Nio plans to use a portion of the net proceeds to repurchase certain existing debt securities, with the remainder to be used primarily to further strengthen its balance sheet position and for general corporate purposes.

Nio (NYSE: NIO) announced plans to issue $1 billion in convertible senior notes to repurchase existing debt securities and strengthen its balance sheet, causing its shares to fall in after-hours trading.

The company today announced plans to issue $500 million in aggregate principal amount of convertible senior notes due 2029 and $500 million in convertible senior notes due 2030, according to an announcement.

Initial purchasers will be able to exercise an option within 30 days of the date of issuance of the notes to purchase up to an additional $75 million in aggregate principal amount of the 2029 notes and up to an additional $75 million of the 2030 notes.

When issued, the notes will become the senior unsecured debt of Nio and will mature on October 15, 2029, and October 15, 2030, respectively.

Holders may convert the notes at any time prior to the maturity date. Upon conversion, Nio will pay or deliver cash, ADSs or a combination of cash and ADSs to such converting holders.

Nio plans to use a portion of the net proceeds from the note offering to repurchase a portion of its existing debt securities and the remainder primarily to further strengthen its balance sheet position and for general corporate purposes, the company said.

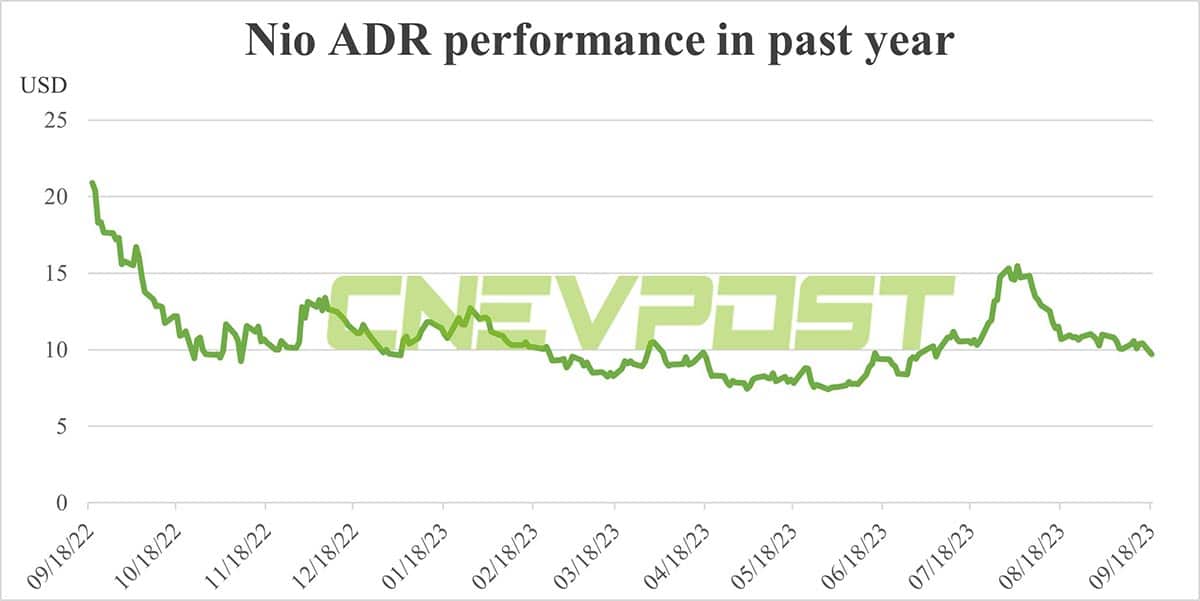

It was the second funding announced by Nio in three months, causing it to plunge in after-hours trading on the US stock market on Monday. As of press time, Nio was down 5.72 percent to $9.72 in after-hours trading.

On June 20, Nio signed a share subscription agreement with Abu Dhabi-based investor CYVN Holdings, which would invest a total of about $1.1 billion in the Chinese electric vehicle (EV) company.

On July 12, Nio announced that it completed a $738.5 million investment from CYVN Investments RSC Ltd, an affiliate of CYVN Holdings. The CYVN entity also acquired certain shares of Nio from an affiliate of Tencent for total consideration of $350 million.

Following the completion of the investment transaction and the secondary share transfer, CYVN Investments owns about 7.0 percent of the total outstanding shares of Nio.

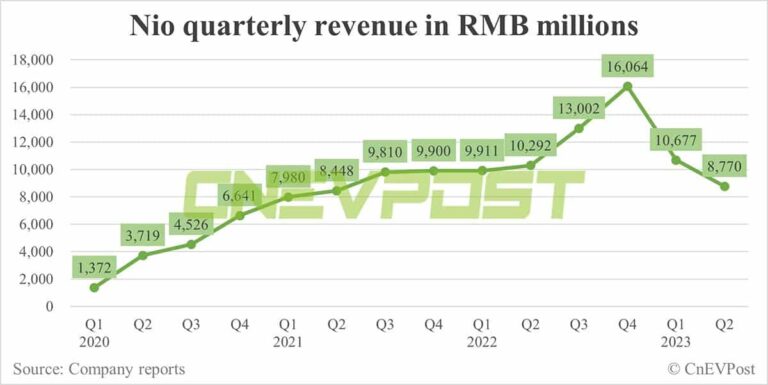

Nio's balance of cash and cash equivalents, restricted cash, short-term investments and long-term time deposits was RMB31.5 billion as of June 30, down RMB6.3 billion from RMB37.8 billion at the end of the first quarter, according to its second-quarter earnings report announced on August 29.

Nio's weak deliveries in the first half of the year and still high investment in research and development led to a continued depletion of cash.

Yesterday, local media outlet HiEV reported that Nio could see two chips tape out next year, based on 7 nm and 5 nm, respectively, which would require additional R&D funds.

The tape-out of a chip based on a 7 nm process will cost roughly $30 million, and roughly $500 million for a 5-nm chip, the report said, citing a person familiar with the matter, adding that Nio will need to prepare sufficient funds for this.