The CPCA did not release preliminary sales figures for NEVs in December. Previous figures showed the CPCA expected the figure to be around 700,000 units.

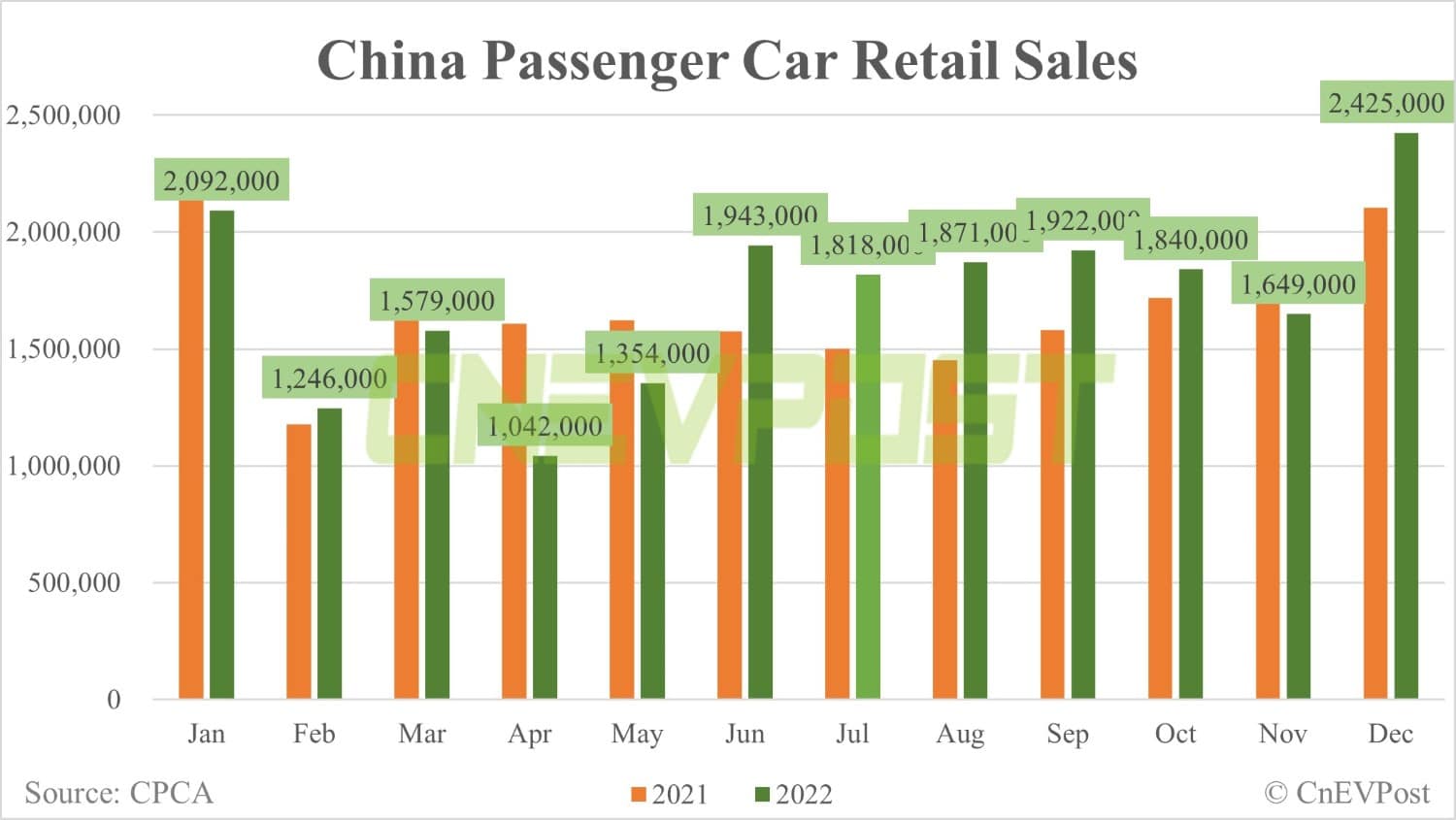

China's December retail passenger vehicle sales were 2.425 million units, up 15 percent year-on-year and up 47 percent from November, preliminary figures released today by the China Passenger Car Association (CPCA) show.

With the expiration of the halving of the purchase tax on internal combustion engine vehicles and new energy vehicle (NEV) purchase subsidies at the end of 2022, consumers were bringing forward their purchases, allowing demand that was suppressed in November to be released in mid- to late-December, the CPCA said.

Chinese passenger vehicle retail sales saw weekly increases in December, with daily sales averaging 30,000, 54,000, 77,000, 91,000 and 125,000 units from the first week to the fifth week, according to the CPCA.

For the full year, preliminary data show that 20.7 million passenger cars were sold at retail in China in 2022, up 1.8 percent from 20.15 million in 2021, the CPCA said.

At wholesale, China's passenger vehicle sales were 2.273 million units in December, down 4 percent from a year earlier but up 12 percent from November, according to the CPCA preliminary data.

During the five weeks of December, daily wholesale sales averaged 30,000, 50,000, 68,000, 68,000 and 141,000 units, respectively.

In 2022, China's wholesale passenger vehicle sales are expected to be 23.2 million units, up 10 percent from 21.1 million units in 2021, the CPCA said.

The CPCA did not release preliminary sales figures for NEVs in December, but said they are on track for a record high.

On December 23, the CPCA released estimated figures showing that retail sales of NEVs in China are expected to be around 700,000 units in December, a record high.

Before China's purchase subsidies for NEVs expire, car companies were taking a lot of measures to digest inventories as quickly as possible to get the last of the subsidies, the CPCA noted.

The withdrawal of the NEV subsidies is significant and will prompt car companies to focus more on the market itself, the CPCA said.

With lower market expectations for growth in the NEV industry, coupled with ample supply from battery and mineral investments, prices for resource products are expected to decrease, according to the CPCA.

Lithium carbonate prices have now dropped to below RMB 400,000 per ton in the futures market, and battery costs will fall significantly in the coming months, helping to improve the profitability of automakers, the CPCA said.