BYD and Tesla both saw record highs in new orders in China in May, according to Deutsche Bank.

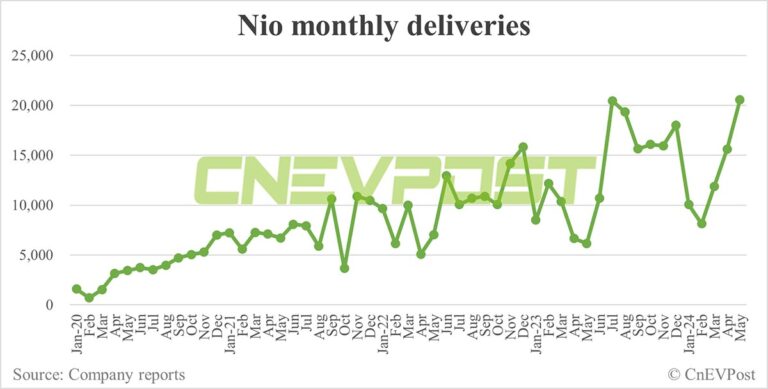

Most of the major EV companies saw new orders in China rise sequentially in May, with Nio (NYSE: NIO) up 37 percent, according to a Deutsche Bank suvery.

Deutsche Bank's monthly new energy-vehicle (NEV) dealer interviews and survey for May 2024 show that sample of dealers' subtotaled new-order flow, a leading indicator of retail sales, increased 75 percent year on year and 5 percent month on month, analyst Wang Bin's team said in a research note today.

The main reasons for the month-on-month increase in new orders in May included one more calendar day compared to 30 days in April and standing-by car buyers unleashing their purchasing power following the government's trade-in subsidy details, according to the team.

Nio's new orders in May were up 37 percent from April and flat year-on-year, according to the team, who attributed the sequential growth to the following factors:

(a) reduced price for BAAS (battery as a service) from Rmb980 per monthly previously to Rmb728 per month for a standard range battery pack, and

(b) around Rmb25k per unit official discount since April, including Rmb10k trade-in subsidy, Rmb6.5k NIO phone coupon, Rmb3.6k battery swap coupon, and Rmb4.6k NOP plus one-year software.

Xpeng (NYSE: XPEV) saw a 9 percent sequential increase in new orders in May, but a 26 percent year-on-year decline, according to the team.

The sequential increase was due to demand release from standby buyers and an increase in the number of calendar days in May. The year-on-year decline was mainly due to competitive pressure from peers such as Xiaomi SU7sedan, BYD products and Tesla Model 3 / Model Y.

Xpeng will showcase the Mona mid-size sedan in June, and deliveries of the car are likely to start in August, according to Wang's team.

Li Auto (NASDAQ: LI) saw a 14 percent sequential increase in new orders in May and a 6 percent year-on-year increase, thanks to the newly launched Li L6, a 5-seat SUV, the team said.

Li Auto announced that the Li L6 received 20,000 orders in April, followed by another 20,000 orders in the first week of May, the team noted.

In other words, the Li L6's order growth for the month was driven by full-month coverage in May, compared to just 12 days of sales in April, according to the team.

Li Auto launched the Li L6 on April 18, by far the cheapest in its lineup, with a starting price of RMB 249,800 ($34,470).

BYD (HKG: 1211, OTCMKTS: BYDDY) saw new orders in May rise 16 percent sequentially and 107 percent year-on-year.

Thanks to the launch of its DM 5.0 hybrid technology on May 28 and the launch of two sedans based on the technology -- the Qin L and the Seal 06 -- BYD's monthly new orders hit a record high in May, Wang's team said.

Meanwhile, orders for new products, such as the Song L's sister product, the Sea Lion 07, also helped increase new orders for the month, the team noted.

Tesla's new orders in May were up 17 percent sequentially and 92 percent year-on-year, according to Deutsche Bank.

In May, Tesla's official price cut of RMB 14,000 per unit, covering the whole month of May, led to a record high in monthly new orders, the team said.

Meanwhile, Tesla also launched a zero-down payment or zero-interest rate auto finance promotion in the month, covering the Model 3 and Model Y, the team noted.

Huawei-backed Aito's new orders in May were down 15 percent sequentially while up 318 percent year-on-year. The sequential decline was largely due to a sharp drop in orders for the Aito M7 SUV, according to the team.

Deutsche Bank's dealer interview and survey tracker covers nearly 100 dealerships of seven leading NEV brands in more than 10 major cities.

These dealers cover about 19 percent of Xpeng's national sales, about 17 percent of Nio's, about 7 percent of Li Auto's, about 4 percent of Tesla's, about 1 percent of BYD's, and about 1 percent of Aito's.

($1 = RMB 7.2475)