CALB's first filing did not mention the amount it plans to raise, but media reports previously suggested its IPO could raise up to $1.5 billion.

CALB, one of China's largest suppliers of batteries for electric vehicles, has filed for a Hong Kong listing to support further expansion of its businesses.

CALB filed the first version of its Hong Kong IPO documents with the Hong Kong Stock Exchange on March 11, which indicated that its sponsor is Huatai International.

The filing did not mention the number of shares the company plans to offer or the amount of money it plans to raise, but media reports last week said CALB's IPO could raise as much as $1.5 billion and is expected to be the largest IPO in Hong Kong so far this year.

Founded in 2007, CALB is headquartered in Changzhou, Jiangsu province, and currently has seven manufacturing bases in Changzhou, Luoyang, Xiamen, Chengdu, Wuhan, Hefei and Heilongjiang.

In 2019, 2020 and 2021, CALB's revenue were RMB 1.734 billion, RMB 2.825 billion and RMB 6.817 billion, respectively, representing a compound annual growth rate of 98.28 percent, the filing shows.

The company posted a net loss of RMB 156 million in 2019, a net loss of RMB 18 million in 2020, and achieved a net profit of RMB 112 million in 2021.

CALB's power battery sales increased from 1.62 GWh to 9.31 GWh in 2019-2021, representing a compound annual growth rate of 139.7 percent.

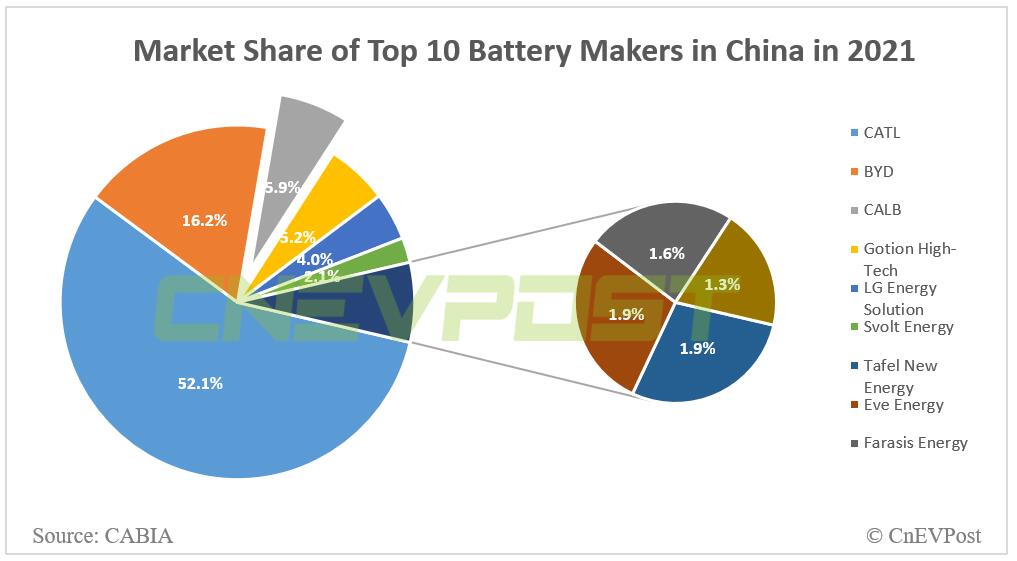

CALB's installed power battery volume in 2021 was 9.05 GWh, ranking third with a 5.9 percent market share, according to data previously released by the China Automotive Battery Innovation Alliance.

China's largest battery maker CATL's power battery installation in China for the full year 2021 is 80.51 GWh, occupying a 52.1 percent market share, according to the data.

CALB is currently a supplier to car companies including GAC, Changan Automobile, GAC Toyota, GAC Honda, SAIC-GM-Wuling and Geely, and has become the largest supplier to GAC and Changan.

The company said in its filing that it will expand its existing manufacturing base with several additional production lines and expects to expand its effective capacity to about 25 GWh and about 55 GWh in 2022 and 2023, respectively.

It is worth noting that on November 17, 2021, CALB said in its strategy launch that it will target power battery capacity to 500 GWh by 2025, with a projected capacity of 1 TWh by 2030.

According to a report by tech media outlet 36kr late last year, Xpeng Motors (NYSE: XPEV, HKG: 9868) plans to bring in CALB as its new main battery supplier, which would cut into CATL's supply share.

Cailian later quoted Xpeng sources as suggesting that the report was true, saying that the supply chain of components needed for vehicle production needed to be continually refined to better ensure supply and yield, and to more accurately predict delivery cycles.