Li Auto guided for first-quarter deliveries of 52,000 to 55,000 vehicles, meaning it expects to deliver a total of 36,859 to 39,859 vehicles in February and March.

Li Auto (NASDAQ: LI) reported solid fourth-quarter results in which revenue came in slightly above analysts' expectations and gross margins saw a significant rebound.

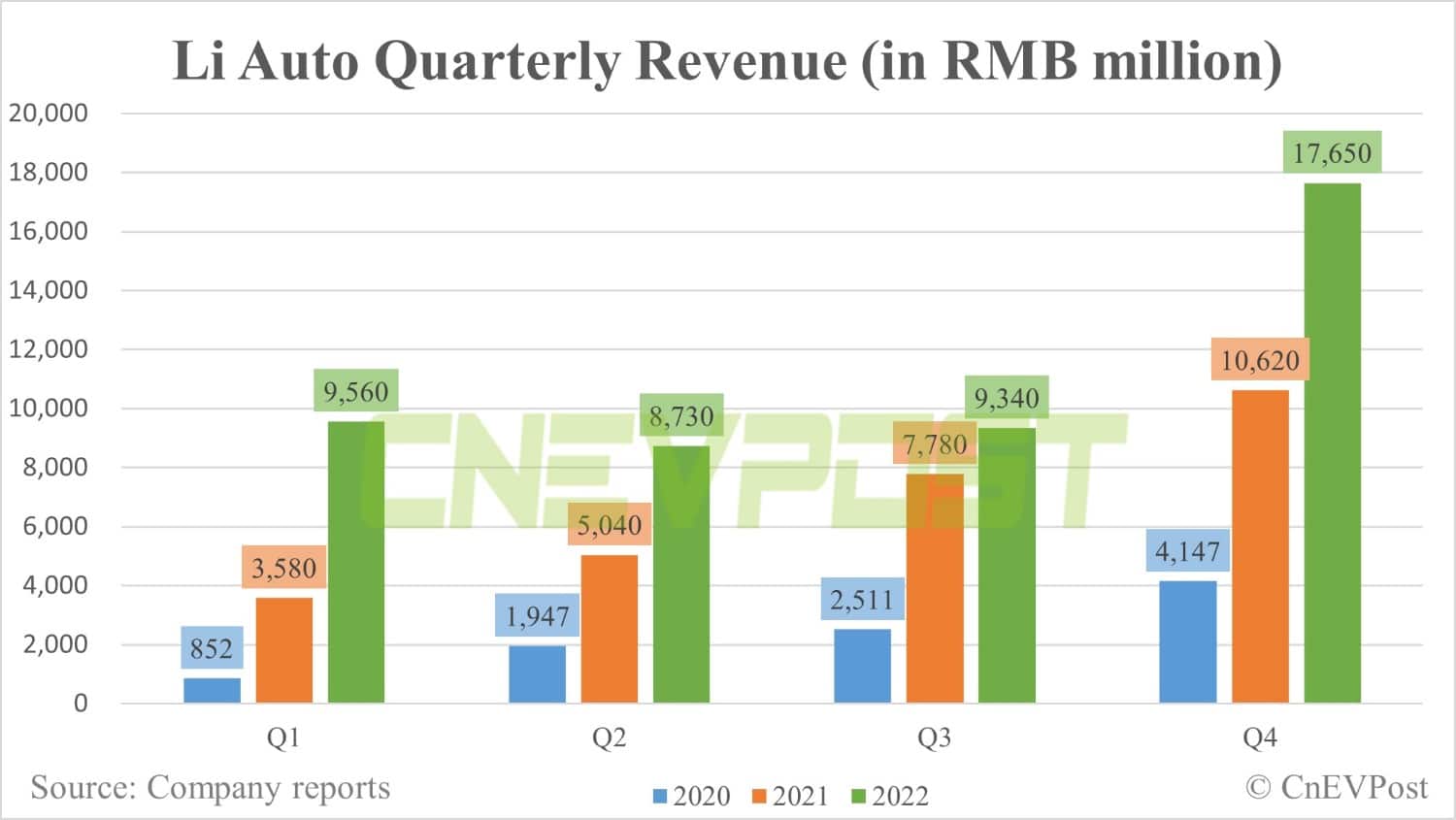

The company reported revenue of RMB 17.65 billion ($2.56 billion) in the fourth quarter, slightly above market expectations of RMB 17.622 billion, according to unaudited financial reports released today.

This was up 66.19 percent from RMB 10.62 billion in the same quarter last year and up 88.97 percent from RMB 9.34 billion in the third quarter.

Li Auto had previously released data showing it delivered 46,319 vehicles in the fourth quarter, within the guidance range of 45,000 to 48,000 vehicles. The company previously guided for fourth-quarter revenue of RMB 16.51 billion to RMB 17.61 billion.

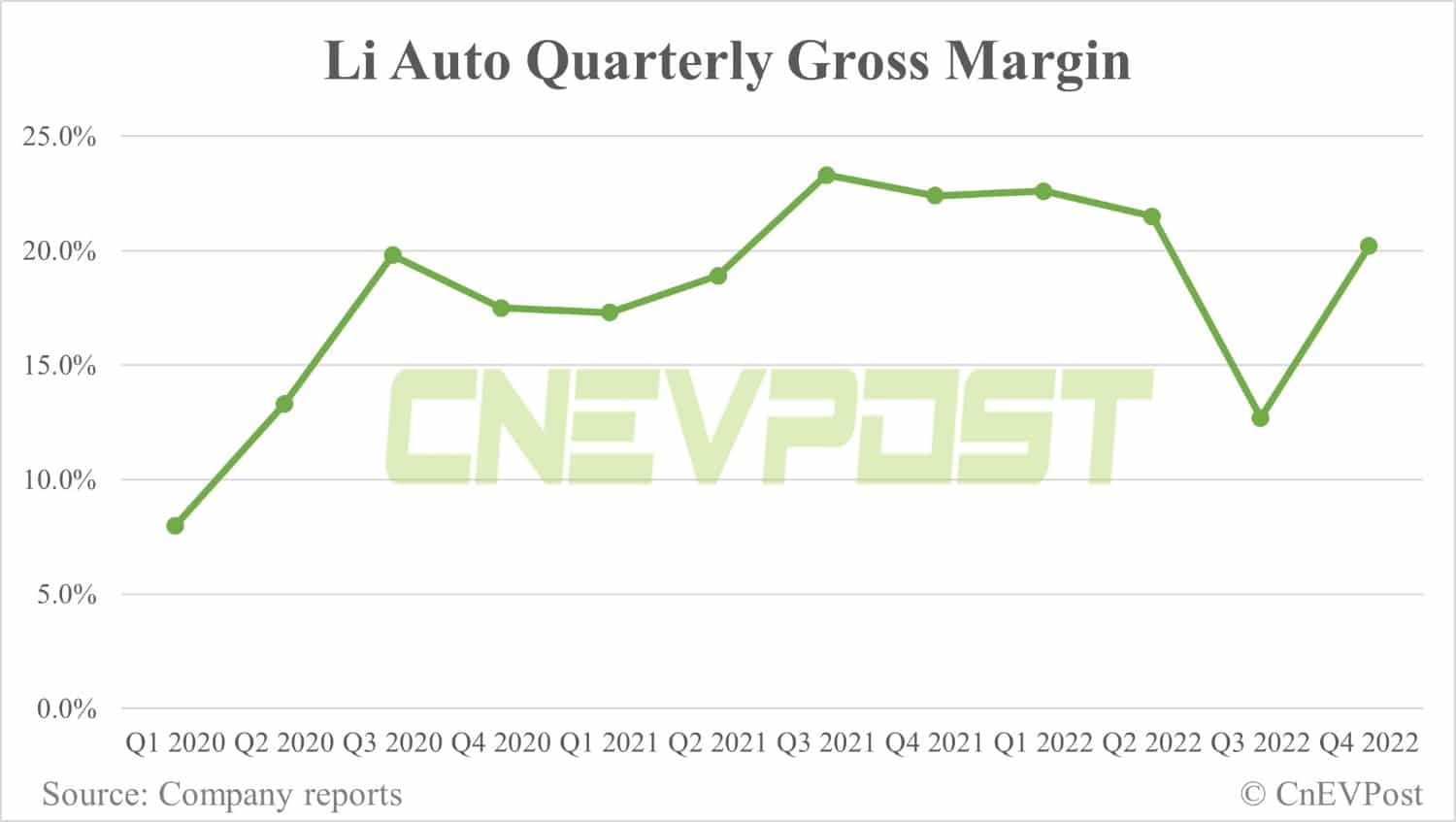

It reported a gross margin of 20.2 percent in the fourth quarter, a sharp rebound from 12.7 percent in the third quarter. Li Auto's accelerated phase-out of its first model, the Li ONE, in the third quarter severely hurt margins.

Li Auto's vehicle margin was 20 percent in the fourth quarter, down from 22.3 percent in the year-ago quarter but up from 12 percent in the third quarter.

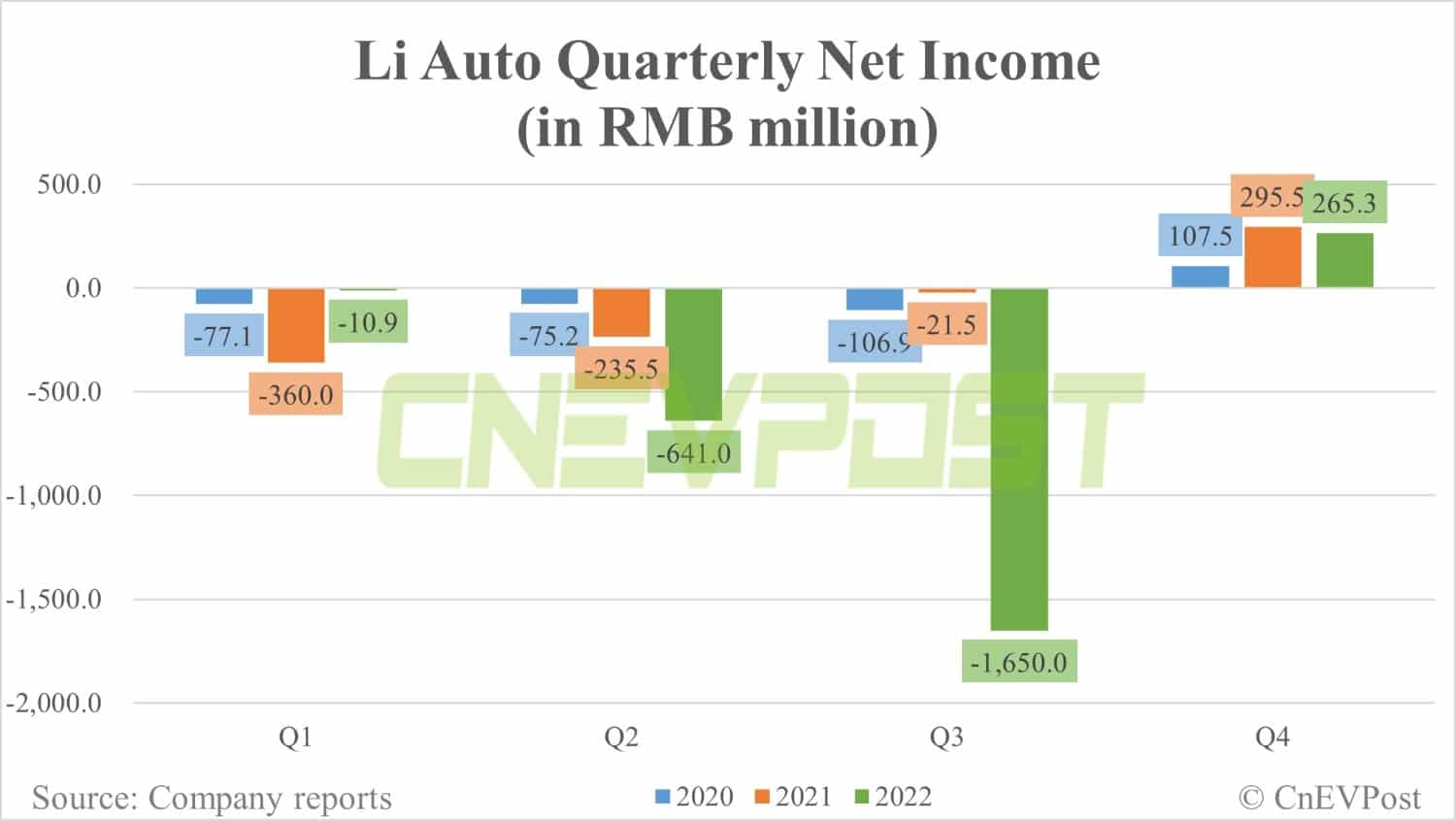

The company achieved a net income of RMB 265 million in the fourth quarter. For comparison, analysts expected it to report a net loss of RMB 111 million for the quarter.

Li Auto has seen net incomes in the fourth quarter in each of the past three years, including RMB 107.5 million in the fourth quarter of 2020 and RMB 296 million in the fourth quarter of 2021.

It reported non-GAAP net income of RMB 967.6 million in the fourth quarter, up 41 percent year-on-year. In the third quarter, it reported a non-GAAP net loss of RMB 1.24 billion.

Li Auto guided for deliveries of 52,000 to 55,000 vehicles in the first quarter, implying a year-on-year increase of 64.0 percent to 73.4 percent.

The company delivered 15,141 vehicles in January, and the guidance means it expects to deliver a total of 36,859 to 39,859 vehicles in February and March.

Li Auto's revenue guidance for the first quarter is RMB 17.45 billion to RMB 18.45 billion, implying a year-on-year increase of 82.5 percent to 93 percent.

The company spent RMB 2.07 billion on research and development in the fourth quarter, an increase of 68.3 percent year-on-year and 14.7 percent from the third quarter.

As of December 31, Li Auto's balance of cash and cash equivalents, restricted cash, time deposits and short-term investments was RMB 58.45 billion.

Li Auto announced on June 28, 2022 a planned at-the-market (ATM) stock offering on NASDAQ to sell up to a total of $2 billion in American Depositary Shares (ADSs), each representing two Class A ordinary shares of the company.

As of today, Li Auto has sold 9,431,282 ADSs representing 18,862,564 Class A ordinary shares under the ATM offering.

After deducting fees and commissions payable to the distribution agent of up to $4.8 million and certain other offering expenses, Li Auto raised total gross proceeds of $366.5 million.