CATL's lithium sharing program is not for price reduction purposes, but rather the company already owns some mineral resources and doesn't want to reap windfall profits, its management said.

Last month it was reported that CATL was pushing a lithium rebate program to electric vehicle (EV) makers to drive down the cost of battery purchases for a handful of customers. Now, for the first time, the power battery giant has acknowledged the move.

CATL's lithium-sharing program is not for the purpose of lowering prices, but rather the company already owns some mineral resources and doesn't want to reap windfall profits, its management said Thursday.

The company released its 2022 annual report Thursday and held an investor call afterward in which its management made those comments, according to a meeting minutes it released today.

CATL hopes to be able to share with long-term strategic customers and is moving forward with relevant communications, the company said.

On February 17, local media outlet 36kr first reported on CATL's plan, saying it was not for all customers, but for several strategic customers including Nio (NYSE: NIO), Li Auto (NASDAQ: LI), Huawei and Zeekr.

The core terms of the partnership include that CATL will settle a portion of the price of power battery supply with car companies at a rate of RMB 200,000 ($28,720) per ton of lithium carbonate for the next three years.

At the same time, automakers signing the partnership will be required to commit about 80 percent of their battery purchases to CATL, according to the report.

CATL did not confirm the report at the time, though Li Auto and Nio both mentioned the program in their respective subsequent earnings calls.

In response to the rumored new pricing arrangement, Li Auto and CATL were in negotiations, the EV maker said during an analyst call following the February 27 announcement of its fourth-quarter earnings.

Whether it's lithium price concessions or battery prices linked to raw materials, it would be good news if battery prices could be brought back to a rational range, Li Auto's management said.

Asked about the topic during a conference call on March 1, Nio's management said the company is also in the process of discussions with CATL.

"Of course, we will maintain a long-term strategic relationship with CATL, and we are discussing some new pricing mechanisms with them," said William Li, Nio founder, chairman and CEO.

Battery makers also recognize that they must share the price volatility of battery materials with car companies, Li said at the time.

Back at CATL, the company's annual report, released yesterday, showed it posted a 39 percent quarter-on-quarter increase in net profit in the fourth quarter and further improved gross margins to 22.57 percent.

CATL's management, when asked about the lithium industry overhaul in Yichun, Jiangxi, said it had essentially no impact on the company, and its projects there are moving forward as planned.

The overhaul is mainly aimed at correcting the chaos in local lithium mining, which is beneficial to compliant companies in the long run, CATL's management said.

In Yichun, nicknamed the "lithium capital of Asia," local lithium miners have shut down production for an industry-wide overhaul, Yicai reported on February 26.

Analysts fear that this may bring disruption to the lithium supply, thus halting the downward trend in lithium prices. But such fears have not materialized.

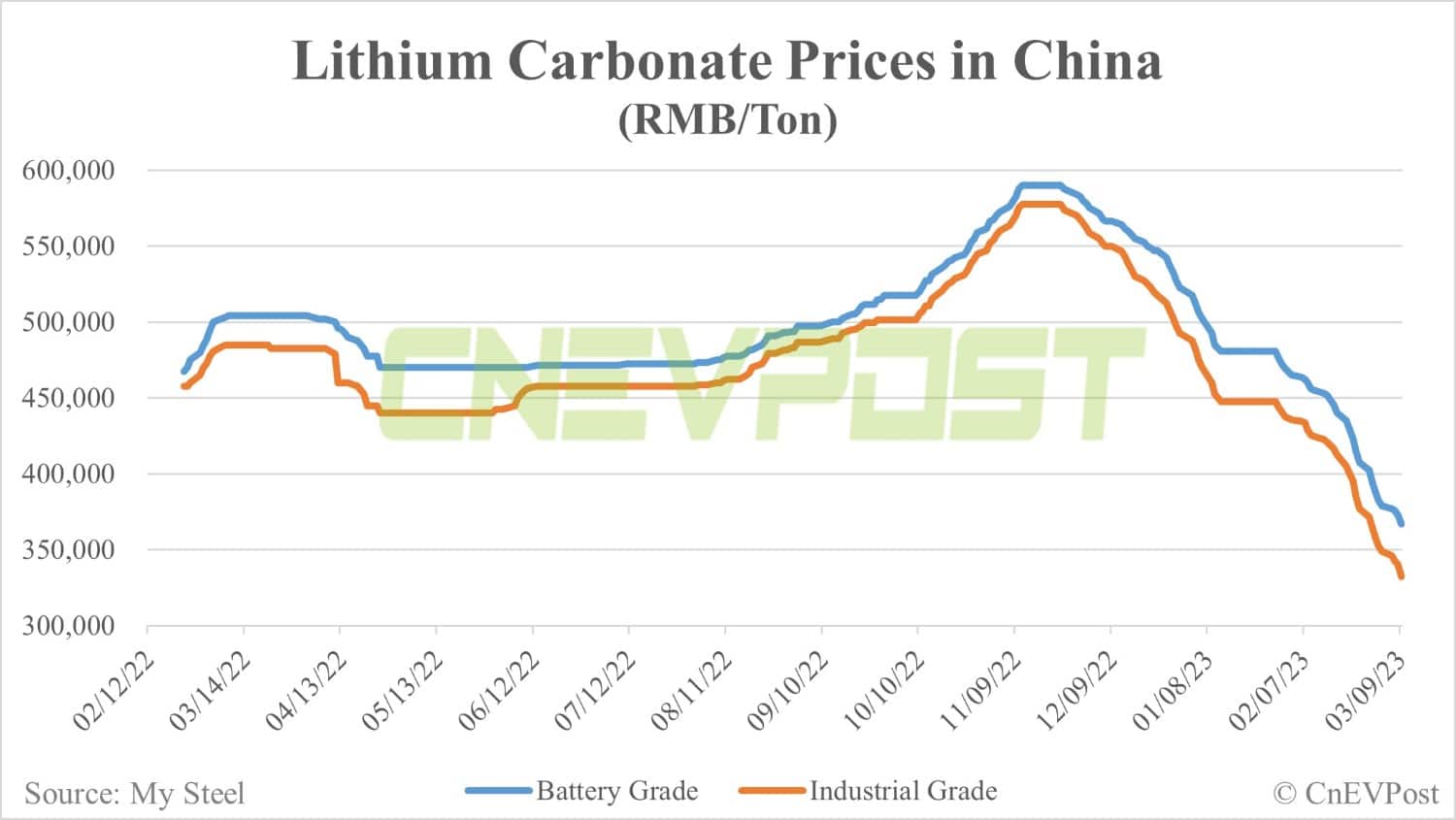

Lithium carbonate prices have continued to fall over the past two weeks, with battery-grade lithium carbonate falling to RMB 367,000 per ton on March 9 and industrial-grade lithium carbonate falling to RMB 332,500 per ton, both one-year lows.

($1 = RMB6.9643)