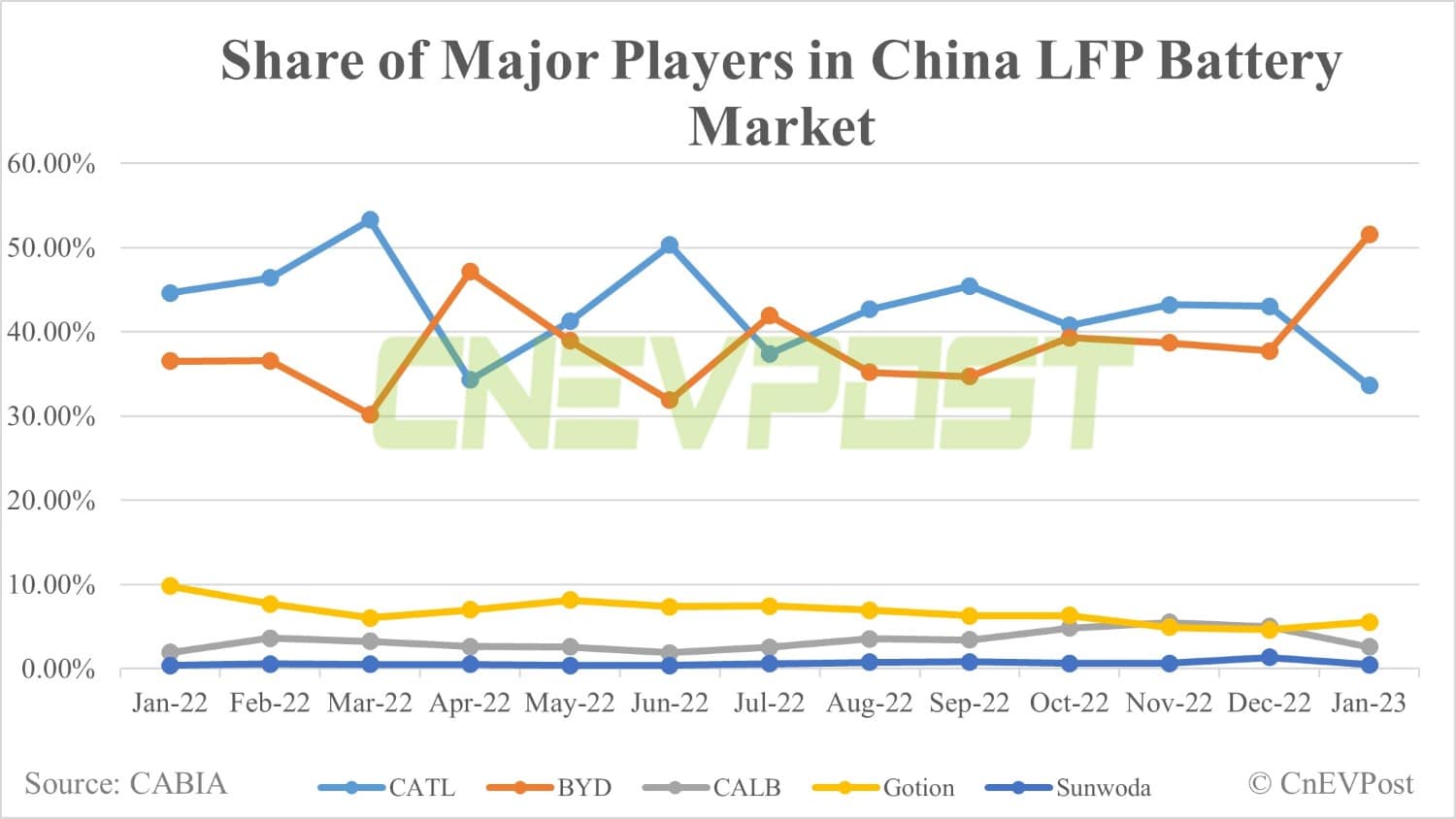

BYD overtook CATL in LFP market share again after six months, the last time being in July 2022.

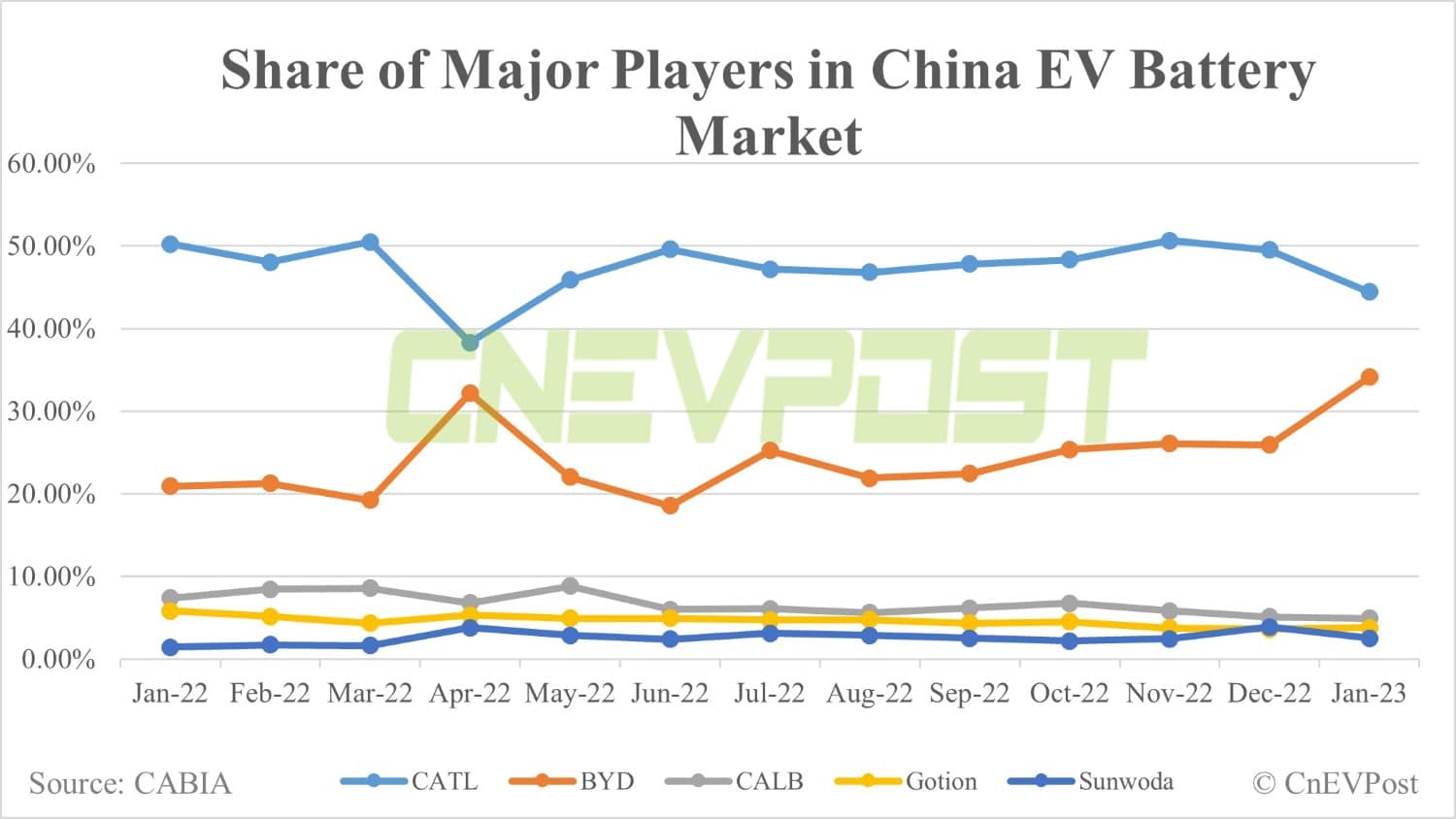

China's battery installations fell sharply in January compared to December, with the New Year holiday causing disruptions to EV makers' production. One notable point is that BYD (OTCMKTS: BYDDY) overtook CATL in the lithium iron phosphate (LFP) battery market share after a few months.

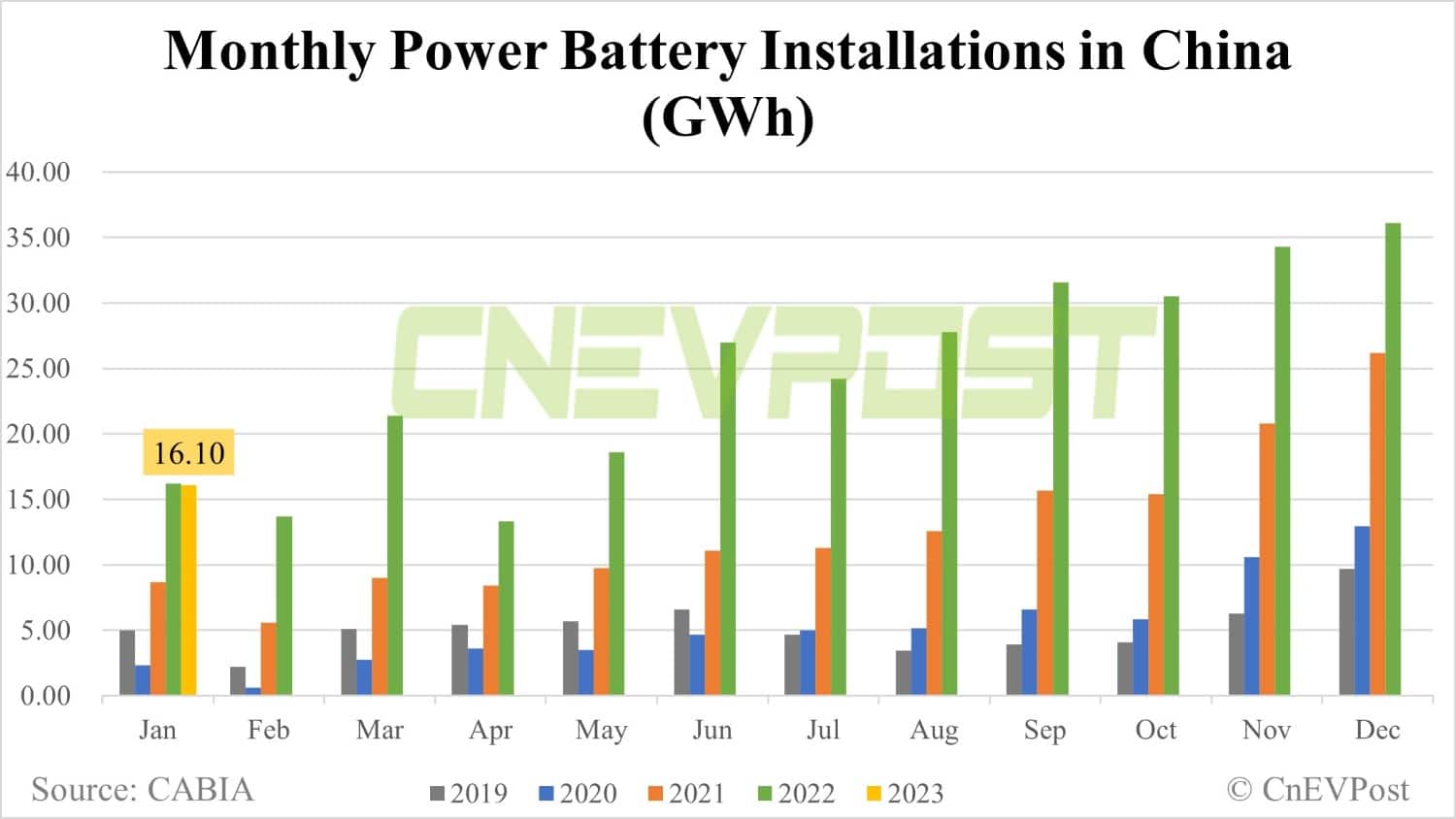

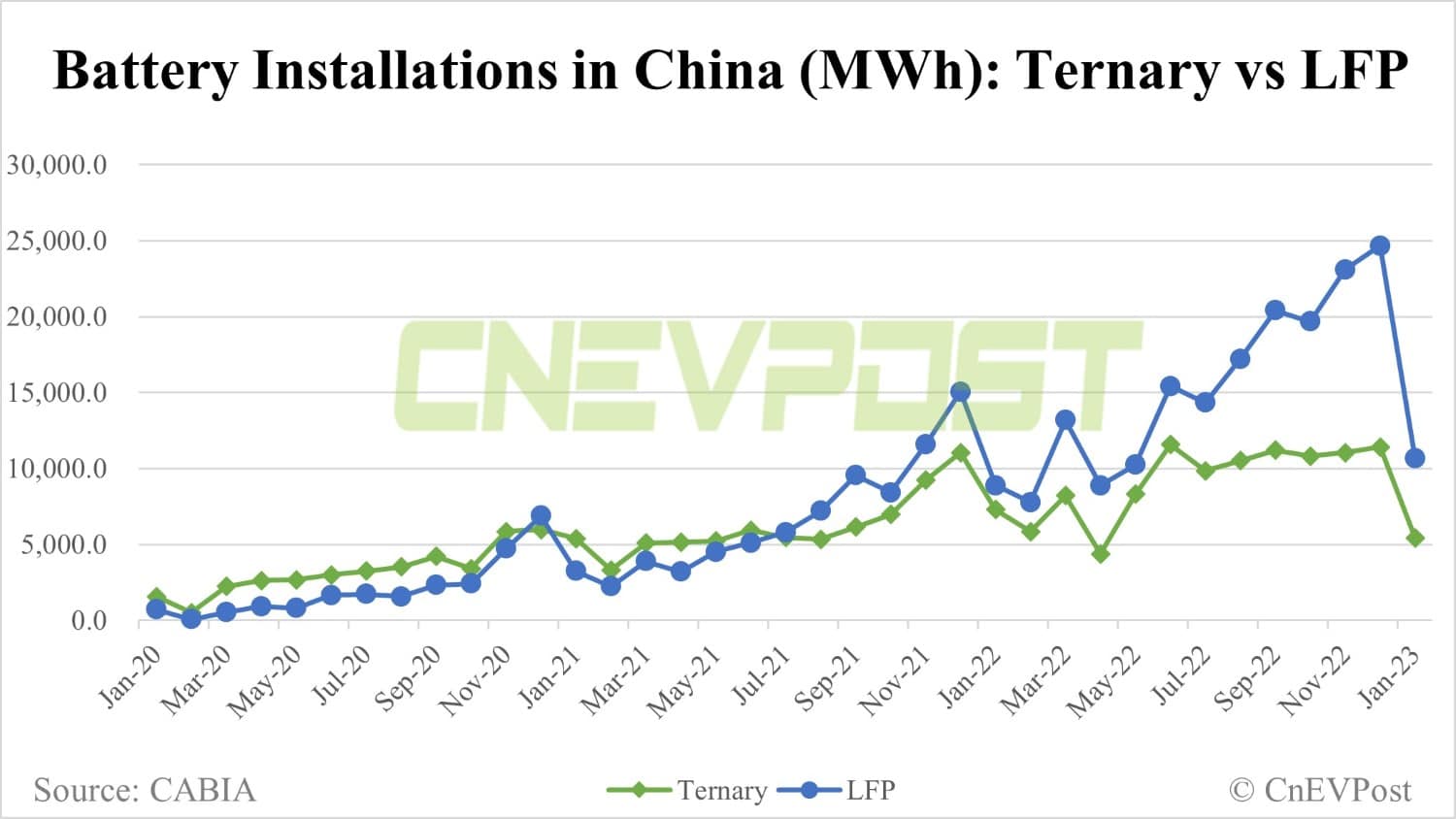

In January, China's installed power battery volume was 16.1 GWh, down 0.3 percent year-on-year and down 55.4 percent from 36.1 GWh in December, according to data released today by the China Automotive Battery Innovation Alliance (CABIA).

The installed base of ternary batteries was 5.4 GWh, accounting for 33.7 percent of the total, down 25.6 percent year-on-year and down 52.4 percent from December.

The installed base of LFP batteries was 10.7 GWh, accounting for 66.2 percent of the total, up 20.4 percent year-on-year but down 56.7 percent compared to December.

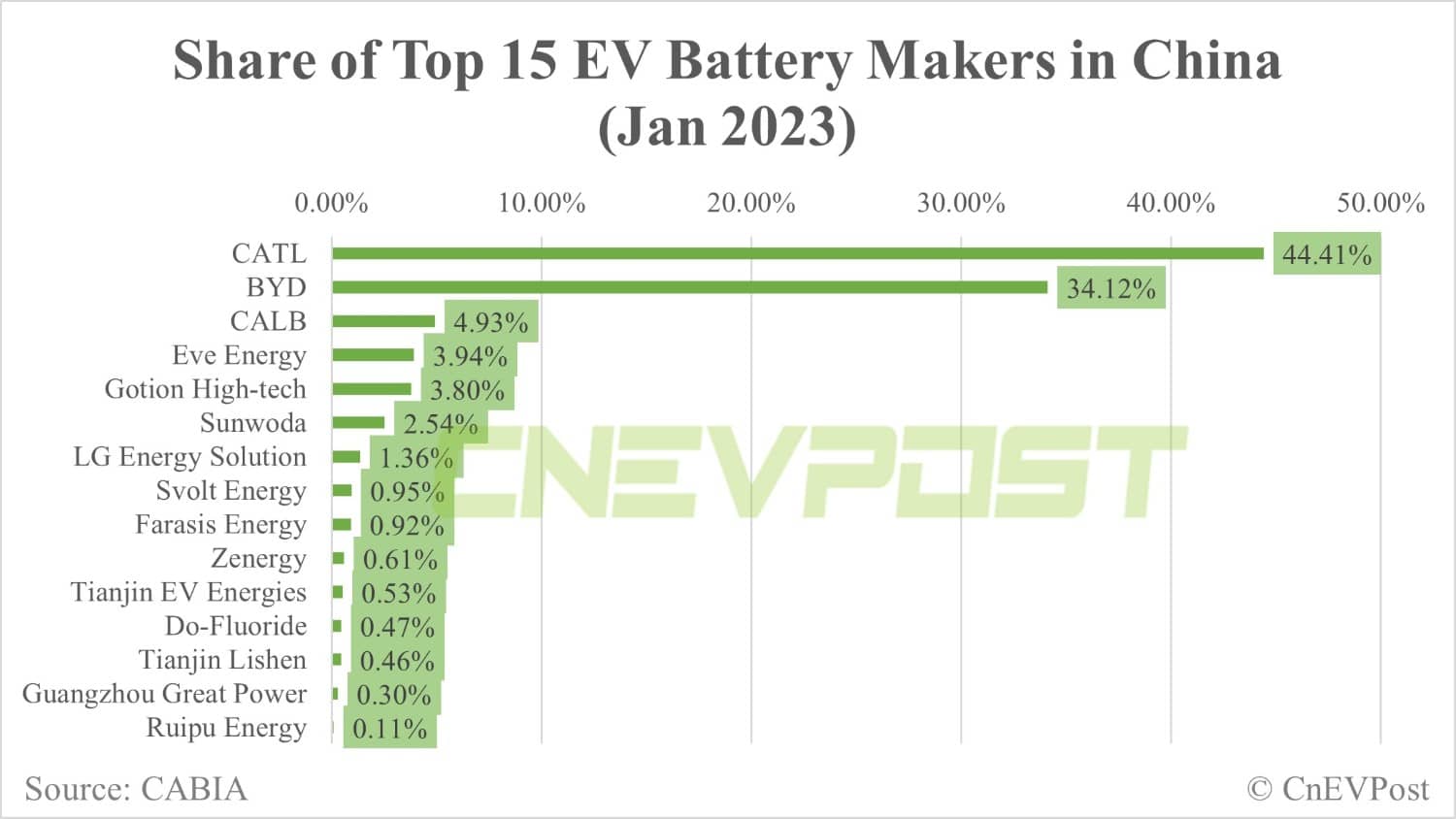

CATL's installed base of 7.17 GWh in January continued to rank first in China's power battery market with a 44.41 percent share, but lower than December's 49.49 percent.

BYD's power battery installed base in January was 5.51 GWh, ranking second with a 34.12 percent share, while CALB and Eve Energy ranked third and fourth with 4.93 percent and 3.94 percent shares respectively.

A notable change is that in the LFP market, BYD installed 5.50 GWh in January, ranking first with a 51.52 percent share.

CATL's installed base in the LFP market was 3.59 GWh in January, ranking second with a 33.63 percent share.

This means that BYD retook CATL as the largest player in the LFP market after six months. In April 2022, BYD overtook CATL in the LFP market for the first time and for the second time in July 2022.

BYD's batteries are mainly LFP products and are used mainly in the company's own new energy vehicle (NEV) models.

The company reported 151,341 NEV sales in January, up 62.44 percent from a year ago but down 35.65 percent from December, according to data released February 1.

BYD's installed power and storage battery capacity in January was about 8.148 GWh, up 70.82 percent from 4.770 GWh in the same month last year, but down 26.94 percent from 11.152 GWh in December, previous data showed.

In the ternary lithium market, CATL installed 3.57 GWh in January, ranking first with a 65.74 percent share.

CALB and Sunwoda ranked second and third in the ternary battery market with 9.56 percent and 6.62 percent shares, respectively.