As Nio's existing model matrix continues to improve and the sub-brand allows further sales growth, Nio's annual sales are expected to reach the 1-million-unit level by 2025, the team said.

(Image credit: CnEVPost)

China-based brokerage firm Soochow Securities initiated coverage on Nio (NYSE: NIO, HKG: 9866) with a Buy rating on the company, bullish on its potential to reach 1 million sales by 2025.

Given Nio's hardware leadership in its products and the barriers it has gained in marketing, the company is expected to see further growth in sales, analyst Zeng Duohong's team said in a research note on Wednesday.

Nio has a comprehensive layout of core technologies, including in-house developed software, and full-stack closed-loop capabilities on hardware, which is expected to increase its autonomy in building products, the team said.

Nio's development and production of powertrain through in-house efforts will enable it to achieve technology iteration and supply chain stability, according to the team.

In terms of marketing, Nio has enhanced its brand image through online channels, including the app, and offline channels, including the Nio House, and has allowed users to help it build the brand together, according to the team.

Nio Power has built an energy service system that can be charged, can battery swap, and can allow battery upgrades. The BaaS body and battery separation model solves mileage anxiety and forms a closed-loop service system, according to the team.

Nio's ES and ET series models cover the field of luxury electric SUVs and sedans, with a comprehensive product matrix layout, the team noted.

Its SUV series of ES8, ES6, EC6 models and the upcoming new car ES7 focus on the luxury electric market above RMB 300,000 and improve brand power with excellent services.

The ET sedan series is based on the new NT 2.0 platform with comprehensive software and hardware upgrades to complement the product matrix, the team said.

The ET7 and ET5 sedans go on sale in 2022, while consumers who choose to lease the battery when purchasing the ET5 will have a starting price below RMB 300,000, which will help sales keep rising, the team said.

Considering that Nio's existing brand's luxury model matrix continues to improve, sales are expected to continue to move upward, while it plans to launch a sub-brand positioned at a cost-effective price, which will further open up sales space, the team said, adding that they expect Nio's annual sales to reach the level of 1 million units in 2025.

Soochow Securities expects Nio's revenue to be RMB57.3 billion, RMB89.6 billion and RMB144.2 billion in 2022-2024, with year-on-year growth rates of 58.44 percent, 56.56 percent and 60.88 percent, respectively.

Benefiting from the booming development of NEVs and potential market share gains, the team expects Nio's sales to maintain high double-digit growth.

They expect Nio's gross margins to be 18.46 percent, 19.64 percent and 20.91 percent in 2022-2024, respectively. The biggest improvement in gross margins for the vehicle business will be driven by the scale effect from the growth in vehicle sales.

Soochow Securities gave Nio a Buy rating without a specific price target, but said they expect Nio's PS valuation to be 2.84x, 1.81x and 1.13x in 2022-2024, respectively.

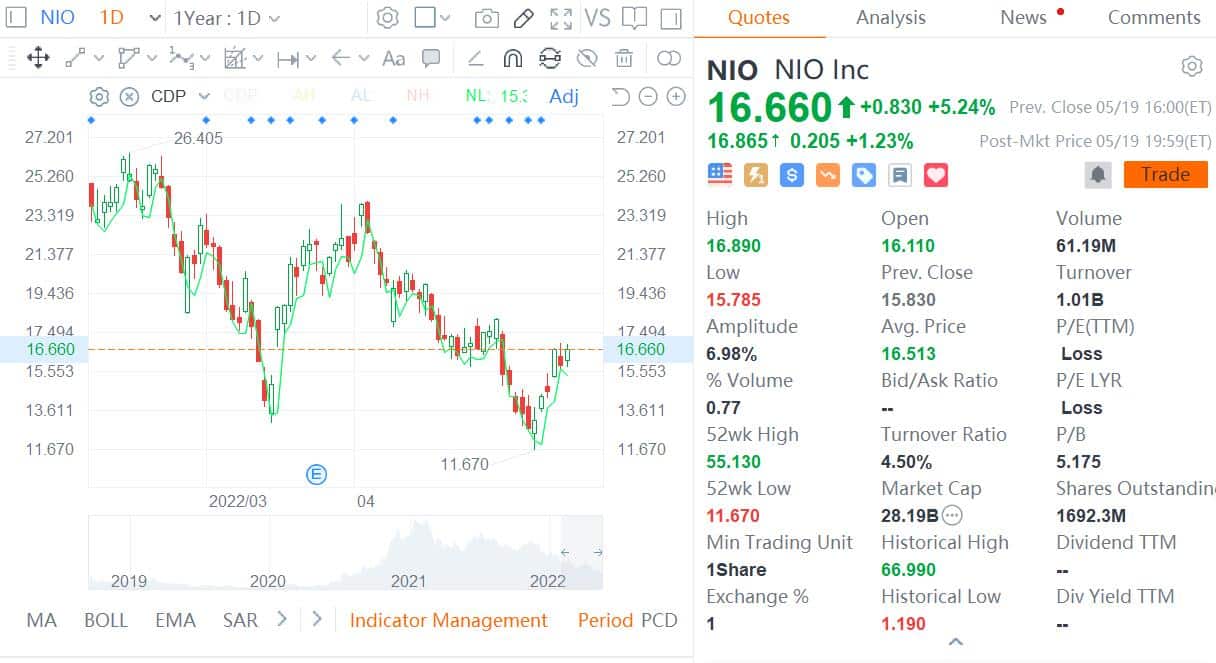

Nio closed up 5.24 percent in the US on Thursday, rallying 31 percent cumulatively since its recent low on May 12.