HSBC Qianhai believes Nio's current share price only partially reflects the company's expected accelerated product cycle in 2022.

Nio's current stock price only partially reflects the company's expected accelerated product cycle in 2022, and its new product launches and sales growth will further drive the stock to the upside, HSBC Qianhai said in a research note released Thursday.

HSBC Qianhai is a securities joint venture between HSBC and Qianhai Financial Holdings, and is majority owned by HSBC.

Demand remains solid and the orders it has accumulated are expected to push up deliveries in the coming months, the brokerage said.

The team said its vehicle sales growth is expected to strengthen as the shortage of automotive chips eases and product cycles accelerate.

The company's user referral turnover rate has reached 60 percent in the third quarter, and strong brand recognition and consumer appeal will drive sales to climb for new Nio models next year, the team added.

Based on the improved clarity of Nio's new model plan in 2022 and the boost to competitiveness from strong brand recognition and product appeal, HSBC Qianhai raised its revenue forecast for Nio by 4 percent and 10 percent in 2022 and 2023, respectively.

However, given supply chain disruptions, the team is lowering Nio's revenue forecast for 2021 by 2 percent.

The team is also lowering Nio's net income attributable to the parent company forecast for 2021-2023 by 36-61 percent as raw material cost pressures are likely to continue and new models take more time to climb or keep margins under pressure.

As new model sales grow in 2022 and more potential new models are launched in 2023, Nio's economies of scale will come to the fore, they said.

HSBC Qianhai maintained its Buy rating on Nio and raised its price target to $53 from $47 to reflect adjusted earnings forecasts.

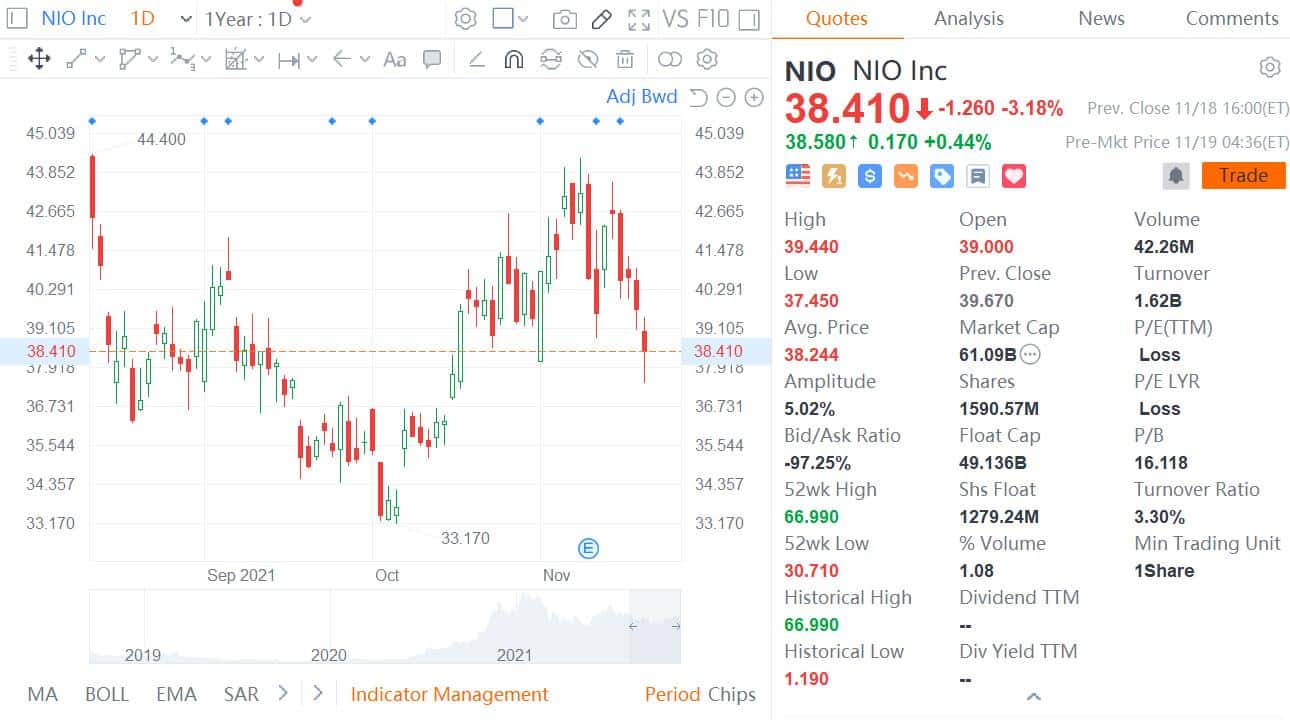

Nio closed down 3.18 percent to $38.41 on Thursday, a target price that implies about 38 percent upside.

"Since the end of September, the company's shares are up 16 percent, while the S&P 500 is up 8 percent over the same period. We believe the current share price only partially reflects the company's product cycle, which is expected to accelerate in 2022, and we expect new product launches and volume creep to further drive the share price to the upside," they wrote.

The team believes that potential catalysts driving Nio shares higher include continued strong sales growth, a clearer product cycle plan revealed by Nio Day, and high consumer acceptance of ET7's self-driving software.

Key downside risks to the stock include weaker-than-expected sales/margins, a continued shortage of automotive chips affecting sales, and competition likely to intensify starting in 2021, the team said.