In the first nine months, China's power battery installed base was 92.0 GWh, up 169.1 percent year-on-year, with ternary batteries still taking the lion's share.

Lithium iron phosphate (LFP) batteries are becoming the dominant choice for Chinese EV companies, at least for now.

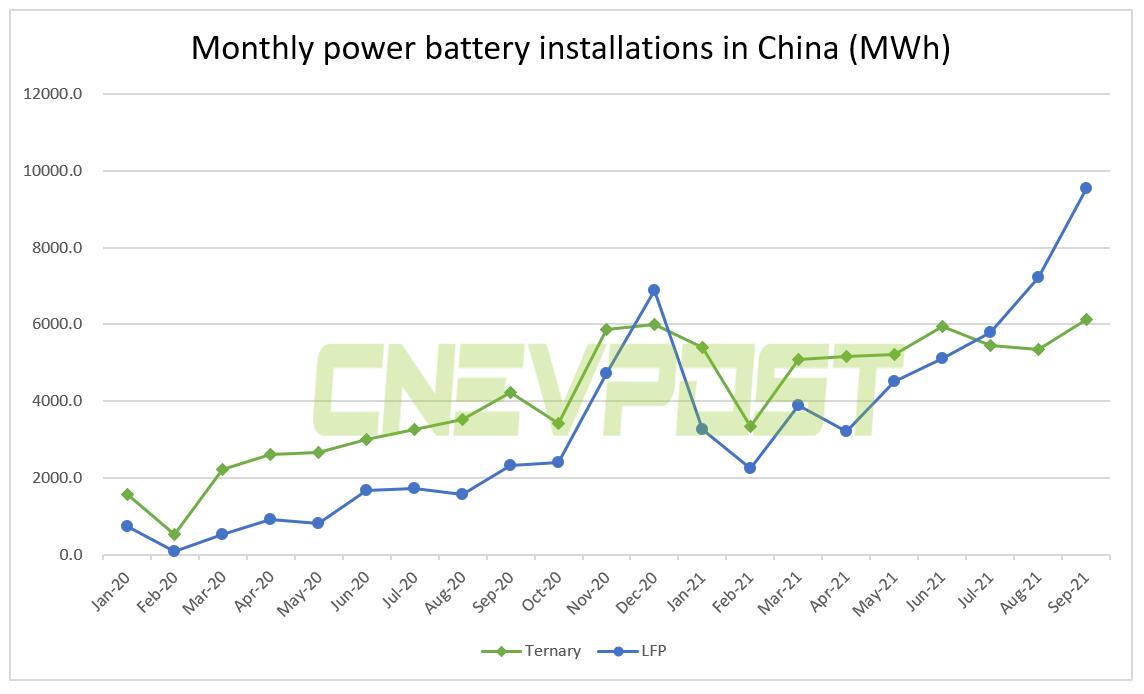

Data released today by the China Automotive Battery Innovation Alliance shows that the installed base of LFP batteries has continued to lead in the past two months after surpassing ternary batteries for the first time this year in July.

According to the data, China's power battery installed base in September was 15.7 GWh, up 138.6 percent year-on-year and up 25.0 percent from August.

(Data from the China Automotive Battery Innovation Alliance. Graphic by CnEVPost. )

Among them, ternary batteries installed a total of 6.1 GWh, up 45.6 percent year-on-year, and up 15 percent from August.

However, the installed volume of LFP battery grew more, with 9.5 GWh installed in September, up 309.3 percent year-on-year and 32.3 percent compared with August.

(Data from the China Automotive Battery Innovation Alliance. Graphic by CnEVPost. )

From January to September, China's power battery installation volume was 92.0 GWh, up 169.1 percent year-on-year, with ternary batteries still occupying the majority of the share.

From January to September, the installed base of ternary batteries was 47.1 GWh, up 99.5 percent year-on-year, accounting for 51.2 percent of the total installed base. Lithium iron phosphate battery installed volume was 44.8 GWh, up 332.0 percent year-on-year, with a 48.7 percent share.

In September, a total of 39 power cell companies in China saw their products installed, 11 fewer than in the same month last year.

CATL remains the largest power cell company in China, with 8.87 GWh installed in September and a 56.5 percent market share, up 4.8 percentage points from 51.7 percent in August.

BYD came in second, with 2.79 GWh installed in September and a market share of 17.8 percent.