Li Auto's third-quarter results were somewhat mixed, with a strong outlook for fourth-quarter sales, according to Deutsche Bank.

Li Auto (NASDAQ: LI) today reported third-quarter revenue that beat expectations, and as usual, Deutsche Bank analyst Edison Yu's team shared their first impressions of the results.

Li Auto's third-quarter results were mixed, with a strong outlook for fourth-quarter volume, the team noted.

The company guided for 125,000-128,000 deliveries in the fourth quarter, above Deutsche Bank's 119,000-unit forecast.

"Management typically guides conservatively so we suspect 130,000 is achievable," the team said.

Below is the full text of the team's note.

3Q23 Earnings First Look

Li Auto delivered somewhat mixed 3Q results along with a strong 4Q volume outlook.

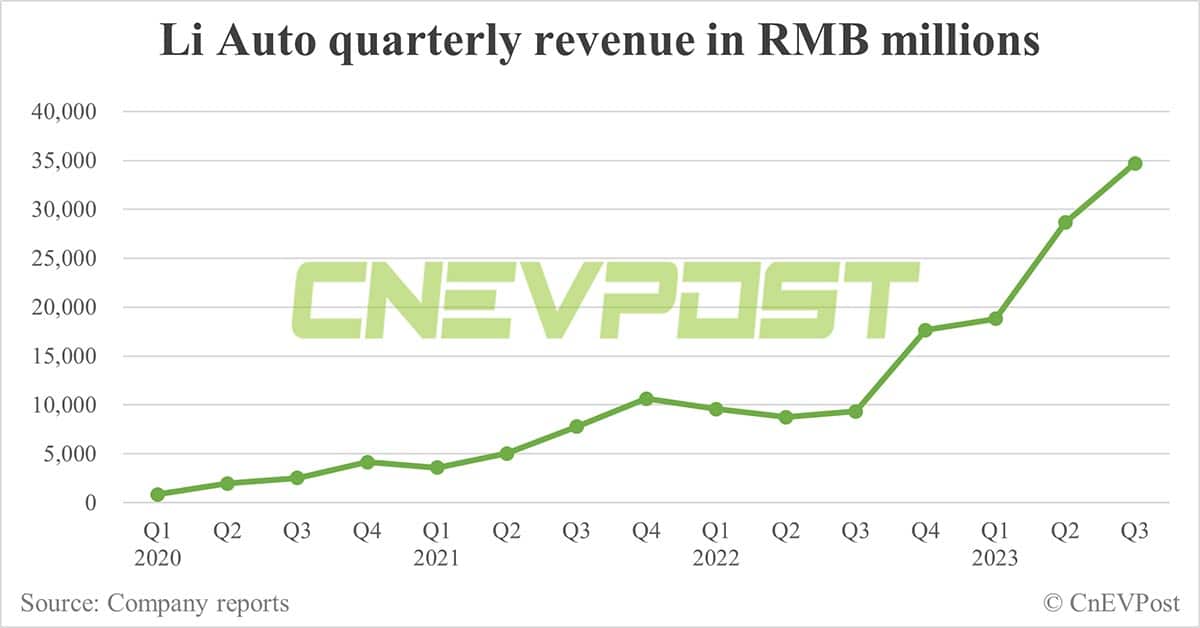

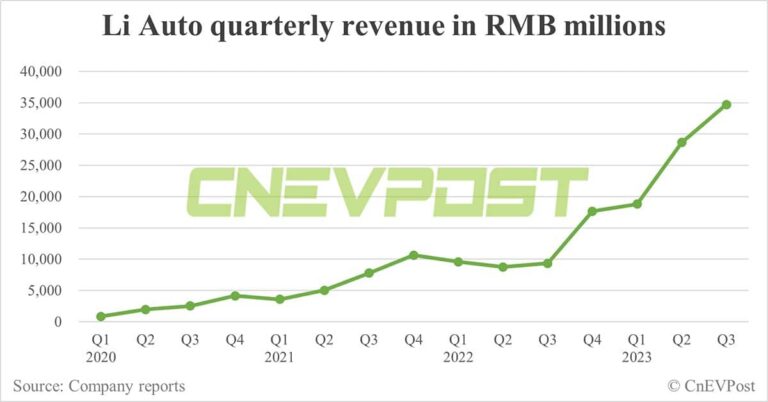

Deliveries were already reported for 3Q at 105,108 units, leading to revenue of 34.7bn RMB, about in-line with our forecast but saw greater services contribution.

Total gross margin of 22.0% was below our 22.9% estimate on weaker vehicle margin of 21.2% (up only 15bps QoQ likely due to greater impact from incentives).

Services margin approached 50%. Opex of 5.4bn was below our expectation, mainly due to lower SG&A, reflecting prudent spending.

Adjusted EPS was 3.29, easily beating DBe/consensus, helped by other income (~23c benefit). Free cash flow came in at >13bn, materially better than anticipated, boosted by working capital (payables and inventory).

Management provided strong 4Q guidance calling for 125,000-128,000 in deliveries, higher than our 119,000 forecast, implying continued growth following October's record 40,422 units.

Management typically guides conservatively so we suspect 130,000 is achievable.

Revenue is expected to be 38.46-39.38bn RMB in 4Q, implying lower ASP QoQ (we estimate ~20K RMB). This should add pressure to vehicle margin on a sequential basis despite cost profile/scale improving.