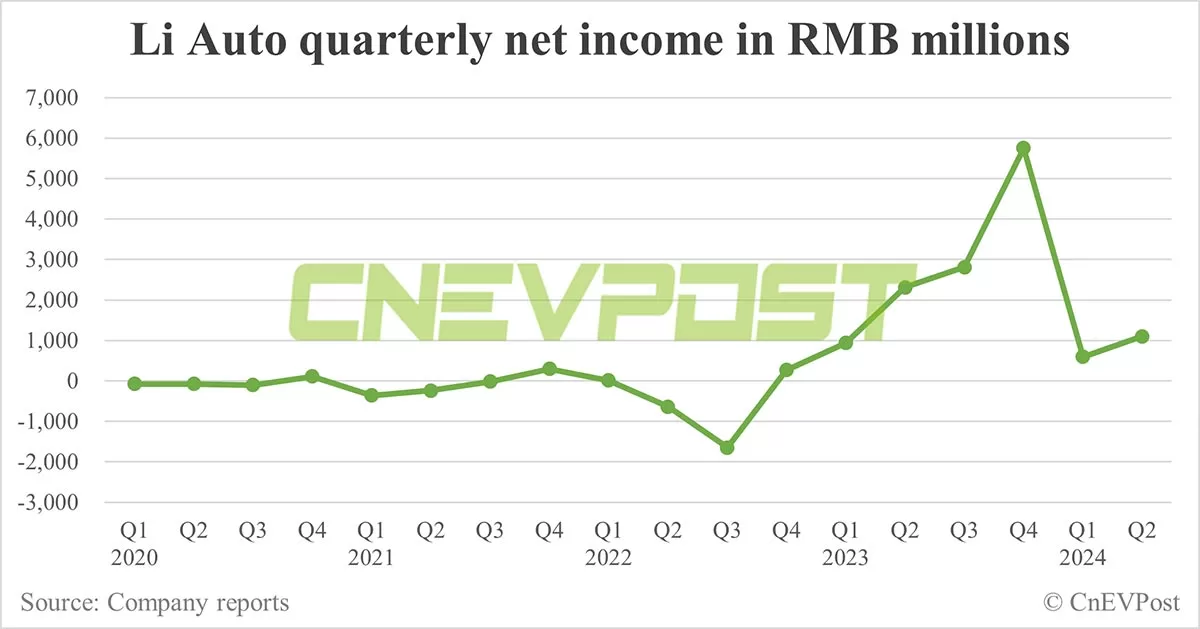

The company's net income for the second quarter was RMB 1.1 billion, a decrease of 52.3 percent from RMB 2.3 billion in the second quarter of 2023 and an increase of 86.2 percent from RMB 591.1 million in the first quarter of 2024.

Non-GAAP net income for the second quarter was RMB 1.5 billion, a decrease of 44.9 percent from RMB 2.7 billion in the second quarter of 2023 and an increase of 17.8 percent from RMB 1.3 billion in the first quarter of 2024.

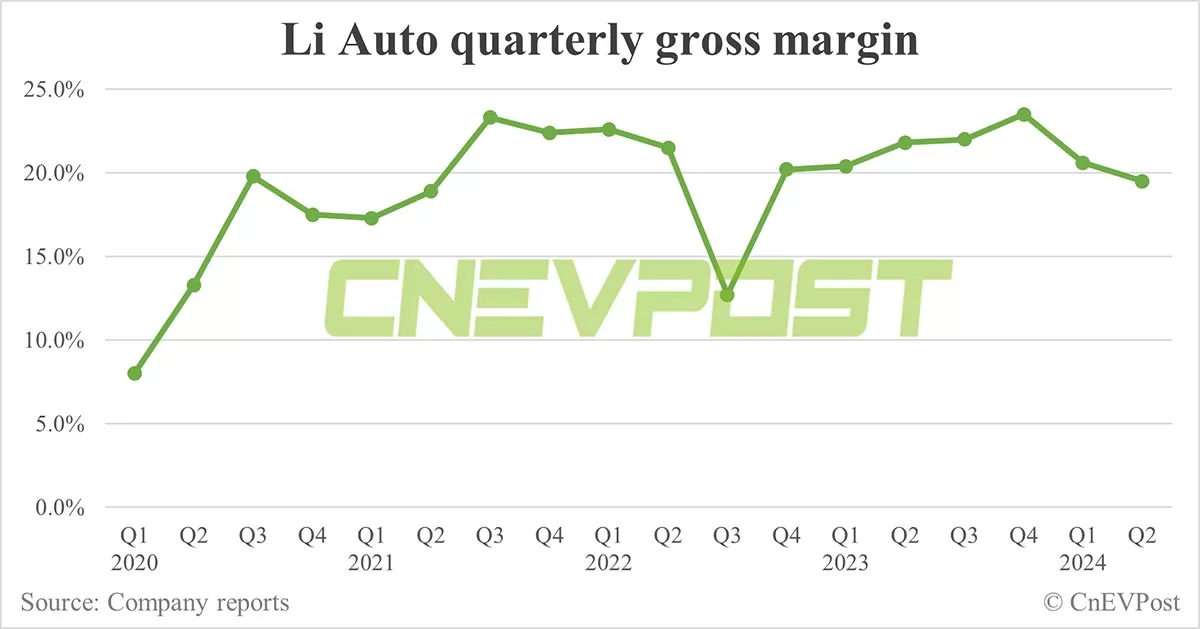

Li Auto's gross margin in the second quarter was 19.5 percent, a further decline from 20.6 percent in the first quarter, but better than analysts' expectations of 19.3 percent. It had a gross margin of 21.8 percent in the second quarter of 2023.

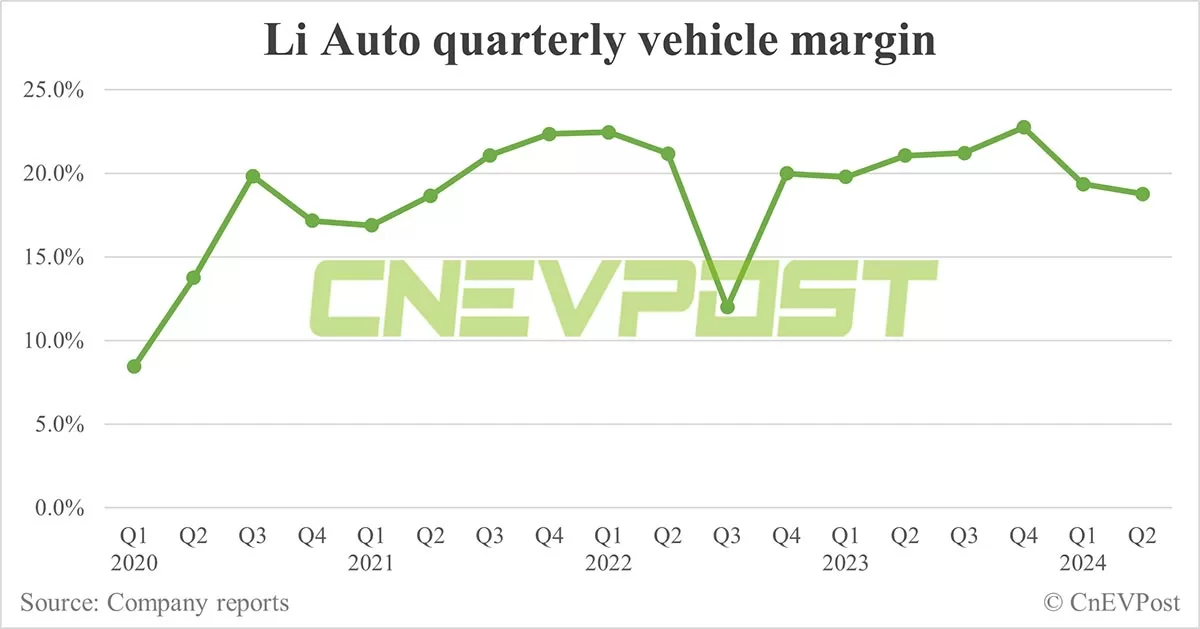

Vehicle margin was 18.7 percent in the second quarter of 2024, compared to 21.0 percent in the second quarter of 2023 and 19.3 percent in the first quarter of 2024.

The year-on-year decrease in vehicle margin was primarily due to different product mix and pricing strategy changes between the two quarters, partially offset by cost reductions. The decrease from the first quarter was primarily due to a different product mix, Li Auto said.

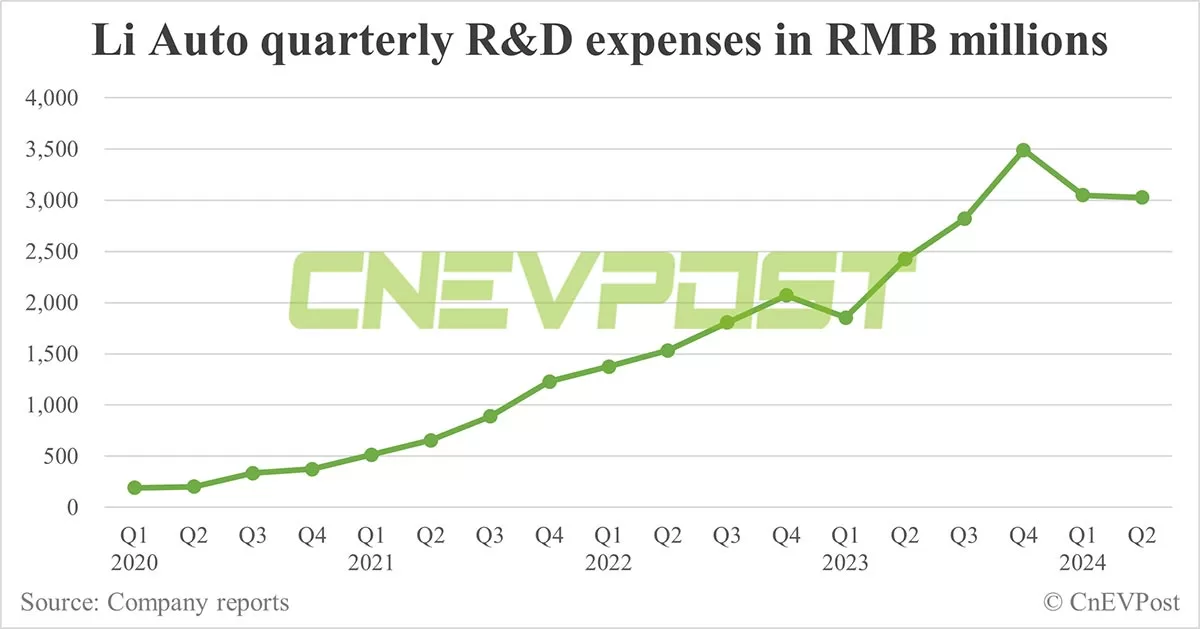

Li Auto's research and development expenses were RMB 3.0 billion in the second quarter, an increase of 24.8 percent from RMB 2.4 billion in the second quarter of 2023 and flat from the first quarter of 2024.

The increase in research and development expenses was primarily due to higher costs to support the expanding product portfolio and technologies, as well as higher employee compensation due to an increase in the number of employees.

As of June 30, Li Auto's cash position was RMB 97.3 billion.

Li Auto guided third quarter vehicle deliveries to be in the range of 145,000 to 155,000 units, representing growth of 38.0 percent to 47.5 percent.

The guidance means Li Auto expected it to deliver a total of 94,000 to 104,000 vehicles in August and September, an average of about 50,000 vehicles per month. The company delivered a record 51,000 vehicles in July.

Li Auto guided third-quarter total revenue to be in the range of RMB 39.4 billion to RMB 42.2 billion, implying year-on-year growth of 13.7 percent to 21.6 percent.