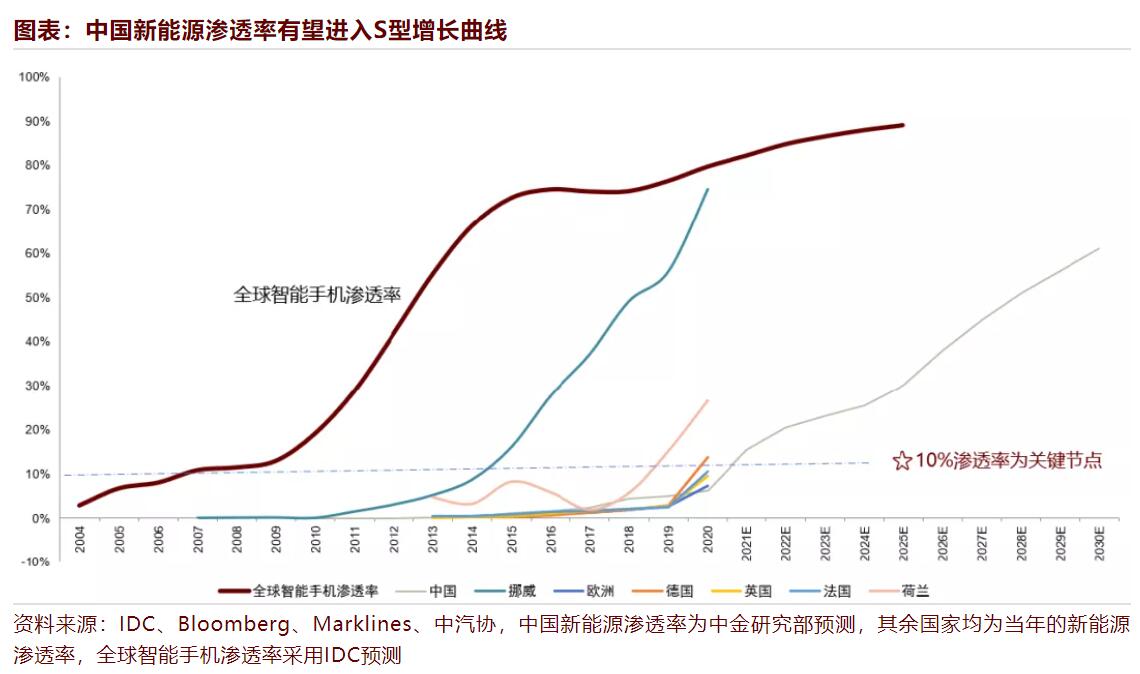

Referring to the S-shaped growth curve, global vehicle electrification has broken through the tipping point and entered a period of steep growth, CICC said.

(File photo of William Li, founder, chairman, and CEO of Nio.)

Based on the experience of the S-shaped growth curve, global vehicle electrification has broken through the tipping point and entered a period of steep growth, with sales expected to exceed 10 million units next year, according to CICC, a top Chinese investment bank.

(CICC: China's NEV penetration is expected to enter the S-shaped growth curve. The red line represents the global smartphone penetration rate.)

Chip concerns will fade away, expectations of new energy vehicle (NEV) supply relief have taken hold and the sector will trend toward accelerated growth, CICC analysts Deng Xue and Liu Chang said in a research note released today.

The analysts expect NEV penetration in China, Europe and the United States to reach about 20 percent, 25 percent and 12 percent, respectively, in 2022, corresponding to sales of 5 million, 3 million and 2 million units, with year-on-year growth rates of about 50 percent, 50 percent and 150 percent, respectively.

This means that the global combined sales of NEVs are expected to reach 10 million units, with a year-on-year growth rate of 70 percent.

The rapid growth of the global NEV industry is the result of the resonance of policy support, quality models coming to market, and strong demand, according to CICC.

In 2021, global NEV sales and penetration have accelerated. In the first nine months of this year, the sales of NEVs in China, eight European countries, and the United States were 2.14 million, 1.31 million, and 430,000, respectively, up 193 percent, 105 percent, and 101 percent year-on-year, CICC noted.

In September, the penetration of NEVs in China, the eight European countries and the United States reached 17.3 percent, 24.3 percent and 5.3 percent respectively, up 11.9 percentage points, 14.3 percentage points and 2.8 percentage points year-on-year, the team said.

The leading smart EV companies performed brightly and Tesla's cumulative global sales reached 627,000 units in the first nine months, up 97 percent year-on-year. Sales of Nio, Li Auto and Xpeng Motors reached 66,000, 56,000 and 55,000 units respectively in the same period, up 152 percent, 294 percent and 195 percent year-on-year, the team noted.

Recently, car companies, including Xpeng, released new technologies for intelligent driving, while Tesla once again released excellent financial results and announced a global price increase. The new global automotive technology landscape is gradually becoming clear, with the advantages of leading carmakers emerging, CICC said.

With the advent of electrification and intelligent change, China's local brands are rising rapidly.

China's long-term vehicle production is expected to reach 40 million units, with local brands currently selling 7 million units and expected to touch a market space of 30 million units in the future, the team said.

China's emerging smart electric car companies have already established medium- to long-term advantages in the current round of change and are poised for definitive sales growth as electrification and smart acceptance increase, CICC said.