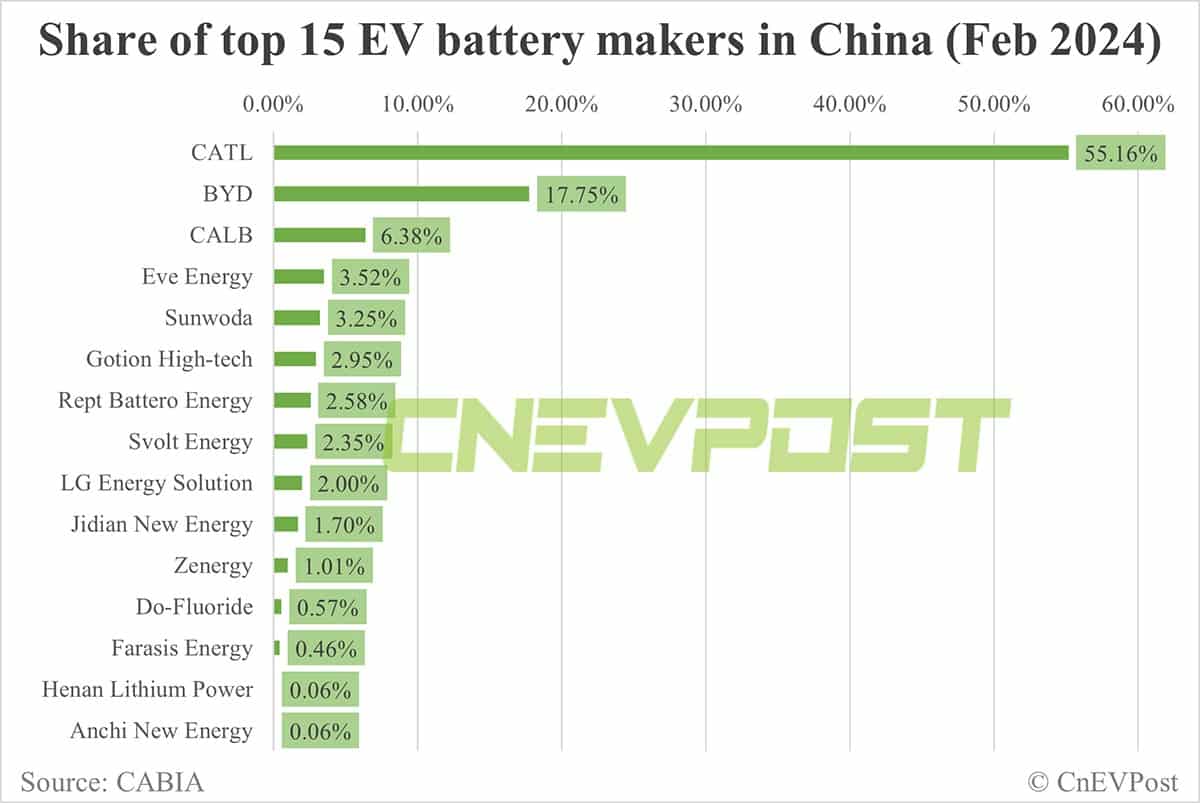

CATL's share of China's EV battery market increased by 5.75 percentage points in February, while BYD's share decreased by 0.82 percentage points.

CATL's share of the electric vehicle (EV) battery market in China increased in February from January, while BYD (HKG: 1211, OTCMKTS: BYDDY) saw its share decrease.

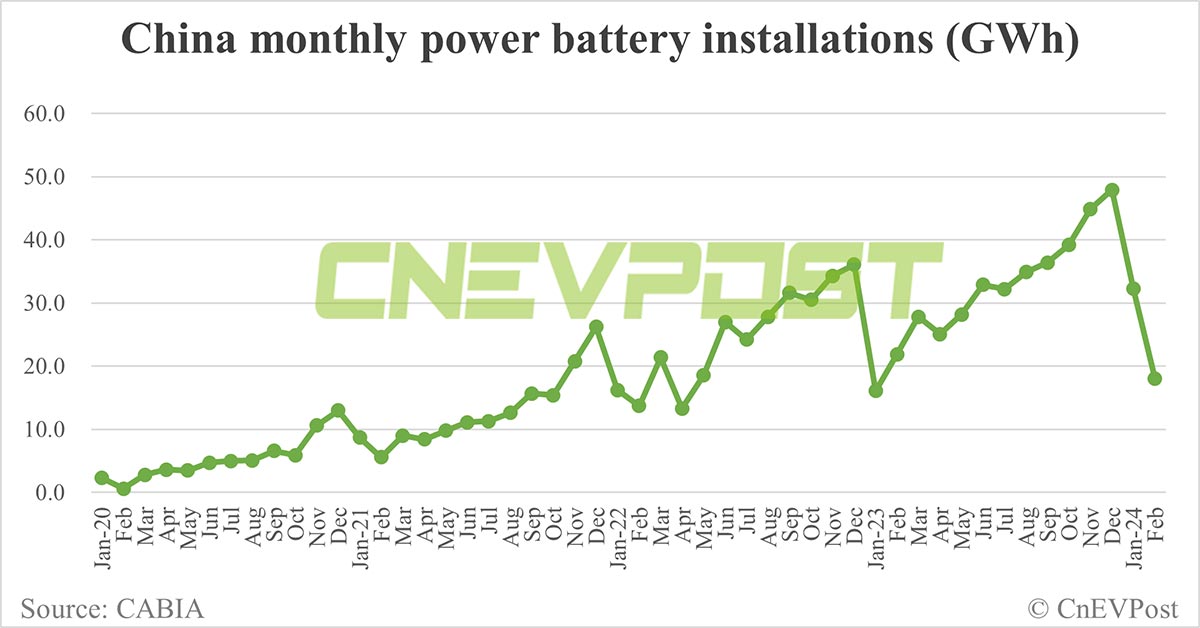

In February, China's installed base of power batteries was 18.0 GWh, down 18.1 percent year-on-year and down 44.4 percent from January, according to data released yesterday by the China Automotive Battery Innovation Alliance (CABIA).

CATL's power battery installed capacity in February was 9.82 GWh, ranking first with a 55.16 percent share, up 5.75 percentage points from January's 49.41 percent share.

BYD's power battery installed capacity in February was 3.16 GWh, ranking second with a 17.75 percent share, a decrease of 0.82 percentage points from January's 18.58 percent.

CALB ranked third with a 6.38 percent share of 1.14 GWh of installed power batteries in February, up 0.97 percentage points from 5.42 percent in January.

Eve Energy ranked fourth in February with 0.63 GWh of installed capacity and a 3.52 percent share. In January, Eve Energy ranked sixth.

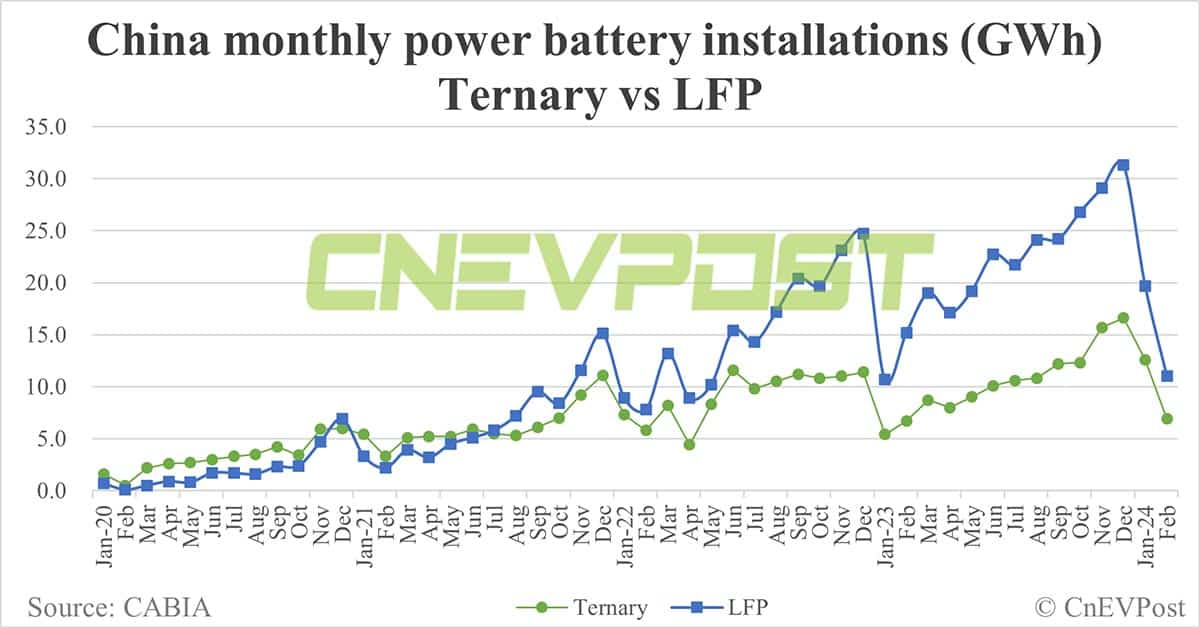

China's lithium ternary battery installed capacity in February was 6.9 GWh, accounting for 38.7 percent of the total installed capacity, up 3.3 percent year-on-year, but down 44.9 percent from January.

Lithium iron phosphate (LFP) battery installed volume was 11.0 GWh, accounting for 61.3 percent of the total, down 27.5 percent year-on-year and down 44.1 percent from January.

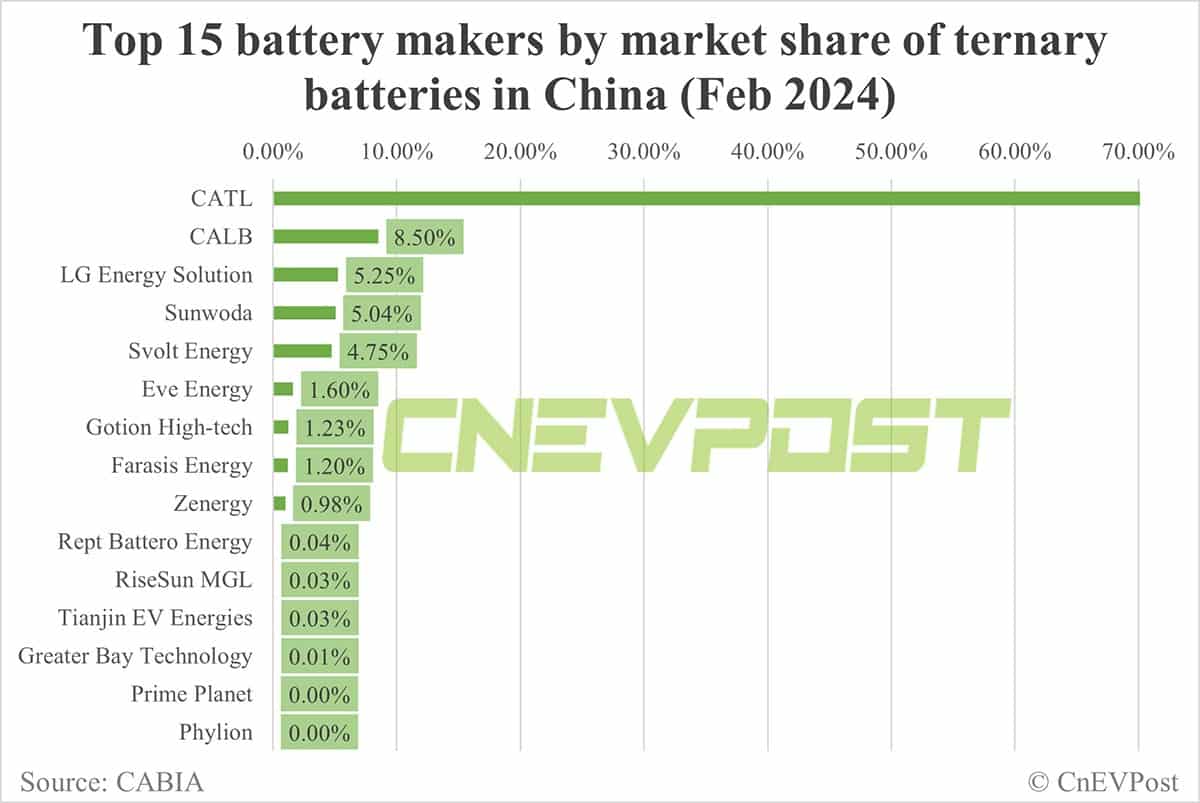

CATL, CALB, and LG Energy Solution were the top three in terms of installed capacity of ternary batteries in February, with shares of 71.33 percent, 8.50 percent, and 5.25 percent, respectively.

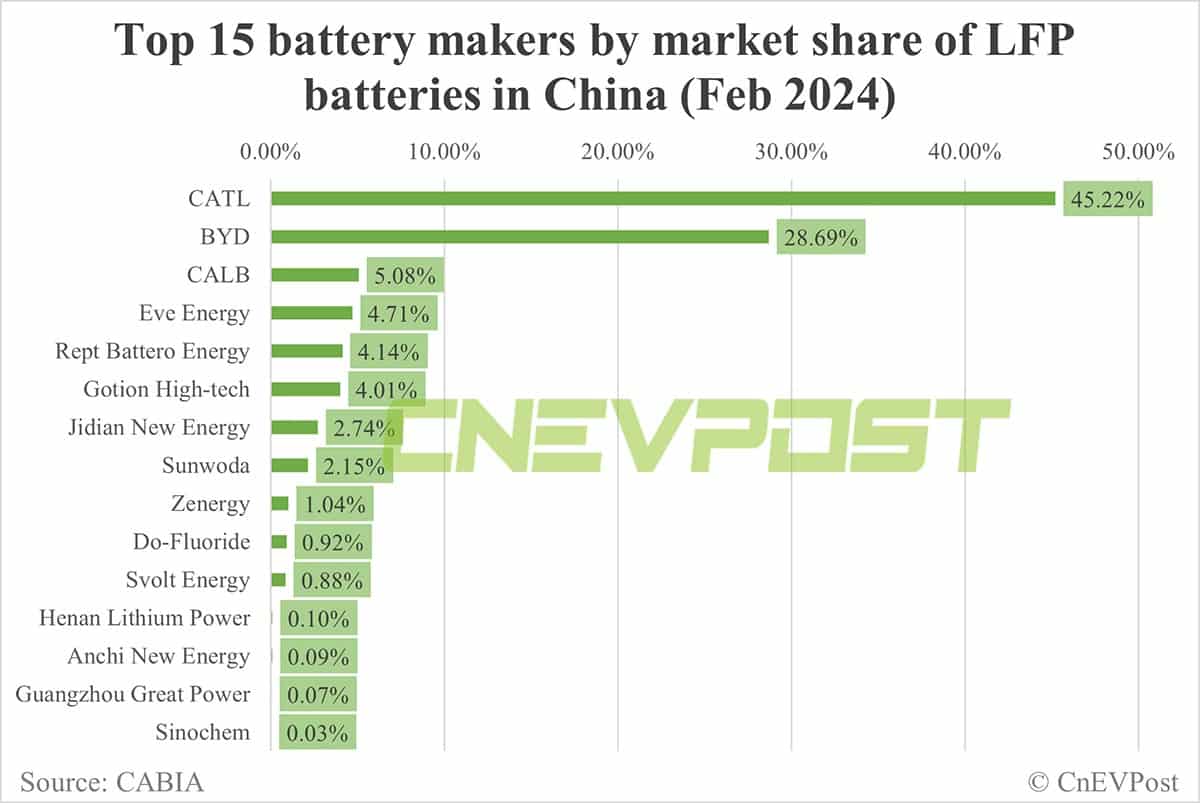

In the LFP battery market, CATL, BYD, and CALB were the top three in terms of installed capacity in February, with shares of 45.22 percent, 28.69 percent, and 5.08 percent, respectively.