Chinese consumers' intent to buy NEVs continues to rise, further squeezing the share of the fuel vehicle market, according to JD Power.

Among Chinese consumers who intend to buy a new vehicle in the next six months, the share of those considering new energy vehicles (NEVs) reached 33 percent, up 6 percentage points from 27 percent in 2022, for the sixth consecutive year of increases, according to a study by US market research firm JD Power.

JD Power released the figures in its China New Vehicle Intender Study (NVIS) yesterday, saying the long-term trend toward NEVs is becoming clearer.

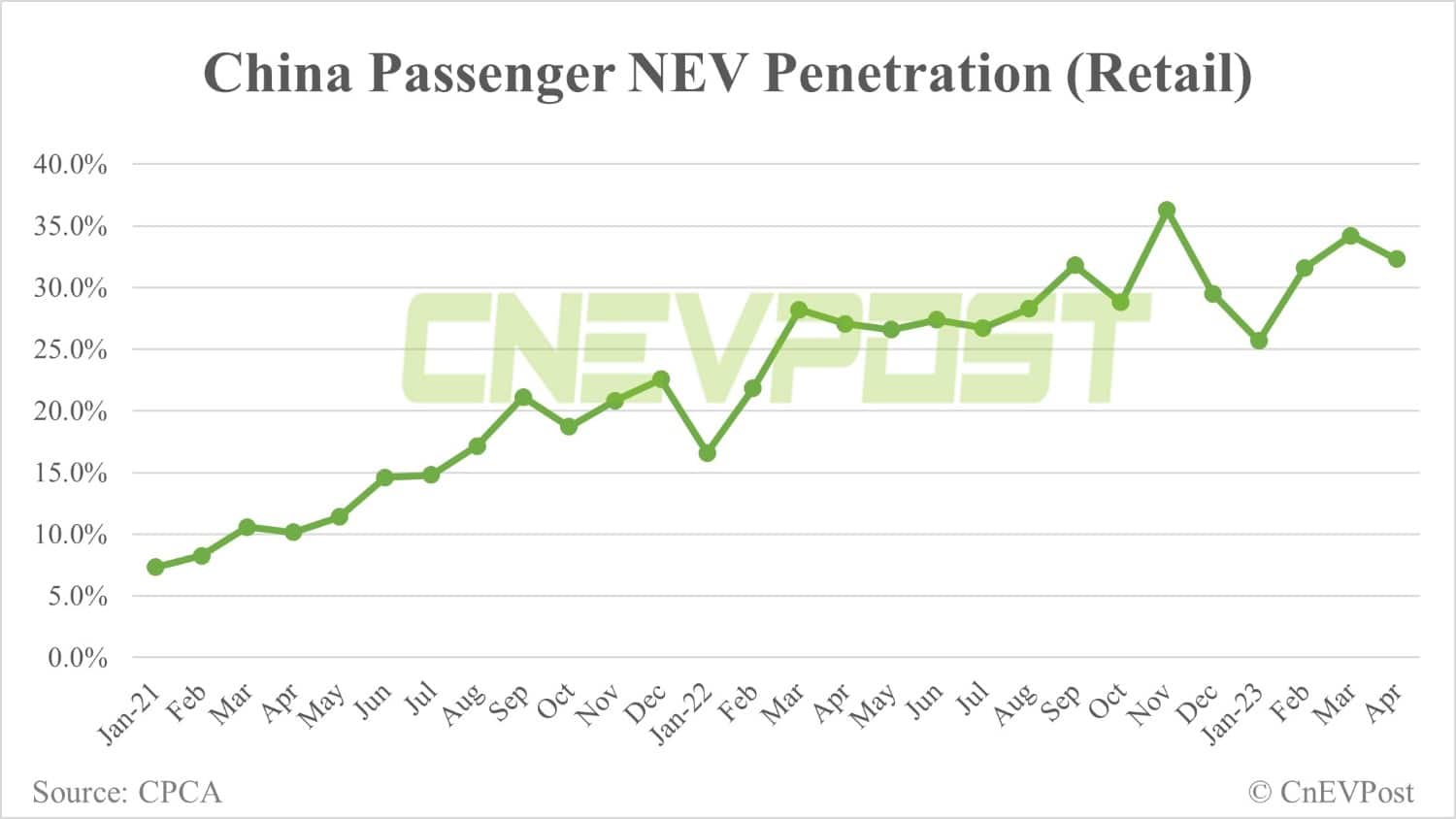

Retail sales of new energy passenger vehicles in China were 527,000 units in April, contributing 32.3 percent of all passenger vehicle sales of 1.63 million units, according to data released by the China Passenger Car Association (CPCA) on May 9.

For comparison, the ratio was 27.1 percent in April last year and only 7.3 percent in January 2021.

In 2023, Chinese consumers' intent to buy NEVs continues to rise, further squeezing the share of the fuel vehicle market, according to JD Power. Intended buyers are consumers who plan to purchase a vehicle in the next six months.

The percentage of consumers considering new energy SUVs has increased significantly, from 11 percent last year to 16 percent this year, and is already on par with new energy sedans, according to JD Power.

Among the new energy models favored most by consumers, luxury plug-in hybrid SUVs and midsize all-electric SUVs saw the largest potential consumer growth, increasing by 6 percent and 5.5 percent, respectively.

The percentage of consumers considering purchasing compact pure electric sedans and mid-size pure electric sedans declined significantly, by 7.5 percent and 5.4 percent respectively.

Going forward, there is a significant trend of consumption upgrading alongside rising penetration of NEVs, according to JD Power.

Data released by the CPCA earlier this week also showed the trend, with retail sales of mini-electric vehicle specialist SAIC-GM-Wuling down 15.9 percent year-on-year in January-April and budget EV maker Neta down 14 percent year-on-year in the period.

Tesla, which is targeting the higher-end market, saw retail sales in China increase 61.5 percent year-on-year during January to April, with Li Auto (NASDAQ: LI) up 118.1 percent and Nio (NYSE: NIO) up 22.2 percent. All three of these companies' sales were dominated by SUVs.

Among other findings, JD Power said more than half of consumers prefer to buy local brands in China, with new car-making brands, in particular, more popular.

For the second year in a row, the percentage of people considering buying a local brand vehicle exceeded 50 percent. For Japanese brands the proportion slipped to 12 percent from 15 percent last year, while German brands rose to 17 percent from 13 percent.

Potential consumers with higher education and higher budgets are more receptive to battery swap and battery leasing sales models, JD Power said.

Potential consumers with adequate budgets are more willing to pay for the battery swap model and also have a stronger willingness to buy NEVs, according to the study.

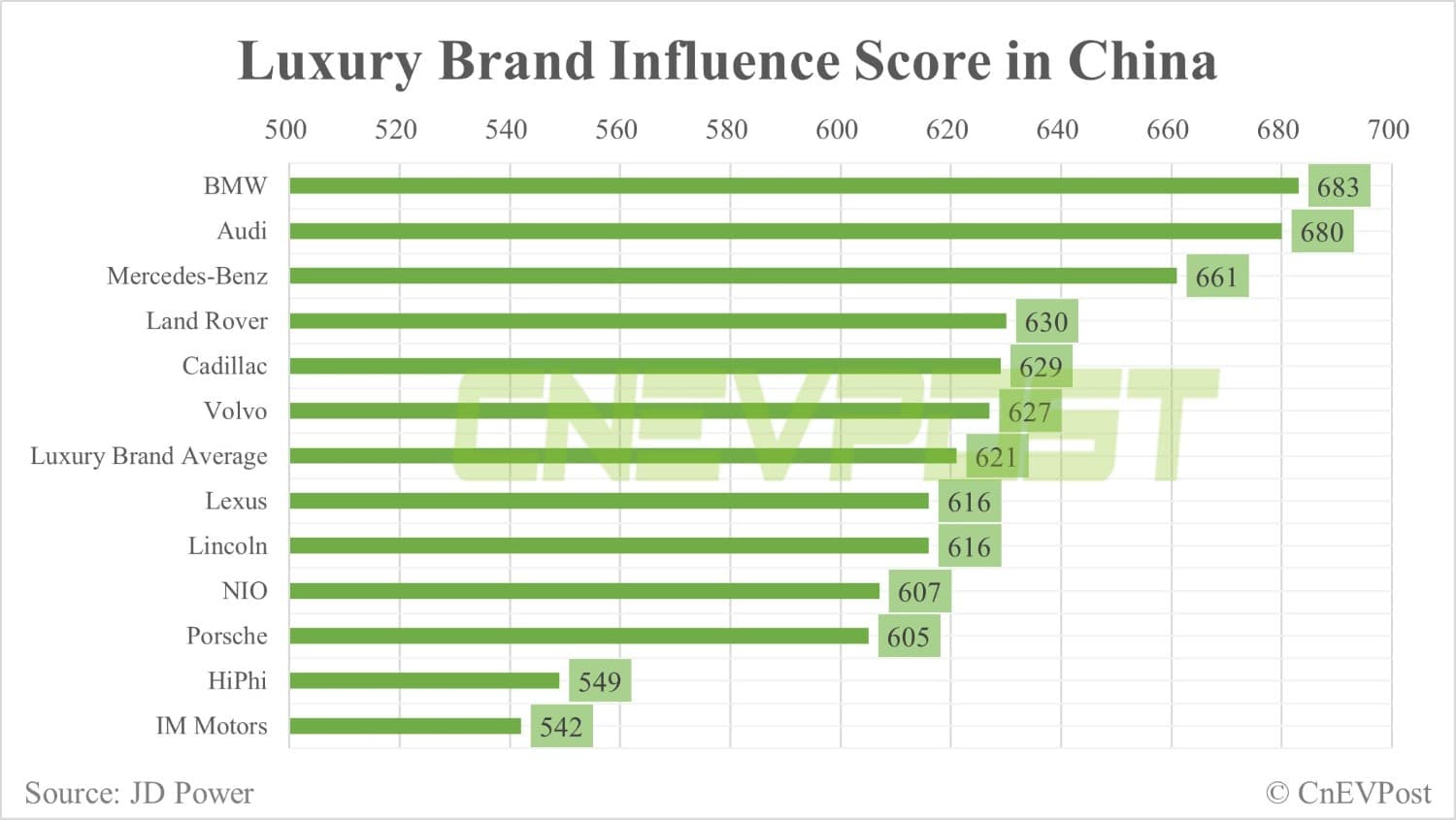

BMW, Audi and Mercedes-Benz had the highest luxury brand influence scores in the JD Power study, scoring 683, 680 and 661 out of a total of 1,000 points, respectively.

Nio ranked 10th with a score of 607, the highest score among local Chinese luxury brands and higher than Porsche's 605.

HiPhi and IM Motors are the other two brands that made it into this luxury brand ranking, with scores of 549 and 542, respectively.

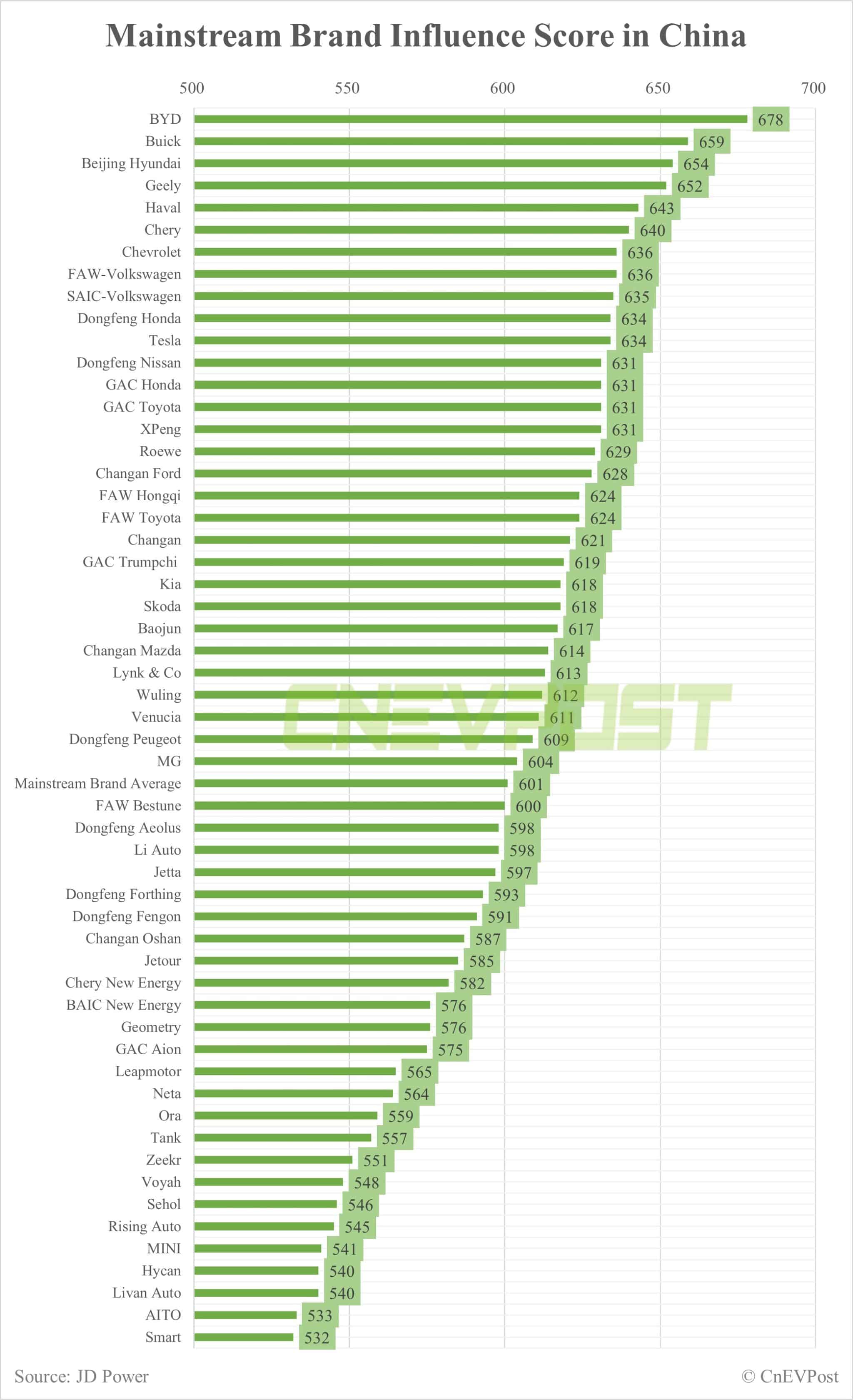

In the mainstream brand influence score, BYD ranked first with 678 points, Tesla 11th with 634 points, Xpeng 15th with 631 points, and Li Auto in 34th place with 598 points.

Full CPCA rankings: Top-selling models and automakers in China in Apr