As a beneficiary of the current era and an industry leader, CATL has a responsibility to maintain a good industry ecology, not bully the weak, Ren Zeping said.

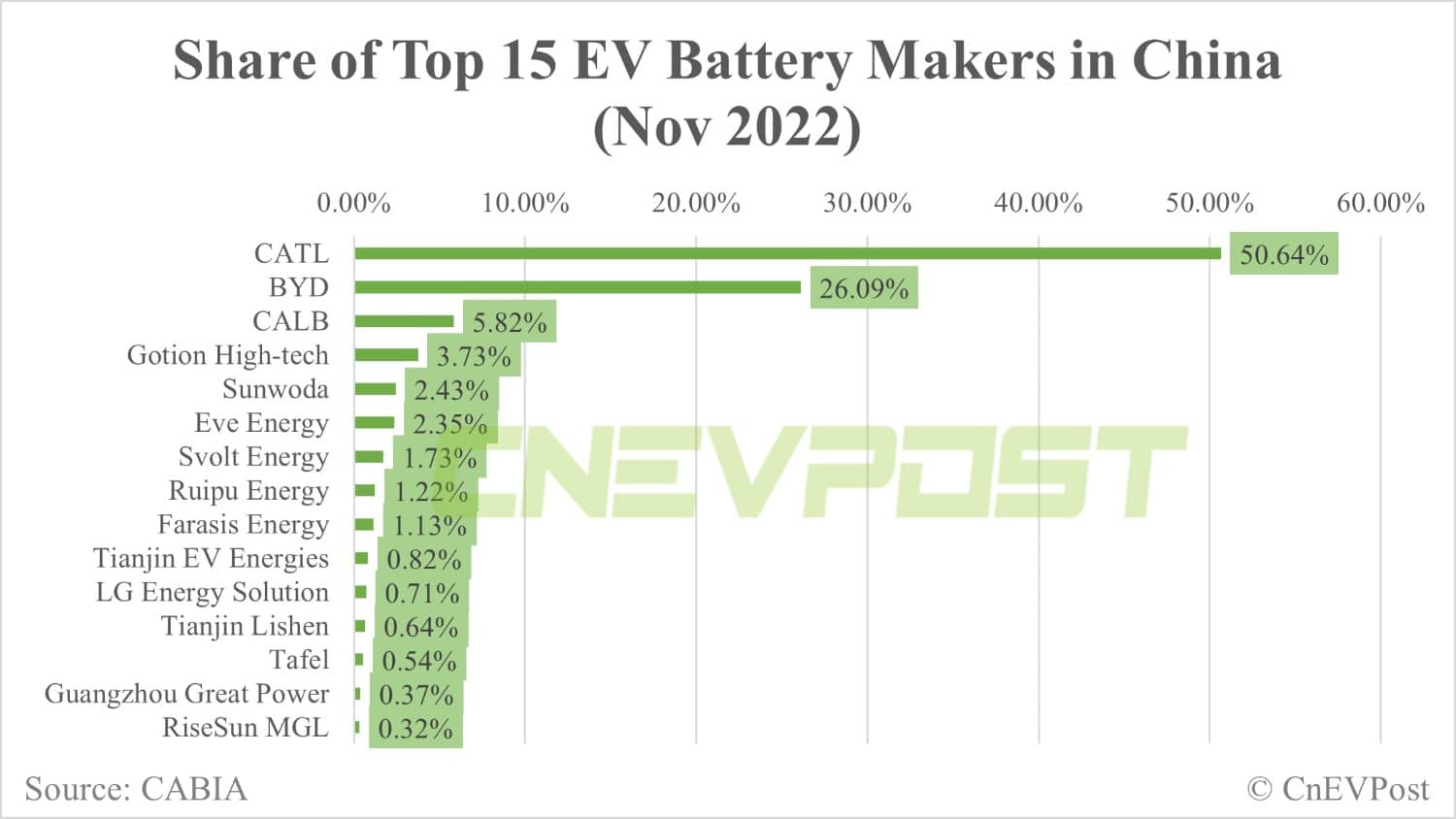

There has been previous discussion about whether CATL, which has a 50 percent share of China's power battery market, has used its market position to suppress its rivals and partners. Now, a prominent economist's attack on the battery maker has brought the topic back into the spotlight.

"CATL has waged war on all sides in recent years, raising widespread concern. The company is suppressing competitors, coercing car companies and squeezing profits upstream and downstream," Chinese economist Ren Zeping said in an article posted to Weibo today.

CATL has gone from being an early leader and contributor of innovation to an industry monopolist and even a destroyer of the market's fair competitive ecology, a regrettable metamorphosis, the article said.

China's new energy industry has seen explosive growth in recent years, the result of a combination of the technology revolution, long-term support from national policy, innovation by scientists, and hard work by entrepreneurs, and CATL should not take the credit for it, said Ren.

As a beneficiary of the times and a leader in the industry, CATL has a responsibility to maintain a good industry ecology rather than bullying the weak, he said.

"To be the leader, you have to behave like a leader, with the pattern and mind of a leader, which is what CATL lacks at the moment and I hope it will improve," the article reads.

Ren suggested that Chinese society, as well as regulators, focus on two key questions: Is CATL involved in using controversial patents to suppress competitors? Is the company involved in monopoly and unfair competition, using its position in the industry to suppress competitors and using tactics to coerce downstream new energy vehicle (NEV) companies?

Recently, some media and institutions said that CATL used uninnovative patents to maliciously suppress its peers, contrary to the legislative purpose of patent law to promote scientific and technological progress and economic and social development, the article noted.

On December 29, 2022, CALB formally sued CATL for unfair competition by abusing its patent rights, and the industry speculated that the company should have substantial evidence, the article said.

Ren said he supports the resistance of the companies, including CALB, from the perspective of the long-term health of the market economy.

The market economy is the main way to allocate resources, and if individual companies do not think ahead but try to suppress their competitors by unfair means, this is certainly against the basic bottom line of the market economy, said Ren.

He also mentioned that CATL has about a 50 percent share of the Chinese lithium battery market, which is equal to the sum of all other competitors. If BYD's 20 percent share is taken out, the combined share of other lithium battery makers is just over 20 percent.

Given the shortage of batteries, will CATL coerce downstream NEV companies to exclusively choose its batteries? Is there a squeeze on the profits of vehicle companies and component suppliers? The article asks.

CATL is monopolizing and undermining fair competition in the market if it is doing these things, said Ren.

Ren previously worked as a chief macro analyst at Guotai Junan and chief economist at Evergrande Group. He is currently an independent economist and has set up his own studio.

(Ren Zeping. Image from his Weibo)

CATL continued to rank as China's largest power battery maker with a 50.64 percent share in November 2022 with 17.35 GWh of installed power battery capacity, according to data released by the China Automotive Battery Innovation Alliance (CABIA) on December 9. The December figures are not yet available.

From July to September 2021, CATL sued CALB for patent infringement and claimed RMB 185 million.

In May 2022, the company raised the amount to RMB 518 million. On August 1, CATL filed an infringement lawsuit against CALB for another patent with a claim amount of RMB 130 million.

On November 30, CALB said it received a judgment on November 29, ruling that it should stop selling products that infringe CATL's invention patent.

The company also had to compensate CATL about RMB 2.63 million ($368,000) and pay RMB 127,500 for the temporary protection period of the invention patent, as well as RMB 200,000 for CATL's reasonable expenses within 15 days from the date of the judgment.

CALB said that its products have adopted more advanced technology, which is completely different from the earlier technology patented in the lawsuit, and that its existing products will not be discontinued.

In addition to that dispute, in early November, there were media reports that CATL had entered into numerous restrictive clauses with the car companies it partnered with in order to maintain its position as the industry's leader.

In its partnership with Li Auto, CATL restricted the company from choosing other battery suppliers, and if violated, CATL will stop supplying, according to these reports.

On November 4, Securities Daily cited CATL's response that the reports were untrue. Li Auto also said that the company's cooperation with CATL was deepening and that the media reports were rumors.