Update: Updated the performance of the Hong Kong stock market at the close of trading.

Chinese and US regulators have maintained good communication over regulation of US-listed Chinese companies, have made positive progress and are working to form concrete cooperation proposals.

China's State Council Financial Stability and Development Committee (FSDC) held a meeting to express support for capital markets after recent violent shocks in Chinese A-shares, Hong Kong stocks and the stocks of Chinese companies listed in the United States.

The meeting, China's highest-level financial meeting, was chaired by Vice Premier Liu He and discussed the current economic situation and capital market issues, according to a report today by Xinhua News Agency.

The conference emphasized that regulators should assume their responsibilities, actively introduce policies that are beneficial to the markets and cautiously introduce contractionary policies.

Where policies have a significant impact on the capital markets, policy makers should coordinate with the financial authorities in advance to maintain stability and consistency of policy expectations.

The FSDC will increase coordination and communication, and will hold relevant parties accountable when necessary.

China welcomes long-term institutional investors to increase their shareholdings, and all parties need to work together to maintain the stable development of the capital markets.

The meeting examined the following issues:

Regarding macroeconomic operations, all parties should effectively revitalize the economy in the first quarter, monetary policy should be proactive and new loans should maintain moderate growth.

Regarding real estate companies, China should promptly study and propose a strong and effective response plan to prevent and resolve risks, and propose measures to transform to a new development model.

Regarding Chinese companies listed in the US, the Chinese and US regulators have maintained good communication and have made positive progress and are working to form specific cooperation programs. The Chinese government continues to support all types of companies to go public outside of China.

Regarding the governance of the platform economy, regulators will improve the established programs with respect to the market forces, rule of law and internationalization, and steadily promote and complete the rectification of large platform companies as soon as possible through standardized, transparent and predictable regulation.

For platform companies, the red light and green light should be set to promote the stable and healthy development of the platform economy and improve international competitiveness.

On the issue of financial market stability in Hong Kong, the regulators of the Mainland and Hong Kong should strengthen communication and collaboration.

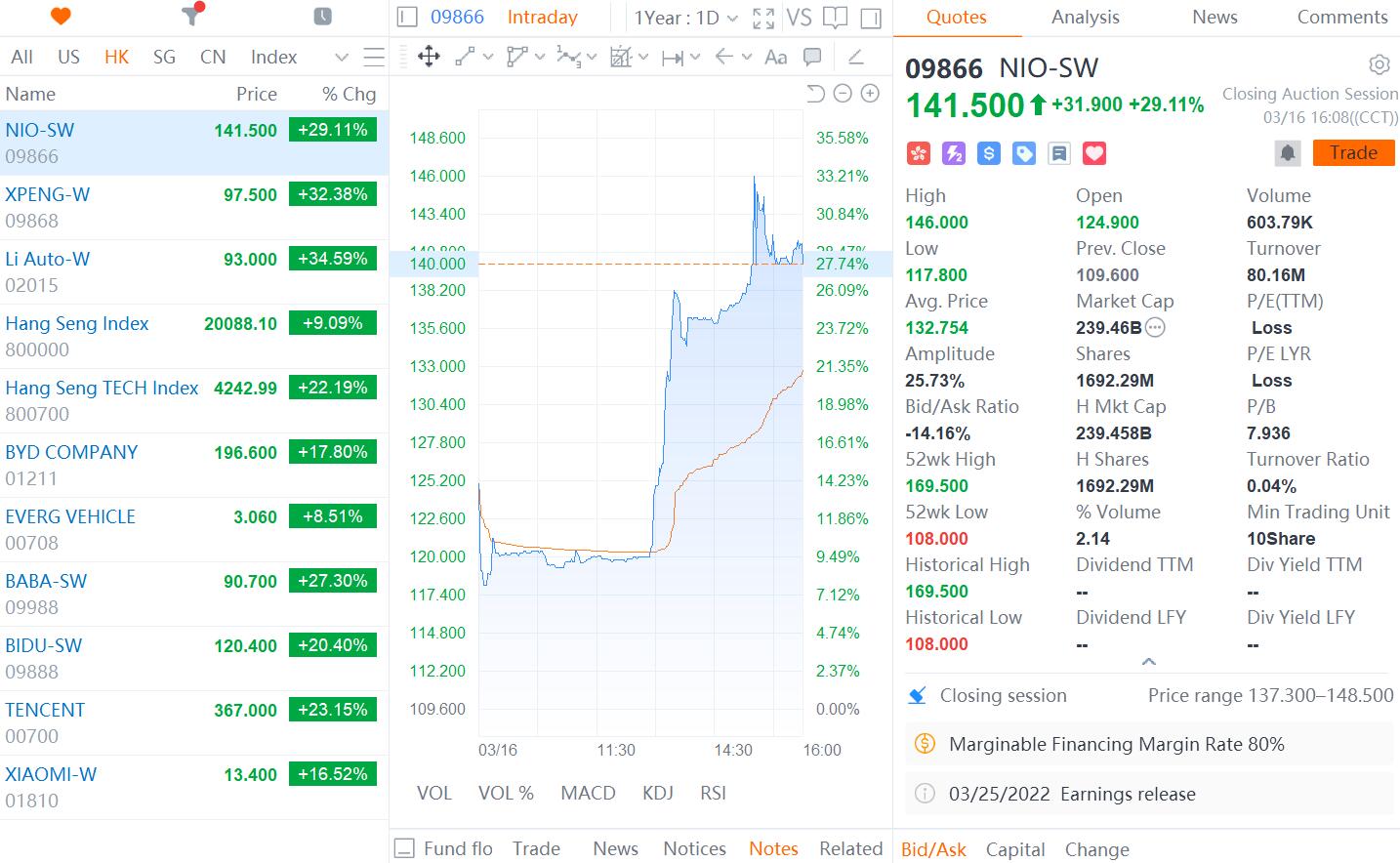

Hong Kong stocks surged after the meeting was reported, with the Hang Seng Index up 9.09 percent and the Hang Seng Tech Index up a record 22.19 percent by the close.

Nio (NYSE: NIO, HKG: 9866) closed up 29.11 percent, Xpeng Motors (NYSE: XPEV, HKG: 9868) was up 32.38 percent and Li Auto (NASDAQ: LI, HKG: 2015) was up 34.59 percent.

Become A CnEVPost Member

Become a member of CnEVPost for an ad-free reading experience and support us in producing more quality content.

Already a member? Sign in here.