Authorities in Hubei province have joined forces with local automakers this month to offer subsidies for car purchases of up to RMB 90,000 yuan ($13,000) for some models.

(Dongfeng Citroen C6. Image from Dongfeng Citroen Weibo)

Some automakers in central China's Hubei province are offering significant subsidies for vehicle purchases, highlighting the pressure on China's auto industry following the withdrawal of some national support.

Authorities in Hubei province have joined forces with several local car companies this month to offer subsidies for consumer purchases of up to 90,000 yuan ($13,000) for some models, according to a report today by local media National Business Daily.

The first to participate are the Dongfeng Motor family of brands, including Dongfeng Honda, Dongfeng Nissan, Dongfeng Citroen, Dongfeng Peugeot and Dongfeng Aeolus, with the Dongfeng Citroen C6 offering a combined subsidy of up to RMB 90,000, according to the report.

After the Dongfeng family of brands, other car companies will also join the ranks of those offering subsidies, though the amount will be slightly lower, the report said.

A picture accompanying the report shows that several Dongfeng Honda models can receive subsidies of up to RMB 60,000. Of those subsidies, the automaker and the government each pay half.

The marketing campaign is only valid in March, and consumers need to buy the cars in Hubei and register the vehicle in the province, National Business Daily said, citing sales at a Dongfeng Citroen dealership store in Wuhan.

Models offering the biggest discounts, such as the Dongfeng Citroen C6, are already sold out, the salesperson said, adding that such models are not available for purchase with loans and that the subsidy amount needs to be obtained after the consumer has installed the license plate.

The Dongfeng Citroen C6 that can receive the RMB 90,000 subsidy is the version with a guide price of RMB 216,800, which means that consumers can buy the mid-size sedan for RMB 126,800.

The large subsidy from Hubei authorities and car companies is a strong move by them to change the sluggish sales situation, said Cui Dongshu, secretary-general of the China Passenger Car Association, as quoted in the report.

Automobiles are the No. 1 pillar industry in Hubei province, where the Wuhan Economic Development Zone, known as China's car valley, is home to eight car companies and 13 vehicle assembly plants.

Dongfeng Motor Group, the largest car company in Hubei, sold 2.15 million vehicles in 2022, down 4.4 percent from a year earlier.

Previously many other local governments in China only provided subsidies for new energy vehicle (NEV) consumption, such as Beijing and Shanghai. Hubei's approach is not quite the same, mostly likely because the local economy is less developed than the mega-cities and acceptance of NEVs is lower.

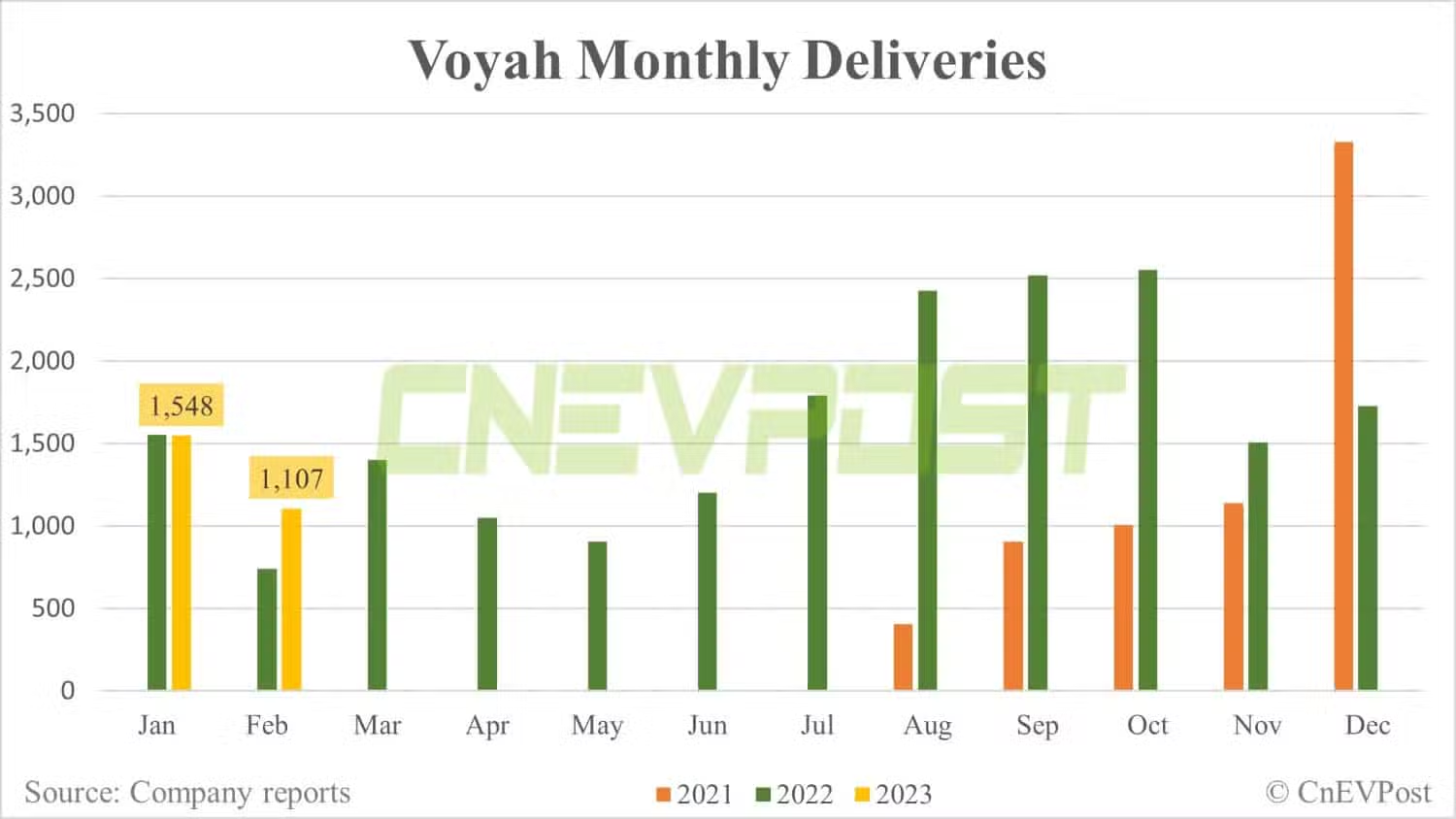

Dongfeng owns a premium EV brand called Voyah, though it has sold fewer than 2,000 units in the past few months, including 1,107 in February, according to data monitored by CnEVPost.

Voyah recently posted on its WeChat account that the purchase of the Voyah Dream MPV by March 31 will qualify for an RMB 40,000 subsidy from the local government.

These subsidies show the pressure the Chinese auto industry is facing after the withdrawal of some support policies.

China previously implemented several years of state subsidies for NEV purchases, which expired at the end of 2022 and were not renewed.

The country's purchase tax exemption for NEV purchases, which also was to have expired at the end of last year, has been renewed until the end of 2023.

In May 2022, China announced a 50 percent reduction in the purchase tax on passenger vehicles of 2.0 liters or less, purchased between June 1 and December 31 and costing no more than RMB 300,000.

Before the policy took effect, China had a 10 percent purchase tax rate on vehicles with only internal combustion engines. The policy was not renewed when it expired at the end of last year.

In the second half of last year, retail sales of all passenger vehicles in China were 13.2 million units, up 12.5 percent year-on-year, according to data from the CPCA monitored by CnEVPost.

Sales of passenger NEVs were 3.95 million units during the same period, up 79.42 percent year-on-year.

With the withdrawal of state-level support policies, the ICE vehicle market is under more pressure, thus dragging down the performance of the Chinese vehicle market.

In the first 2 months, retail sales of all passenger vehicles in China were 2.657 million units, down 21 percent year-on-year. Retail sales of passenger NEVs rose 23 percent to 770,000 units in the same period, according to data released earlier today by the CPCA.

(An image from National Business Daily shows discounts offered on a variety of Dongfeng Honda models.)

($1 = RMB 6.9344)