Update: Added comparison of Nio's capacity with Xpeng and Li Auto.

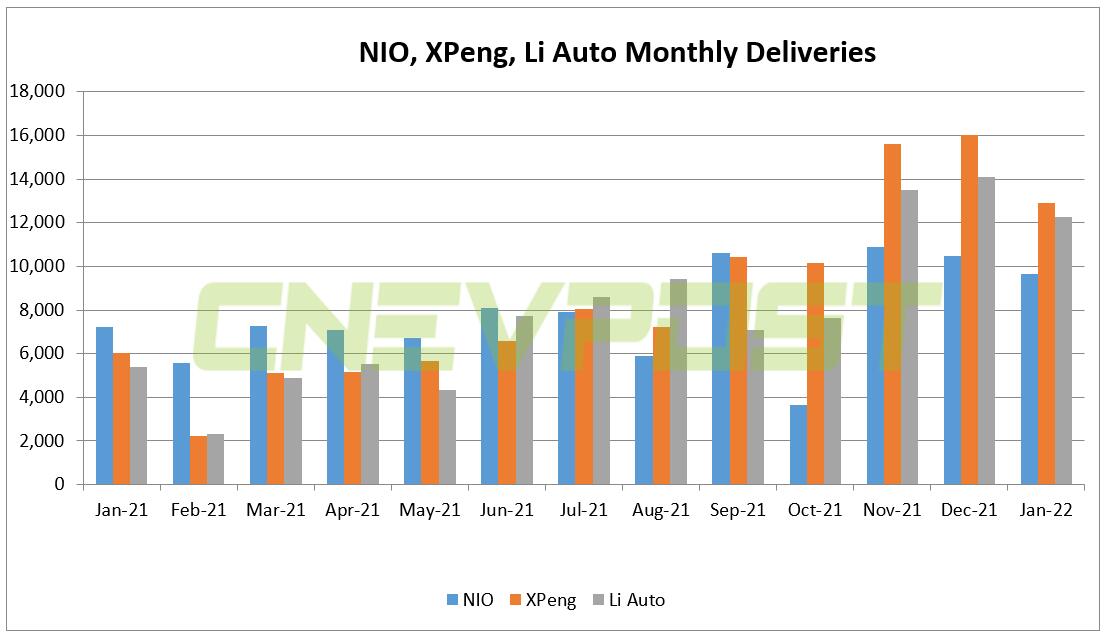

Over the past four months, Xpeng, which always has the lowest average price, has seen the highest deliveries, and Nio, which has the highest price, has the lowest deliveries.

Nio and its local counterparts Xpeng Motors and Li Auto have both released their January delivery figures today, and many readers are curious how they compare.

We hope this article gives you a quick idea of the dynamics, but note that they target different markets and have different pricing, so these comparisons can only help you understand the overall picture.

January deliveries

Of the three, Xpeng's models are less expensive and target a larger market space, and it continues to lead in deliveries for the past several months.

Xpeng delivered 12,922 vehicles in January, the fifth consecutive month above 10,000. This was higher than Nio's 9,652 vehicles and Li Auto's 12,268 vehicles.

(Graphic by CnEVPost)

Here is a breakdown of the different models for these three companies

Nio:

5,247 ES6s.

1,531 ES8s.

2,874 EC6s.

Xpeng:

6,707 P7s.

4,029 P5s.

2,186 G3 series.

Li Auto:

12,268 Li ONEs.

All three companies saw a decline in deliveries in January compared to December, likely due to vehicle deliveries being delayed by the Chinese New Year holiday and the week before, which is the peak travel time for the Chinese population. This year's Chinese New Year holiday is from January 31 to February 6.

It is also worth noting that starting in January, China's purchase subsidies for new energy vehicles (NEVs) were reduced by 30 percent compared to 2020, and both Nio and Xpeng consumers are starting to face higher costs for buying their vehicles.

Li Auto, which has previously been excluded from China's state subsidies because its models cost more than RMB 300,000 and do not support battery swap like Nio, is neutral to the withdrawal.

However, NEV companies, including these three, are generally facing a supply shortage and already have enough orders on hand for deliveries in the coming months. As a result, the subsidy rollback does not appear to have an impact on their deliveries for now.

For Xpeng, one thing in particular needs to be noted.

Xpeng is carrying out a technology upgrade at its Zhaoqing plant, taking advantage of the scheduled production downtime over the Chinese New Year Holiday starting at the end of January to early February.

The upgrade will enable accelerated delivery of the significant order backlog carried over from 2021 as well as allow us to better serve the increasing demand in the new year, Xpeng said.

Nio had upgraded its production line during China's National Day holiday last October and caused a significant drop in deliveries to 3,667 units that month. It and Li Auto have not announced plans to adjust production lines during the Chinese New Year holiday.

In addition, Nio's second plant in Hefei's NeoPark is still under construction, and its current production capacity comes entirely from the Nio JAC manufacturing base, and January deliveries appear to be the upper limit of current capacity.

Nio is preparing for the production of its new sedan ET7 and ET5 in addition to its three existing SUVs, ES8, ES6 and EC6, at the current plant.

The company has started locking orders for the ET7 on January 20, will open the model for test drives on March 5, and will schedule production in the order of intended deposit payments from March 11.

On January 29, Nio announced that it had seen the first prototypes of the ET5 for production line validation roll off the production line, just one month after the announcement of the new sedan.

This is an important part of the Validation Build phase, in which the ET5 opens a full range of testing and validation work that will mainly be completed to optimize the production line process, according to the company.

Positioning should not be forgotten

Nio is targeting a very different market from Xpeng and Li Auto, and there is a big difference in the price of the products.

Looking at deliveries over the past four months, Xpeng, which has the lowest average price of these three companies, saw the highest deliveries, and Nio, which has the highest price, had the lowest deliveries.

Nio is targeting the luxury car market, aiming to take market share from German luxury car companies, including BMW, Mercedes-Benz and Audi.

Xpeng targets a broader market, hoping to attract a younger demographic with more affordable prices and sexy products.

Li Auto, on the other hand, targets families with children, becoming one of the top models for young parents today.

In the first 11 months of 2021, the average sales price of Nio vehicles was RMB 413,800, local consulting firm Land Roads said in a report released on December 20.

In China, the average sales price of Nio vehicles ranked fourth, below Mercedes-Benz's RMB 481,900, but above Lexus' RMB 403,000 and well above the auto industry average transaction price of RMB 179,000, according to the report.

Li Auto's average sales price in the first 11 months of 2021 was RMB 333,600, compared to RMB 236,900 for Xpeng, according to the report.

Based on this price information and the latest deliveries, we can roughly calculate that Nio's revenue from vehicle sales in January was approximately RMB 4 billion, Li Auto was RMB 4.1 billion, and Xpeng was RMB 3.1 billion.

Comparison of production capacity

Nio revamped its existing plant in early October last year to increase annual capacity from the previous 100,000 units to 120,000 units per year, which could reach 240,000 units under double shifts.

The upgrade will be fully completed in the first half of 2022, when annual capacity could rise to 300,000 units by way of additional shifts or increased workloads, the company said at the time.

Nio's second plant in NeoPark will go into operation in September and will be able to produce 300,000 units a year when it reaches capacity, according to a report by Hefei News Channel on October 13 last year.

It is worth noting that at present, Nio's production seems to be mainly limited by the supply of batteries.

In a conference call following the release of third-quarter earnings on November 10 last year, William Li, founder, chairman, and CEO of Nio, said CATL was trying to secure battery supply for Nio as much as possible, but that is still the ceiling for the company's deliveries.

Xpeng currently has a factory in Zhaoqing with an annual capacity of 100,000 units. Last August, the company announced an expansion of the plant that would increase annual capacity to 200,000 units. The company has not announced when the project will be completed.

In September 2020, Xpeng began construction of a second plant in Guangzhou with a planned annual capacity of 100,000 units and expects to start production by the end of 2022.

In July 2021, Xpeng began construction of a plant in Wuhan with a planned annual capacity of 100,000 units. There is no timetable for the plant to be put into production.

Li Auto's current plant in Changzhou, Jiangsu province, went into production in 2019 with an annual capacity of 100,000 units.

The company previously said that the new plant is expected to be completed in 2022, which will increase annual production capacity to 200,000 units.

Li Auto's manufacturing site in Beijing's Shunyi District broke ground on October 16 last year and is scheduled to go into production by the end of 2023, when it reaches production, the plant will have an annual capacity of 100,000 pure-play electric vehicles.