Extended delivery times and rising prices in China have led some to see an opportunity to resell Tesla vehicles at a profit.

(Image credit: CnEVPost)

Extended delivery times and rising prices in China are giving some people the opportunity to resell Tesla (NASDAQ: TSLA) vehicles at a profit. The electric vehicle (EV) maker has taken steps to try to combat this behavior but has sparked controversy.

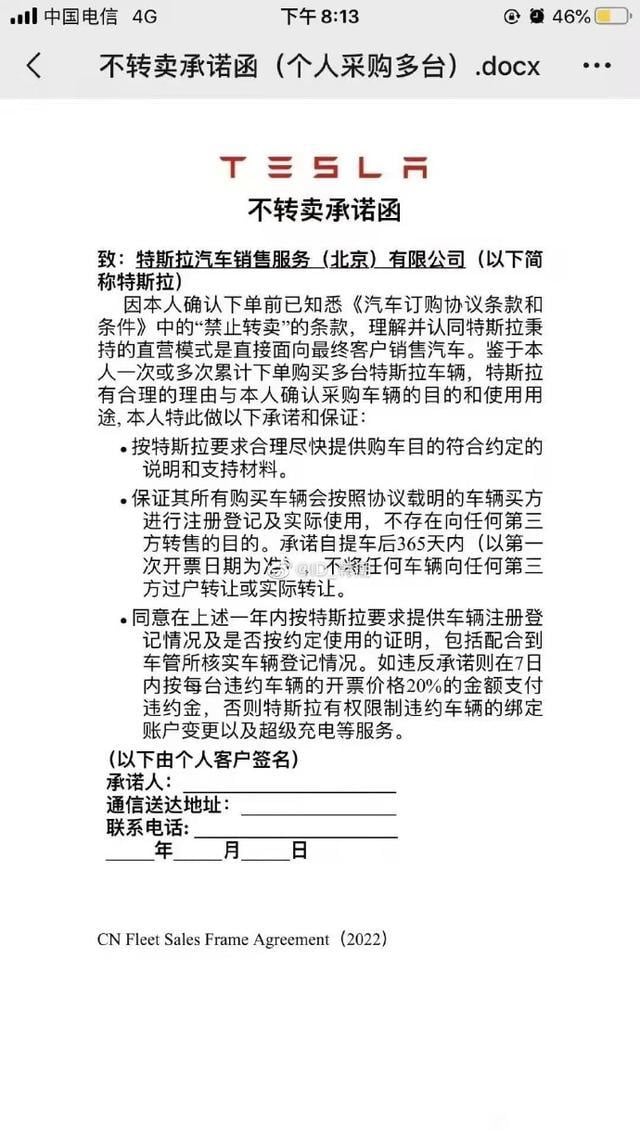

Weibo blogger @ID_韩潮 shared a document on Wednesday showing that Tesla requires owners who buy multiple Tesla vehicles in one or more cumulative purchases to sign a contract promising not to sell the vehicles to others within a year of purchase.

If a buyer who signed the contract broke the promise, he or she would be required to pay Tesla default damages of 20 percent of the invoice amount, according to the contract.

Local media Chengdu.cn reported on Thursday that an unmade source at Tesla confirmed the existence of the contract, saying the move was aimed at maintaining a fair and transparent car-buying experience for consumers.

This has no impact on the normal vehicle purchase or overall experience of the average consumer, the source said.

Long delivery times and rising vehicle prices are forcing some consumers to be willing to accept orders that are transferred, the report noted.

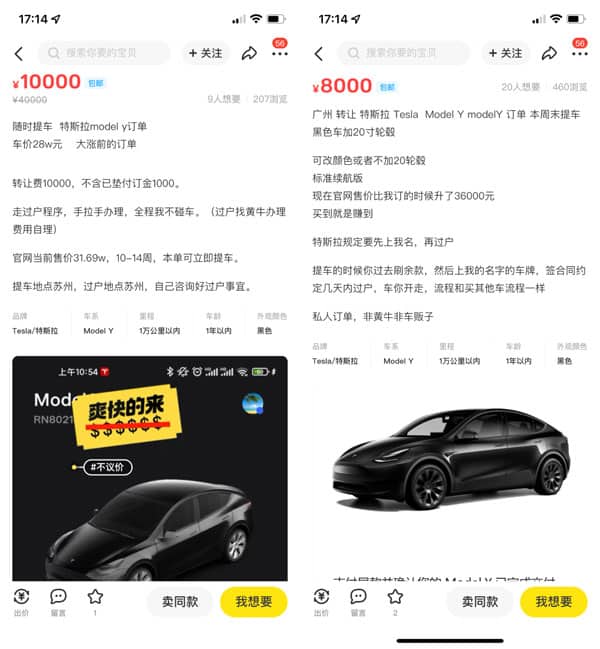

Users who pay RMB 1,000 ($157) to reserve a vehicle can make more than RMB 10,000 in profit on a successful transfer, which has led some to place a large number of orders, according to the report.

However, the preventive action taken by Tesla is being questioned as invalid.

That contract by Tesla places restrictions on the consumer's exercise of ownership, and it is highly unlikely that it will be found invalid, Chengdu.cn quoted Song Hongyu, an attorney at Tahota Law Firm, as saying.

The move comes in direct correlation to Tesla's difficulty in meeting consumer demand.

On March 4, Tesla's Chinese website updated the expected delivery dates, extending the wait time for most models by four weeks to 16-20 weeks.

A few days later, Tesla raised the prices of Model 3 Performance, Model Y Long Range, and Model Y Performance in China by RMB 10,000 on March 10.

On March 15, Tesla further raised the prices of all China-made vehicles, except for the entry-level Model Y. But on March 17, the price of the Model Y was also raised.

At Xianyu, a used trading platform owned by Alibaba, multiple orders allowing for immediate delivery are being marked up by as much as RMB 10,000 to transfer.