So far this month, Nio had 18,700 insurance registrations, Xpeng 7,800, Li Auto 43,000, Tesla 41,900, Xiaomi 11,400 and BYD 257,900.

Major electric vehicle (EV) makers mostly saw an increase in deliveries last week, as month-end volumes are usually skewed to the upside.

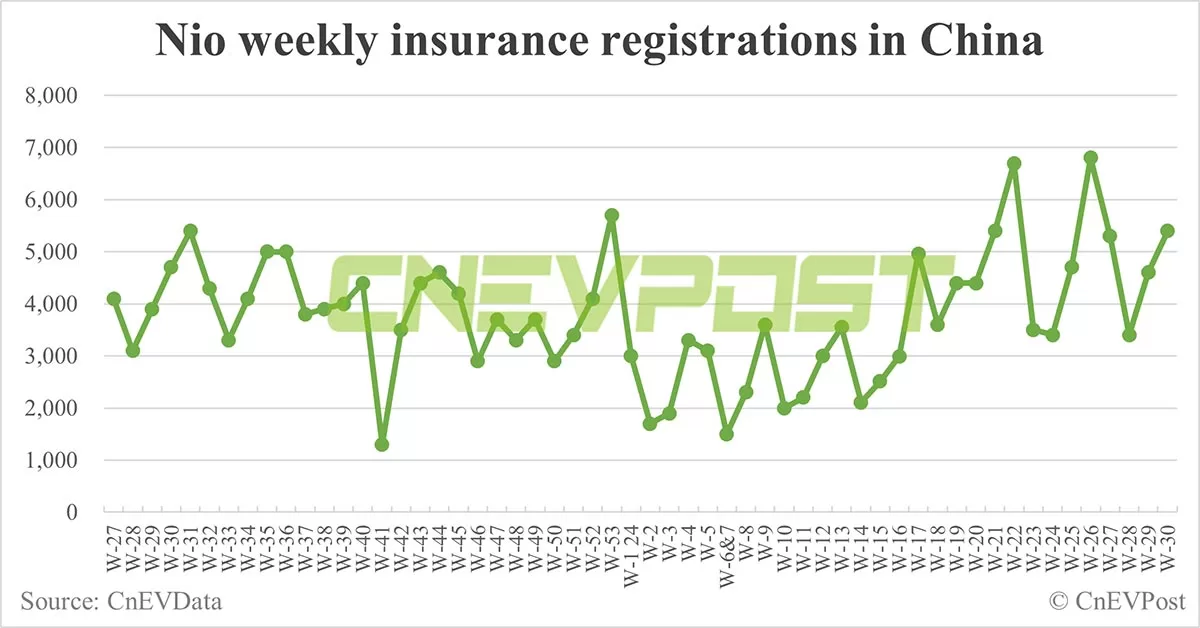

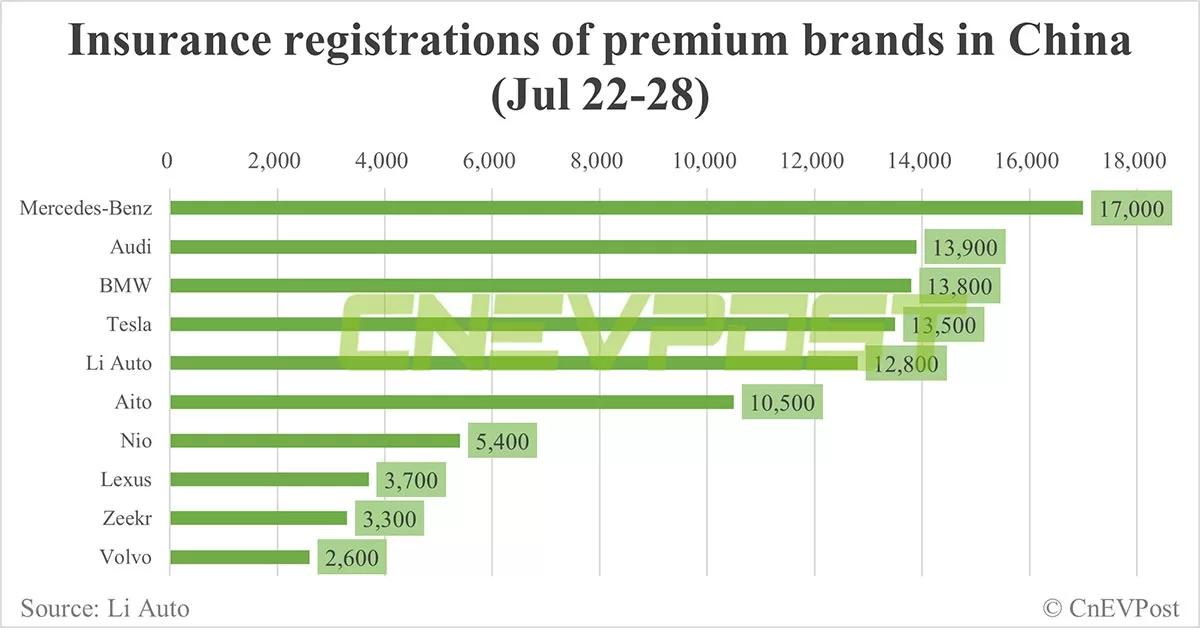

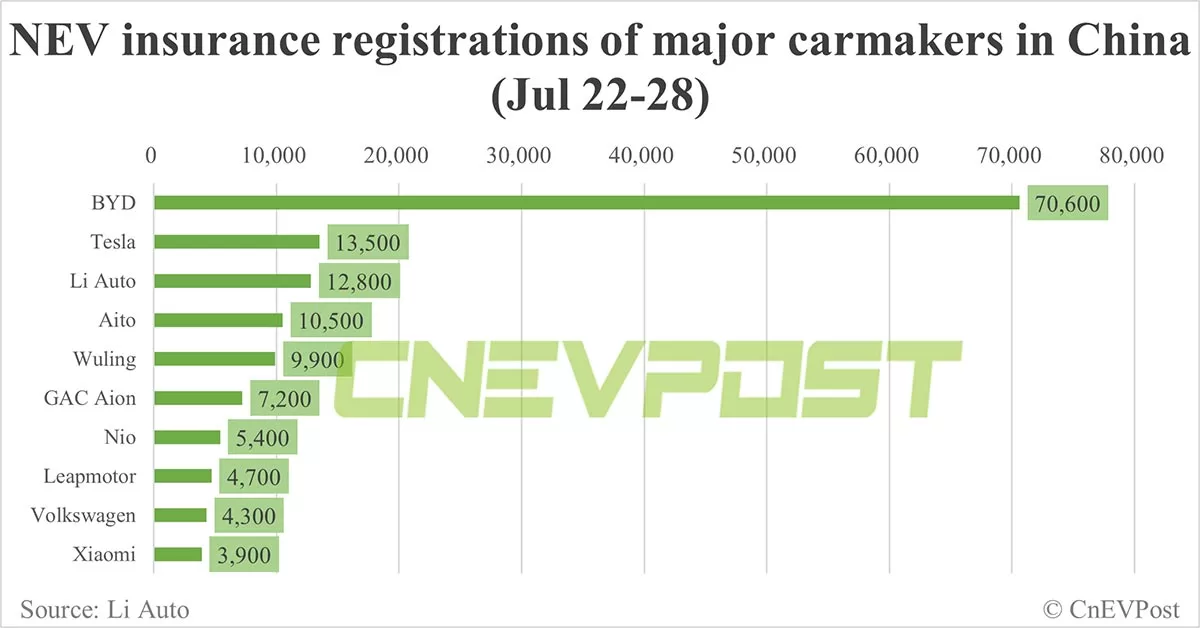

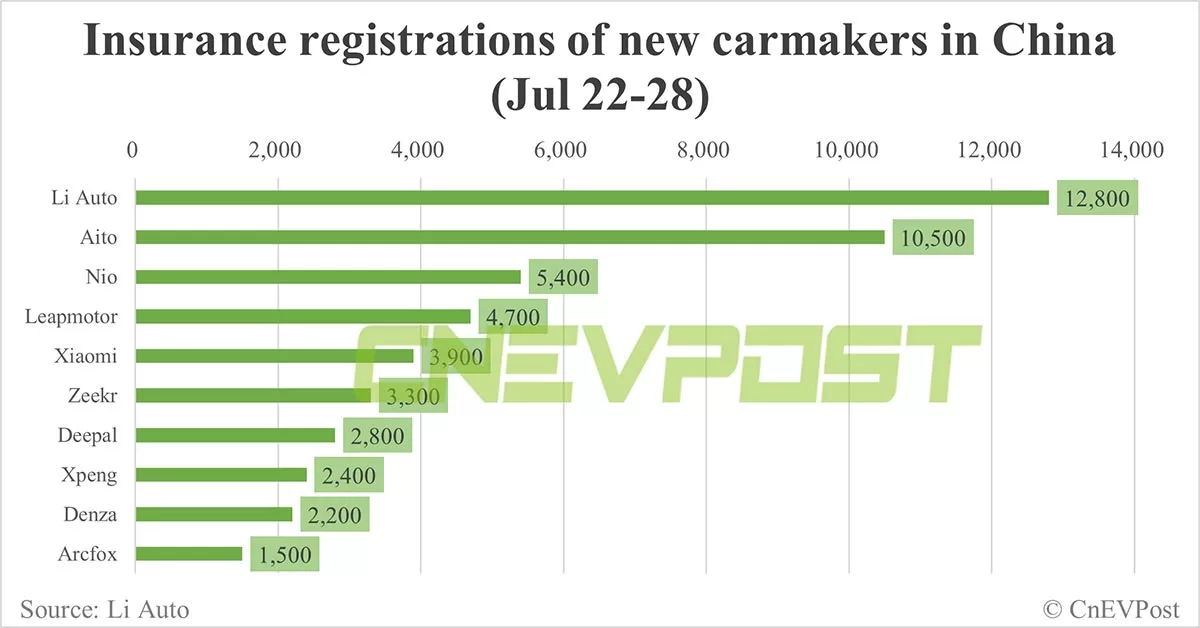

For the week of July 22-28, Nio (NYSE: NIO) vehicles had 5,400 insured registrations in China, up 17.39 percent from 4,600 in the previous week, according to data shared today by Li Auto (NASDAQ: LI).

Li Auto stopped sharing weekly insurance registrations earlier this year, after about a year of doing so. It resumed sharing those numbers in early May.

As of July 28, Nio had 18,700 insurance registrations so far this month.

Nio delivered 21,209 vehicles in June, beating May's previous record of 20,544 vehicles for a second consecutive record month.

It delivered a record 57,373 vehicles in the second quarter, unexpectedly exceeding the upper end of its guidance range of between 54,000 and 56,000 vehicles.

Nio's retail sales in July are expected to be 21,000 units, flat year-on-year and flat sequentially, Deutsche Bank analyst Wang Bin's team said in a July 24 research note.

Nio's new order flow is forecast to be around 22,000 units as its promotional efforts in the first 20 days of July are in line with its June policy, the team said.

Local automotive media outlet Auto Home reported on July 17 that Nio would scale back its purchase incentives for some models on July 22. Nio has not denied the report, but has also not publicly announced the reduction in offers.

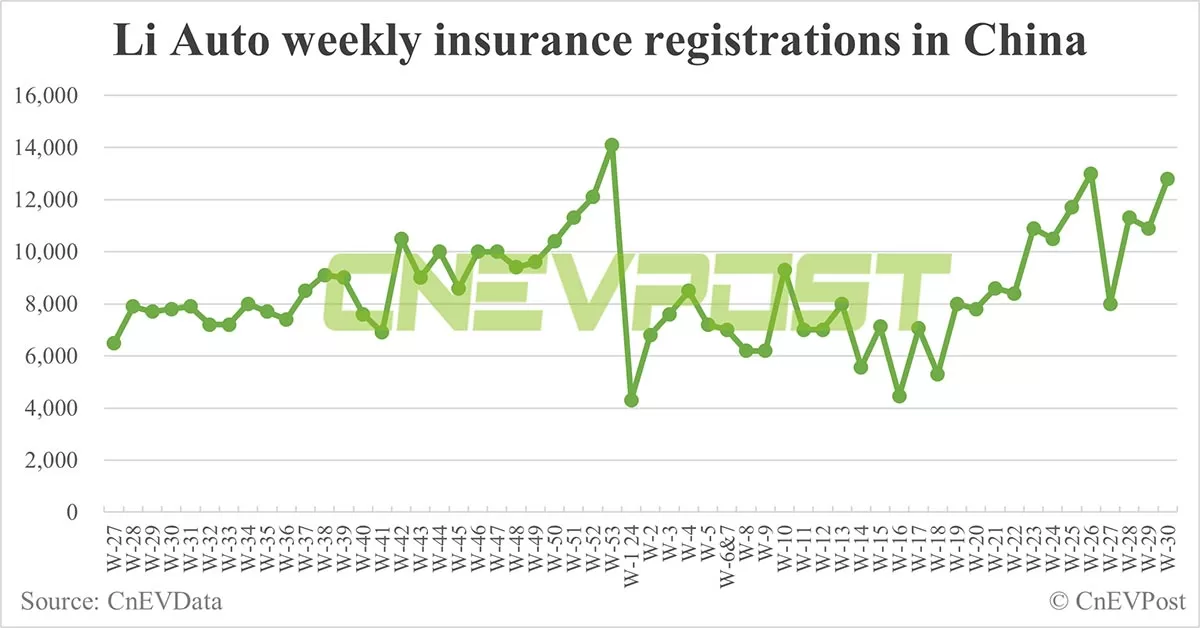

Li Auto had 12,800 insurance registrations last week, up 17.43 percent from 10,900 the week before.

So far this month, Li Auto has that figure at 43,000 vehicles.

The company delivered 47,774 vehicles in June, second only to its record high of 50,353 vehicles in December last year.

In the second quarter, Li Auto delivered 108,581 vehicles, which is within the guidance range of between 105,000 and 110,000 vehicles.

Wang's team expected Li Auto to have retail sales of 48,000 units in July, up 41 percent year-on-year and flat sequentially.

On July 25, Li Auto announced scaled-back car-buying incentives, amid an easing price war in China's auto market.

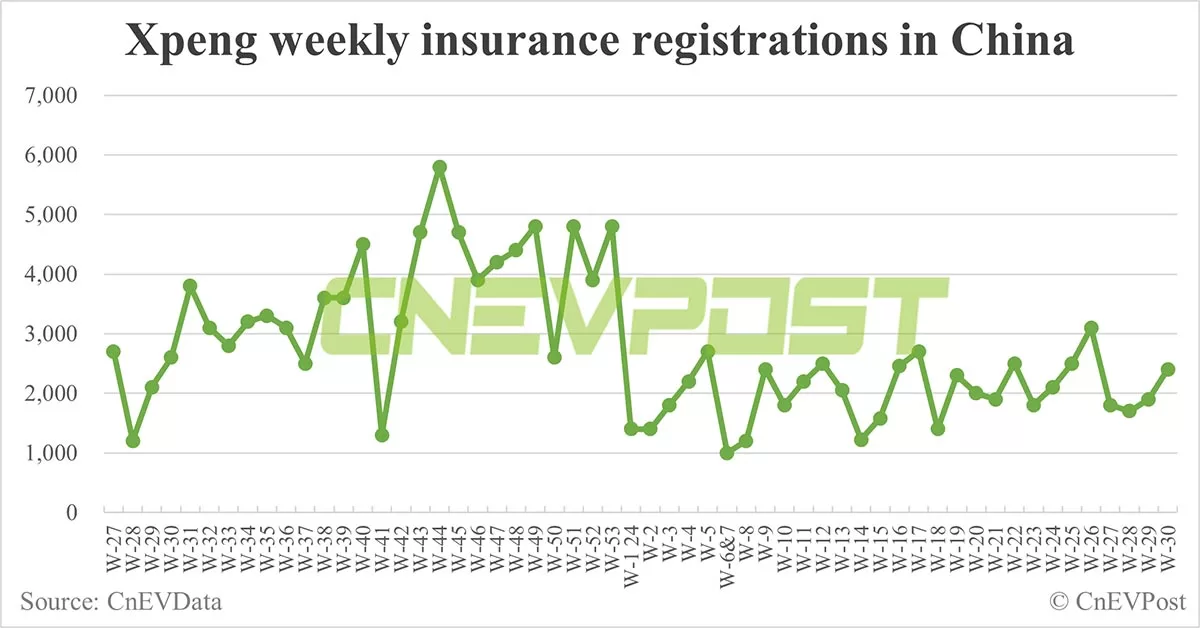

Xpeng (NYSE: XPEV) had 2,400 insurance registrations last week, up 26.32 percent from 1,900 the week before.

So far this month, Xpeng's insurance registrations stood at 7,800 vehicles.

Xpeng delivered 10,668 vehicles in June, up 23.76 percent year-on-year and up 5.14 percent from May.

In the second quarter, Xpeng delivered 30,207 vehicles, within the guidance range of between 29,000 and 32,000 vehicles.

Xpeng's domestic retail sales in July are estimated at 8,500 units and overseas deliveries are estimated at 1,500 units, according to Wang's team.

The company will be holding a technology event later today where it is expected to unveil a major update on its XNGP (Xpeng navigation guided pilot) assisted driving feature.

Xpeng gave the Mona lineup's first model, the M03, its debut on July 3, saying the official launch would be in August.

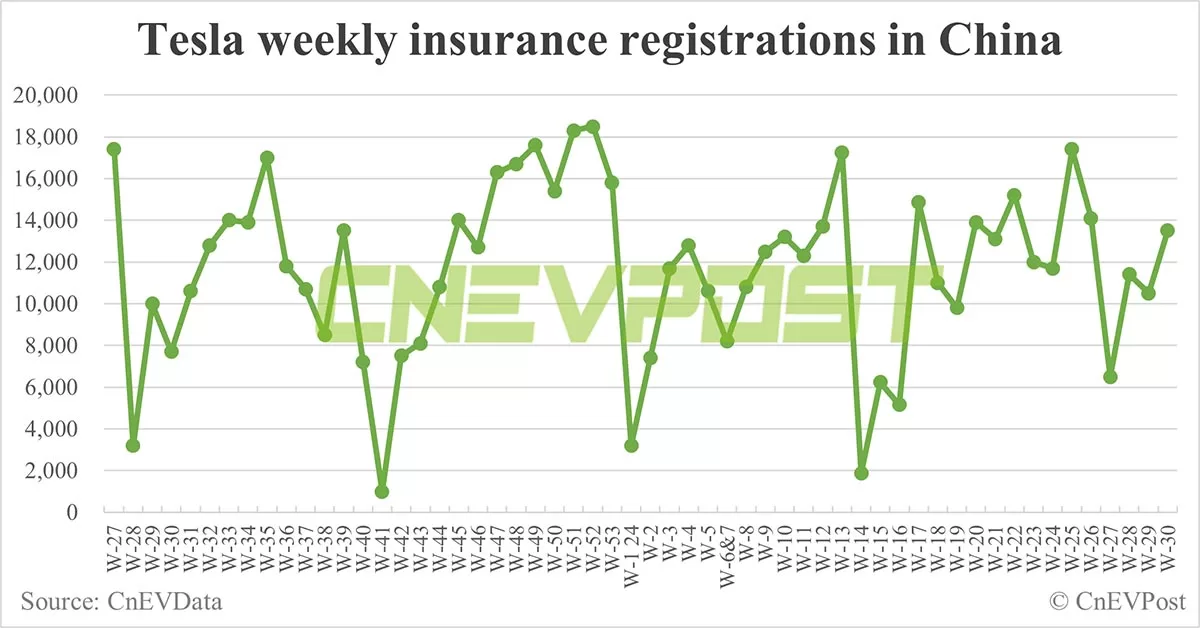

Tesla (NASDAQ: TSLA) had 13,500 insurance registrations in China last week, up 28.57 percent from 10,500 the week before.

So far this month, Tesla's insurance registrations in China stood at 41,900 vehicles.

The US EV maker sold 59,261 vehicles in China in June, down 20.15 percent from 74,212 a year earlier, while up 7.33 percent from 55,215 in May.

Tesla China exported 11,746 vehicles in June, down 39.67 percent from 19,468 in the same month last year and down 32.33 percent from 17,358 in May.

Tesla on July 23 further extended its 5-year 0 percent interest loan incentive in China, which was due to expire on July 31, to August 31.

Deutsche Bank expected Tesla to retail 45,000 units in China in July, up 37 percent year-on-year but down 23 percent sequentially.

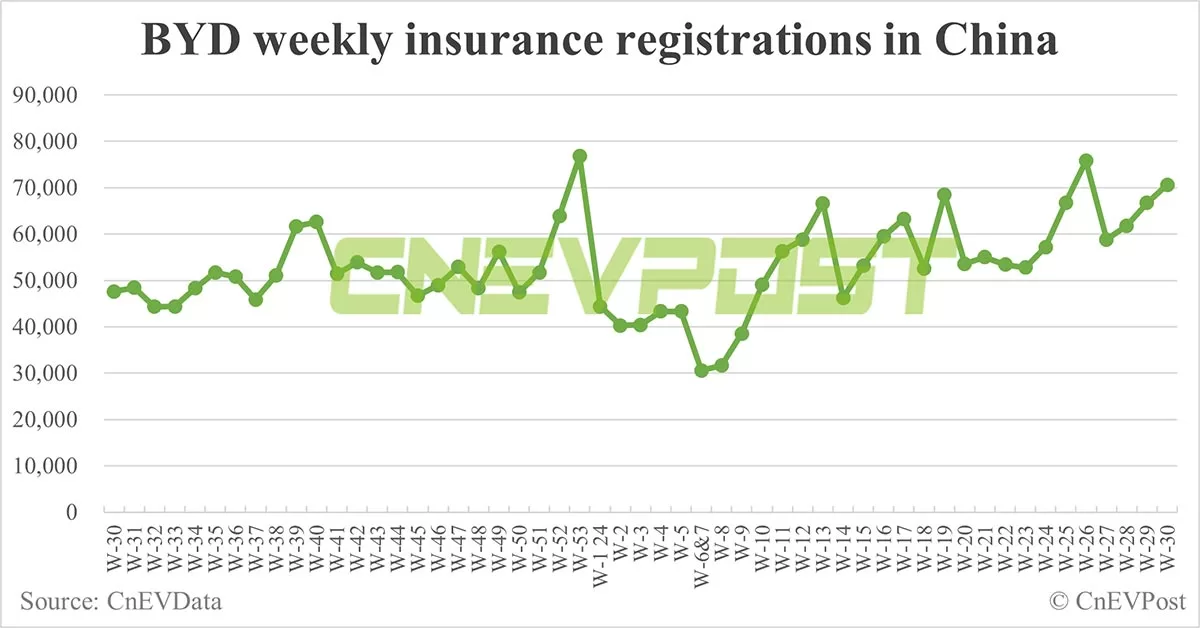

BYD (HKG: 1211, OTCMKTS: BYDDY) had 70,600 insurance registrations in China last week, up 5.85 percent from 66,700 the week before.

For the month so far, BYD's figure stood at 257,900 vehicles.

BYD sold 341,658 new energy vehicles (NEVs) in June, surpassing its previous record of 341,043 vehicles in December 2023.

In the second quarter, BYD sold a record 986,720 NEVs, up 40.25 percent year-on-year and up 57.56 percent from the first quarter.

BYD launched the Song L DM-i and 2025 Song Plus DM-i on July 25, the second batch of hybrid models with the DM 5.0 system after the Seal 06 DM-i and Qin L DM-i hybrid sedans. The two new SUV (sport utility vehicle) models both start at RMB 135,800 ($18,770).

BYD's July retail sales are expected to be 300,000 units, up 8.5 percent sequentially and up 41 percent year-on-year, according to Wang's team.

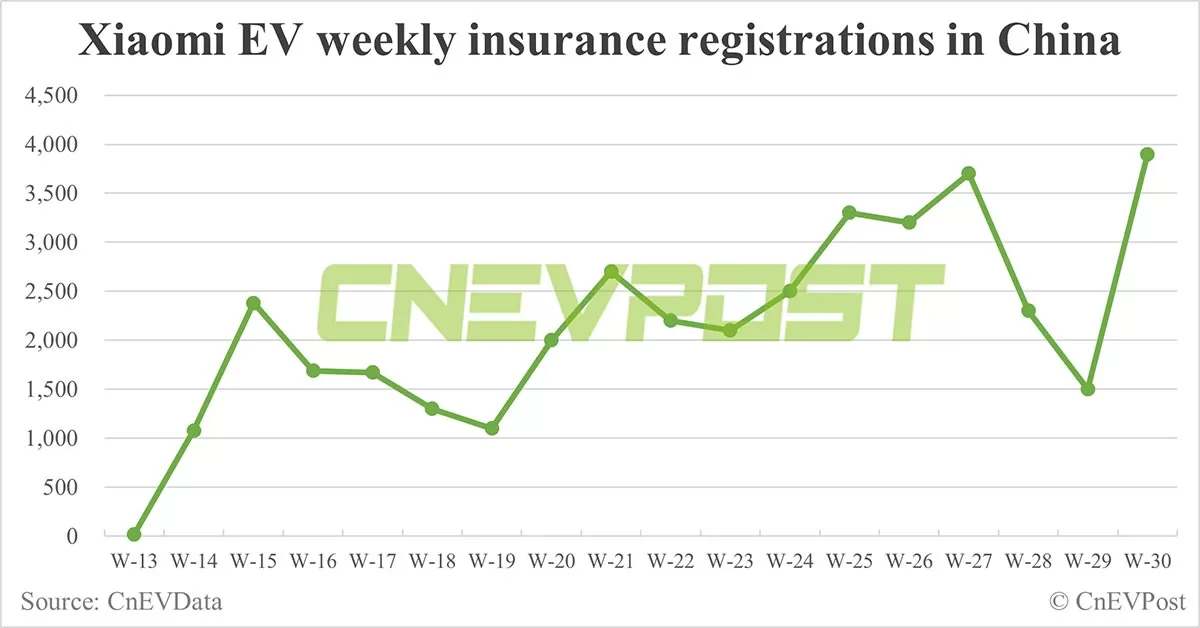

Xiaomi (HKG: 1810, OTCMKTS: XIACY) saw a record 3,900 insurance registrations last week, up 160 percent from 1,500 the week before.

So far this month, Xiaomi's figure stood at 11,400 vehicles.

On July 2, Xiaomi EV said it would conduct a new round of production line optimization to boost capacity.

Xiaomi's founder, chairman and CEO Lei Jun said in a July 26 Weibo post that capacity ramp-up at the Xiaomi EV factory were completed, and the full-year delivery target of 100,000 units is expected to be completed by early November.

Xiaomi's sole current model, the SU7, delivered over 10,000 units in June, Xiaomi EV announced on Weibo earlier this month, without revealing specific numbers.

In July, Xiaomi SU7 deliveries would still exceed 10,000 units, Xiaomi EV previously said.

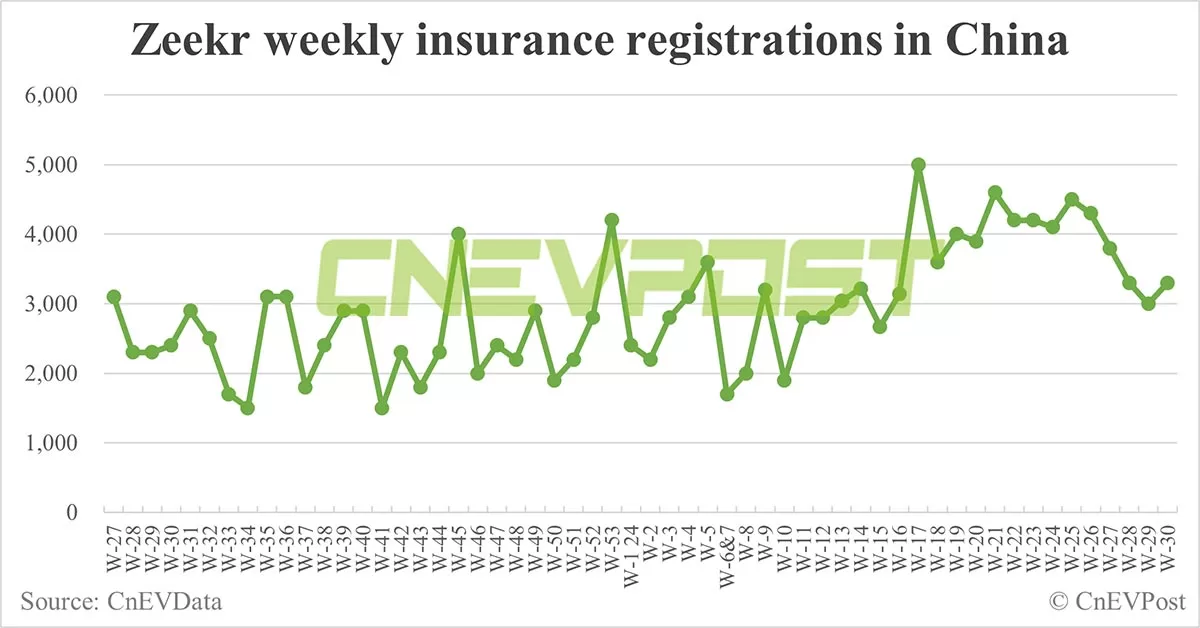

Zeekr (NYSE: ZK) saw 3,300 insurance registrations last week, up 10 percent from 3,000 vehicles the week before.

So far this month, Zeekr had that number at 13,400 vehicles.

The company delivered a record 20,106 vehicles in June, marking the first time monthly deliveries exceeded the 20,000 mark.

Zeekr delivered a record 54,811 vehicles in the second quarter, up 100.05 percent year-on-year and up 65.8 percent from the first quarter.

Zeekr launched the updated Zeekr 009 MPV (multi-purpose vehicle) and its right-hand drive version on July 19 in Hong Kong.

Deutsche Bank expected Zeekr to report retail sales of 15,000 units in July, up 25 percent from a year earlier while down 25 percent from June.

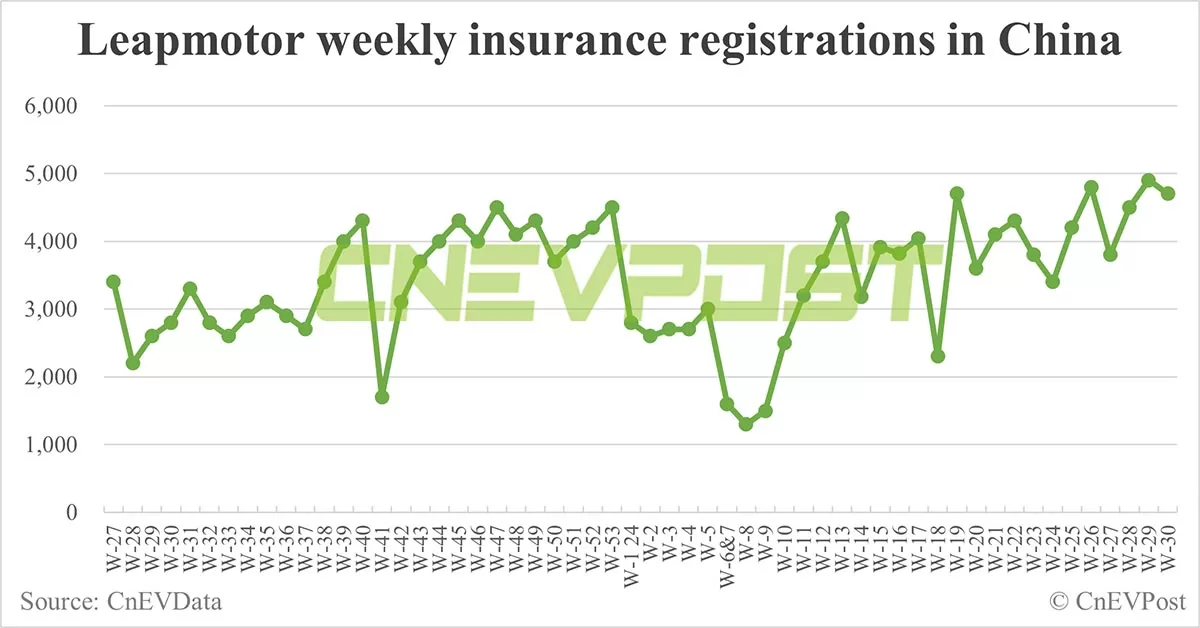

Leapmotor (HKG: 9863) had 4,700 insurance registrations last week, down 4.08 percent from 4,900 the week before.

So far this month, Leapmotor had that figure at 17,900 vehicles.

Leapmotor delivered a record 20,116 vehicles in June, bringing second-quarter deliveries to 53,286.

The company said on July 22 that its six-seat SUV, the C16, which was launched on June 28, topped 10,000 orders in its first month on the market.

Deutsche Bank expected Leapmotor to retail 21,000 units in July, up 46 percent year-on-year and up 4 percent sequentially.

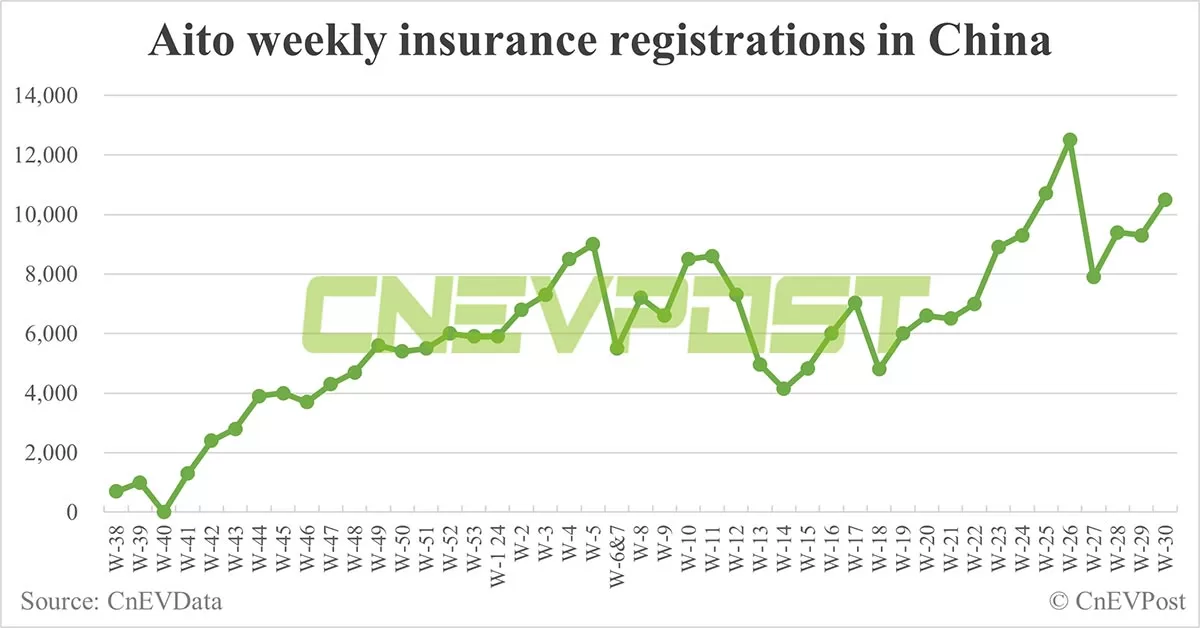

The Aito brand, jointly created by Huawei and Seres Group, saw insurance registrations of 10,500 vehicles last week, up 12.9 percent from 9,300 the week before.

So far this month, Aito had that figure at 37,100 vehicles.

Aito announced yesterday that it saw its 400,000th vehicle roll off the production line, two and a half years after the new brand's December 2, 2021 inception.

Aito's retail sales in July are expected to be 43,000 units, up about 865 percent year-on-year and flat sequentially, according to Deutsche Bank.