Deutsche Bank's Edison Yu's team sent their first look to investors following Li Auto's third-quarter report.

(Image credit: Li Auto)

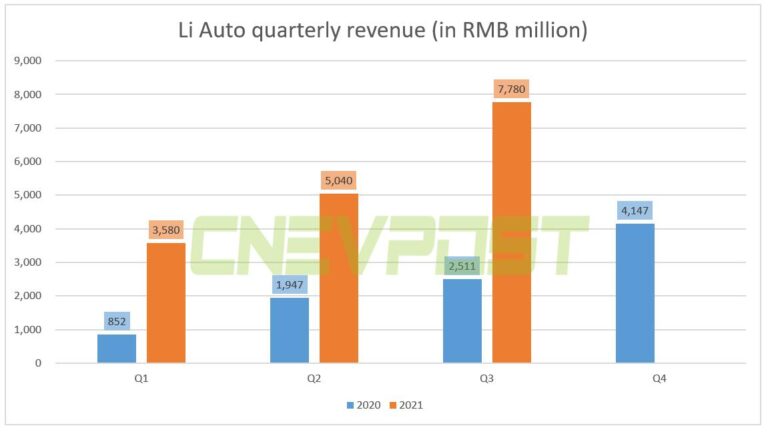

Li Auto reported third-quarter revenue that beat market expectations on Monday, and its loss narrowed significantly.

Deutsche Bank's Edison Yu's team sent investors their first look on the earnings report after it was released.

Here's what they said:

Li Auto reported strong 3Q results. Deliveries were previously reported at 25,116 units, leading to revenue of 7.78bn RMB (vs. our 7.59bn forecast and consensus at 7.42bn).

Total gross margin of 23.3% came in materially above our 19.4%, helped by a higher vehicle margin and benefitting from the sale of regulatory credits (we had modeled this occurring in 4Q).

Opex of 1,910m came in higher than expected due to headcount and distribution network expansion.

All together, adjusted EPS of 0.34 came in above our/consensus 0.13/0.15 estimates.

Free cash flow of 1,165m was materially stronger than anticipated despite largely higher capex, likely supported by robust working capital performance.

Management provided solid guidance for 4Q21 calling for 30,000-32,000 deliveries, above our 30,000 forecast at the midpoint.

This would imply a large increase from October's 7,649 units as the radar bottleneck in Malaysia seems to be improving (November guided at >10k units). Revenue is expected to be 8.82-9.41bn vs. our 8.88bn forecast.

Production capacity is running around 15k/month on 2 shifts but Bosch ESP continues to be a constraint.

As for gross margin, Li Auto still thinks the refreshed Li ONE is structurally a 25% product but inflationary pressures could hold it down in the 22-23% range even when production ramps up next year.

Management continues to expect R&D of ~3bn this year with this at least doubling in 2022 (6-7bn). SG&A should trend around 10% range.