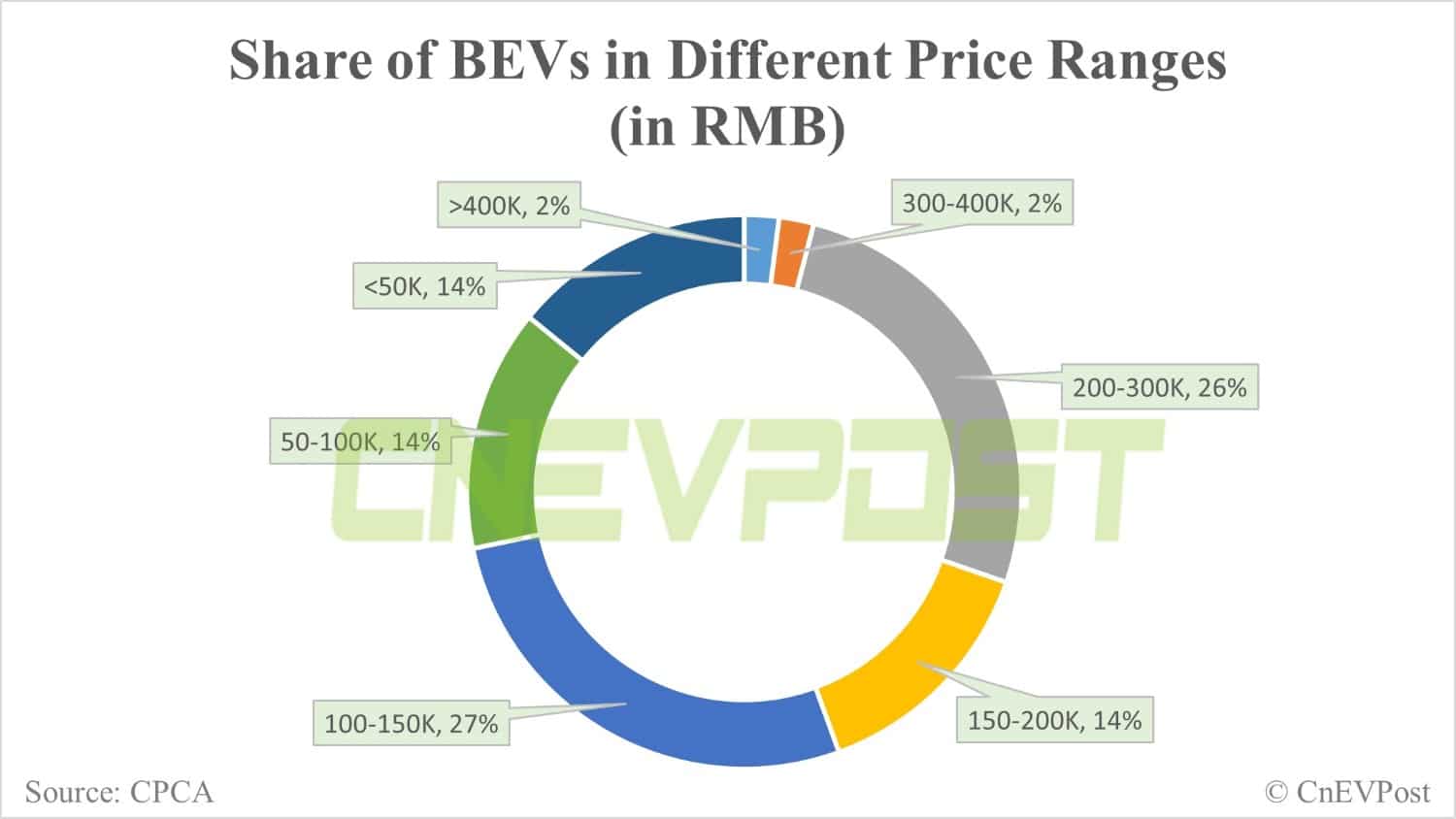

Models in the RMB 100,000-300,000 price range contributed 67 percent of BEV sales in China in September.

Many people know that budget vehicles contribute the majority of China's battery electric vehicle (BEV) sales, but what does that picture really look like? The latest data provides the answer.

In September, the best-selling BEVs in China were in the price range of RMB 100,000 ($13,890) - 150,000, and they contributed 27 percent of all BEV sales, according to data shared today by the China Passenger Car Association (CPCA).

BEVs in the price range of RMB 200,000-300,000 came in second with a 26 percent share, according to the data.

BEVs in the RMB 150,000 - 200,000 range, which is midway between the above two price ranges, contributed 14 percent.

This means that models in the price range of RMB 100,000-300,000 contributed 67 percent of BEV sales in China in September.

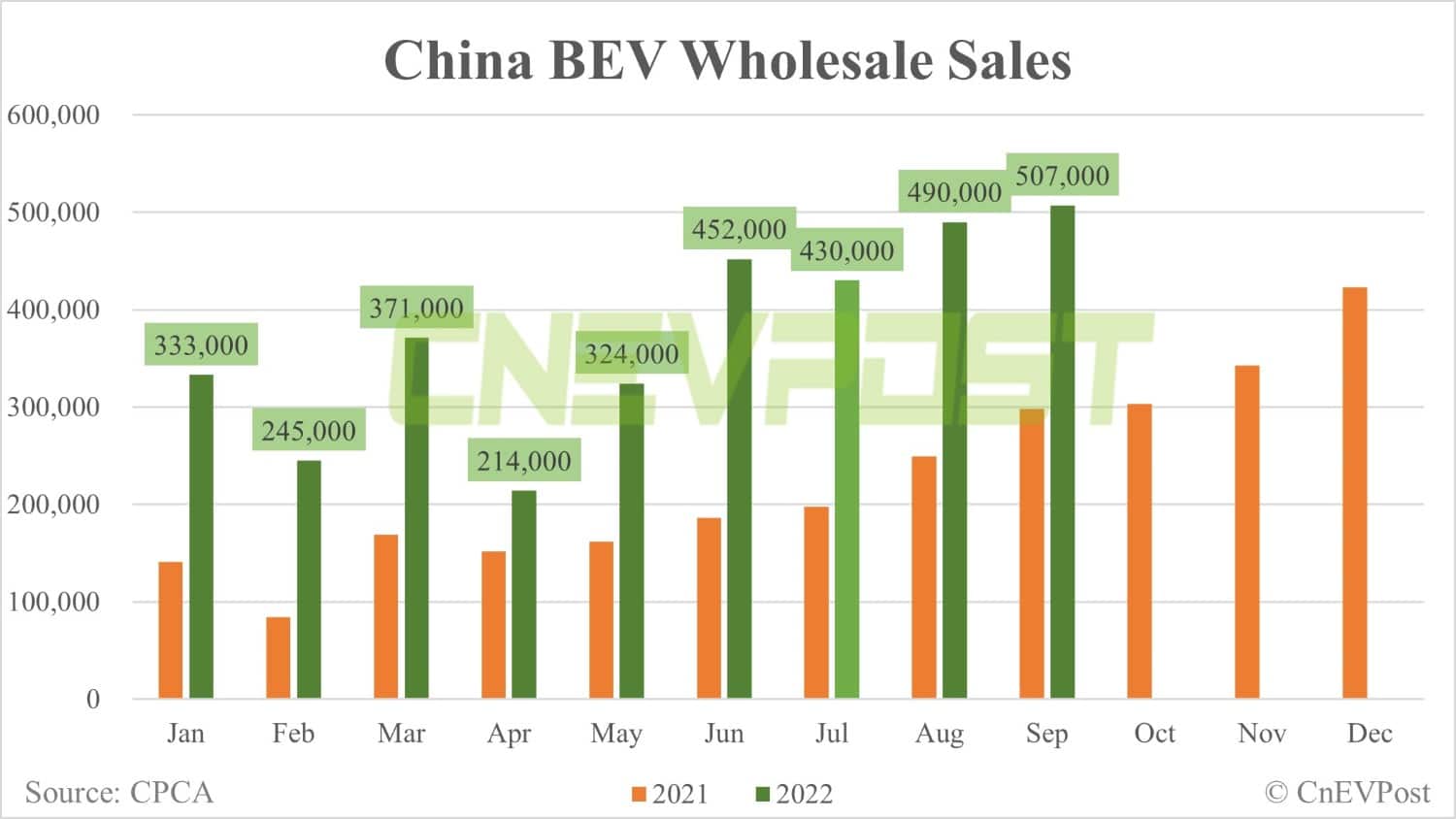

China's wholesale sales of new energy passenger vehicles reached a record 675,000 units in September, 75.1 percent of which were BEVs, or 507,000 units, according to data released earlier this month by the CPCA.

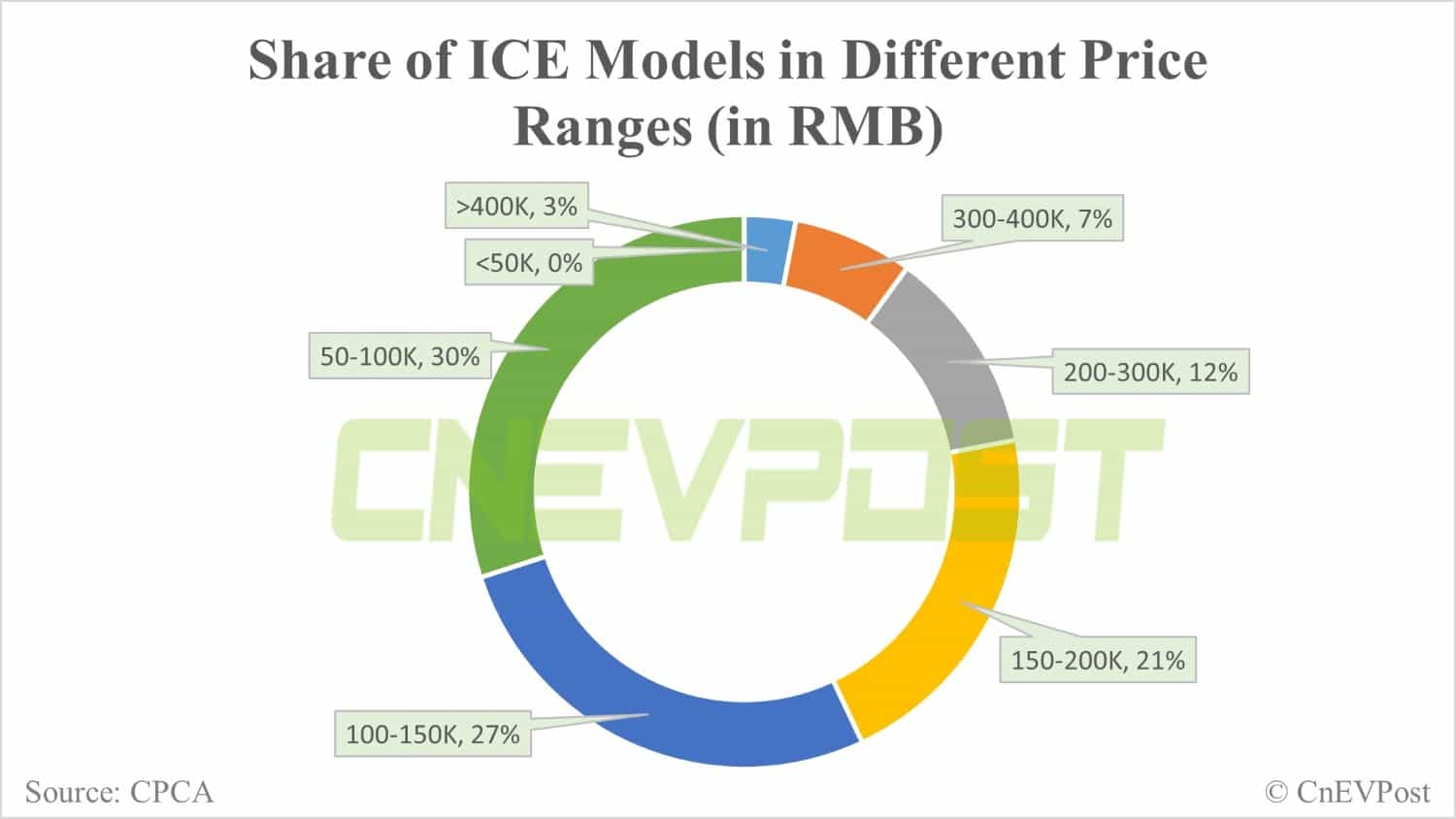

For internal combustion engine (ICE) vehicles, it's a completely different picture, where the lower the price, the higher the sales contribution.

ICE vehicles in the price range of RMB 50,000-100,000 contributed 30 percent of sales in September, 27 percent for the RMB 100,000-150,000 range and 21 percent for RMB 150,000-200,000, according to the CPCA.

What do these two charts mean?

The sales structure of ICE vehicles in different price ranges means that for such vehicles, the lower the price the larger the consumer base.

But for the BEV market, this is not the case.

While the lower-priced BEVs contribute some sales, that contribution is significantly smaller than that of their ICE counterparts.

With the advent of the electric vehicle era, the Chinese public is increasingly attracted to, and willing to pay for, models in the middle of the price band, rather than only for those at the lower end.

This could also explain why Nio is launching a new brand in addition to the Nio brand. The company is currently building a sub-brand under the internal code name ALPS, and is rumored to be working on a third brand that could be even less expensive.