BYD's global deliveries could reach 6 million units by 2026, including about 1.5 million units in overseas markets, JPMorgan said.

JPMorgan believes BYD's (HKG: 1211, OTCMKTS: BYDDY) efforts to expand into global markets will see a key milestone in 2026, when full-year deliveries are expected to reach 6 million units.

By 2026, BYD's global deliveries could reach 6 million units, with about 1.5 million in overseas markets and the rest at its home market, analyst Nick Lai's team said in a July 9 research note.

That means BYD's share of the global light-vehicle market will expand from 3 percent in 2023 to 7 percent in 2026, and its share of the new energy vehicle (NEV) market will remain at about 22 percent, the team said.

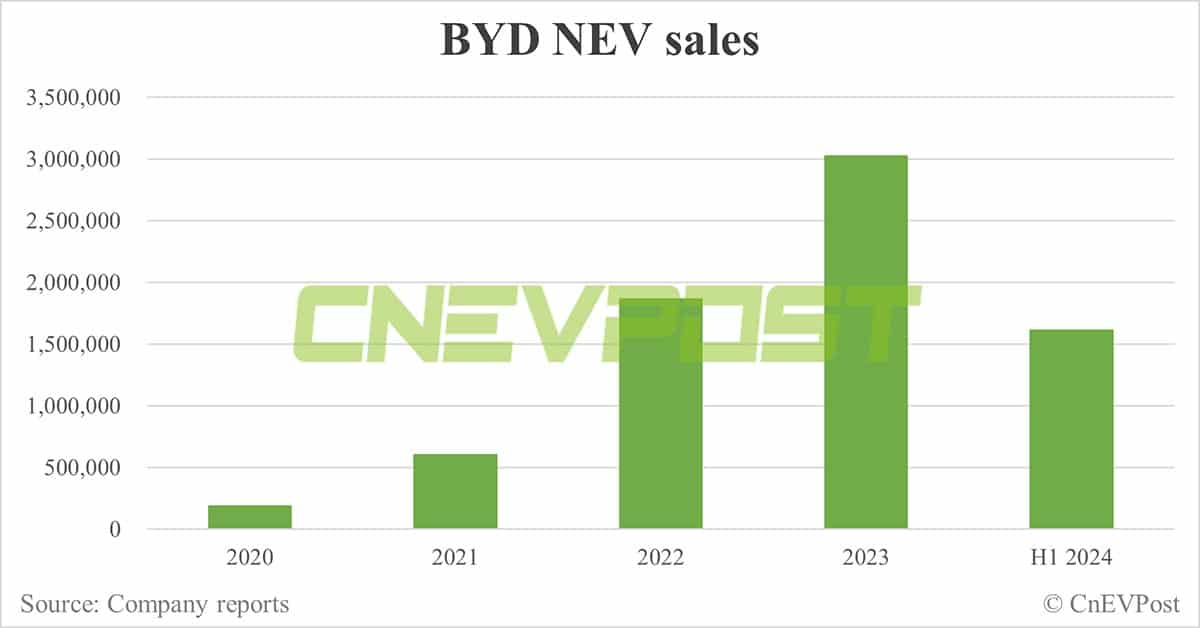

BYD sold 3,024,417 NEVs in 2023, a year-on-year increase of 62.30 percent, according to data compiled by CnEVPost.

In the first half of this year, BYD sold 1,612,983 NEVs, up 28.46 percent year-on-year.

According to JPMorgan, 2026 will be an important strategic inflection point and milestone in BYD's global expansion ambitions as it completes and gradually ramps up production at its four overseas production bases in Thailand, Indonesia, Brazil and Hungary.

On January 26, BYD announced the launch of production at its plant in Uzbekistan, and on July 4, BYD's Thailand plant went into operation. In addition to these two plants, BYD is also building passenger car plants in Hungary and Brazil.

At the end of March, an Indonesian official said that BYD planned to hold a groundbreaking ceremony for its Indonesian plant, which will start production in 2026, in July this year.

On July 8, BYD signed an agreement with the Turkish government to invest about $1 billion in the country to build a NEV production base with a planned annual capacity of 150,000 vehicles, which will go into production by the end of 2026.

Turkey is one of the automotive industry's gateways to the European market through the customs union and has signed free trade agreements with 23 European countries.

Earlier this month, the European Commission announced a provisional anti-subsidy duty on imports of battery electric vehicles (BEVs) from China starting July 5, with BYD's 17.4 percent additional duty rate being the lowest of all Chinese carmakers.

While the EU will raise tariffs, JPMorgan believes BYD will aim to compete overseas through configuration or product, rather than price.

At the same time, the team noted that while BYD's NEV products can compete with most of their mass-market overseas counterparts in terms of cost and features, establishing a brand abroad will not be easy.

JPMorgan is bullish on BYD's expansion in global target markets, mainly Southeast Asia, Latin America and the European Union.

The bank believes that overseas markets will be able to provide BYD with stronger growth opportunities, as well as excellent margins.