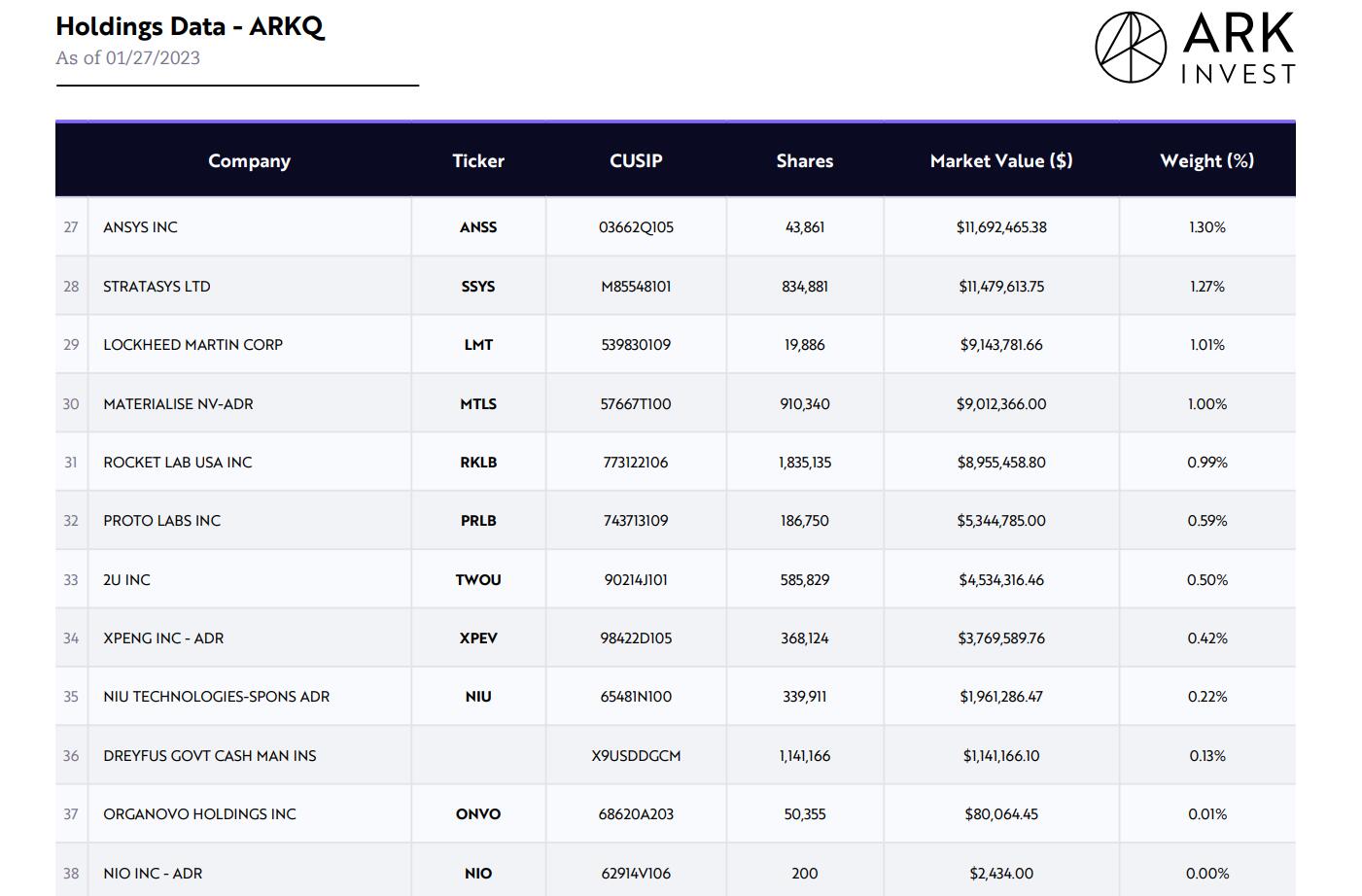

In the meantime, ARKQ has also sold its shares of Xpeng three times this month and now holds about $3.77 million worth of the company's stock.

Cathie Wood, one of the best-known US investors, reduced her position in Nio (NYSE: NIO) to close to zero after first buying it 10 months ago.

The ARK Autonomous Tech. & Robotics ETF (ARKQ), managed by Wood's ARK Invest, reduced its position in Nio for the third straight time this week on Friday, to just 200 shares, its daily trading records show.

As of January 27, ARKQ's holdings in Nio were valued at $2,434, the lowest of its holdings disclosed in the ETF.

On March 25, 2022, amid a broad decline in US-listed Chinese companies, ARKQ bought 420,057 shares of Nio, worth about $8.4 million, which at the time represented 0.5 percent of the ETF's total position.

It was the first time a Wood-managed fund bought Nio shares, with the average cost of the position at about $20 a share.

The move comes on the heels of ARK Invest's large holdings in Tesla and its purchases of shares of Nio's local peers BYD (OTCMKTS: BYDDY) and Xpeng (NYSE: XPEV).

On January 17, ARKQ sold 325,795 shares of Nio stock, the first time we've seen the ETF reduce its position in the Chinese electric vehicle company. Based on that day's closing price of $11.41, ARKQ sold off about $3.7 million worth of Nio stock.

On January 23, ARKQ sold another 5,167 shares of Nio stock.

ARKQ's selling of Nio shares paused for one day on January 24, then continued for three consecutive days, selling 1,400 shares, 300 shares and 100 shares from January 25 to January 27, respectively.

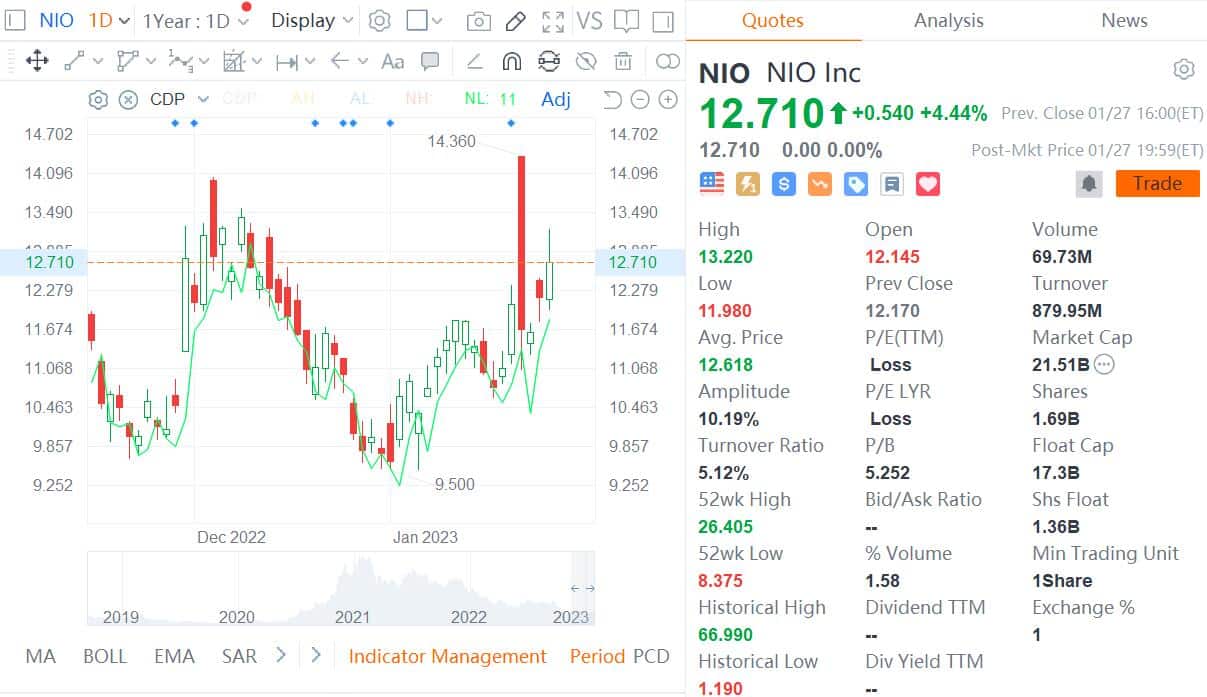

Notably, Nio shares traded in the US rebounded during the month.

As of Friday's close, Nio rose 4.44 percent to $12.71, accumulating a 30.36 percent gain this month. Since January 17, Nio has gained 7.71 percent.

In addition to selling Nio, ARKQ sold Xpeng shares three times this month, selling 169,472 shares on January 6, 111,173 shares on January 9 and 339,543 shares on January 10.

As of January 27, ARKQ held 368,124 shares of Xpeng worth about $3.77 million, or 0.42 percent of the ETF's total position.